Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by: BitChain Vision

Bitcoin’s sideways movement suggests its IPO moment has arrived – which is why BTC allocations are expected to increase.

Jordi Visser is one of my most admired macro thinkers, and I read every article he writes.

His latest article (see Bitcoin Vision’s previous coverage “Bitcoin’s Silent IPO”) discusses a core issue: Despite the constant good news—strong ETF capital inflows, regulatory breakthroughs, continued growth in institutional demand, etc.—Why Bitcoin is still frustratingly stuck in sideways and even volatile downward trading.

This is the best analysis of the current state of the Bitcoin market that I have read in the past six months, and I highly recommend you give it a read.

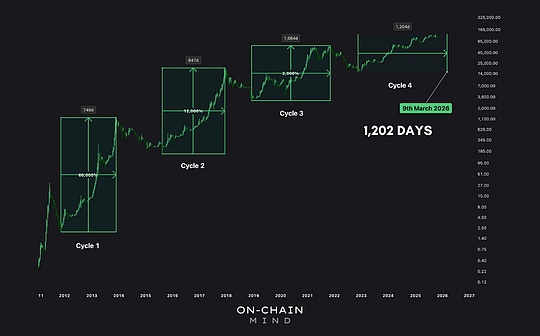

According to Visser,Bitcoin is undergoing a “silent IPO”, is transforming from a crazy idea into a mainstream success story.He noted that typically when a stock completes an IPO, it tends to trade sideways for six to 18 months before starting to move upward.

Take Facebook as an example. It was listed on May 12, 2012 at a price of $38 per share. After that, its stock price continued to trade sideways or even fell for more than a year, and it did not regain its IPO price of $38 until 15 months later.Google and other high-profile tech startups are showing similar trends.

Visser said,Sideways fluctuations do not necessarily mean there is a problem with the underlying asset itself.This situation often occurs because founders and early employees cash out and leave – those who bet when the risk of the startup was extremely high have now reaped a hundredfold return, and naturally want to cash out and profit.The process of insider selling and institutional takeover takes time. Only when this ownership transfer reaches a certain balance can the stock price resume its upward path.

Visser pointed out that this is very similar to Bitcoin today.Those early believers who bought into Bitcoin when it was priced at $1, $10, $100 or even $1,000 are now sitting on generational wealth.As Bitcoin enters the mainstream — ETFs trade on the New York Stock Exchange, major corporations build Bitcoin reserves, and sovereign wealth funds get on board — these investors can now finally cash in on their returns.

Hats off to them!Their patience was well rewarded.Five years ago, if someone dumped $1 billion worth of Bitcoin, it would likely throw the market into chaos; but now, a diverse group of buyers and sufficient trading volume can digest such large transactions more smoothly.

It should be noted that on-chain data shows that the composition of sellers is relatively complex, so Visser’s analysis is only part of the current market drivers, but it is a crucial part and it is worth thinking about its significance for the future market.

Here are the two core points I extracted from this article:

Viewpoint 1: Highly bullish potential

Many cryptocurrency investors were frustrated after reading Visser’s article: “The early OGs are selling Bitcoin to institutions! Do they know something inside that we don’t?”

This interpretation is dead wrong.

The sell-off by early investors does not mean the end of an asset’s journey, but simply the beginning of a new phase.

Let’s look at the example of Facebook again: It is true that its stock price has been trading sideways below $38 a year after its IPO, but it has now risen to $637, an increase of 1576%.Back in 2012, if I could have bought all Facebook stock at $38, I would have done so without hesitation.

Of course, if you invest in Facebook’s Series A financing, the rate of return may be higher, but you will also have to bear much greater risks.

The same is true for Bitcoin today.In the future, it may be difficult for us to see Bitcoin achieve a hundredfold return within a year, but once this “chip transfer stage” is completed, its room for growth is still huge.As Bitwise pointed out in the “Bitcoin Long-term Capital Market Assumptions” report, we believe that Bitcoin will reach $1.3 million per coin by 2035, and I personally think this prediction is still conservative.

I would also like to add that there is a key difference between the Bitcoin after the early OGs sold off and the company after the IPO – the company still needs to continue to grow after completing the IPO.The reason why Facebook was unable to rise from US$38 to US$637 overnight was because its revenue and profits at the time were not enough to support such a valuation. It needed to expand revenue, expand new business lines, develop mobile business, etc., and the process was still accompanied by risks.

But that’s not the case with Bitcoin.Once the early OG sell-off is completed, Bitcoin does not have to do anything else.The only thing it needs to grow from a $2.5 trillion market capitalization to a gold-level market capitalization of $25 trillion is widespread acceptance.

I’m not saying this will happen overnight, but it’s entirely possible that it will grow faster than Facebook.

From a long-term perspective,Bitcoin’s sideways movement is a gift – it’s the perfect opportunity to buy more before it restarts its uptrend.

Viewpoint 2: The era of Bitcoin’s 1% allocation is a thing of the past

As Visser said in the article, the risks of a company that has completed an IPO are much lower than those in the start-up stage.Their equity holdings are more widely spread, they are subject to stricter regulations, and they have greater opportunities to diversify their businesses.Investing in Facebook post-IPO is far less risky than funding a college dropout who works out of a Palo Alto party house.

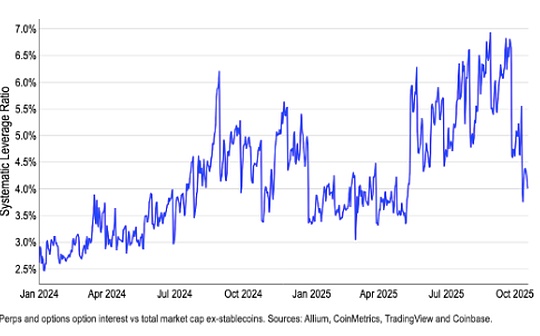

The same is true for Bitcoin.As Bitcoin moves from early adopters to institutional investors and matures as a technology, it no longer faces the existential risks it did a decade ago, and its maturity as an asset class has increased significantly.This is clearly seen in Bitcoin’s volatility, which has dropped significantly since the Bitcoin ETF began trading in January 2024.

Bitcoin historical volatility

Data source: Bitwise Asset Management Company, data range is January 1, 2013 to September 30, 2025

This brings an important revelation to investors:In the future, Bitcoin returns may be slightly lower than in the past, but volatility will decrease significantly.As an asset allocator, my response to this change is not to sell—after all, we predict that Bitcoin will remain one of the best-performing major asset classes in the world over the next decade—but to accumulate.

In other words, lower volatility means it’s safer to hold more of these assets.

Visser’s article made me even more convinced of a trend – over the past few months, Bitwise has conducted hundreds of meetings with advisors, institutions and other professional investors, and we found:The era of Bitcoin’s 1% allocation ratio is completely over.More and more investors require 5% as a starting point for BTC allocation.

Bitcoin is having its IPO moment.If history is any guide, we should embrace this new phase by adding to our holdings.