Author: Henry

1. Introduction

Not long ago, with WebX 2025 opening in Tokyo, Japan once again attracted the attention of the global crypto market.In fact, with the rapid development of blockchain technology and crypto assets, Japan has become an important participant in the global crypto asset market. It not only has many technology developers and individual investors, but also attracts many Web3 institutions to explore the future of Japan’s digital finance.Driven by the dual driving of technological innovation and risk prevention and control, Japan’s crypto asset ecosystem is gradually maturing.

According to the 2024 annual report of the Japan Virtual and Crypto Asset Exchange Association (JVCEA), the number of crypto asset accounts in Japan has exceeded 12 million, and the user deposit balance exceeds 5 trillion yen.Among them, the holding rate of mainstream crypto assets such as Bitcoin and Ethereum has increased significantly, and institutional investors’ interest in investment in crypto assets is increasing. 57% of respondents believe that crypto assets will be mainstreamed in the future.In addition, the public calls for transparency in regulation are increasingly strong, and these data together portray a market with widespread perception, diverse applications and clear expectations for regulation.

In this context, understanding Japan’s crypto asset tax system and regulatory system is not only a need for the compliance development of crypto enterprises, but also an element for investors to understand market risks.This study will focus on the two main lines of basic tax system and regulatory framework, presenting the interaction between the system and the market in the Japanese crypto asset ecosystem, in order to clearly describe the overview of the Japanese crypto asset system for readers.

2. Japan’s basic tax system and crypto assets tax treatment

Japan is a country that mainly focuses on direct taxes. The current main taxes include: legal person tax, personal income tax, consumption tax, alcohol tax, customs tax, inheritance and gift tax, fixed asset tax, stamp tax, etc.This article will focus on introducing the basic tax system and related tax treatment methods for crypto assets.The current tax types in Japan are mainly shown in the following table:

1. Legal person tax

Japanese corporate tax is a tax that levied on the income generated by the business activities of a corporate person. It is a type of income tax in a broad sense (Japanese income tax is personal income tax, see below for details).In Japan, the legal person with a headquarters or major firm is a resident enterprise, and the legal person other than that is a non-resident enterprise.For resident enterprises, regardless of whether their income comes from domestic or foreign countries, all income belongs to tax objects, and non-resident enterprises only bear tax obligations on their domestic income in Japan.In terms of the calculation of taxable income, the company’s income is the sum of all sources, and there is no specific requirement to distinguish the type of income.The standard tax rate for corporate tax is 23.2%. For corporate persons whose registered capital is less than or equal to 100 million yen, the tax rate of 15% shall apply to the income of less than 8 million yen (however, if the company’s taxable income exceeds 1 billion yen, the preferential rate will be increased to 17%).

2. Income Tax

Income tax is a tax on individual income, and in Japan, permanent resident taxpayers are required to pay tax on their global income.Non-resident taxpayers pay taxes only on their Japanese origin income.Non-permanent resident taxpayers tax their income other than foreign-sourced income that has not been transferred to Japan (particularly possible including certain capital gains) and may tax some foreign-sourced income that has been paid or remitted to Japan.Japan divides taxpayers’ tax revenue into ten categories, and calculates and processes them separately: salary income, interest income, dividend income, operating income, real estate income, resignation income, transfer income, mountain forest income, one-time income and miscellaneous income (income that cannot be covered by the first nine items, the current Japanese tax law includes personal income from crypto assets in miscellaneous income).When calculating the personal income tax amount, each person’s taxable income should be determined and summarized, the income amount should be reduced by minus the necessary expenses, and the income deduction will be made in accordance with relevant regulations to obtain the taxable income tax, and finally the taxable income tax amount of the individual in that year should be calculated based on the applicable tax rate.The current Japanese personal income tax rate table is as follows:

3. Consumption tax

Japan’s consumption tax is levied when companies transfer goods, provide services, or import goods into Japan.The general tax rate is 10%, but the lower tax rate is 8% for food and beverages (except for consumption in restaurants and alcoholic beverages) and newspaper subscriptions that meet certain criteria.Zero tax rates apply to exports and certain services provided by non-residents.Specific transactions, such as the sale or lease of land, the sale of securities, and the provision of public services, are not subject to taxation.

4. Inheritance and Gift Tax

Inheritance tax is the tax levied on the property when the property is transferred due to death.In addition to financial assets such as cash, savings and deposits, stocks, the inheritance tax targets include various forms of assets such as movable property and real estate.The taxpayer of inheritance tax is an individual who acquires property through inheritance or bequest.The tax rate of inheritance tax is set for the inheritance that exceeds the threshold inheritance inherited by each heir. The excess progressive tax rate of 10%-55% is applicable according to the scale of the taxed inheritance. For details of the specific tax rate, please refer to the table below:

Gift tax is the tax levied on the property when the gift is transferred.Gift tax is generally a tax that supplements inheritance tax.Japan’s gift tax will combine the price and calculate tax on property acquired through donations within one year, even if it is obtained from different donors.The taxpayer of the gift tax is the individual who obtained the property due to the gift.If a legal person acquires property due to gifts, a legal person tax shall be levied.The object of taxation for gift tax is the property obtained from gifts.The property here contains all things and rights that can become the object of property rights.There are two tax methods for gift tax, namely “taxes for previous years” and “actuarial taxation during inheritance” (integrated measures for inheritance tax-grant tax). The tax rate of gift tax in previous years is subject to an excess progressive tax rate of 10%-55%.

5. Tax processing of crypto assets

6. Reform trends

In December 2024, the Japanese government issued the “Tax Treatment of Crypto Assets and Other Tax Treatment (FAQ), which brings together common issues regarding tax processing of crypto assets and electronic payment methods, including income tax, legal person tax, consumption tax, gift tax, inheritance tax and other taxes. For details, please refer to the relevant documents.Recently, JCBA and JVCEA cooperated to summarize a request for tax reform related to crypto assets in fiscal year 2026, and submitted it to the government for review on July 30. Therefore, this section will focus on the analysis and comparison of Japan’s crypto assets tax reform proposals with the current system, as shown in the following table:

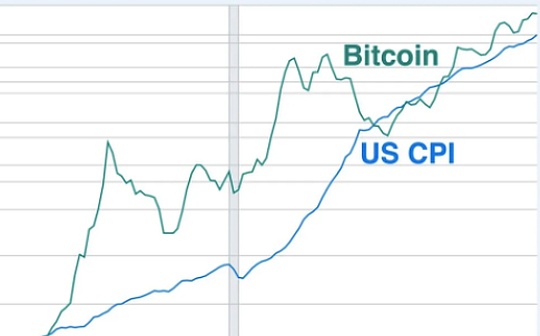

According to the above table, the progressive tax rate of the current system is very unfriendly to high-frequency traders and high-net-worth investors, and the proposal will significantly reduce the tax rate to 20%, and allow losses to be carried forward, which is conducive to attracting funds to return to the Japanese market.At the same time, delayed taxation of currency transactions will greatly simplify declaration and record obligations and reduce the pressure of tracking a large number of transaction details.In addition, lower tax barriers to donation and inheritance may promote the application of crypto assets in the fields of social donation and wealth inheritance.These proposals in Japan are clearly moving closer to attracting crypto industry and capital.

3. Basic research on crypto supervision in Japan

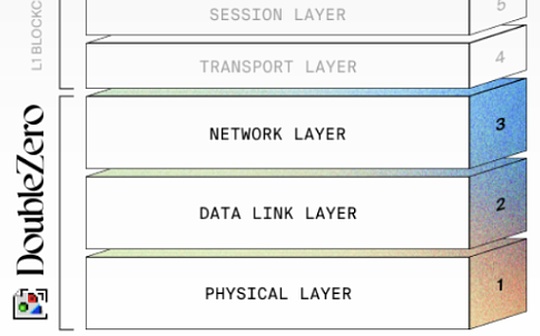

1. Basic framework

Japan is one of the earliest jurisdictions in the world to include crypto asset transactions in the statutory financial regulatory system. It has built a relatively complete dual-track regulatory framework through the Payment Services Act (PSA) and the Financial Instruments and Exchange Act (FIEA).The former focuses on the registration, asset custody, anti-money laundering and anti-terrorism financing (AML/CFT) and user protection of crypto asset exchange operators; the latter establishes a strict information disclosure, market manipulation prohibition and investor protection system for investment assets such as securities tokens (STOs), investment tokens ICOs, derivatives, etc.The two laws have both division of labor and are connected through specific terms, so that crypto assets have clear compliance boundaries from payment to investment, from spot to derivatives.Since 2018, Japan has implemented a mandatory registration system for crypto asset trading platforms, and has increased the requirements for cold wallet custody ratio, advertising standards, and cross-border transfer information disclosure through multiple rounds of amendments in 2019 and 2022.FSA has adopted a high-pressure trend towards unregistered operations and closely monitors emerging forms such as DEX, stablecoins and staking, indicating a trend of continuous expansion of regulatory scope.

Under this framework, the Japan Financial Agency (FSA) is a national-level competent authority. In addition, JVCEA (Japan Virtual Currency Trading Association) and JCBA (Japan Crypto Assets Business Association) also play an important role in the Japanese crypto asset industry.JVCEA is an industry self-regulatory organization spontaneously established by major virtual currency exchanges. With the development of Japan’s crypto market and the emergence of related risk events, the Japan Finance Agency (JFSA) officially authorized JVCEA to be an official industry organization with self-regulatory responsibilities in 2018.This means that JVCEA must not only formulate standards for operation, risk control, anti-money laundering for member exchanges, but also assist the government in implementing supervision and responding to industry changes and risks in a timely manner.JVCEA not only improves industrial transparency and compliance levels, but also becomes a key driving force for exchanges to obtain legal operating qualifications, protecting investors’ interests and rebuilding market confidence.

Unlike JVCEA, which focuses on exchanges and regulatory self-discipline, JCBA focuses more on promoting the overall development of the crypto asset industry.JCBA members cover diversified institutions such as wallet service providers, blockchain companies, and market participants.The association mainly promotes industry innovation and ecological improvement through industry exchanges, technical research, policy recommendations, and popular education.JCBA plays a bridge role in communication with regulatory agencies, tax policy consultation, standard formulation and response to emerging industry issues, providing support for industry self-discipline, enhancing consensus between the government and the market, and implementing policies.The two form a division of labor and supplementary relationship, jointly promote the standardized, healthy and diversified development of Japan’s crypto asset industry.

2. Legal Evolution

Japan was one of the first countries to establish a regulatory framework for crypto assets (formerly known as virtual currencies).As early as 2016, Japan was the first to respond to the international community’s requirements in anti-money laundering (AML) and anti-terrorist financing (CFT) by amending the Fund Settlement Law (hereinafter referred to as “SA”), and made institutional responses to the bankruptcy of operators who provide crypto assets and fiat currency exchange services in China.This amendment (executed in April 2017, hereinafter referred to as the “2016 Amendment”) establishes a registration system for relevant service providers and introduces a series of measures, including identity verification when opening an account, fully explaining the transaction terms to users, and implementing the separation management of customer assets and own assets, thereby establishing basic norms in both anti-money laundering and consumer protection.

With the development of the crypto asset market, some new risks and problems have gradually emerged: such as the abuse of highly anonymous crypto assets, insufficient internal management of some crypto asset exchange service providers (hereinafter referred to as “exchange service providers”), incidents of user-entrusted crypto assets and funds being leaked or misappropriated, and excessive advertising.In view of these circumstances, Japan revised the PSA and FIEA again in 2019 (the amendment was implemented in May 2020, hereinafter referred to as the “2019 Amendment”).The main contents of the 2019 amendment include: requiring exchange service providers to report in advance rather than afterward when changing the crypto assets they operate; in principle, they must use cold wallets to store user crypto assets; and establish regulatory rules for advertising and persuasion.At the same time, in order to deal with new trading behaviors and improper transactions, it is clear that derivative transactions involving crypto assets will be included in the supervision, and it is stipulated that ICO tokens granted profit distribution rights should be subject to FIEA.At the same time, unfair trading activities such as price manipulation are also prohibited.

On this basis, Japan revised the “Prevention of Transfer of Crime Profits” in 2022 (implemented in June 2023, hereinafter referred to as the “2022 Amendment”) and introduced the “Travel Rule” in accordance with the recommendations of the Financial Action Task Force (FATF).The rule requires that when the exchange service provider transfers crypto assets on behalf of the user, the identity information of the transferor and the receiver must be transmitted to the receiver’s exchange service provider.

In 2025, the Japanese government has submitted a draft PSA amendment to the Congress (if there is no special explanation, the “amendments” in the following text refer to the draft amendment).These include: empowering regulatory authorities to keep assets in Japan to ensure that assets can still be returned to domestic users in extreme cases such as bankruptcy; and adding a new category of intermediary business specializing in the purchase, sale or exchange of crypto assets.

3. Important Rules

In addition, if crypto assets have securities nature, the higher requirements of the Financial Commodity Trading Law (FIEA) regulations on information disclosure and market manipulation, fraud, etc. are subject to the higher requirements.

4. Revise the dynamics

(1) Introducing domestic asset preservation orders for crypto asset exchanges

Previously, relevant Japanese departments were concerned that crypto asset exchanges that handle spot transactions might transfer their assets overseas, thereby harming user interests in bankruptcy and other situations.The relevant amendments allow the Japanese government to issue “Asset Retention Orders” to prevent such assets from flowing out of the flow and ensure the safety of user assets.

(2) Implement more flexible management requirements for trust-based stablecoin reserves

It was previously stipulated that stablecoin issuers must hold all reserves in the form of current deposits.The amendment allows issuers to hold up to 50% of their reserves in the form of low-risk assets such as government bonds or redeemable time deposits.This change is expected to enhance the international competitiveness of stablecoins issued by Japan.

(3) Newly established crypto asset brokerage business category

Previously, institutions that only engage in crypto asset intermediaries also needed to register as a full exchange, and the entry threshold was relatively high.The amendment has added a new category of “brokership business”, allowing intermediary institutions to operate according to an independent regulatory framework, lower the entry threshold, and more in line with the actual situation of the industry, and helps promote new service providers to enter the market.This initiative is consistent with regulatory practices in other financial sectors.

(4) Supervision of cross-border collection service

In the past, cross-border payment services were basically unregulated and no permission was required for fund transfer business, but there was a risk of being abused for illegal gambling, investment fraud, etc.The new regulations have strengthened supervision of such services.The core of the new regulations is to crack down on unregistered illegal funds transfers.For high-risk businesses, additional consumer protection and anti-money laundering (AML) measures will be strengthened.Any collection services that do not directly facilitate transactions of goods or services will be included in the supervision of fund transfer business; while low-risk services such as platforms directly involved in transactions or third parties custody under other legal supervision are expected to be exempted.Industry groups such as the Japan New Economic Association are worried that excessive regulation may harm the digital payment industry, so they call on the new rules to focus on actual risks and avoid impacting the ecology of electronic payments, point settlement, etc.The subsequent regulations are issued and the impact on the industry and innovation needs to be closely monitored.

(5) User refund speed increases when the fund transfer institution goes bankrupt

In the past, even if the user’s assets were guaranteed by banks or trust methods, the refund process still had to be led by the government and took at least 170 days.The new amendment introduces a direct refund path, and banks or trust institutions can directly return funds to users without the need to go through the original procedures.This measure has improved consumer protection and effectively improved the efficiency of financial services, so that funds can be returned to users faster and safely when there are problems in institutions.

4. Conclusion

To sum up, Japan has gradually improved its institutional structure of tax supervision and financial supervision in the field of crypto assets: on the one hand, the tax system with NTA as the core has made detailed provisions on income tax, corporate tax, inheritance tax, gift tax, etc. of crypto assets. Although the current system still has certain constraints on investment activity in terms of tax rates, loss carryover, taxation time points, etc., the 2026 tax system reform proposal has clearly evolved towards tax burden reduction, transaction facilitation and public welfare friendly; on the other hand, with the FSA-led financial regulatory framework, through the “Fund Settlement Law”, “Financial Commodity Trading Law” and the supporting management of the Self-regulatory Organization (JVCEA), Japan has taken the lead in the world to establish a compliance system covering the entire chain of spot, derivatives, stablecoins, etc., and continue to iterate to deal with new technologies and new business models.

This steady optimization of tax system and regulation not only responds to the Japanese domestic market’s demand for transparency, efficiency and international alignment, but also reflects Japan’s development idea of deeply integrating crypto assets with Web3.0 strategy.In the future, with the implementation of separation of taxation, delayed taxation of currency transactions, inheritance and donation preferential policies, as well as the improvement of more flexible market access and consumer protection mechanisms, Japan is expected to maintain high-level risk control while improving its competitiveness in the global crypto assets and blockchain industry chain, attract more capital, technology and entrepreneurship projects to be implemented in its market, thereby further consolidating its leading position in the Asia-Pacific and even the global digital financial landscape.