Author: Long Yue, Wall Street News

Larry Fink, CEO of BlackRock, the world’s largest asset management company, hasPositioning “asset tokenization” as the next revolution in the financial market, the goal is “to put all traditional financial assets into digital wallets.”

On October 14, during the company’s latest 2025 third quarter earnings conference call, BlackRock not only announced that its assets under management (AUM) reached a record-breaking US$13.5 trillion, but Fink also clearly pointed out the company’s key future direction.According to him, the scale of assets held in global digital wallets has reached approximately US$4.1 trillion, which is a huge potential market.

The vision laid out by Fink is that by tokenizing traditional investment vehicles such as exchange-traded funds (ETFs), a bridge can be built between traditional capital markets and a new generation of crypto-savvy investors.

“This is BlackRock’s next wave of opportunities in the coming decades,” Fink said in an interview with CNBC. This strategy has been initially verified through the success of its iShares Bitcoin Trust (IBIT), which exceeded $100 billion in assets in less than 450 days, becoming the fastest-growing ETF in history.

This forward-looking layout quickly received positive feedback from Wall Street.In a research note, investment bank Morgan Stanley reiterated its “overweight” rating on BlackRock shares and noted,“Tokenization of all assets” is one of the core narratives supporting its bullish outlook on BlackRock.

Targeting the $4 trillion digital wallet market

The core of BlackRock’s strategy is to reach the huge pool of funds currently outside the traditional financial system.According to Fink, this digital wallet market is approximately $4.1 trillion.

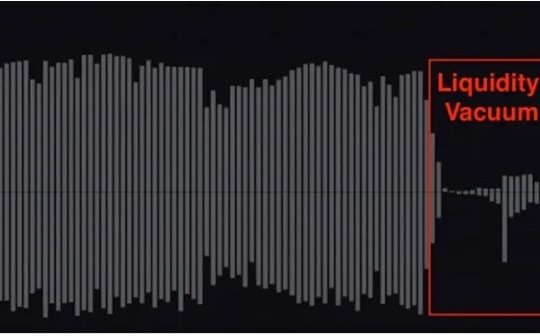

Morgan Stanley estimated in a report released on October 15,The total value of crypto assets, stablecoins and tokenized assets currently exceeds $4.5 trillion, and these funds “currently do not have access to long-term investment products”.

According to analysis by Morgan Stanley,BlackRock aims to “replicate everything in traditional finance today into digital wallets”.

By achieving this, BlackRock can introduce young investors accustomed to using tokenized assets to more traditional asset classes such as stocks and bonds, and provide them with long-term retirement savings opportunities.

Fink believes that tokenization can also reduce transaction costs and intermediary fees, such as in real estate and other fields.

Asset Tokenization: A Vision for the Future of Finance

Fink firmly believes that the next major change in global finance will come from the tokenization of traditional assets, including stocks, bonds, and real estate.He said in an interview that the company sees tokenization as an opportunity to introduce new investors to mainstream financial products through digital means.

Fink pointed out that although tokenization has huge potential, it is still in the early stages of development.Citing research from Mordor Intelligence, he predicts that the tokenized asset market will exceed US$2 trillion in 2025 and is expected to soar to more than US$13 trillion by 2030.

BlackRock is already laying the groundwork for deeper involvement in this space.The company’s internal team is actively exploring new tokenization strategies to solidify its leadership position in digital asset management.

From Bitcoin Skeptic to Blockchain Advocate

Fink’s change in attitude towards digital assets marks the evolution of mainstream financial institutions’ views on the field.He once called Bitcoin a “money laundering index,” but now takes a very different stance.

In a recent interview, Fink admitted that his views have changed.”I was a critic before, but I’m growing and learning,” he told CNBC.

He now compares crypto assets to gold and believes it can be used as an alternative investment for portfolio diversification.

Wall Street bullish on “tokenization” growth prospects

Wall Street analysts believe that BlackRock is well-positioned to dominate the tokenization space due to its industry position and resources.

Morgan Stanley analyst Michael J. Cyprys raised BlackRock’s price target to $1,486 in a report, highlighting its “grand vision to tokenize all assets” as a key driver.

The report noted that BlackRock has been experimenting with its tokenized money market fund BUIDL, which has grown to nearly $3 billion in assets under management since its launch in March 2024.

Morgan Stanley believes that with its strategic focus starting from the top management, the company’s scale, extensive business footprint and client relationships, BlackRock has the ability to influence the future industry structure and work with leading exchanges and vendors to execute and deliver tokenized BlackRock products.

BlackRock seeks to tokenize traditional assets as a bridge between traditional capital markets and digital assets.Tokenization has the potential to bring traditional assets into the digital wallet-native paradigm—more than $4.5 trillion worth of cryptoassets, stablecoins, and tokenized assets are currently inaccessible to long-term investment products.

BlackRock aims to replicate everything in traditional finance today into digital wallets, so investors never need to leave their digital wallets to build a long-term, high-quality portfolio of stocks, bonds, cryptocurrencies, commodities and more.

By enabling this, BlackRock can steer the large pool of young investors using tokenized assets toward more traditional assets and prepare them for future long-term savings opportunities for retirement.