Author:Prathik Desai, Source: Token Dispatch

Preface

The past year has been a year of uncertainty for both centralized exchanges (CEX) and decentralized exchanges (DEX).Over the past 12 to 18 months, players in the cryptocurrency space have witnessed a shift in trading momentum and liquidity from centralized exchanges (CEX) that rely on trust and compliance to decentralized exchanges (DEX) that promise user transparency, composability, and autonomous custody.

Although media reports claim that centralized exchanges are making a strong comeback, a deeper analysis of the data reveals that the actual situation is far more complicated than this.

In this quantitative analysis, I will delve into data from DEX and CEX to better understand the evolution of spot and leveraged liquidity in cryptocurrency trading.

CEX-DEX BATTLE

Longer term, 2025 looks to be the year for centralized exchanges (CEX) to make a strong comeback after nearly two years of declining confidence and shrinking liquidity.Between January 2021 and May 2022, the average monthly trading volume on centralized exchanges was well over $1.5 trillion.However, since June 2022, and until November 2023, monthly trading volume has exceeded the trillion-dollar mark only once.

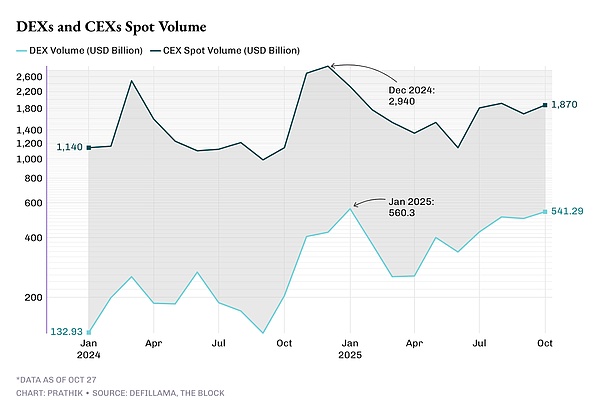

CEX trading volumes have surged over the past two years.Trading volumes are hitting record highs, thanks to ETF and macroeconomic tailwinds.By December 2024, that number has climbed to $2.94 trillion.

The fourth quarter of 2024 is a turning point in volume growth.Spot trading volumes on CEX surged from $1.14 trillion in October to $2.94 trillion in December, taking the monthly average for the quarter to more than $2.25 trillion.

The growth coincides with rising risk appetite following U.S. President Donald Trump’s re-election and the ongoing negotiations to support cryptocurrency regulation.

The first quarter of 2025 continued this growth momentum, with average monthly trading volume approaching $1.8 trillion, but fell by approximately 30% to $1.3 trillion in the second quarter.However, in the third quarter of 2025, transaction volume quickly rebounded, with average monthly transaction volume exceeding $1.8 trillion.

While centralized exchanges (CEX) have made a strong recovery, decentralized exchanges (DEX) have not stood still.In fact, they continue to grow faster than centralized exchanges.

In January 2024, DEX spot trading volume was approximately $133 billion.Just 18 months later, that number had quadrupled to more than $540 billion.

Average monthly trading volume on DEX was $395 billion in the first quarter of 2025 and $332 billion in the second quarter.By the third quarter of 2025, average monthly trading volume increased by 50% to $480 billion.Transaction volume in October has exceeded $540 billion.

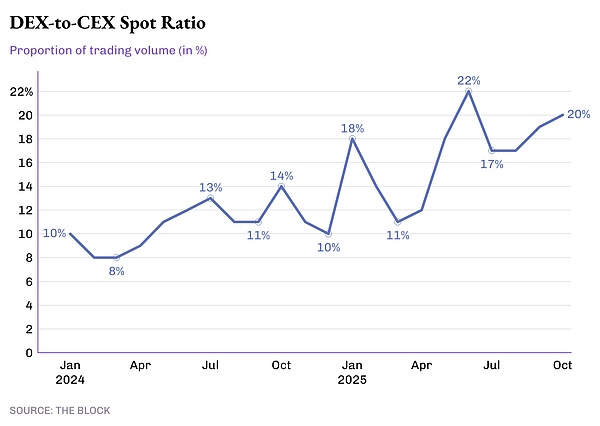

Spot trading volume on decentralized exchanges (DEXs) has accounted for nearly 20% of all spot trading volume so far this year, up from just over 10% in 2024.Although centralized exchanges (CEX) still dominate the market due to the advantages of fiat deposit channels, DEX has become the first choice for those seeking speed, composability, anonymity and self-custody.

Better user experience, lower gas fees, and tighter spreads provided by protocols such as Uniswap v4, Hyperliquid L1, and Raydium bridge the experience gap between the two ecosystems.

The driving force behind derivatives

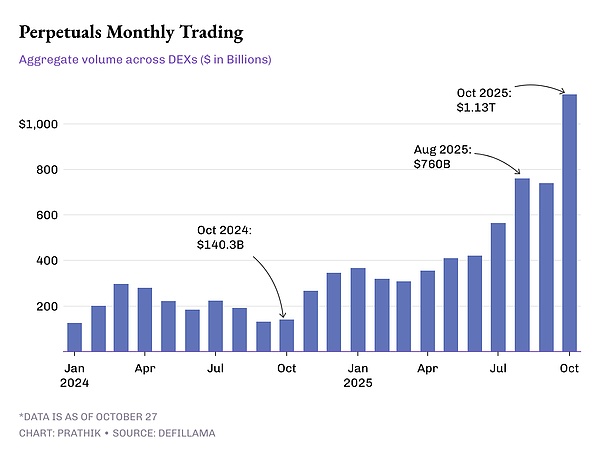

If you ask me what is the most important factor driving DEX activity, I will choose perpetual contracts without hesitation.Prior to 2024, on-chain perpetual contracts will remain a niche product with only a few hundred billion dollars in monthly trading volume.This is mainly focused on protocols like dYdX, GMX, and a few other Arbitrum-based DEXs.However, by the end of 2025, these platforms will begin to rival the entire decentralized exchange (DEX) spot market in size.

In January 2024, the monthly trading volume of perpetual contract DEX was $127 billion.That number will nearly triple to $345 billion by December 2024.

But 2025 changes that trend.Average monthly trading volume in perpetual contracts more than doubled from $332 billion in the first quarter to $688 billion in the third quarter.In October alone, its trading volume exceeded $1.13 trillion, becoming the first month in which on-chain derivatives trading volume exceeded a trillion dollars, more than twice the size of the DEX spot market.

This data not only shows that more traders are entering the on-chain space, but also that the trading activity per trader has increased.On-chain DEXs offering perpetual contracts now replicate some of the features of centralized exchanges (CEXs), such as independent margining, deep order books, and cross-chain staking.Additionally, they offer a high degree of composability that CEX cannot.These advantages are enough to retain many high-value traders to trade on the chain.

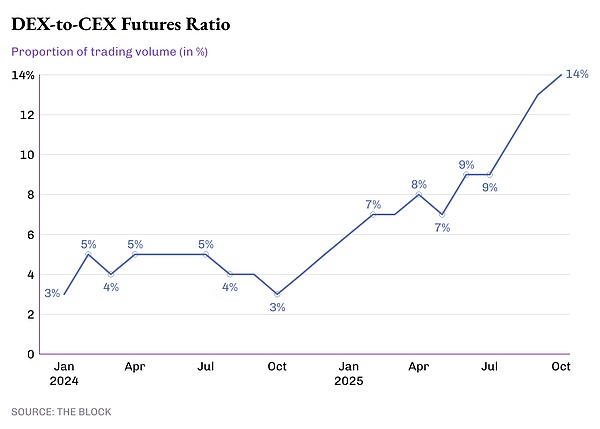

This trend is reflected in the steady increase in the ratio of decentralized exchanges (DEX) to centralized exchanges (CEX) in derivatives trading.

In 2024, decentralized exchanges will handle less than 5% of global futures trading volume.By mid-2025, this number doubled to 10%, and by October it reached 14.3%, marking the highest proportion of on-chain derivatives relative to centralized exchanges.

This number is still small compared to Binance’s size, but it’s a sign of where things are headed.While derivatives trading volumes on centralized exchanges have remained largely range-bound this year, volumes on decentralized exchanges have grown every quarter since mid-2023.

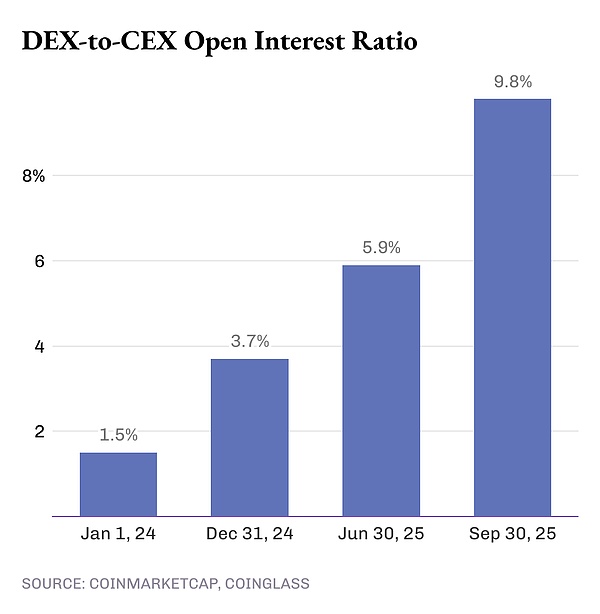

Volume certainly tells part of the story, but open interest (OI) provides more granular information.As of January 1, 2024, open interest on on-chain exchanges accounted for only 1.5% of global derivatives trading volume.This doubled to 3.7% by December 31, 2024, and reached 5.9% by June 30, 2025.By September 30, 2025, this proportion reached 9.8%.In less than two years, the growth exceeded 6.5 times.

Together, these changes suggest that while centralized exchanges (CEX) remain centers of liquidity, decentralized exchanges (DEX) will soon become the new center of risk.Where a trader chooses to trade depends not only on trust, but also on the platform’s additional features.

The growth of DEXs in spot, derivatives, and perpetual contracts suggests that they offer capabilities that CEXs cannot replicate, at least not yet.The sheer number of on-chain traders may still be a minority, but their intentions and the features they request send a clear message to cryptocurrency developers about what should be prioritized when developing a cryptocurrency exchange.