Author: André Dragosch, Bitwise European Research Director; Translation: BitChain Vision xiaozou

“If in doubt, extend the time axis and observe”

Here are the key chart highlights from our latest Bitwise quarterly market report.

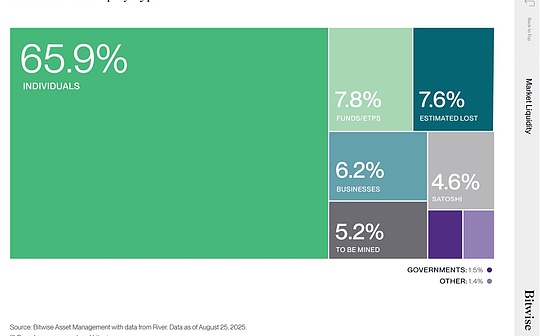

This data clearly reveals the current general trend and even explains the peculiarities of this Bitcoin cycle (data provided by River).

1, interpretation“Great transfer of wealth“essence

The core key point is this: Bitcoin is flowing from early retail investors to institutional investors (funds/exchange-traded products), businesses and even government entities.

Unlike other traditional asset classes in history, the popularity of Bitcoin began with retail investors such as cypherpunks and early participants, and then ushered in the first deployment of institutional investors such as family offices, fund managers, and ETFs.

Even today, retail investors still account for about 66%, which means that the vast majority of Bitcoin is still controlled by non-institutional investors (see the matrix distribution in the figure above)!In comparison, the latest data from U.S. 13F documents show that the allocation ratio of institutional investors in traditional asset classes is significantly higher.

Observe the proportion of institutional holdings in mainstream traditional financial ETFs:

iShares 20-year and above Treasury Bond ETF (TLT) institutional holdings are 79%;

SPDR S&P 500 ETF (SPY) institutional holdings are 58%;

SPDR Gold ETF (GLD) institutional holdings are 36%.

Comparing the latest survey of Bank of America’s global fund managers: the current average allocation ratio of crypto assets (including Bitcoin and other tokens) is only 0.4%.(Additional: IBIT’s institutional holdings currently account for only 26%…)

It follows that, as the industry saying goes, “We’re still in the early stages,” institutional adoption is still in its infancy.

But it is undeniable that a large-scale wealth transfer from retail investors to institutions is taking place.The wealth migration from early retail currency holders to institutional investors will bring multiple impacts, which may be far-reaching beyond imagination:

2, Popularization of Bitcoin: Trends and Cycles

(1) trend

First of all, let’s be clear: This shift will not happen overnight, but will be a long-term trend.

The reality is: most Bitcoins are illiquid and are being held for the long term.Only about 14.5% of the Bitcoin supply is stored on exchanges such as Coinbase or Binance with relative liquidity, and the remaining assets are stored in off-chain wallets to remain illiquid.

Without financial incentives, Bitcoin wealth will not automatically transfer.

Many early holders set psychological price levels (such as $1 million/BTC) or financial goals (such as “money to buy a house”) as triggers for selling Bitcoin, which is well above the current market price of approximately $115,000.To attract these illiquid tokens to the market (i.e. exchanges), the Bitcoin price would need to rise significantly.

In the process, Bitcoin’s popularity will expand as ETFs hold assets in trusts for millions of individual investors.Financial reports of listed companies also show that they are held by hundreds of thousands of different investors.As of this writing, institutional investors (ETPs and listed companies) control approximately 12.5% of the Bitcoin supply—and rising rapidly.

(2) periodic pattern

Most analysts probably agree that the early Bitcoin bull-bear cycle was dominated by the halving event that occurred every 210,000 blocks (about 4 years), which halved the output of Bitcoin (hence the name “halving”).

But the impact of halving events is diminishing with each event—both in absolute terms and in proportion to the circulating supply.As the adoption rate of institutions increases and the demand structure changes, the halving effect has been significantly weakened.

Data in 2025 shows that the scale of institutional demand has reached approximately 7 times the supply gap caused by the halving!

In this process, the influence of traditional macro cycles has been relatively enhanced—Bitcoin has become a true “macro asset.”

Our quantitative analysis also shows:past6Monthly Bitcoin price fluctuations80%The above is driven by macro factors such as global growth expectations and monetary policy., the influence of token-specific factors is less than 5%.

However, the dominance of macro factors also means that the future bull and bear cycles of Bitcoin will fluctuate in sync with the macro/business cycle, and the four-year cycle driven by “halving” is likely to “fail”.

This ultimately suggests that Bitcoin accumulation and distribution will depend on the prevailing macro environment (expansion/prosperity vs. contraction/recession), triggering short-term price swings in a risk-on/risk-aversion pattern.

3.Conclusion

The fundamental meaning of the “Great Wealth Shift” is that the price of Bitcoin needs to reach higher – much higher than current – levels to encourage further adoption and complete the transfer from early retail investors to institutional investors.

The continued influx of institutional investors means that Bitcoin has become a true “macro asset”, indicating that future bull and bear cycles will be increasingly dominated by macro/business cycles (rather than halving events).