Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by: BitChain Vision

Being a long-term cryptocurrency investor can be frustrating at times.

When I invest in cryptocurrencies, I am essentially making a multi-year bet on the future of money and finance.I firmly believe that a robust digital currency (Bitcoin) will provide an important way out of the continued depreciation of the US dollar and other fiat currencies; stablecoins will revolutionize payments; and tokenization will forever change the way we trade stocks and bonds.

I make these investments with the expectation that they will pay off in years or even decades.So far, it’s going pretty well.Bitcoin has risen more than 350-fold in the past 10 years and has been the best-performing asset in the world in every cycle.

butThis is not the case for all cryptocurrency investors.Some people will invest with high leverage – up to 100 times – hoping to get rich quickly.Sometimes these investments succeed and sometimes they fail.

Most of the time, I can safely ignore the “casino” nature of cryptocurrencies as it is just noise; it does not fundamentally change the trajectory of cryptocurrencies.But occasionally, it gets too noisy to ignore.Last weekend was an example.

At 4:57 pm Eastern Time last Friday, President Trump tweeted on “Truth Social” threatening to impose 100% tariffs on all imported goods from China.The move comes in response to China’s threats to cut off exports of rare earth metals, which are vital to U.S. technology manufacturing.

This tweet sounds like a major escalation in the global trade war.With the stock market closed, traders desperate for answers turned to a place that never closes: the crypto market.

Bitcoin price fell sharply.As prices fall, leveraged traders face automatic liquidation, causing prices to fall further and enter a downward spiral.A total of nearly $20 billion in leveraged positions were liquidated, making it the largest liquidation in crypto history.Bitcoin trading prices fell by 15% at one point.Altcoins performed even worse, with Solana falling 40% at one point.

But then, the market quickly reversed course, falling as quickly as it rose.The Trump administration has de-escalated the trade war, and cryptocurrency prices have recovered accordingly.By Monday morning, Bitcoin was trading back up to $115,000, not far from where it was before Trump’s tweet.It’s like flash crashes almost never happen.

The question I’ve been thinking about ever since is: “Did the collapse of 1011 matter?”

This time my answer is “not important”.Cryptocurrencies have rebounded quickly because the fundamentals of their prospects—such as their underlying technology, security, or regulatory environment—haven’t changed.But “not important” is not the inevitable answer.In some cases, moves like Friday’s are sure to have an impact on the long-term trend of cryptocurrencies.

In this week’s memo,I’d like to walk you through the list of things I consider to determine whether a market turmoil like last Friday’s is a blip or a major event.

Question 1: Did any major market players collapse?

Whenever there is a significant market correction, the first thing Bitwise does is conduct a channel check with partners and service providers, from custodians to liquidity providers.Even a sharp market correction driven by technical factors can cause real damage if it fundamentally harms large institutions such as hedge funds or prominent market makers.In this case, the damage appears to be limited to individual investors.Some companies have suffered losses, but it looks like they will all survive.This is one of the reasons why cryptocurrencies have rebounded so quickly.

Question 2: How does blockchain technology perform?

The second question I often ask is how cryptocurrencies — and thus the blockchain itself — are performing.Large market fluctuations are a stress test for the cryptocurrency market.Can they withstand such high trading volumes?Do decentralized exchanges work well?Has the website been shut down?

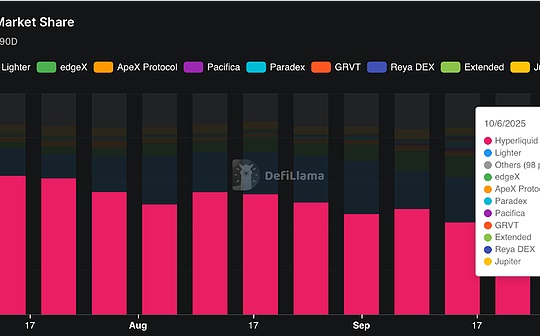

Cryptocurrencies have performed reasonably well during this pullback, if not perfectly.Many DeFi platforms performed flawlessly: Uniswap, Hyperliquid, Aave, and others did not suffer losses.But a handful of centralized platforms like Binance had problems; in fact, it had to refund nearly $400 million to traders.Overall, cryptocurrencies have performed as well or better than traditional markets under the same circumstances.

Question 3: What does my inbox look like?

The third question I asked was, what does my inbox look like.If I’m bombarded with emails, phone calls, or text messages from investors, I know the market is really in a panic and it might take a while to calm down.

This time, nothing happened to me.Although I received many questions from the media and received a large number of responses on crypto Twitter,Professional investors largely ignored the news.

What’s next?

All of which suggests that the 1011 flash crash won’t have any lasting impact.The long-term forces driving this market – improved regulation, increased institutional investor allocations, and the growing awareness that cryptocurrencies are disrupting all traditional markets – remain intact.It also helps to zoom out: Bitcoin is up 21% in 2025, and the Bitwise 10-cap cryptocurrency index is up 22%.

The crypto market may be slightly nervous in the short term.Market makers and liquidity providers often exit the market within days of large market moves, and a lack of liquidity can cause large price increases or decreases.

But I expect,Over time, the market will slowly regain its energy and refocus on cryptocurrency fundamentals.Until then, I think the bull market will continue.