Author: @BlazingKevin_ , the Researcher at Movemaker

Real adoption and expansion of USD stablecoins

In our previous analysis, we have argued that the birth of Plasma is a key strategic move for Tether, aiming to fundamentally transform its business model from a passive “stable currency issuer” to an active “global payment infrastructure operator” in order to recapture the huge value captured by third-party public chains.The urgency and importance of this strategic layout are being continuously amplified by an irreversible macro trend: the adoption of U.S. dollar stablecoins in the real world is undergoing a significant paradigm shift and entering a phase of accelerated expansion.

1. Quantitative expansion of total market volume

First of all, from a macro data perspective, the overall size of the stablecoin market is experiencing a new round of structural growth.Compared to the market cycle two years ago, the total market capitalization of global stablecoins has climbed from approximately $120 billion to $290 billion, a 140% increase.This data shows that the demand for stablecoins has exceeded the scope of speculation and trading in the native field of cryptography, and has begun to gain recognition from the wider market as an independent asset class and financial instrument.

2. The explosion of core application scenarios: cross-border payment

The strongest manifestation of this growth is in the vertical field of cross-border payments.Two years ago, actual use cases for stablecoins for cross-border settlements were in their infancy and almost negligible.According to the latest data, the current monthly settlement volume in this field has exceeded the $60 billion mark.Even more noteworthy is its growth slope – month-on-month growth of 20% to 30%, clearly demonstrating a steep adoption curve.

Despite rapid growth, its market penetration is still at a very early stage.Compared with the current global traditional cross-border payment market totaling US$200 trillion per year, the share of stablecoins is still negligible, which indicates that there is still huge room for growth of dozens or even hundreds of times in the future.

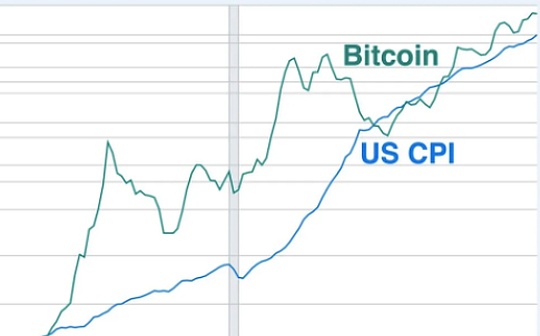

3. Core driving force: “currency substitution” demand in high-inflation economies

Behind the accelerated adoption of stablecoins is the strong economic driving force in the real world, which is particularly evident in emerging markets and high-inflation countries.

An in-depth analysis report by Cointelegraph in August pointed out that in countries such as Venezuela, the sovereign currency (bolivar) has basically lost its core function as a daily commercial transaction medium due to hyperinflation.Strict capital controls, an ineffective local banking system and chaotic official exchange rates have combined to create a “scorched earth” financial environment.In this environment, citizens and businesses actively seek currency alternatives, and the US dollar stable currency, which has sufficient liquidity and value stability, is far more reliable than cash or local bank transfers, and has become the “hard currency” chosen by the market spontaneously.

This phenomenon is not unique to Venezuela.Since the global inflation wave in 2022, many major economies, including Argentina, Nigeria, Turkey, and Brazil, have faced severe depreciation pressure on their national currencies, which has given rise to huge demand for value storage and payment hedging.

Venezuela ranks 18th globally in cryptocurrency adoption, according to Chainalysis.More telling data is that in 2024, 47% of the country’s small transactions under $10,000 were done through stablecoins, making it the ninth largest crypto adopter in the world on a per capita basis.This is no longer a niche behavior, but proof that stablecoins have been deeply embedded in its socio-economic fabric.

More importantly, this kind of adoption is gradually moving from the “grey” area where people are spontaneous to the “sunshine” area recognized by the government.In Brazil, stablecoins have been integrated into its national instant payment system PIX; in Argentina, the use of stablecoins to pay large contract payments such as house rent has also been legally recognized.These cases mark that the adoption of stablecoins is evolving from “spontaneous at the bottom” to a higher stage of “confirmation at the top”.

US dollar stable currency: three strategic pivots of US national interests

Since the regulatory framework represented by the Genius Act was clarified, the growth trajectory of U.S. dollar stablecoins has shown an exponential acceleration, and its long-term potential is far from reaching its ceiling.This explosive growth is not only market behavior, but also deeply bound to the strategic interests of the United States at the national level.From a macro perspective, the global expansion of U.S. dollar stablecoins can bring at least three major strategic dividends to the United States:

1. Maintaining the hegemony of the US dollar: an asymmetric extension of monetary influence

In the past decade, the process of “de-dollarization” on a global scale has been slow but has been advancing continuously and orderly, causing long-term erosion of the international reserve and settlement status of the US dollar.The rise of US dollar stablecoins provides a new, asymmetric solution to reverse this situation.

Especially in the high-inflation countries mentioned above, the popularity of U.S. dollar stablecoins essentially builds a parallel “digital dollarization” economic layer anchored by the U.S. dollar outside the financial system of sovereign countries.It can effectively bypass the capital controls and fragile fiat currency systems of these countries, allowing the value proposition of the US dollar to reach end users directly.This not only did not use any traditional geopolitical or military means, but in fact achieved deep monetary penetration into these economies, greatly expanding the actual coverage of the “US dollar ecology” (traditional US dollar + digital US dollar), thereby consolidating the international status of the US dollar in a new dimension.

2. Relieve fiscal pressure: Create structural demand for U.S. Treasury bonds

The second strategic fulcrum is to provide support for the increasingly heavy government finances of the United States, which is crucial.The stability of the U.S. Treasury market, especially its yield level, is a core concern of U.S. economic policy.The Treasury market is a cornerstone of the U.S. macro economy, as evidenced by the Trump administration’s extreme sensitivity to fluctuations in the 10-year Treasury rate as it dealt with the tariff dispute.

The issuance mechanism of U.S. dollar stablecoins has naturally created a huge and continuously growing source of demand for U.S. Treasury bonds.Although the current reserve assets of stablecoin issuers have been largely allocated to U.S. Treasury bonds, as their total market value further expands, their role as a “big buyer of U.S. debt” will become increasingly important.Citibank’s analytical model predicts that the potential long-term size of the stablecoin market could reach $1.6 trillion by 2030.The model further states that there will be hundreds of billions of dollars inIncremental demand for U.S. debt, mainly from three aspects: 1) the reallocation of US dollar cash in global circulation to digital form (about 240 billion US dollars); 2) the partial reallocation of global central bank base currency (M0) (about 109 billion US dollars); and 3) the reallocation of US dollar deposits held by foreign countries into stable currencies (about 273 billion US dollars).This new purchasing power will play a positive role that cannot be ignored in stabilizing U.S. Treasury yields and reducing government financing costs.

3. Consolidate the first-mover advantage: Dominate the formulation of rules in the era of digital assets

Finally, the United States is working hard to ensure its dominance in the global crypto market, and U.S. dollar stablecoins are at the core of achieving this goal.The 180-degree shift in the direction of regulation from repression in the past to embrace today clearly exposes the evolution of its strategic intentions.When decision-makers realized that they could not completely kill encryption technology, they quickly turned to the strategy of “incorporation” and “exploitation”, that is, by establishing a complete legal framework to bring this emerging field into their own regulatory and economic territory.

This strategy is not unique to the United States, but is a competition among major economies around the world.The ultimate goal of all countries and regions that are actively legislating stablecoins is to seize a favorable position and share future dividends in this new financial technology track.By supporting U.S. dollar stablecoins, the United States aims to ensure that the underlying settlement standards of the future global digital economy remain firmly in its own hands.

The Current Situation of Non-USD Stablecoins: Structural Dilemmas and Strategic Inevitability

1. Extreme concentration of the market structure

Although the expansion of U.S. dollar stablecoins is strong, a healthy global digital asset ecosystem should present a pattern of coexistence of multiple legal currencies.However, real-life data reveals an extremely imbalanced picture: the market space for non-USD stablecoins is being severely squeezed.

The data shows that this sector has experienced a sharp contraction.In the early stages of market development in 2018, non-USD stablecoins once occupied 48.98% of the market share, almost rivaling US dollar stablecoins (51.02%).Today, however, its total market share has collapsed to just 0.18%.In terms of absolute size, the total market capitalization of non-USD stablecoins is only $526 million, of which euro stablecoins ($456 million) account for nearly 88.7% of the absolute dominance.This shows that apart from the US dollar, no other legal currency has yet been able to form effective market competitiveness on the stablecoin track.

2. Structural risk: “Exchange rate tax” for non-USD zone users

As the stablecoin market becomes increasingly closely integrated with real-world economic activities, this “unipolar system” composed of U.S. dollar stablecoins will bring potential structural risks to users in non-U.S. dollar areas (especially developed economies that are also in a low-inflation environment).The core problem is that they are forced to take unnecessary risks in participating in the global crypto economy.Foreign exchange fluctuation risk.

We can illustrate this problem through a typical user path:

Suppose a user in Tokyo purchases Ethereum (ETH) using Japanese Yen (JPY) on the local compliance exchange bitFlyer.When she hopes to put these assets into global DeFi protocols (such as lending on Aave, or providing liquidity on Uniswap), she will find that the core fund pools of these mainstream protocols are almost all denominated in U.S. dollar stablecoins (USDC, USDT, etc.).

The concept of her “yen balance” in her bitFlyer account cannot be directly transferred to the on-chain world.In order to participate in DeFi, she must hold an on-chain, tokenized stable asset.In the absence of a Japanese yen stablecoin with sufficient liquidity and composability, her only option is to exchange ETH for a U.S. dollar stablecoin.With this step, her investment portfolioAdding a layer of JPY/USD exchange rate exposure out of thin air.Regardless of whether she makes a profit or a loss in the future, she will have to bear the exchange rate fluctuations during this period when she eventually exchanges it back to Japanese yen, which is equivalent to being levied an invisible “exchange rate tax.”

3. Systemic Risks and the Strategic Necessity of Diversification

From a more macro level, the current liquidity lifeline of the entire crypto economy is almost entirely tied to the US dollar stable currency, which constitutes a potential and highly concentrated systemic risk point.Any extreme regulation, technology failure or monetary policy shock originating from the United States could have a catastrophic impact on global markets.

Therefore, the significance of promoting the development of multiple high-quality stablecoins such as the euro, pound, and yen goes far beyond market competition itself.It is equivalent to building a “risk wall“and a”Systematic backup plan“. A diversified multi-fiat stablecoin ecosystem can effectively hedge the risks caused by over-reliance on a single national currency and single regulatory system, and improve the anti-fragility of the entire system.

For major economies such as the European Union and Japan, promoting stablecoins that are regulated by their own financial systems and linked to their national currencies is no longer a purely commercial act;Maintaining the extension of one’s own “currency sovereignty in the digital era” is a national strategic task.Although the current non-USD stablecoins are far from the US dollar stablecoins in terms of scale and liquidity, the logical foundation for their existence is solid, and their development is an inevitable trend in history.Next, we will provide a detailed introduction to the development of major non-USD stablecoins.

euro stablecoin

Against the background that the global stablecoin market is absolutely dominated by the US dollar, the evolution path of the euro stablecoin provides us with an excellent sample to observe how non-USD currencies try to break through under the driving force of regulation.

1. Two stages of market evolution: from early exploration to regulatory-driven acceleration

The development process of Euro stablecoins can be clearly divided into two stages with the EU’s Crypto Asset Market Regulation (MiCA) as the watershed:

-

Early exploration phase (pre-MiCA bill): The landmark project of this phase is STASIS Euro (EURS), launched in 2018.As a pioneer in the market, EURS has faced the dilemma of slow growth for a long time, with its market capitalization hovering in the range of tens of millions to 100 million euros for a long time.This reflects the fact that in the absence of a clear regulatory framework and institutional-level demand, the market is limited to a small number of local crypto enthusiasts in Europe and has failed to achieve economies of scale.

-

Accelerated development stage (driven by the MiCA Act): The proposal and gradual implementation of the MiCA bill is a fundamental catalyst that changes the rules of the game.It provides market participants with unprecedented legal certainty, thereby attracting the formal entry of industry giants.Stablecoin issuers Circle (issuer of USDC) and Tether (issuer of USDT) launched Euro Coin (EURC) and Euro Tether (EURT) respectively.Circle, in particular, has begun to actively promote its multi-chain deployment strategy during 2023-2024 as MiCA approaches, extending EURC to multiple mainstream public chains such as Ethereum, Solana, and Avalanche.

The results of this strategic transformation are confirmed by data: between 2023 and October 2025, the total market value of euro stablecoins has experienced rapid growth and currently reaches US$456 million.in,Circle’s EURC contributed most of the increase, with its market capitalization achieving a 155% increase in 2025, growing from $117 million at the beginning of the year to $298 million.Although there is still a huge gap in absolute value compared with USD stablecoins, its growth rate shows strong catching-up momentum.

2. Market Acceptance Assessment: Infrastructure is in place, but network effects are insufficient

-

Exchange and DeFi integration: The euro stablecoin has completed the basic infrastructure laying.All first-tier exchanges such as Coinbase, Kraken, and Binance have listed EURC or EURT and provided trading pairs with mainstream crypto assets.At the same time, leading DeFi protocols such as Aave, Uniswap, and Curve have also been integrated.Especially in protocols optimized for stablecoin exchange such as Curve, the liquidity size of the euro stablecoin pool is steadily increasing.

-

Potential application scenarios: In the field of payment and remittance, some Web3 payment applications and financial technology companies have begun small-scale pilots to use euro stablecoins for instant settlement and cross-border payments within the euro zone.

-

Core obstacle – cognitive gap: Although the infrastructure is initially complete, the euro stablecoin faces huge “cognitive gap“and”network effects deficit“. In the mental model of the vast majority of crypto users around the world, the concept of “stablecoin” is almost equated with “USD stablecoin”, which makes the euro stablecoin facing many obstacles in acquiring new users and liquidity.

3. Double dilemmas for future development

-

Potential competition from an official digital euro (CBDC): The European Central Bank (ECB) is actively promoting research and development of a digital euro.Once the digital euro, issued directly by the central bank and without credit risk, is launched, it will constitute direct and asymmetric competition for euro stablecoins issued by private institutions.By then, the digital euro is likely to gain an overwhelming advantage in regulatory status and application scenarios, thereby squeezing the living space of private stablecoins.

-

Business model challenges caused by interest rate differentials: This is a more fundamental economic restriction.The core profits of stablecoin issuers come from the interest income from their reserve assets (mainly short-term government bonds).Historically, interest rates in the Eurozone have been lower than in the United States for a long period of time.This means that, at the same scale,Issuing Euro stablecoins is endogenously less profitable than issuing USD stablecoins.This difference in profitability directly limits the issuer’s ability to promote DeFi protocol integration and user adoption through revenue sharing, liquidity incentives and other means, forming a negative cycle that hinders its cold start and scale expansion.

Australian dollar stablecoin

The Australian dollar stablecoin market presents a completely different development paradigm from that of the Eurozone.Although its total public market capitalization is approximately $20 million, ranking second among non-USD stablecoins globally, its most notable feature isA top-down exploration led by traditional banking institutions rather than crypto-native companies.

1. Market dominant force: entry of traditional banks

Australia’s most high-profile stablecoin projects originate from two of the country’s “big four” giants – ANZ and National Australia Bank (NAB), which launched A$DC and AUDN respectively.This phenomenon is extremely rare globally, and it marks the mainstream financial system’s direct recognition of the potential value of stablecoin technology.However, it is worth noting that these two stablecoins issued by banks are still mainly in the stage of inter-institutional settlement and internal pilot, and have not yet been opened to the public on a large scale.

The supply of Australian dollar stablecoins for the retail and crypto trading markets is mainly filled by third-party payment companies, represented by AUDD.

AUDD (by Novatti)

-

Issuer background: Novatti is a licensed payments provider listed on the Australian Securities Exchange (ASX) with a background in compliance and fintech.

-

target customer group: It has a clear positioning and mainly serves three types of users: cryptocurrency traders, individuals or businesses with Australian dollar cross-border remittance needs, and Web3 application developers.

-

Technical path: AUDD chose to issue on public chains known for their payment efficiency such as Stellar, Ripple, and Algorand instead of Ethereum, which reflects its strategic considerations focusing on payment and settlement.

-

market position: Currently, AUDD is the easiest Australian dollar stablecoin for retail users to obtain and use.

2. Core development dilemma: dual uncertainties in regulation and official CBDC

-

Lack of regulatory framework: Unlike the EU, which has fully implemented the MiCA Act, Australia has not yet introduced a comprehensive and clear legal framework for stablecoins as of October 2025.This kind ofregulatory lagconstitutes the biggest bottleneck in market development.Even strong banks like ANZ and NAB have been able to explore on a small scale and not be able to roll out products to the public at scale without clear regulatory definitions.This greatly limits the development speed and scale of the entire Australian dollar stablecoin ecosystem.

-

Potential competition from official digital Australian dollar (CBDC): The Reserve Bank of Australia (RBA) has been active in research into issuing an official CBDC and has recently successfully completed a related pilot project.This development brings a second level of uncertainty to the market.If the RBA decides to formally issue a digital Australian dollar in the future, as an “ultimate risk-free asset” that is directly owed by the central bank and does not involve any credit risk, it will directly compete with stablecoins issued by commercial banks or private institutions.By then, whether the two will complement each other or compete as substitutes, the long-term market structure is still unclear.

Korean won stablecoin

The Korean market presents us with a unique paradox: as a country that is extremely receptive to crypto-assets, it lacks the “soil” for the growth of stablecoins.This is diametrically opposed to the bottom-up adoption path adopted by the private sector in high-inflation countries. The fundamental reason is that South Korea’s highly developed financial technology (FinTech) and instant payment systems have already met the daily needs of the vast majority of users.Thus weakening the “endogenous motivation” of stablecoins as payment alternatives.

Therefore, if the Korean won stablecoin wants to gain market adoption, the only feasible path is to “top down” strategic promotion led by large institutions. This may include the following scenarios:

-

Led by the government or technology giants such as Naver and Kakao, it can be seamlessly embedded into existing payment or remittance backends.

-

Promoted by mainstream exchanges, the Korean won stable currency replaces the physical Korean won as the core trading medium.

-

The platform launches innovative incentives or micro-payment functions based on stable coins.

However, before these scenarios can be realized, the market faces a series of deep structural barriers.

1. The core dilemma of development: legislative vacuum and corporate caution

The main current bottleneck isSerious lag in legislation.Although the South Korean Congress has a backlog of five related bills, the legislative process is extremely slow.According to the current (October 2025) progress forecast, even if the Financial Services Commission (FSC) can submit the government plan on time, the relevant laws will not officially come into effect until early 2027 at the earliest.Prior to this, no company could carry out stablecoin business legally and on a large scale within the legal framework.

This regulatory uncertainty has directly led to the division and general cautious attitude of the Korean business community:

-

small business: Shows active willingness to participate, but its activities are more for public relations effect and market voice, and generally lack the capital, compliance and technical capabilities required to operate stablecoin business on a large scale.

-

Large Enterprises (Chaebol): Generally adopt an extremely cautious “hold money and wait and see” strategy.There are two core considerations: first, the legal risks are too high; second, they assess that in the highly involved domestic market, the actual commercial returns that switching to blockchain technology can bring are not enough to attract them to invest huge resources.

At present, all activities surrounding the Korean won stablecoin are basically at the superficial stage of theoretical discussions and trademark applications.

2. Four major structural obstacles

To sum up, the difficulties faced by Korean won stablecoins can be attributed to four interrelated structural obstacles:

-

The battle over technology routes: private chain vs. public chainRegulatory agencies such as the Bank of Korea and the FSC, out of the primary consideration of risk controllability, are strongly inclined to conduct the first issuance of stablecoins on a “customized private chain with Korean characteristics”.However, this idea was generally considered “disappointing” by the industry.Not only does it violate the core values of open, permissionless and interoperable blockchain, it is also likely to cause the Korean financial system to be further fragmented by multiple disconnected private networks, forming inefficient “walled gardens”.

-

Double constraints on the reserve asset market: scarcity and low returnsThe business model of stablecoins is based on reserve assets.South Korea faces a double problem here: First, its domestic financial marketLack of short-term government bonds with maturities of less than one year, which leaves the most ideal and safest reserve asset class for stablecoins missing.Secondly, even the market size and liquidity of alternative assets such as currency-stabilizing bonds are not sufficient to support large-scale stablecoin issuance.What’s even more fatal is that the yield rate of about 2% in the Korean bond market is far lower than the level of about 4% in the United States. ThisGreatly weakening the issuer’s profit motivation to operate stable currency business, making it commercially unattractive.

-

Technical misunderstandings about public chain supervisionThe Korean government generally holds the view that “the risks of public chains are too high and difficult to regulate”, which is to a certain extent a misunderstanding of existing technology.In fact, through well-designed smart contracts, effective supervision and compliance control of user identity authentication (KYC) and capital flows can be achieved on an open public chain.

-

A collective lack of vision and urgencyThe most fundamental problem is that no key participant, from the government, financial institutions to large enterprises, has put forward a clear goal or a specific plan for the future of the Korean won stable currency.The entire market fell into a strategic stagnation of “collective waiting”.However, the evolution of global blockchain finance will not wait for any latecomers.If South Korea waits until 2027 to launch its stablecoin on a closed private chain, it will find itself far behind the world.

Hong Kong dollar stablecoin

Hong Kong’s stablecoin development path presents a complex picture consisting of a three-party game between clear local regulations, active market participation, and prudential regulatory forces from the mainland.Currently, Hong Kong is at a critical turning point. After experiencing initial overheating, the market is entering a new stage of “partial cooling” and structural differentiation.

Despite market volatility, Hong Kong’s official stance remains firm.Xu Zhengyu, director of the Treasury Bureau, has publicly stated that the license application for compliant stablecoins is progressing according to the established framework, and the first batch of licenses is expected to be issued in early 2026 in accordance with the original schedule.

1. Hong Kong’s active layout and the initial overheating of the market

Hong Kong’s strategic goal of becoming the world’s leading virtual asset center is very clear.To this end, the Hong Kong government has adopted a series of proactive and well-paced measures:

-

March 2024: Launching a “sandbox” for stablecoin issuers to provide a regulated testing environment for the market.

-

August 1, 2025: The “Stablecoin Regulations” were officially implemented, establishing the world’s first comprehensive and clear legal framework for stablecoin supervision.

This leading regulatory certainty has greatly stimulated market enthusiasm, attracting more than 77 companies to express their intention to apply, which once made the track appear “overly hot”.However, the phenomenon of a large number of Chinese-backed financial institutions rushing into the market has aroused the cautious attention of mainland regulatory agencies.

2. Prudent intervention of mainland regulatory authorities

The core concern of the recent “window guidance” provided by mainland regulatory agencies to relevant Chinese-funded institutions is not to stifle innovation, but is based on the following considerations:

-

Risk isolation: Ensure that potential risks in Hong Kong’s virtual asset business will not be transmitted back to the mainland’s large and strictly regulated parent company financial system through equity relationships.

-

capital controls: Strictly prevent mainland funds from flooding into Hong Kong’s virtual asset market through non-compliant channels.

-

market order: Chinese-funded institutions are required to keep a low profile and avoid excessive publicity or creating public hot spots to prevent irrational overheating in the market.

This kind of “Hong Kong’s global ambitions“and”Mainland financial prudence“The tension between” is the core background for understanding the current dynamics of the Hong Kong dollar stablecoin market.

3. Market status: partial cooling, expected slowdown, structural differentiation

The intervention of mainland supervision has had an immediate impact on the market. The current situation can be summarized as follows:

-

The first batch of quitters appear: Before the official application deadline on September 30, at least four Chinese-backed financial institutions, including Guotai Junan International, have publicly announced their withdrawal from stablecoin license applications or suspended RWA-related business.The market expects that some originally proactive Chinese banks (such as Bank of China Hong Kong) may also postpone their application process.

-

The strategy shifts to “what can be done but not said”: The guidance of mainland supervision is not a total ban, but a requirement to “keep a low profile.”This forced the strategy of Chinese-funded institutions to shift from high-profile advances in the early stage to more cautious internal research and quiet layout.

-

market structure differentiation: This round of “cooling down” islocalandasymmetricof.The affected entities are highly concentrated in institutions with Chinese-funded backgrounds.At the same time, local Hong Kong and other international financial institutions are still advancing their virtual asset businesses in an orderly manner under the existing legal framework.

-

Expected Dealing Rhythm: The market generally expects that the first batch of licenses will follow a cautious pace similar to VASP exchange licenses, that is, only a very small number (perhaps only one or two) licenses will be issued at the end of 2025 or early 2026, and will be gradually liberalized based on market development.

4. Strategic dilemmas faced by Hong Kong dollar stablecoins

-

Uncertainty under the influence of mainland regulations: This is the core dilemma at present.Chinese-funded institutions are an integral part of Hong Kong’s financial market. Their collective “suspension” or “low-key” will undoubtedly affect the market size, liquidity depth and breadth of application scenarios of Hong Kong dollar stablecoins in the early stages of issuance.The Hong Kong authorities need to find a delicate dynamic balance between promoting market opening and responding to mainland regulatory concerns.

-

The contradiction between the pace of development and global competition: Compared with the “comprehensive heating up” of the U.S. market, Hong Kong has adopted a more “restrained and prudent” development pace under the influence of the mainland.Although this steady rhythm helps risk control, it also faces the risk of missing the time window and being widened by competitors in the global financial innovation competition.

-

The trade-off between risk and reward: The intervention of mainland regulators essentially forces Chinese-funded institutions to re-evaluate the risk-benefit ratio of being the “first entrants”.Although first movers can enjoy the greatest policy dividends and first-mover advantages, they must also bear the highest market and compliance trial and error costs.

Japanese Yen Stablecoin

Japan’s stablecoin development path is a financial infrastructure innovation carefully designed from top to bottom by the government under its unique macroeconomic background.Its core driving force does not come from private speculative demand, but from the urgent need to solve the long-term structural economic difficulties faced by the country such as “low interest rates, low growth, and deflationary pressure.”Stablecoins have high hopes here and are seen as a policy tool that can improve financial efficiency, activate capital flows, and inject new impetus into the weak domestic payment system and the illiquid government bond market.

To this end, the Japanese government has passed a series of legislation such as the “Correction of Fund Decision Law” and established a set of stable currency regulatory frameworks that can be called the most stringent in the world.Its strategic intentions are extremely clear:Transform stablecoins from pure “crypto assets” into “financial infrastructure” serving national strategies.

1. From theory to practice: the implementation of the first compliant product

Currently, the Japanese stablecoin market has officially entered the “commercial practice period” from the “theoretical preparation period”.

-

landmark event: Fintech startup JPYC Inc. has received regulatory approval to issue the first fully compliant Japanese yen stablecoin “JPYC” in the fall of 2025.

-

Key cooperation models: This issuance reveals the Japanese market entry model——“Technological innovation of a startup (JPYC Inc.) + Compliance infrastructure of a giant platform (Mitsubishi UFJ Trust Bank’s Progmat Coin)”.This shows that supervision is open to innovation, but only if it is anchored within the strong compliance framework of licensed financial institutions.

-

Technology Path and Business Ambition: “JPYC” plans to be issued on multiple mainstream public chains such as Ethereum and Avalanche, reflecting its pursuit of openness and composability under the premise of compliance.The goal it has set of “issuing 1 trillion yen within three years” and the Series A investment it has attracted from international giants such as Circle all demonstrate its great determination to seize the market.

JPYC is not positioned to replace fiat currency, but as a “On-chain yen”, becoming a bridge that seamlessly extends the function and value of the Japanese yen to the global digital economy.

2. Core application scenarios

-

International remittance and corporate settlement: Provide near-real-time, low-cost payment solutions for overseas students, cross-border e-commerce, etc., and use smart contracts to simplify B2B payment processes and cross-border fund management between enterprises.

-

Build a local Web3 ecosystem: As the “native liquidity carrier” on the chain denominated in Japanese yen, it provides a stable value medium for Japan’s huge games, NFT and other Web3 applications, and builds its underlying financial infrastructure.

3. Multi-level national strategic intentions

The launch of the Japanese yen stable currency carries Japan’s multi-level strategic considerations:

-

Defensive Strategy: Fighting for Digital Currency SovereigntyThis is the most core measure.By launching a compliant Japanese yen stablecoin, it aims to break the monopoly of U.S. dollar stablecoins in the digital world and provide a non-USD option for Japan’s cross-border trade and international settlement, thereby reducing reliance on traditional systems such as SWIFT.

-

Economic Strategy: Activate the Treasury Bond Market and Innovate Monetary Policy ToolsThis is an exquisite design that kills two birds with one stone.By stipulating that a large amount of reserve assets be allocated to Japanese government bonds (JGBs), it will not only create a new, structural buyer in the government bond market that has long-term insufficient demand, but also help to reduce the government’s financing costs; in the further future, the central bank may even adjust the reserve requirements of stable coins and use it as a new monetary policy tool to regulate market liquidity.

-

Development strategy: Promote the upgrading of financial infrastructureThe approval of JPYC will play a “catfish effect” in Japan’s conservative financial system, activate the innovative vitality of local giants such as Sony and Mizuho, promote the modernization of the domestic payment system, and safely connect the Japanese financial system to the global Web3 ecosystem in a highly compliant manner to avoid being left behind in the next wave of digital finance.

4. Challenges and the Demonstration Effect of the “Japanese Model”

-

Business model challenges: In a zero interest rate environment, the traditional profit model that relies on interest on reserve assets is completely ineffective.This requires issuers to quickly achieve a huge issuance scale and maintain operations through economies of scale of “small profits but quick turnover”.

-

The ultimate risk prevention and control framework:

-

legal characterization: Strictly define stablecoins as “electronic payment instruments” and fundamentally strip away their speculative attributes.

-

subject limitation: Issuers are limited to licensed financial institutions such as banks and trust companies.

-

Unique “asset top-up clause”: Mandates that issuers must use their own capital to make up the difference when their reserve assets depreciate.This is a strong restriction not seen in European and American supervision, which greatly protects the security of user assets.

-

Mandatory AML/KYC checks.

To sum up, the “trust-based”, “strong supervision” and “semi-centralized” stablecoin model pioneered by Japan has achieved the ultimate in security and compliance.It provides a model of great reference value for other Asian economies such as Hong Kong and South Korea that also focus on financial stability, and may lead the entire East Asia region to form a new regulatory consensus on the road to “compliant stablecoins.”