Shaw, Bitcoin Vision

Starting last Saturday, the crypto market restarted a new wave of rising prices. Bitcoin and Ethereum increased significantly, driving the overall market upward.Bitcoin exceeded $115,000, with a 24-hour increase of nearly 3%; Ethereum also exceeded $4,200, with a 24-hour increase of more than 6%.In the past 24 hours, the total liquidation amount in the cryptocurrency market reached US$430 million, and short positions liquidated US$356 million.

This timeWhat are the positive drivers of cryptocurrency recovery and rise?Have the previous factors that suppressed the market disappeared?Is the market about to resume its uptrend?

1. After the liquidation of the 10.11 plunge, the market has been recovering for half a month

Starting last Saturday, the crypto market began a clear rebound and upward trend.Bitcoin rose rapidly this morning, breaking through $115,000 for a short time to $115,005.29, with a 24-hour increase of 2.93%; Ethereum also rose sharply, breaking through $4,200 for a short time, to $4,201.44, with a 24-hour increase of 6.27%.Coinglass data shows that the total liquidation amount in the cryptocurrency market in the past 24 hours reached US$430 million, of which long positions were liquidated at US$73.8677 million and short positions were liquidated at US$356 million.

Half a month has passed since the liquidation of the 10.11 plunge, and the crypto market has recovered its losses and returned to its previous level.The market’s recovery may have digested the panic caused by the plunge, and the market suppression factors caused by the “currency black swan” have gradually diminished..It may only be a matter of time before the crypto market returns to its previous strength or even reaches new highs.

2. Sino-US trade tensions ease

From October 25th to 26th, the economic and trade teams of China and the United States began a new two-day round of Sino-US economic and trade consultations in Kuala Lumpur, Malaysia.Li Chenggang, international trade negotiator and deputy minister of the Chinese Ministry of Commerce, told Chinese and foreign media reporters after the consultation that the two sides had reached a preliminary consensus on properly resolving a number of important economic and trade issues of mutual concern, and the next step would be to implement their respective domestic approval procedures.Li Chenggang said: “In the past month or so, there have been some shocks and fluctuations in Sino-US economic and trade relations, which have attracted great attention from the whole world.” Since the Sino-US economic and trade talks in Geneva in May this year, China has strictly followed the consensus reached by the heads of state of China and the United States on multiple phone calls, faithfully and conscientiously implemented the consensus arrangements reached in the economic and trade consultations, and carefully protected the hard-won and relatively stable Sino-US economic and trade cooperation relations.”These shocks and fluctuations are not what China wants to see.” After the talks, US Treasury Secretary Bessent also said in an interview that after two days of talks in Kuala Lumpur, the two sides reached a “very substantial framework agreement” and the US would “no longer consider” imposing 100% tariffs on China.

Affected by news about the trade situation over the weekend, market risk appetite increased.Spot gold and silver gapped and opened lower on Monday, while WTI crude oil and Brent crude oil continued to strengthen after gapping.All three major U.S. stock index futures rose.The crypto market has also seen a clear upward trend, stimulated by macro market factors.

After the conclusion of the latest economic and trade consultations between China and the United States, trade tensions have eased and the market has gained some breathing space, which has affected the rise of risk assets including cryptocurrencies to a certain extent..

3. The U.S. CPI data is belated and the Federal Reserve is about to cut interest rates again.

On the evening of October 24, affected by the “shutdown” of the U.S. government, the U.S. core CPI data for September came belatedly.The core CPI monthly rate after seasonally adjustment in September was 0.2%, expected to be 0.30%, and the previous value was 0.30%.U.S. CPI not seasonally adjusted annual rate recorded 3% in September, a new high since January 2025, and the growth rate was slightly lower than the market consensus of 3.1%.

Huatai Securities said that the U.S. CPI slowed down more than expected in September, mainly affected by the unexpected slowdown in the rent sub-item.With the current government shutdown continuing and the job market cooling, a rate cut by the Federal Reserve in October is a high probability event, and a rate cut in December is also a baseline scenario.CICC Research reported that this inflation data is relatively mild and supports the Federal Reserve’s continued interest rate cuts.Given the downside risks to the labor market, CICC expects the Federal Reserve to cut interest rates by 25 basis points in October and December respectively.According to CME’s “Fed Watch”:The probability that the Fed will cut interest rates by 25 basis points in October is 96.7%, and the probability of keeping interest rates unchanged is 3.3%.The probability that the Fed will cut interest rates by 50 basis points in December is 94.8%.

After the release of CPI data in September, the market increased its bets on the Fed’s interest rate cut in October..On October 29, local time in the United States, the Federal Reserve will announce its latest interest rate decision, and it is almost certain that the Federal Reserve will cut interest rates again.CPI data and market expectations for an interest rate cut by the Federal Reserve are also one of the driving factors behind the recent resurgence of the crypto market..

4. The whale account moves frequently and is long in the crypto market

During the continuous rise in the encryption market, trading actions on the whale chain occurred frequently.On-chain analyst Ai Ai (@ai_9684xtpa) monitored that the “mysterious whale with a 100% winning rate” added another 173.6 BTC early this morning.Currently, the giant whale holds long positions worth US$338 million, with floating profits exceeding US$17 million.The whale’s current positions include: 1,482.9 long Bitcoin orders, worth $165 million, with an opening price of $110,680.1; and 40,043.81 long Ethereum orders, worth $168 million, with an opening price of $3,929.76.In addition, the 10.11 Insider Whale-related address 0xc2A, which has been profitable in both long and short positions recently, opened a 5x long ETH order again last Friday, holding a position of 7375.45 ETH, worth US$28.42 million.

The continued large-amount transactions on the whale chain indicate the recovery and warming of market investment sentiment.The whales continue to increase their long positions in Bitcoin and Ethereum, which stimulates the continuous rise of spot prices in the encryption market and also indicates the market’s betting direction on the next market trend..

5. The net inflow of Bitcoin ETF funds indicates that the market trend is gradually recovering.

Farside monitoring data shows that the cumulative net inflow of U.S. Bitcoin spot ETFs last week was US$446.3 million.Treasury Edge released a chart saying that BlackRock ETHA, the largest Ethereum ETF, holds Ethereum worth $15.5 billion.Glassnode said that net outflows of spot Bitcoin ETF funds tend to be concentrated near local market lows, accompanied by the subsidence of market sentiment.When capital flows turn positive, historical patterns usually mean that the early stages of demand recovery and trend pick-up have arrived.

Bitcoin spot ETF funds turned to net inflows, indicating a renewed increase in investor demand for Bitcoin, the encryption market will also rebound, thus driving a price rebound.

6. Trump pardons CZ and appoints crypto-friendly CFTC chairman

The White House said on Thursday that Trump had pardoned convicted Binance founder Changpeng Zhao (CZ).White House press secretary Levitt said in a statement that Trump “exercised his constitutional authority to pardon Changpeng Zhao, who was indicted in the Biden administration’s cryptocurrency crackdown.”Trump said, “The reason why Binance founder CZ was pardoned is because he is not guilty and is a victim of persecution by the Biden administration.”

Last Friday, Trump appointed Michael Selig, chief adviser to the SEC’s Cryptocurrency Task Force, as chairman of the U.S. Commodity Futures Trading Commission (CFTC) to deal with the growth of the crypto industry.Michael Selig later posted on social media that he was honored to be nominated by President Trump to serve as the 16th Chairman of the CFTC.The U.S. financial market will usher in a great golden age and abundant new opportunities will emerge.He promised to spare no effort to promote the sound operation of commodity markets, promote freedom, competition and innovation, and assist President Trump in building the United States into a global cryptocurrency center.

Trump pardons Binance founder Changpeng Zhao and appoints new crypto-industry-friendly CFTC chairman, explainedThe U.S. government will spare no effort to support the development of the encryption industry in the United States at the policy and regulatory levels.The continued favorable regulatory policies in the United States have also played a role in promoting the rebound and rise of the crypto market..

7. How does the market bet on the next trend?

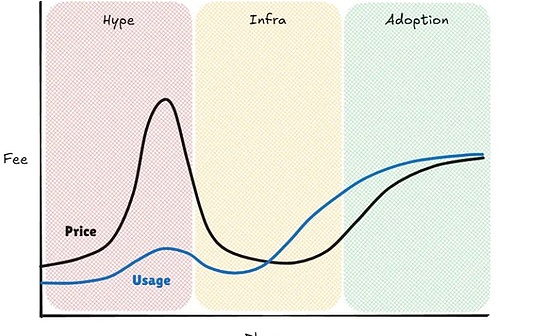

BitMine Chairman Tom LeeIn an interview with CNBC, he said that the chain reaction after the crypto market deleveraging event on October 11 is still continuing, but these phenomena are about to end, because the contract positions of Bitcoin and Ethereum are at historically low levels, and at this time, both technical indicators are turning to a positive trend. Therefore, he believes that cryptocurrencies will also usher in a wave of rising prices before the end of the year. JPMorgan Chase also recently stated that it may accept cryptocurrencies as collateral in the future, which is very helpful to market confidence.

Crypto Quant Analyst AxelA post on social media stated that the proportion of Bitcoin supply in a profitable state (change on the 30th) has rebounded from -12% to -6%, indicating that the selling pressure is weakening and the market is buying on dips.Although the current proportion of profitable currencies is still lower than the level before one month, the decline has narrowed significantly – the negative momentum is weakening.

Alex Thorn, Head of Research at Galaxy DigitalIn an interview, he said that the Bitcoin bull market is still stable, but the market is at a “critical node” where sentiment can quickly turn.In the long term, growth in institutional demand provides solid support, and the market is entering the “post-$100,000 era.”He also believes that Bitcoin has gradually broken away from the historical four-year cycle and is building a more stable foundation, which is reflected in the decline in volatility, the increase in institutional positions and the slowdown in passive absorption.

BitMine Chairman Tom Lee“Bitcoin has broken out of its typical four-year cycle, which suggests a longer cycle is taking shape,” Anthony Pompliano, a crypto entrepreneur, said in an interview on Thursday.

VanEckHe said that Bitcoin’s correction in October was a mid-cycle adjustment and not the arrival of a bear market.Leverage levels have returned to normal, on-chain activity has increased, and liquidity is continuing to drive this cycle.

Standard Chartered BankIt is predicted that the price of Bitcoin may reach $200,000 by the end of this year.