Author: danny; Source: X, @agintender

Prediction market arbitrage has entered an advanced stage at the institutional level and has no direct relationship with ordinary people’s participation.This article aims to demonstrate the Poly-Perp-Pendle hybrid linkage DeFi strategy through some non-practical examples:

How to turn frictional YES + NO < 1 arbitrage opportunities on Polymarket into a negative cost of capital through Pendle Finance’s fixed income mechanism, while leveraging Hyperliquid perpetual contracts to achieve delta neutral hedging and capture positive/negative funding rates.

In addition to attracting traffic, there are several main reasons for writing this:

-

Let you who are eager to try and gear up, eat more chestnuts and go back early to wash up and go to bed. This is not a place for children;

-

Card bugs and arbitrage opportunities always exist, it depends on whether you pay attention – and there are more opportunities in circles, don’t be affected by market sentiment

-

Concrete the beauty of DeFi LEGO – in addition to memes, there are still many fools willing to write these protocols

One last word, I strongly urge everyone to read this article and not participate.This is how 10.11 came about.

1. Polymarket arbitrage: taking advantage of friction YES + NO < 1 condition

A. Theoretical parity and actual deviation: constraints of negative risk mechanism

In the design of Polymarket, the price of the predicted share is always between 0 and 1 USDC, and for any binary event (this article does not discuss n-element events), the sum of the YES share price and the NO share price needs to be fully collateralized by 1 USDC.In an ideal frictionless market, the theoretical parity condition YES + NO = 1 should strictly hold.When the YES + NO price < 1, the arbitrageur can lock in a fixed return of 1 at a cost lower than 1 by buying the shares of both parties at the same time, achieving Profit = 1 - (YES + NO).

The Polymarket platform further strengthens parity execution by introducing a “Negative Risk” (Negative Risk) mechanism.This mechanism allows traders to convert any one NO share into a combination of YES shares of all other outcomes (in non-binary markets), or in binary markets, theoretically achieves a low-friction exchange of NO shares with all other (i.e. YES) shares (in practice, the difference will be large depending on how good the liquidity is).This Negative Adapter is a formal arbitrage tool built into the platform and designed to quickly eliminate price deviations.

The existence of this mechanism therefore suggests that any sustained YES + NO < 1 arbitrage opportunity must overcome a threshold of operating costs.The actual achievable arbitrage profit Profit Arbitrage must satisfy:

Profit Arbitrage > Polymarket Transaction Fee + Gas + Spread

This means that YES + NO < 1 must be significantly lower than 1 to produce a positive net return.

B. Sources of frictional arbitrage profits under the CLOB model

In CLOB mode, arbitrage opportunities are instantaneous and usually arise from the following two types of friction:

-

Bid-ask spread is inefficient: A brief spread gap occurs when market makers fail to quote closely on both sides of the order book.Using APIs and low-latency systems, arbitrageurs can immediately fill this gap with limit orders.Since Polymarket charges trading fees for both buyers and sellers, arbitrageurs must ensure that the spread captured is sufficient to cover these fees.

-

Market sweeps triggered by large transactions: When retail or institutional traders execute large orders, especially in the “Endgame Sweep” strategy where the outcome of the event is almost certain (for example, large orders exceeding 10,000 are often executed at prices higher than 0.95), the liquidity on one side of the order book may be drained instantly, creating a short-lived YES + NO < 1 imbalance.Arbitrageurs must capture this instantaneous profit through fast execution before the price rebounds or the NegRisk mechanism steps in.

C. Polymarket arbitrage profit overview

In Polymarket’s CLOB environment, market makers must constantly monitor liquidity depth and use protective limit orders to ensure expected returns comfortably exceed slippage and fees.The table below quantifies the costs that arbitrage activities must cover at different price deviations.

For large amounts of capital (e.g. 200,000 USDC), if the price difference captured is only 0.5%, even a successful execution could end up with a net loss due to transaction fees of around 2%.Therefore, for an arbitrage strategy to be sustainable, it must either capture larger price imbalances or significantly reduce its working capital costs through external mechanisms.

2. Use Pendle Finance to improve capital efficiency

A. Pendle’s mechanism as a fixed income layer

Pendle Finance tokenizes interest-bearing assets (Yield-Bearing Assets) and splits them into principal tokens (PT, Principal Token) and yield tokens (YT, Yield Token).PT tokens are similar to zero-coupon bonds, promising to exchange for the underlying asset at a 1:1 ratio on the maturity date, allowing users to lock in a fixed rate of return.

Polymarket arbitrage requires a large amount of USDC capital, which is often idle when transactions are not executed, or only earns lower demand rates, constituting an opportunity cost.The role of Pendle is to convert this part of capital into a fixed and predictable income stream, thereby achieving the “superimposed utilization” of capital.

B. Strategy: Use PT as interest-earning collateral

The core strategy is to establish a leveraged fixed income position, and the borrowings from this position are used for arbitrage with Polymarket.

-

Convert USDC used for Polymarket arbitrage to a Pendle-compatible interest-bearing stablecoin (such as USDe, Pendle has integrated USDe yield markets).

-

Tokenize this interest-earning asset to obtain a PT-asset (e.g. PT-USDe).

-

Deposit PT-Assets into compatible money markets as collateral.

-

Based on the Collateral Factor, USDC stablecoins are borrowed from the money market for Polymarket transactions.

The key to this mechanism is the calculation of the net cost of capital (NCC).If the fixed annualized rate of return on PT collateral, PT, is higher than the annualized borrowing cost of borrowing USDC, then the capital provided for the Polymarket transaction is effectively acquired at a negative cost.For example, if a PT asset provides a fixed annualized return of 5% and borrowing costs are 3%, then each unit of capital deployed will receive a 2% subsidy from the Pendle layer.

This negative NCC mechanism significantly improves overall return on capital invested (ROCE).It improves the profitability bottom line of Polymarket’s arbitrage strategies, making arbitrage opportunities that would otherwise have been considered small profits or losses due to transaction fees, become feasible after the Pendle subsidy is added.

C. Chestnut: Pendle Capital Overlay Financial Model

The table below illustrates the amplifying effect on Polymarket’s net cost of capital when leveraged using Pendle PT as collateral.

3. Use Hyperliquid for risk neutralization and return stacking

A. Hyperliquid as Delta Hedging Counterparty

This co-ordination strategy is mainly suitable for markets on Polymarket that are related to the price fluctuations of the underlying crypto assets, such as “will Bitcoin reach 130K by a certain date”, or “whether the Federal Reserve will cut interest rates by a certain quarter”.

Taking a Delta Neutral Position: Purchasing a share of YES in the price prediction market for an asset on Polymarket is equivalent to gaining synthetic long exposure to that asset.In order to hedge this directional risk, traders who have not experienced 1011 can simultaneously establish a short perpetual contract position of equal nominal value on Hyperliquid.The final compound position will be delta neutral, with profits and losses no longer dependent on the overall movement of the BTC price, but solely on whether the Polymarket share ultimately settles at 1.00.

B. Enhanced returns through funding rate capture (arbitrage trade overlay)

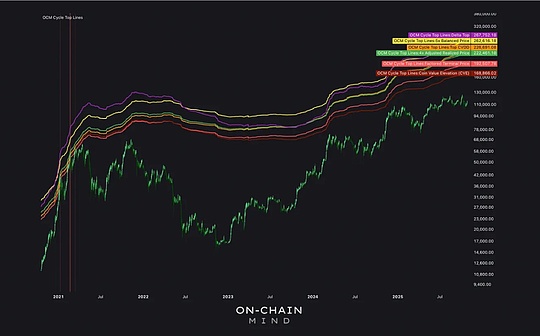

A key feature of the perpetual contract market is the funding rate, which ensures that the perpetual contract price converges with the spot price.Data shows that funding rates on platforms like Hyperliquid are structurally biased toward positive values (positive more than 92% of the time in Q3 2025) due to the interest component inherent in the derivatives formula and the intervention of arbitrage capital (such as Ethena).

Arbitrage trade integration: A typical delta neutral carry trade involves going long the spot asset and short the perpetual contract to capture positive funding rates (or vice versa).In this ternary structure, Polymarket shares (YES or NO) can act as synthetic spot long agents.By holding shares of Polymarket and shorting the Hyperliquid perpetual contract, the strategist gains a double advantage:

-

risk neutral: Isolates the risk of BTC price fluctuations.

-

sustained income: When the funding rate is positive, the short position of the perpetual contract will continue to receive funding fees from the long position, forming a continuous and predictable income stream.

This funding fee income stream directly acts as an operating subsidy for Polymarket transactions, offsetting transaction fees and gas costs, effectively increasing the profitability floor of compound positions.

C. Chestnut: Hyperliquid Delta Neutral Strategy Cash Flow

An example of how funding fee income can provide stable cash flow when hedging the Polymarket price prediction market with Hyperliquid.This article will no longer join Boros’ discussion and expansion. Those who are interested can check it out by themselves.

4. On how many candies there are in roasted chestnuts with sugar

A. Case Study 1: Fixed Income Enhanced Arbitrage (Polymarket + Pendle)

scene: Arbitrage a 14-day geopolitical market (e.g., “whether a candidate will resign within the month”).The market’s YES + NO imbalance is 0.015, and arbitrageurs successfully deployed 180,000 USDC within 24 hours through limit orders.

Modeling parameters:

-

Initial capital: 100,000 USDC.

-

Pendle Tier (based on Table III.C.1): Deployed capital of 180,000 USDC, effective net cost of capital (NCC) is -2.50%.

-

Polymarket layer:

-

Deployed funds: 180,000 USDC.

-

Gross profit capture: 1.5% (180,000 * 0.015 = 2,700).

-

Polymarket transaction fee (assuming 2.0%): 180,000 * 0.02 = 3,600

Model analysis:

-

Polymarket net trading profit and loss: 2,700 (gross profit) – 3,600 (fees) = – 900 (net loss).

-

Pendle fixed income subsidy (14 days): The initial capital of 100,000 enjoys an annualized net income of 2.50.Pendle subsidy = 100,000 * 0.025 *14/365 = 95.89

-

Final total net income: – 900 (Polymarket loss) + 95.89 (Pendle gain) = – 804.11.

Conclusion: In this case, even though the Pendle subsidy transformed a meager 1.5% gross profit into better net income, a single low-margin frictional arbitrage was still difficult to make profit due to Polymarket’s high 2% fee structure.This highlights two key points: a) even with negative NCC, arbitrageurs must still capture at least 2% of the spread to achieve significant profitability; b) the true value of a negative NCC strategy is that it allows strategists to hold large amounts of capital at very low risk and continue to earn returns, ensuring a minimum return on capital even in periods lacking high-profit arbitrage opportunities.

B. Case Study 2: Delta Neutral Return Overlay (Polymarket + Hyperliquid)

scene: Trading “Will BTC surpass 130k market in 45 days. Current YES share price is 0.15.”

Modeling parameters:

-

Polymarket position: Buy 100,000 notional shares of YES at an actual cost of 15,000 USDC.(100,000* 0.15).Total transaction fee 300 USDC.(15,000* 2%)

-

Hyperliquid Hedging: Short 100,000 BTC perpetual contracts (1x leverage).

-

Funding rate: Daily average +0.02% (based on historical positive bias).

-

Duration: 45 days.

Model analysis:

-

Polymarket risks and returns: The main directional risk of this position will be neutralized to a certain extent and converted into basis risk.If BTC reaches 130k in 45 days, the profit is 100,000 – 15,000 = 85,000 USDC (gross profit).

-

Hyperliquid funding fee income: Funding fees received for short positions within 45 days:Funding fee income = 100,000 * 0.0002 * 45 = 900

-

Net cost and benefit optimization:

-

The funding fee income of 900 is much higher than the Polymarket transaction fee of 300.This provides a net subsidy of 600 USDC.

-

Risk premium optimization: With Hyperliquid hedging, this strategy converts a highly volatile speculative position tied to the price of BTC into a hedged arbitrage position.The capital fee income of 900 USDC establishes a net profit bottom line of 600 USDC for the transaction, focusing the risk on contract settlement and oracle risk rather than traditional market price beta risk.This allows arbitrageurs to enter price-related prediction markets with greater capital efficiency.

C. Summary

Based on the analysis of the two cases, traditional Polymarket frictional arbitrage faces severe challenges in its independent profitability due to high transaction fees.However, by embedding Polymarket into a multi-tiered structure, capital efficiency and returns are significantly improved:

-

Pendle negative NCC effect: Solve the capital opportunity cost problem and obtain net income subsidies through PT mortgage, providing Polymarket with a more generous arbitrage profit margin.

-

Hyperliquid funding fee stacking effect: It solves the directional risk and transaction fee issues in the price market and establishes a lower limit on returns through continuous funding fee income, allowing the strategy to capture lower-risk event resolution premiums.

The ROCE of this ternary protocol stack strategy is much higher than that of a single platform strategy because it not only seeks alpha from the imbalance of YES + NO < 1, but also captures additional structural alpha in the time dimension (fixed income) and directional risk dimension (arbitrage trading) through Pendle and Hyperliquid respectively.

If you are smart, you may have thought that if I can “assemble” and “combine” these protocols, will the benefits (and risks) be magnified?Will there be more opportunities?

Finally, forget about specific numbers, if there is anything you remember after reading this article, or the most important thing about this article, it is:

I hope that at this moment you can truly feel the beauty of DeFi lego.

Web3 gives us not only the wealth effect, but also the materialization of financial imagination – only here can we unknown people use our imagination and code to realize our imagination of the future world.