Author: Yuqian Lim, Source: Coingecko, Compiler: Shaw Bitcoin Vision

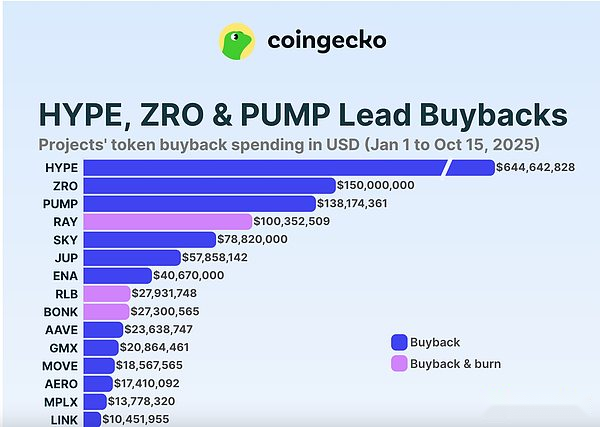

Which tokens have the largest buybacks?

Hyperliquid sets record for largest token buyback so far this year, its aid fundMore than $644.64 million has been spent so far.Hyperliquid alone will account for 46.0% of all token repurchase spending in 2025, equivalent to the sum of the next nine largest token repurchase amounts.A total of at least 21.36 million HYPEs were repurchased, accounting for 2.1% of the total supply..

The average monthly expenditure on HYPE token repurchases was US$65.5 million, with the lowest being US$39.14 million in March and the highest being US$110.62 million in August.As of now,The average price for HYPE token buybacks is approximately $30.18.

LayerZero is currently the second largest token buyback project, the project announced in September that it had spent $150 million to repurchase 5.0% of ZRO’s total supply of tokens from early investors.This brings ZRO’s average buyback price to $3.00, the highest level since May.However,LayerZero stated that this is currently only a one-time autonomous buyback, so it will likely be surpassed by projects that conduct token buybacks on a regular basis..

Pump.fun follows closely behind in third place with $138.17 million in buybacks and continues to grow.Since starting token buybacks in July, Pump.fun has spent an average of $40.47 million per month to buy back PUMP.While PUMP’s buyback payout is relatively low compared to HYPE, it’s worth noting that Pump.fun has bought back 3.0% of the total supply of tokens.The average PUMP repurchase price is $0.0046, which means that the tokens repurchased by Pump.fun are currently at a paper loss after the cryptocurrency plunge on October 11.

at the same time,Solana DEX Raydium is the project with the highest token buyback and burn spend at $100.35 million.Unlike the top three token buybacks that were only implemented this year, the RAY token buyback plan has been implemented since 2022.

The other four projects implementing buyback and burn plans are Rollbit (expenditure $27.93 million), Bonk’s proceeds from its launch platform Bonk.fun ($27.3 million), the Tron ecosystem’s Sun platform ($3.03 million), and exchange WOO ($1.68 million).

Overall,28 well-known projects have allocated funds for token buybacks in 2025.It’s unclear whether more projects will implement token buybacks, as the cryptocurrency community is still debating whether buybacks are the best mechanism to return value to token holders and align team incentives.

GMX, MPLX and SKY bought back the highest proportion of token supply

Decentralized exchange GMX has bought back 12.9% of its total supply so far this year, spending $20.86 million to repurchase 1.33 million tokens.However, GMX’s buyback and distribution structure means that not all bought-back tokens will be withdrawn from circulation.GMX spends an average of $2.24 million per month on token buybacks, with amounts ranging from $1.23 million to a high of $5.81 million in April.

Following closely behind is Solana distribution platform Metaplex, the company used half of the protocol revenue, or $13.78 million, to fund its DAO6.5% of total MPLX token supply bought back.MPLX token buyback payouts range from $650,000 to $2.57 million per month, with an average of $1.38 million per month.

Since its launch in February,Sky Protocol’s token buyback program has cumulatively accounted for 5.4% of the total token supply, has used $78.82 million in surplus revenue year-to-date, making it the third-highest buyback token.SKY token repurchase spending fluctuates between US$2.96 million and US$18.31 million per month, with an average of US$9.68 million per month.

In comparison, token buybacks for Jito and Chainlink cost $1 million and $10.45 million respectively, accounting for only 0.05% of the total token supply year-to-date.Among the top ten projects by token repurchase amount, Ethena and Aave have the lowest repurchase ratio, only 0.6%.

Excluding buyback and burn plans, the 23 token buyback projects examined here bought back an average of 1.9% of their respective total supply.So far, 14 of the 23 projects have bought back less than 1.0% of the total supply.

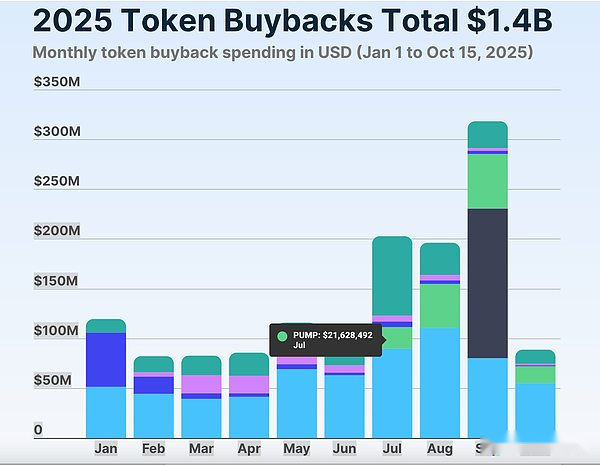

What is the token buyback payout in 2025?

Total spend on token buybacks in 2025 so far exceeds $1.4 billion.In a context where the low-circulation/high fully diluted valuation (FDV) token economic model has been criticized, Hyperliquid’s aid fund’s promotion of the token buyback mechanism has made it a key issue.In other words, the average monthly total expenditure on token repurchases by various projects this year reached US$145.93 million.

While there was a surge in token buyback spending in September, this was due to LayerZero’s one-time buyback announcement, which did not specify when the buyback would be implemented.Excluding ZRO’s buyback, token buyback spending in September was only $168.45 million.

despite this,Token repurchases increased significantly in the second half of the year, with repurchase spending increasing by 85.0% month-on-month in July.As of the first half of October, token repurchase spending has reached US$88.81 million, which is expected to exceed the monthly average level of US$99.32 million in the first half of the year for the fourth consecutive month..

methodology

This study examined the total token buybacks performed by each project between January 1 and October 15, 2025, based on data compiled from official project tracking systems and announcements or other reliable sources.Buyback payouts are in USD, calculated based on source-related data, or estimated based on CoinGecko’s daily price data; similarly, the number of buyback tokens is estimated as needed.Circulation and total token supply data come from CoinGecko.Average monthly buyback payout is calculated based on completed months only, while average token buyback price is calculated based on year-to-date totals.

Tokens with direct destruction mechanisms or procedures were not included in the study, but direct destruction is similar to buyback destruction.