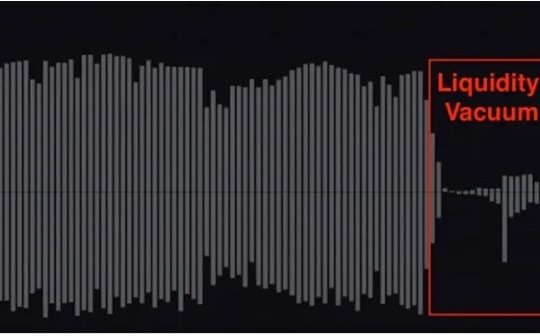

In the thrilling crash on October 11, a large number of retail investors’ positions were wiped out.The sudden withdrawal of market makers and the depletion of liquidity are very similar to the withdrawal rug on DEX.

“Rug” is the abbreviation of “Rug Pull”, which literally means “suddenly pulling the rug out from under your feet” and making you fall over. It vividly describes the experience of investors who lose all their money in an instant.

“DEX withdrawal rug” refers to a fraudulent behavior in which the development team of a cryptocurrency project suddenly withdraws all funds that provide liquidity for the project’s tokens in a decentralized exchange, and then completely disappears with the money, causing the token price to instantly return to zero and investors unable to sell.

The principle is that in order for the project team to allow people to trade their new tokens (for example, “Tudog”), they need to create a trading pair pool (for example, “Tudog”/ETH).They need to invest a certain amount of ETH and equivalent “Tugo” tokens as initial liquidity.

Then, the project party bribed KOLs to publicize the project, and supplemented it with small favors such as hair-raising rewards and other activities, attracting a large influx of investors.

When the project team believes that it has attracted enough funds (ETH) into the pool, they will use the liquidity pool certificates they own to remove all ETH and “Tugo” tokens that provide liquidity from the pool at one time.

The liquidity pool was drained instantly and became empty.

Since there is no more ETH in the pool for redemption, anyone holding the “Tugo” token cannot sell it.

The price of the “Earth Dog” token will show a straight line falling vertically to zero on the chart, becoming worthless.

The project team fled with all the fraudulent ETH.

Here, the DEX trading protocol (such as uniswap) itself only acts as a technically neutral trading venue.Switching to CEX is a centralized exchange that acts as a provider of trading venues.

The project side that launches projects on DEX and withdraws from the pool also plays the role of LP, the initial liquidity provider.

On CEX, market makers are only liquidity providers, not project parties.

The “earth dog” token is just a tool, a sickle.As it turns out, you don’t necessarily need to build the scythe yourself.

You can completely use other people’s counterfeit projects (such as this altcoin and that altcoin) to deceive others.

A more powerful way is to simply provide retail investors with a tool for everyone to freely issue coins, and let them create their own sickles to harvest them – and even encourage and guide retail investors to issue coins in the name of “freedom” and “fairness”.

As for the name of the coin, whether it is called “Tugou”, “Shit” or “6” is actually the least important thing – the only important thing is that the name must be “taken from the community” in order to facilitate the spread of KOL and stimulate the carnival of the mob to the greatest extent.

This is why, from the perspective of a slightly sober and rational person, this kind of almost performance art carnival of smearing shit on one’s face is very difficult to understand and incredible.

A famous quote from Shakespeare was quoted in “Westworld”: Violent joy must have a violent ending.

KOL’s hard-working propaganda and community carnival cannot hide the fact that all tokens, no matter what they are called, have a common name – air.

No matter how high the sentiment price of a token goes, air is still air.

Every floating token is a debt of the banker.

So when you read the news in the Jiaolian article that most of the retail investors who are speculating on earth dogs are making profits and A8A9 is everywhere, you should know that the fall of the banker’s sickle is already brewing.

According to the principle of DEX LP rug, as long as the market maker (MM) is arranged to suddenly withdraw, it can cause the rug effect of pulling out the bottom of the cauldron.

Moreover, each CEX is essentially the inner disk of the high wall of the small courtyard.Even if a coin is available on other platforms, as long as the network cable is unplugged in an instant, the brick mover is stuck, and the liquidity interoperability is closed, the liquidity of the platform can be exhausted and the platform can be shut down calmly.

Since market makers cannot really run away, it would be considered a fraud. Therefore, they must be arranged to come back quietly after a lightning rug or a thunder blow.

This is also because the centralized exchange that provides the venue has to pretend to be decent and must level the price of the pin to be consistent with other platforms before it can reopen its doors.The fewer people who copy unusually low prices during this period, the smaller the banker’s losses.

So if the spot goods are only shipped one at a time, and there is no time for the leeks to cut the flesh at the instant low point, wouldn’t the lightning rug be a waste of hard work?

It is best to force the leeks to cut their flesh at the instantaneous low point.

What tool can be used to forcefully cut meat?

Congratulations, you answered correctly, it is a contract.

The contract comes with leverage.Leverage can force the liquidation of positions, commonly known as liquidation.

Those who liquidate their positions will automatically be cut off.

One by one, the price came back, the position was exploded, and the money was harvested.

Just explain, comfort, and brainwash, and the matter will be smoothed over.

No need to run away, it’s very decent.

Finally, let me make it clear that the above are purely fictional deductions based on imagination and do not represent anything that actually happened in reality.Any similarity is purely coincidental.

Remember, in the world of finance, reality is more magical and cruel than you can imagine with your best imagination.