Author: Wang Yuehua

What is a crypto asset vault company (DATCOs)?

definition: Crypto Asset Vault Companies refer to listed companies that hold Bitcoin or other crypto assets on the balance sheet as their core strategic function.They will actively accumulate these assets and have a clear goal of expanding their holdings.

Investment logic:DATCOs can increase the net asset value per share (NAV) by generating native returns of crypto assets. In this way, compared to simply holding spot, they can obtain more ownership of underlying crypto assets within a certain period of time.

Differences from ETFs: Unlike ETFs, DATCOs can strategically raise and deploy funds while also benefiting from narrative-driven investor capital inflows, creating potential higher returns.

Existing crypto asset vault companies

(The stock price of the secondary market changes instantly, the data in the table below is not real-time)

DATValue creation mechanism

Four major value creation strategies:

-

Net Asset Value per Share in Tokens (NAV) Issuing stocks at a premium

-

Issuing convertible bonds and stock-linked securities (invested increase) to realize volatility

-

Through pledge rewardsDeFiRevenue and operating income to generate returns

-

Acquisition of other trades at close to or below net asset valueDATcompany

Logical chain:

Tokens/share→Prices of underlying tokens rise→ NAVMultiple growth

Case example

Tokens/The concept of per share

Why hold itDATCompany, instead of buying spot stock directly?

-

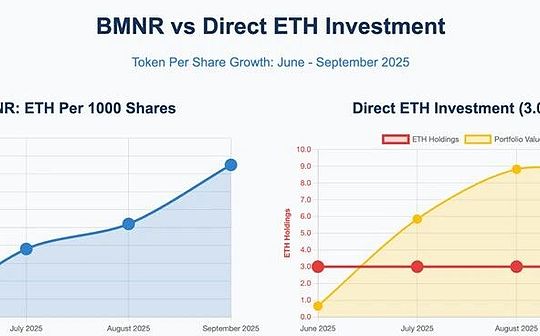

byBMNRFor example: its stock is usually higher than its net worth (NAV) trades at a premium.So why are some people willing to spend the same money byBMNRStocks to get“0.01 ETH”, instead of buying it directly0.01 ETHWoolen cloth?

-

The only reason is: stock investors believe thatBMNRStocks obtained“0.01 ETH”, it will eventually be more than holding directly0.01 ETHMore valuable, that is, by holding BMNR stocks, you can not only directly obtain the ETH share it represents, but also obtain the value-added value of the ETH standard.

-

The method isimprove“Tokens per share”.BMNRImplemented by:

1. Issuing stocks at a premium

2. Or raise funds by issuing convertible bonds

3. Then use the raised funds to buy more Ethereum

-

Essentially, these tools are all means to sell volatility—in other words, they are selling call options for their own stocks.

Case

-

AssumptionsBMNRBe able to make it every year for two consecutive years“Per shareETHquantity”increase50%.

-

If your initial holdings are0.01 ETH, then two years later, through this compound interest growth, you will eventually have about0.0225 ETH.

The current marketDAT

In addition to Bitcoin and Ethereum as the core in the marketDATIn addition to the company, there are someOther tokens (Altcoins)A crypto asset vault company based on it.These companies also operate through similar models:

-

Holding specific tokens on the balance sheet (e.g.SOL,AVAX,LTCwait)

-

Through financing, additional issuance, pledge rewards,DeFiExpanding with benefits and other means“Tokens per share”

-

And it may further enhance its valuation multiple through mergers and acquisitions and market operations (mNAV))

This typeDATThe existence of digital asset vault model is from a singleBTC,ETHExpand to a wider crypto asset ecosystem.Deding Innovation Fund has also actively made plans in this fieldLTC,BNB, as well asSOLRelatedPIPEproject.

Future crypto asset listing strategies

from2025Since the first half of the year, listed companies that have crypto-treasury methods have indeed gained popularity among Wall Street institutions, and huge funds have flowed to this type of financial products.However, the United StatesSECas well asNasdaqFor this categoryDATFormalPIPE dealThe supervision and audit have also been gradually strengthened, and even the most recent one hasSolanaforTreasuryListed companiesForward Industry, also directlyNasdaqMarket intervention, althoughTreasuryThere should be a certain premium in itself, but the crazy behavior of the market also makes the stock price irrational, resulting in the interests of retail investors being ignored and even losing.

In the long run, the listing logic of crypto assets should be more diversified. Here we can give two examples, one isIP/Story(NASDAQ CASK),This projectIPBased on this, it has derived a variety of business models and opportunities, creating considerable income and profits, and its business model is sustainable and has the possibility of growth. This type of crypto-asset company that can create income and profits can be achieved throughSPACIn the way of reverse acquisition of listed companies, backdoor listing, etc., thenPIPEThe scale of flywheel growth may be more suitable for future Wall Street funding participation.

Another case isEtherFi,As EthereumRestakingThe top items,EtherFiIt has long been deployed in a diversified business model, generating interest through mortgages, liquidity income, andETHNative value has been improved8digit profit.In the future, we will continue to lay out other financial products and provide more financial derivative financial tools to expand the user base andTVL,The vision for the future is to become a sustainable and all-round financial services company.Then throughSPACas well asPIPEImplement cryptoasset companieslisting vision.As a strategic investment institution of EtherFi, Deding Innovation is also actively involved in the growth and development of the entire project.