Author: Eliezer Ndinga, Head of Strategy and Research, 21 Shares; Source: X, @elindinga

Why is the Bitcoin and cryptocurrency moment of 2025 comparable to the internet of 2003?Despite recent volatility, why should we remain cautiously optimistic about the future of Bitcoin and cryptocurrencies?

This article explores the striking similarities between these two technological revolutions and explains why their fundamentals are stronger than ever.With rapid adoption and growing interest from institutional investors, this type of asset is gradually moving away from short-lived hype.

However, macroeconomic and geopolitical risks remain.Read on to learn why the road ahead requires both optimism and vigilance.

As far as Bitcoin and cryptocurrencies are concerned, we are currently roughly where the Internet was in 2003:The NFT and Meme coin craze has subsided, and the phase of easy speculation has passed.In contrast, AI is proving its worth with clear, tangible use cases, raising the bar for cryptocurrencies to demonstrate real value.Just like after the dot-com bubble burst,Cryptocurrency’s previous “growth” relied heavily on airdrops and leverage, which eventually led to a major fraud case at FTX, which was exactly the same as the collapse of Enron in 2001.Note: The Enron Incident refers to the bankruptcy case of Enron in the United States in 2001.Enron was once one of the world’s largest energy, goods and services companies, ranking seventh among the Fortune 500. However, on December 2, 2001, Enron suddenly applied for bankruptcy protection in the New York Bankruptcy Court. The case became the second largest corporate bankruptcy case in U.S. history.

2020-2021 is an extremely abnormal two years for the macroeconomy. Unless a similar huge crisis occurs again, it is unlikely to happen again..In my opinion, using that period as a benchmark for measuring future performance is a fundamental mistake because:

-

The massive monetary expansion is aimed at stabilizing the economy during the pandemic.

-

The population is confined to their homes, with vast amounts of time and liquidity, fueling a frenzy of speculation from stocks to cryptocurrencies.

Since then, Bitcoin and cryptocurrencies have matured as an asset class.The next phase will reward projects with real practical value: consumer applications and networks built on solid economic fundamentals.Tokens will rarely disappear completely, but the continued creation of value will rely more on substance than narrative.

Amazon issued a letter to shareholders after the dot-com bubble burst in 2000, which is very relevant to the cryptocurrency industry and today’s environment.Benjamin Graham’s insight about markets still applies: “In the short term, the market is a voting machine; in the long term, it is a weighing machine.”

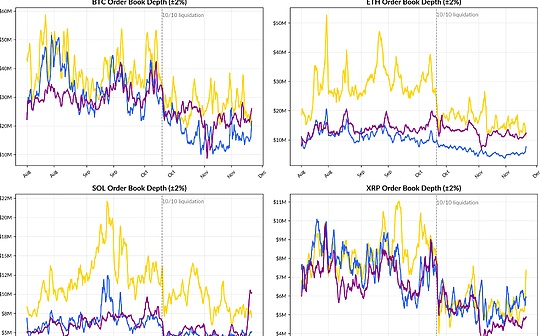

Despite the short-term market volatility, fundamentals are stronger than ever:

-

Bitcoin and cryptocurrency users account for approximately 10% of total Internet users (more than 700 million), similar to the Internet penetration rate in 2003.Emerging markets have the fastest growing user base.

-

Adoption by institutional investors is just beginning: Several major investors, including Harvard University’s endowment, publicly hold large amounts of cryptocurrency.

-

Blockchain is moving from the “dial-up Internet era” similar to the Internet era to the “broadband era” and can handle 3,400 transactions per second, exceeding the peak processing speeds of Stripe and Nasdaq.

-

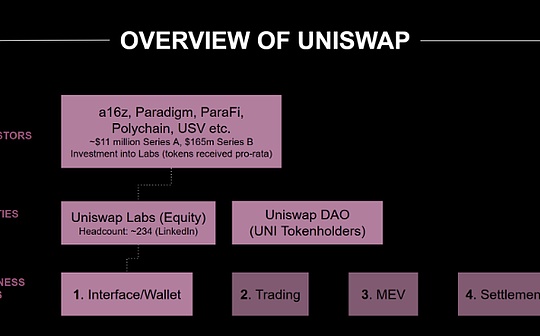

As companies like Stripe and Klarna adopt blockchain technology for payments and financial services,Decentralized Finance (DeFi) is becoming Fintech 2.0.

-

Consumer products such as Polymarket and Helium are quietly using blockchain back-end technology to reshape the media and telecommunications industries.Helium powers grassroots 5G networks with over 1 million daily active users, while Polymarket leverages crowdsourced intelligence to accurately predict world events.

Here is Jeff Bezos’ letter to shareholders: