Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by: BitChain Vision

At the beginning of this year, we predicted that Bitcoin ETFs would attract more money in 2025 than in their record first year ($36 billion in 2024).Looking at the chart, you might think we’re starting to get nervous.Bitcoin ETFs have attracted $22.5 billion in the first three quarters of this year, and at this pace, full-year inflows will reach about $30 billion.That number, while impressive, is slightly below the 2024 high.

Gold vs. Bitcoin: Annual ETF Inflows

Source: Bitwise Asset Management, data from ETF.com, Farside Investors and U.S. Bureau of Labor Statistics.Data as of October 3, 2025, and adjusted for inflation.Past performance is not indicative of future results.

But here’s a bold take: I’m not worried.

In my opinion,A variety of favorable factors have come together to drive very strong inflows into the fourth quarter – strong enough to give us a new record (and a new all-time high for the price of Bitcoin).

There are three reasons:

1. We finally won the big wealth management platform

Until recently, the world’s largest wealth managers were banned from buying Bitcoin ETFs.This situation has finally changed.

October 1,Morgan Stanley’s Global Investment Committee——The organization guides$2 trillion in assets under managementof 16,000 advisors – released a report titled “Asset Allocation Considerations for Cryptocurrencies.”The landmark report states that the firm’s financial advisors and clients now have the “flexibility to allocate cryptocurrencies as part of their multi-asset portfolios.”The report suggests that for investors with a strong risk tolerance, an allocation of up to 4% is appropriate.

Morgan Stanley recommends maximum allocation to cryptocurrencies in multi-asset portfolios

Source: Morgan Stanley Wealth Management Global Investment Council and Bloomberg.Data as of September 30, 2025.

Morgan Stanley is not alone.Wells Fargo (which has about $2 trillion in assets under management) also recently reversed course and allowed advisors to make allocations on behalf of clients.I suspect UBS, Merrill Lynch and others will soon follow suit.

I don’t expect all the advisors at these firms to immediately pile into Bitcoin ETFs.New guidance will take time to digest, especially when we are dealing with tens of thousands of financial professionals.But I can tell you this from multiple conversations with advisors in recent months: There is serious pent-up demand here, and I expect significant inflows in the fourth quarter.

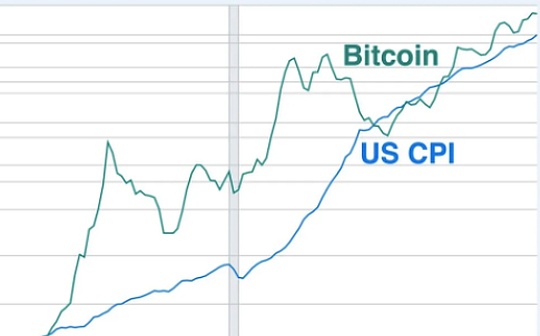

2. “Depreciation trading” is a popular trade this year

The best-performing major assets globally this year are gold and Bitcoin.

Wall Street has a term for this: “devaluation trading.”It refers to investing in assets that are expected to perform well when governments devalue or weaken their currencies.And the government is indeed devaluing the currency: Since 2020, the U.S. money supply has grown 44%.J.P. Morgan released a major report on currency devaluation trading on October 1, which is a clear indication that devaluation trading is becoming mainstream.

Why is this important?Because when advisors sit down with clients for their annual review, they want the year-end report to show they held the most successful investments.And the only way to do that is: buy gold and Bitcoin.

Last year, everyone wanted their Nvidia holdings to appear on their annual reports.This year, they want gold and Bitcoin.I suspect you’ll see strong inflows through the end of the year as advisors ride the bandwagon of devaluation trades.

3. Bitcoin prices are soaring

I doubtThe third – and most fundamental – reason we will see high inflows is that I am optimistic about Bitcoin returns in the fourth quarter.We are already at all-time highs, breaking the psychological barrier of $100,000, and Bitcoin price surpassing $125,000.Bitcoin prices rose 9% in the first week of October alone.Although somewhat counter-intuitive, higher prices typically spur greater demand for Bitcoin ETFs as the media, companies, and everyday investors turn their attention to Bitcoin.

In fact, although correlation does not necessarily imply causation,In every quarter in which Bitcoin has posted double-digit returns, Bitcoin ETFs have also seen double-digit billions of dollars in inflows.

Bitcoin ETF Inflows vs. Bitcoin Returns

Past performance is no guarantee of future results.

Q4: Good start

Notably, the fourth quarter started well.Through the first four trading days of the quarter, we have recorded $3.5 billion in net ETF inflows, bringing total year-to-date inflows to $25.9 billion.

We have 64 trading days left to secure another $10 billion.I think we can not only do it, but we will do it better.