Author: Divine Grace

The doors of banks are officially open to cryptocurrencies, and a financial revolution is quietly coming.

“Sir, what business do you need to handle?”

“I want to transfer $1 million from my company account to buy Bitcoin.”

“Okay, we recently launched a partnership with Coinbase to process it quickly for you.”

This sounds like a conversation from a future scenario,is becoming a reality today.Global financial giant Citigroup officially announced a strategic cooperation with Coinbase, the largest compliant cryptocurrency exchange in the United States.

In the past few years, major banks have shunned cryptocurrencies, but now Citigroup is actively embracing them. This shift marks a complete reshaping of the boundary between the traditional financial system and the crypto world.This cooperation is not a small pilot project;Comprehensive and in-depth business integration, aiming to provide Citi’s institutional clients with payment solutions that seamlessly connect traditional finance and digital assets.

Breaking boundaries, Citi and Coinbase join forces

Looking closely at the details of the cooperation, the cooperation between Citigroup and Coinbase has great strategic depth.According to the official statement, the initial stage of the cooperation will focus on supporting users through Coinbase’s services.Deposit and withdraw traditional currencies(fiat currency) to achieve smooth conversion between traditional currency and cryptocurrency.

More importantly, Citi revealed that it will reveal more specific feature details in the coming months, includingExplore ways to convert traditional currencies into stablecoins.This move points directly to core changes in financial infrastructure.

The cooperation between the two parties is based on complementary advantages.Coinbase will export its experience in secure digital asset infrastructure serving 120 million users around the world, as well as its full-stack custody and trading solutions specifically designed for institutions.

Citi opened its coverage94 markets, a global network connecting more than 300 payment and clearing systems.This combination of traditional financial giants and leaders in the encryption field is a match made in heaven.

The technical roadmap revealed by Debopama Sen, head of Citi’s payment services, shows that the bank is actively evaluating the direct launch of on-chain stablecoin payment functions in the next few months.This deployment is by no means a simple interface connection, but to build programmable payment capabilities.

Solve pain points and usher in revolutionary breakthroughs in cross-border payments

The key breakthrough of this cooperation is cross-border payment, a long-standing pain point area.The crux of traditional cross-border payments lies in cumbersome procedures, long settlement cycles, and high intermediate costs.

Blockchain-based stablecoin payment is implementedPayment is settlement, greatly improving payment efficiency.Cross-border remittances from traditional banks usually take up to 5 working days to complete settlement, but for cross-border payments based on stablecoins, 100% of transactions can be completed in less than an hour.

In terms of cost, World Bank data shows that the average cost rate of cross-border remittances under the traditional model is about 6.35%, while the cost of sending stablecoins through high-performance blockchainsThe average cost is only about $0.00025.Cost differences of this order of magnitude are extremely attractive to multinational companies.

Citi has previously built a blockchain platform “Citi Token Services” to support customers’ 24-hour real-time fund transfer within its global network through tokenized deposits, laying the technical foundation for this cooperation.This cooperation with Coinbase will further amplify the efficiency of this infrastructure.

Why now?The regulatory turn in the Trump era

Citi chose this time to enter the cryptocurrency market in a big way, which is inseparable from the changes in the global regulatory environment.Since March 2025, the U.S. Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, and the Federal Reserve have successively revoked their previous regulatory filing/approval requirements for banking institutions to participate in cryptocurrency-related businesses.

This policy change allows banking institutions to do a good job in risk management and control while alsoIndependently engage in legally permitted cryptocurrency activities.The lowering of regulatory thresholds has cleared policy obstacles for traditional financial institutions such as Citigroup.

After taking office, the Trump administration has adopted a friendly attitude toward cryptocurrency and encouraged companies to expand related businesses in the United States, creating a favorable growth and investment environment for the industry.In March 2025, Trump also signed an executive order announcing the establishment of a “strategic Bitcoin reserve” and a “digital asset inventory.”

At the same time, the United States passed the GENIUS Act to establish federal regulatory rules for stablecoins, further eliminating policy uncertainty.The clarification of supervision provides institutional guarantee for traditional financial institutions such as Citi to enter crypto assets.

Banks deploy crypto assets, Citigroup is not alone

Citi is not the first traditional bank to enter the cryptocurrency space.Back in 2019,JPMorgan Chase launches its own stablecoin——JP Morgan Coin.In 2023, JPMorgan Chase upgraded it to the blockchain payment platform Kinexys, with average daily transaction volume exceeding US$2 billion.

Since 2025, banking institutions have accelerated significantly in exploring the issuance of stablecoins.Itau Unibanco, Brazil’s largest bank, plans to launch its own stable currency, and Sumitomo Mitsui, Japan’s second largest financial group, announced that it will cooperate with blockchain platform companies to develop stable coins linked to legal currencies.

At the same time,Hong Kong Virtual Bank ZA BANKCryptocurrency trading services have been provided directly to retail users, allowing users to buy and sell Bitcoin and Ethereum through Hong Kong dollars and US dollars.Emirates NBD, one of the largest banks in Dubai, has also launched cryptocurrency trading services through its digital banking platform Liv X.

Citi itself is also actively promoting institutional-level encryption custody services and plans to launch related custody services in 2026 to cooperate with the improvement of the regulatory environment.This series of actions shows that traditional banks are fully embracing crypto assets.

What practical benefits will enterprise customers see?

For Citi’s corporate clients, this cooperation will bring real convenience.Multinational companies canMake instant payments to downstream suppliers through stablecoins, eliminating exchange losses caused by exchange rate fluctuations.

In the field of cross-border e-commerce, merchants can quickly complete the payment verification process and reduce the period of fund retention.For entities that invest overseas, they can use the transparent nature of blockchain to track every cross-border capital flow in real time.

What is even more noteworthy is that the blockchain-based payment system breaks working day restrictions and enables cross-border transactions.No longer subject to time zone differences, truly realizing “7×24 hours” seamless connection.For companies operating globally, this means a qualitative leap in capital management efficiency.

The cooperation between Citi and Coinbase will also introduce programmable payment capabilities, such as setting specific conditions to trigger automatic payments and releasing funds in stages according to project progress and other intelligent operation modes.For industries that require refined cash flow management, such tools can effectively improve the transparency and controllability of fund use.

The integration of traditional finance and the crypto world is irreversible

The cooperation between Citigroup and Coinbase is a microcosm of the integration of traditional finance and the crypto world, but it is by no means an exception.This convergence trend has shown irreversible momentum.

The scale of the stablecoin market continues to rise, and the annualized transaction volume of stablecoins in 2024 has reached$15.6 trillion, equivalent to 119% of Visa’s annual transaction volume and 200% of MasterCard’s.This data fully shows that stablecoins have become an important part of the global payment system.

The integration of capital markets and crypto markets is also advancing in all directions.In 2024, securities regulatory authorities in the United States and Hong Kong have successively approved the launch of crypto-asset ETFs, providing a compliant channel for institutional investors to invest in cryptocurrencies.Traditional asset management giants such as BlackRock and Fidelity have also launched tokenized fund products.

The integration of crypto exchanges and stock exchanges is also accelerating.Cryptocurrency exchange Kraken acquires retail futures and foreign exchange trading platform NinjaTrader, and cryptocurrency exchange Coinbase is actively advancing its acquisition of cryptocurrency derivatives exchange Deribit.These mergers and acquisitions are opening up investment transactions between traditional financial assets and cryptocurrencies.

MicroStrategy raised funds through convertible bonds and additional stock issuances to purchase Bitcoin, turning the company into a “Bitcoin agent” for the U.S. stock market. Its stock rose by about 1,600% in 3 years, far exceeding the 420% increase of Bitcoin in the same period.This financial innovation is just an early example of the convergence of traditional finance and the crypto world.

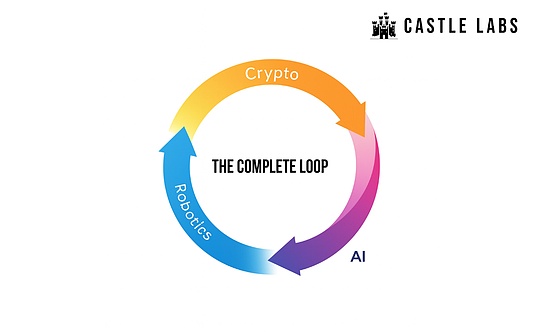

In the future, as more traditional financial institutions like Citi enter the market, we will see more innovative models emerge.Banks are no longer just guardians of fiat currencies;A bridge between traditional finance and the crypto world.

It’s not that you are chasing the wind, but that the wind is serving you.The currency circle is no longer fringe, it is becoming a part of finance.