Author: Yue Xiaoyu; Source: X, @yuexiaoyu111

1. The RWAFi track has emerged.

I just saw the latest information that Falcon, the universal collateral layer for stablecoins, will integrate two new assets:

One is gold on the chain (Tether Gold), and the other is US stocks on the chain (Backed).

This is actuallyIt marks that RWA has officially entered a new stage of RWAFi.!

I have written before that the development of RWA will be divided into three stages, but I did not expect it to appear so soon.

The first stage: open up liquidity, traditional enterprises obtain global liquidity, and currency circle projects obtain financial support from compliance institutions;

The second stage: the emergence of innovative financial gameplay, making full use of the composability of the on-chain financial system;

The third stage: Tokens are deeply integrated with actual business, and these key elements of products, enterprises, equity, equity, and financial instruments can be fully connected and integrated.

The first stage of RWA is to tokenize real-world assets to solve the problem of whether everyone can buy them.

Once the assets are on the chain, the next step is to solve the problem of whether there is any profit.

2. The ability of RWA to turn into an income-generating asset is a rigid need for institutional investors.

Previously, many big names outside the industry were consulting me about stablecoins and RWA related information.

Many of them have asked me a question:

In the past, if companies had liquid funds, they would actually make some low-risk financial investments.

If it is later replaced by a stable currency, the stable currency itself has no room for appreciation. So how can companies realize the appreciation of their own liquidity funds?

In fact, many people outside the circle are still stuck at the currency issuance level and do not know that the blockchain world has already built a CeFi+DeFi financial system.

Through the composability of CeFi+DeFi, stablecoins also have many financial management channels, and can even achieve an annualized return of 10%.

Falcon Finance goes one step further and directly supports on-chain gold and on-chain US stocks. It is the first protocol to allow RWA to be used as collateral to issue stablecoins.

3. Everything is put on the chain and the previous passive income is converted into active income.

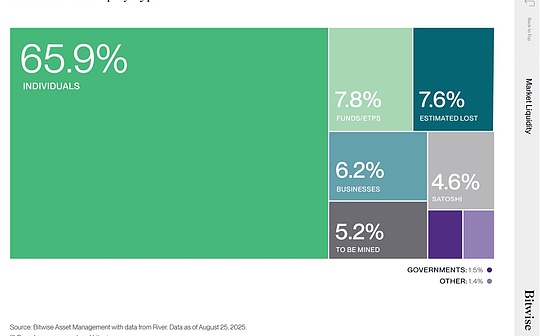

The RWA track currently has a total on-chain value of US$30 billion+, making it the fastest growing sector in DeFi.

Among them, Tether Gold (XAUt) has a market value of approximately US$1 billion+ and is the world’s leading gold token;

The assets supported by xStocks are: TSLAx, NVDAx, MSTRx, SPYx, CRCLx.

In the past, when people bought gold or stocks, they could only wait for the passive appreciation of these assets, but now with the introduction of the DeFi system, you can actively earn on-chain returns.

We can take a closer look at the mechanism of Falcon Finance:

Users can mint USDf by depositing eligible collateral, such as US stocks, gold, etc. on the chain, and then users can pledge USDf into sUSDf to earn income.

In the future world where everything is on the chain, Falcon is evolving into a universal mortgage layer that connects traditional finance (TradFi) and DeFi. This narrative space can be said to be very large.

So, weYou need to continue to pay attention to the RWAFi track. A large number of new financial species will emerge in this track.!