Source: Coinbase; Compiled by: Bitcoin Vision

Zcash is a privacy-focused cryptocurrency that uses zk-SNARK technology to enable fully encrypted (“shielded”) transactions, allowing users to hide senders, recipients, and transaction amounts while maintaining on-chain validity.The network supports transparent addresses (similar to BTC) and shielded addresses and allows value to be transferred between them, so it can act as a traditional cryptographic channel when transparency is sufficient, or as an anonymity layer when confidentiality is critical.

several catalysts

The broader privacy narrative has thrust ZEC back into the spotlight.Several catalysts have emerged over the past few weeks, supporting Zcash’s parabolic rise:

-

Over-regulation: With the implementation of EU MiCA and the advancement of stricter KYC/transaction monitoring rules, some users and developers are looking for compliant and privacy-friendly solutions.Zcash’s selective disclosure model makes it a solution that balances the need for transparency with the privacy of transactions.

-

Growth in institutional adoption: While the entry of spot crypto ETF issuers and digital asset treasuries has been a key catalyst in the current crypto cycle, it has also made crypto users more cautious about who controls some of these networks.

-

Roger Ver Settles with U.S. Department of Justice: ‘Bitcoin Jesus’ Reaches a Provisional $48 Million Settlement for Alleged Tax Fraud Related to Hiding Bitcoin Holdingsprotocol, once again triggered public discussions on privacy, autonomous custody and traceability.This has prompted a focus on tools that enable confidentiality, with ZEC often mentioned as an option.

-

Product user experience benefits: Zashi Wallet recently updated its cross-chain exchange feature, making it easier to transfer cash directly into shielded ZEC, reducing the friction of everyday private finance.As a result, (1) the supply share of the shielded pool and (2) the number of shielded transactions have increased – proving its practicality and not just speculation.

-

Industry Spillover: Improvements to network-level privacy from peer projects (Monero’s “Fluorine Fermi”) validate the widespread viability of anonymity technology.The upgrade has reignited interest across the privacy space and prompted re-ratings across assets, including ZEC.

-

Ethereum Privacy Cluster: The Ethereum Foundation has established a “Privacy Cluster” team to focus resources on a range of privacy initiatives, signaling that privacy is moving from niche areas to core infrastructure, creating positive spillover effects for zero-knowledge proof assets like ZEC.

-

Institutional Portal: Grayscale’s expansion of regulated ZEC tools for accredited investors provides a clearer channel for capital to express privacy arguments, helping to translate narratives into actual flows.

Our View: Together, these catalysts create a coherent backdrop for the growing ZEC market: increased incentives for private transactions in the real world, enhanced accessibility and user experience for such transactions, and an expected decrease in structural selling pressure.Under these conditions, ZEC’s privacy utility can transform from pure momentum-driven trading to enduring demand.

Zcash Token Economics

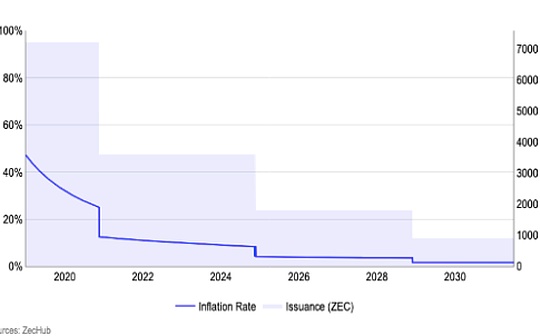

In addition to news catalysts, supply pressures are expected to structurally decline over time, meaning positive demand shocks will be met with scarcer new issuance.ZEC’s issuance schedule is reduced with each halving, which pushes the implied inflation rate from double digits in the early years to low single digits in the late 2020s.When demand rises—whether from the macro privacy narrative or new wallet/merchant integrations—miner supply tapers off to absorb that demand.With the November 2025 halving approaching, we believe market demand is likely to remain resilient through the end of the year.

Figure 1 Zcash issuance is expected to drop significantly with the halving in November 2025

From a technical perspective, the initial breakout is divided into two phases: 1) the initial short squeeze, and 2) the continued emergence of momentum bulls.The first wave was marked by a surge in liquidations and negative funding costs, suggesting that shorts were forced out rather than longs taking immediate profits.After the initial liquidation, open interest rose and funding costs turned positive, meaning momentum traders then aggressively chased the longs, turning the squeeze into a sustained move.

Our View: While open interest remains elevated, we believe the lack of a sustained surge in inflows suggests that a significant portion of the positioning is delta neutral rather than pure leveraged longs.We believe that this structure will leave more room for ZEC to expand as long as the privacy narrative remains unchanged.

Figure 2 ZEC Liquidation and Open Interest

Figure 3 ZEC financing interest rate and price

On-chain privacy usage is changing, adding fundamental support to price action.Privacy supply continues to climb and privacy transaction volume hits new highs, indicating that more and more value is not only flowing into privacy pools, but also being traded there – proving that ZEC’s core functionality is being truly used and not just traded based on narratives.

Figure 4 The number of shielded transactions and supply will surge in 2025

Our View: With issuance declining and shielding activity increasing, Zcash’s structural and functional background appears to be more supportive than in previous years.However, we believe that going forward will mostly depend on how BTC trades: Friday’s cross-market liquidations and subsequent spike in Bitcoin dominance suggest that Bitcoin’s price action still determines the liquidity of every other asset.While Zcash showed relative strength during the rally, its momentum has since waned, as has Bitcoin.If BTC reverses, we think ZEC will likely follow suit.