How DAT is reshaping the investment landscape

In the past five years, from MicroStrategy in the United States to Metaplanet in Japan, to dozens of publicly listed companies around the world, the Digital Asset Treasury (DAT) model has gradually evolved from an individual phenomenon into a new capital market trend.By incorporating digital assets such as Bitcoin and Ethereum into the balance sheet, DAT not only reshapes the capital structure of the company, but also provides investors with an alternative investment channel that is different from ETFs and funds.

As the first article in the “DAT Series”, this report will lead readers to understand the basic concept, development context, core characteristics and differences with ETFs of this model, and analyze its strategic significance in the capital market and crypto ecosystem.Through data and cases, we will see why more and more companies choose to become “coin stocks” and how this model can become a bridge between the traditional finance and digital asset worlds.

1. What is DAT?

DAT refers to a business model in which listed companies allocate some or all of their treasury assets (such as cash and equivalents) to crypto assets such as Bitcoin and Ethereum as one of their core strategies.It is not only an adjustment of asset allocation, but also the strategic positioning of enterprises for the future digital economy.

Against the background of the continuous inflow of institutional funds and active pursuit of digital asset allocation, Digital Asset Treasury Companies (DAT) have become an important narrative in the digital asset ecosystem.Such companies are usually listed companies and have publicly announced plans to hold large amounts of digital assets in their business strategies for the long term, making them part of the company’s core strategy.

Cases represented by MicroStrategy and favorable regulatory policies in the United States have jointly promoted the rapid development of digital asset treasury companies.The executive order signed by US President Trump officially allows the establishment of strategic Bitcoin reserves; at the same time, institutional investors can now measure digital asset positions at fair value, allowing digital asset strategies to be confirmed and verified on the company’s balance sheet.Driven by these favorable factors, market demand has rapidly followed.In terms of regional distribution, the United States is the largest market for these treasury companies.Such companies are also subject to strict capital reporting requirements and must work closely with regulated custodians, cryptocurrency exchanges and market makers to successfully execute their strategies.Other regions are following suit, with Asian companies adopting a more cautious approach, seeking to balance risk appetite with regulatory prudence.

Currently, most treasury companies mainly hold Bitcoin and Ethereum, but some institutions have begun to deploy other emerging high-quality assets, such as Solana, XRP, HYPE, SUI, etc.According to current public data, listed companies hold a total of 1,011,352 Bitcoins, accounting for approximately 5% of all Bitcoins on the network, with MicroStrategy being the largest holder.Corporate holdings of Bitcoin have doubled since 2025.At the same time, the Ethereum Treasury Company holds a total of approximately 3.88 million ETH, accounting for approximately 4.34% of the entire network’s Ethereum.

2. Brief history and development status of DAT

The initial form of DAT started with DAT with Bitcoin as the underlying asset.In December 2020, MicroStrategy announced that its total Bitcoin purchases in 2020 exceeded US$1 billion, and it has since begun its DAT journey.In the past five years, MicroStrategy has increased its holdings of Bitcoin several times through its own cash, bond issuance, and stock issuance.Data shows that as of September 16, MicroStrategy held a total of 638,985 Bitcoins, making it the company holder with the highest Bitcoin holdings.

MicroStrategy Bitcoin holdings chart.Source: Bitcointreasuries.net

According to MicroStrategy’s Bitcoin holdings data, in the first four years, MicroStrategy basically increased its holdings of Bitcoins at a rate of less than 100,000 Bitcoins per year. In 2024, its holdings exceeded 200,000, and in 2025, its holdings were also close to 200,000 Bitcoins.

Amount of BTC purchased per year.Source: MicroStrategy – Bitcoin holdings timeline (annual growth)

Judging from the development of companies holding BTC (as shown below), in addition to MicroStrategy increasing its holdings of Bitcoin every year, more and more companies have joined in holding Bitcoin. According to reports, 64 new listed companies holding Bitcoin have increased from the end of 2024 to the first half of 2025. Currently, a total of 190 listed companies and 64 non-listed companies are or have held Bitcoin. The total holdings are respectively1,011,352 and 299,207 Bitcoins.

The historical trend chart of Bitcoin holdings shows that the growth of Bitcoin holdings of listed companies jumped at the beginning of 2021 and the end of 2024, mainly driven by several operations of MicroStrategy.Bitcoin holdings of unlisted companies surged in the second half of 2022, mainly driven by Block.one’s public holding of 164,000 Bitcoins in September of that year.

Bitcoin distribution over time, source: Bitcointreasuries.net

These Bitcoin holding companies cover many different countries. As shown in the data chart, half of the listed companies are from the United States and Canada, and nearly half of the unlisted companies are from the United States.

Distribution of Bitcoin holding companies in various countries.Source: Bitcointreasuries.net; compiled by HashKey Capital.

It can be seen that the development of Bitcoin DAT presents the characteristics of multi-company, multi-region, and steady growth.

In the past five years, DAT’s underlying assets have gradually become more differentiated, gradually including digital assets other than BTC, such as ETH, SOL, etc. Most of these underlying assets are mainstream altcoins with high market value.Ethereum DAT started in April this year and grew rapidly at a rate of nearly doubling in July and August.

Ether DAT position trend chart, source: strategicetherreserv

Compared with Bitcoin DAT, there are 17 DAT entities with Ethereum as the underlying asset, holding a total of 3.88M ETH.Among the 17 Ethereum holders, there are 15 listed companies, 1 is preparing to be listed, and 1 is an on-chain protocol.Among the listed companies, there are 12 American companies and 3 Chinese (Hong Kong) listed companies.This distribution is significantly different from Bitcoin DAT, especially the existence of the on-chain protocol ETH Strategy, whose token is STRAT issued on Uniswap.This situation stems from the technical differences between Ethereum and Bitcoin. Ethereum’s smart contracts allow the construction of complex DApps, so the ecosystem is richer.

Ethereum holdings by country and region, source: strategicetherreserve, compiled by HashKey Capital

Followed closely by Solana, according to Coingecko data, there are 8 listed entities holding it, distributed in three countries.

Solana holdings by country/region, source: strategicetherreserve, compiled by HashKey Capital.

The main DAT companies targeting Bitcoin, Ethereum, and Solana are the three mainstream directions at present. The relevant information is summarized as follows:

Data as of 2025/09/15, BTC holding entities include those who have held it and are currently 0, excluding ETFs, DAO vaults, etc.Statistical comparison of the three major DAT categories with BTC, ETH, and SOL as underlying assets, source: compiled by Bitcointreasuries.net, strategicetherreserve, and HashKey Capital

It can be seen from the table that the number of entities holding BTC is much higher than that of Ethereum and Solana, reaching 15 times and 30 times respectively. This phenomenon shows that most DAT companies choose Bitcoin as the target, and also demonstrates the special status of Bitcoin in the cryptocurrency world.

Further analysis of the main holding ratio shows that the largest holder of DAT companies in BTC is MicroStrategy, which accounts for 49%, which is much higher than the second place of 13%.MicroStrategy’s absolute proportion and high BTC volume hide a certain crisis. As a market vane, when it exhibits behaviors or phenomena such as selling Bitcoin or being unable to continue the DAT strategy, it will pose a great threat to the market.The largest holder of ETH is even worse, reaching 55%, but the second largest holder also reaches 21%, and the top three account for 90%. The structure is unbalanced.In terms of SOL, the top three entities each hold an average of 30%, and the market structure is balanced.

Comparison of the position distribution of the three major DAT categories with BTC, ETH, and SOL as underlying assets, source: Bitcointreasuries.net, strategicetherreserve, compiled by HashKey Capital.

In addition to BTC, ETH, and SOL as the underlying assets, the underlying assets of DAT also involve other assets, such as public chain assets TRX, SUI, XRP, exchange platform currency BNB, decentralized contract platform token HYPE, Trump family platform token WLFI, etc. The magnitude of the underlying assets held by these DATs ranges from $300M to 2B.This phenomenon will continue to intensify after entering the third quarter of 2025, and we expect that more DATs will appear with other assets as targets.

In addition to the above-mentioned single-asset-only strategies, DAT companies with multi-asset assets as their underlying assets are gradually emerging, or they are performing position adjustment operations on the underlying assets. For example, Lion Group (LGHL) announced in September that it will convert all its SUI and SOL into HYPE.In addition, mutual investment among these DAT companies has also begun. For example, KindlyMD, a subsidiary of Nakamoto Holdings (NASDAQ: NAKA), announced its commitment to invest in the international equity financing of Metaplanet, a Japanese Bitcoin reserve company.

3. Characteristics of DAT

Whether it is a single-asset or multi-asset DAT company, compared with traditional companies, ETFs and other listed transactions and other financial products, DAT as an emerging business model has very distinctive characteristics:

strategic publicity

Companies are required to publicly announce their DAT strategies and regularly disclose holdings.This commitment is the basis for gaining market trust and premium.For example, MicroStrategy has issued dozens of currency purchase announcements since implementing its BTC reserve strategy to transparently display changes in its holdings to shareholders.At the same time, a new indicator “Bitcoin Yield” was introduced to measure the percentage increase in the number of BTC held per share.This approach reflects DAT’s self-discipline and acceptance of public supervision with a long-term currency holding strategy. It can not only attract investors who prefer this strategy, but also allow the market to have a clear understanding of the company’s risks.

ecological synergy

The fate of DAT companies is deeply bound to the ecology of crypto assets it holds.When a company holds a large amount of a certain token, it actually becomes a large stakeholder in the blockchain ecosystem, and therefore has the incentive to invest resources to promote the development of the ecosystem.For example, the aforementioned BitMine company holds a huge amount of Ethereum and actively participates in staking on the Ethereum network to help maintain network security and obtain additional income.The company’s own growth and ecological prosperity form a positive cycle – the appreciation of tokens benefits the company, and the company’s growth and progress support the ecosystem.This synergy helps build a closed loop of value: DAT investors and the project community achieve a “win-win” and promote the long-term sustainable development of the entire digital asset ecosystem.

Compliance Evolution

As the regulatory environment changes, the DAT model itself is gradually becoming institutionalized and compliant.In the early days, companies that directly held currency were often regarded as outliers, and the impact of highly volatile assets on financial reports also caused headaches for traditional audits.Now, everything from accounting standards to regulatory policies are adapting to this trend.U.S.-listed DAT companies must meet strict auditing and capital adequacy requirements, use regulated custody institutions to store digital assets, and comply with anti-money laundering and information disclosure regulations.At the same time, new products such as Bitcoin ETFs provide more compliant investment alternatives, but also force DAT companies to improve their standard operation standards to highlight their advantages in the competition.It is foreseeable that in the future, the operation of DAT will become closer and closer to the style of mainstream financial institutions – not only enjoying the growth dividends of crypto assets, but also following a sound risk management and compliance framework.

4 Comparison with other financial instruments

When evaluating the investment value of DAT, a core perspective is to place it within a broader spectrum of financial instruments for comparative analysis.We selected three methods of direct investment in cryptocurrencies, cryptocurrency spot ETFs, and DAT company stocks, and analyzed them from the four key dimensions of liquidity efficiency, risk-return characteristics, leverage structure, and downside protection (see the table below for details).Our analysis shows that DAT is not a simple replacement for the first two, but a more advanced compound tool that combines the characteristics of equity and crypto assets, providing professional investors with a unique source of Alpha returns.

Beyond Beta: In Search of Structural Alpha

The core of direct investment and ETF investment is to obtain the Beta return of cryptocurrency, that is, the basic return of the market.However, the investment logic of DAT goes beyond Beta, and its core charm lies in obtaining structural Alpha returns.

-

For direct holders, the income curve highly coincides with the currency price, which is a pure but passive risk exposure.

-

For ETF investors, despite gaining compliance and convenience, the revenue model is still essentially “currency price minus management fees” and cannot escape the category of Beta.

-

For DAT investors, the source of income is diversified: it not only includes the appreciation of the underlying crypto assets, but also includes the premium brought about by primary market discounts, intelligent leverage use, cross-market arbitrage, and the execution ability of the management team.This Alpha does not come from market fluctuations, but from the value creation ability inherent in the special capital structure of DAT.

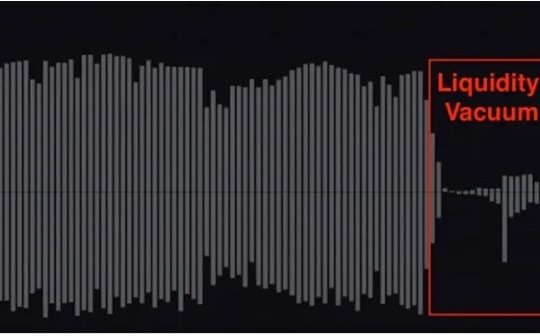

Upgrading the dimension of risk management: from passive acceptance to active utilization

Traditional perceptions of risk view volatility as something to be avoided.DAT provides a new perspective: converting volatility into manageable resources and even sources of profit.Direct investment and ETF investors can do little in a falling market but passively accept drawdowns.DAT’s complex capital structure provides it with multi-dimensional risk management tools.The change in discount and premium between its stock price and NAV provides the market with arbitrage opportunities, and this arbitrage behavior itself becomes a mechanism for stabilizing prices.

-

By issuing non-callable long-term debt (such as convertible bonds), DAT companies can amplify returns in bull markets, while in bear markets, their debt structure provides a buffer and avoids the risk of forced liquidation caused by margin calls.

-

When DAT’s stock price falls below its net asset value (mNAV<1) due to market panic, this itself will attract value investors and arbitrageurs to enter the market, forming a built-in “safety cushion” mechanism, which is a dynamic risk adjustment capability that the other two investment methods do not have at all.

To sum up, it cannot be simply understood that DAT is just an “alternative way to invest in cryptocurrency”. In fact, DAT is a unique and self-contained asset class.Therefore, for professional investors and institutions seeking higher capital efficiency, richer strategic tools, and more proactive risk management methods, DAT is not an option, but a must.It represents not a replacement for the past, but an upgrade to the future investment paradigm.As Dr. Xiao Feng, founder of HashKey Group, said: “ETF is good, but DAT is better.”What makes it even better is its ability to create Alpha returns, which cannot be replicated by traditional financial instruments and is inherent in its structure.

5. The meaning of DAT

As a new carrier connecting the traditional financial world and the encryption world, the emergence of digital asset treasury companies is of great significance in many aspects.

DAT is a bridge for traditional investors to enter the crypto ecosystem

Similar to ETFs, DAT companies provide a bridge for investors who are unable or uncomfortable to hold cryptocurrencies directly.However, the way DAT operates is more flexible than ETFs, because many institutional investors (such as public funds, pension funds, etc. in certain countries) are subject to regulatory restrictions and cannot directly purchase Bitcoin or related ETFs, but they can purchase shares of overseas listed companies.Therefore, the DAT structure can expand the potential investor base for cryptocurrency investment and help traditional capital enter the digital asset ecosystem while complying with local regulations and investment policies.

Some high-profile corporate allocations – such as MicroStrategy’s first purchase of Bitcoin – have also attracted widespread attention from corporate finance departments, brokers and other financial institutions, prompting greater participation in the digital asset from institutional investors.In this sense, DAT companies act as a bridge between traditional capital markets and the cryptocurrency ecosystem, normalizing cryptocurrency exposure in institutional portfolios.

Empowering the blockchain ecosystem and realizing value closed loop

The emergence of digital asset treasury companies has also introduced powerful new sources of funds into the encryption project ecosystem, helping projects achieve internal value cycles.On the one hand, DAT Company continues to purchase coins in the secondary market and lock them up for a long time, which objectively reduces the circulation supply of tokens, helps maintain the stability and rise of currency prices, and supports the currency value of the project ecology from the market level.

On the other hand, because they hold a large number of tokens of a certain project, these companies and the project officials (foundations) have highly consistent interests, and they all hope that the ecosystem will prosper and the currency price will rise.Managers will contribute the tokens they hold to the links that the ecosystem needs most, such as participating in staking on the PoS chain to improve network security, or lending tokens to DeFi protocols to provide liquidity, or even investing in start-up projects within the ecosystem to support the implementation of practical applications.This growth flywheel can make ecological empowerment more efficient and achieve a win-win situation for DAT investors and the ecosystem.

Refocusing on long-term value amid short-term volatility

The DAT model also guides the market focus from short-term speculation to long-term value creation.Under traditional concepts, cryptocurrency companies are often labeled as “speculative” and “volatile”, and investors are also keen to speculate on the short-term rise and fall of currency prices.The treasury company has made it clear that its core financial goal is the net value of digital assets corresponding to each share, rather than chasing short-term currency price fluctuations.This means that management is more concerned about how many coins it can hold in a number of years and how much the intrinsic value of the coin itself can grow, rather than buying and selling positions at will for quarterly profits and losses.

When the market begins to view DAT companies in a similar way to evaluating value investment companies, the valuation system of the entire ecosystem also tends to become mature and stable.Long-term investors (such as value funds) are more likely to join, which will improve the stability of the investor structure and reduce the violent volatility of stock and currency prices.In other words, the DAT model helps direct the attention of “blind speculation” to the discussion of “the ability of assets to appreciate in the long term.”It makes investors think: Will the Bitcoin/Ethereum held by this company be more valuable in five or ten years due to the development of the ecosystem?If the answer is yes, then short-term price corrections are nothing to fear.Such a change in philosophy will help the emergence of more long-termists in the digital asset field, thereby improving the stability and health of the entire industry’s valuation.

in conclusion

As a product of the intersection of traditional finance and the digital asset world, Digital Asset Treasury (DAT) companies are playing multiple roles as bridges, enablers and anchors.On the one hand, they open the door for traditional funds to participate in encryption, expanding the capital pool and recognition of the encryption market; on the other hand, their own existence is also forcing the encryption ecosystem to become more mature – whether it is improving compliance or focusing on long-term fundamentals.The rise of such companies reflects the transformation of the digital economy: more and more companies are beginning to regard digital assets as strategic resources to allocate and operate.

In the next article in this series of reports, we will focus on how DAT companies are specifically issued and operated, and how to judge and evaluate the investment value of DAT companies from the perspective of investors.