When reporters asked Eric Trump whether their calculation of the Trump family’s crypto business profits – more than $1 billion – was accurate, the president’s second son gave a meaningful smile..

“Probably more,” he said.

That was a few months ago.Now we know he was right.

In September 2025, the latest data revealed an even more shocking fact:In just a few weeks, the Trump family added an estimated $1.3 billion to their wealth through two crypto businesses.Their combined net worth has soared to$7.7 billion, and a significant portion of this comes from cryptocurrency projects that didn’t exist less than a year ago.

This is not slow wealth accumulation, this is explosive wealth creation.It took the Trump family less than a year to go from “almost running out of money” to US$7.7 billion, from real estate tycoon to crypto giant.

Remember last year when Trump claimed in court documents that he was “running out of money”?He said that if the $500 million civil penalty cannot be reduced to about $100 million, he will have to sell off the remaining real estate assets at a discount.That scene was just a few months ago, but the Trump family’s fortunes have already taken a dizzying turn.

This is no ordinary business story.This is a modern fable about how power is transformed into money, how policy generates wealth, and how a family switches freely between regulators and profiteers.Today, let’s step into this ever-expanding crypto empire and see how this unprecedented wealth game works.

Act One: The magnificent turn from “scam” to “savior”

An unabashed hater

Back to 2019.Trump has made no secret of his attitude toward Bitcoin on social media:

“I am not a fan of Bitcoin and other cryptocurrencies, they are not currencies and their values are highly volatile and based on air.”

At that time, he even went a step further and labeled cryptocurrencies as “unpatriotic.”The reason is simple: these digital currencies could threaten the U.S. dollar’s global dominance.In Trump’s view, this is weakening the national interests of the United States.

“Scam” – this is how he defined Bitcoin on multiple occasions.

But in American politics, no position is immutable, as long as the price is right.

The story of being “debanked”

During the 2024 campaign, the Trump family began to tell a new narrative: that they were victims of a Wall Street witch hunt.

In an interview, Eric Trump’s tone was full of grievance and anger: “We have been targeted and the traditional financial institutions have closed their doors to us for political reasons. We have to find alternatives.”

This “debanked” narrative became the official narrative of the Trump family’s shift to cryptocurrencies.Is this true?There is no way for outsiders to verify.But this story gave Trump a perfect reason to turn around – he didn’t change his position, but was forced to find a new way out.

At this time, the cryptocurrency industry is in its darkest hour.The FTX empire collapsed, founder Sam Bankman-Fried was convicted of fraud and money laundering, and the entire industry was severely regulated by the Biden administration.The SEC’s Gary Gensler has become the most hated name in the crypto industry, and one crypto company after another has been sued or investigated.

The crypto industry is in desperate need of a political savior.Trump needs money.This is a perfect political marriage.

nashville promise

In July 2024, a conference center in Nashville was packed.This is a cryptocurrency conference, but what the audience is waiting for is not a technology tycoon, but a presidential candidate.

When Trump took the podium, the audience burst into thunderous applause.These encryption practitioners, who have struggled to survive under the iron fist of the Biden administration, finally see the glimmer of hope.

Trump’s speech was full of passion and promise:

“I will end Biden’s anti-crypto crusade!”

“Gary Gensler? Get him out of here on day one!”

“We want to build a US Bitcoin strategic reserve!”

But what excited the audience the most was this sentence:

“The rules will be set by people who love your industry, not people who hate you.”

This is not just a policy commitment, it is a naked declaration of solidarity.The applause from the audience lasted for a long time.Many people had tears in their eyes – they knew their savior had come.

And Trump stood on the stage, looking at these enthusiastic faces, and must be thinking in his heart: How much money will these people give me?

Act Two: Money, Power and the Art of Exchange

money starts flowing

In the months following the Nashville speech, crypto industry money began to flow toward Trump like crazy.

Coinbase, the largest cryptocurrency exchange in the United States, opened the wallet.Ripple Labs, the company currently fighting the SEC, has put up millions of dollars.Circle, the stablecoin giant, has also joined this “investment”.

But what is truly jaw-dropping is a super PAC called Fairshake.Founded in 2023, by the time of the 2024 election, it had raised $260 million — all from the crypto industry.The purpose of the money is clear: to support crypto-friendly congressional candidates.

The data is sobering: Fairshake spends nearly twice as much money supporting Republican candidates as it does supporting Democratic candidates.This is not neutral industry lobbying, this is a clear political bet.

Trump’s inauguration fund also received a record number of crypto industry donations.Where does this money come from?Where to go?No one pressed too deeply.

By the first half of 2025, six months before Trump returned to the White House, his super PAC had received at least $41 million more in crypto industry donations.The money will be used for the 2026 midterm elections — ensuring Congress remains crypto-friendly.

It’s a self-reinforcing cycle: donations → policies → profits → more donations.

Inauguration Day Blitz

On January 20, 2025, Trump’s inauguration ceremony.When he raised his right hand to take the oath in front of Capitol Hill, in another corner of Washington, a man was packing up his office.

Gary Gensler, SEC Chairman, public enemy number one in the crypto industry.

He was not “fired on day one” by Trump – because he resigned voluntarily.The regulator who once clamped down on the crypto industry knew his time was over.

He was replaced by Paul Atkins, a lawyer considered “one of their own” by the crypto industry.His appointment met with little resistance.

What happened next is a miracle in the history of regulation.

Coinbase, a company being sued by the SEC, suddenly announced a settlement with the SEC.Ripple Labs, accused of illegally issuing securities, case dropped.Consensys, the Ethereum infrastructure company under investigation, had its investigation abruptly halted.

Interesting coincidence: All three companies were big donors to Trump’s inauguration.

Ministry of Justice’s new rules

If the SEC’s turn can be explained by “leadership changes,” then the Department of Justice’s policy changes are even more explicit.

In April 2025, just three months after Trump took office, the Department of Justice issued a new guideline: it would no longer prosecute “regulatory violations” of digital assets unless it could be proven that they were “intentional.”

what does that mean?It effectively amounts to a renunciation of law enforcement for the crypto industry.Because the legal threshold for proving “intentional” is extremely high, it is impossible for most cases to meet this standard.

Crypto industry lawyers cheered.This is not just regulatory deregulation, this is regulatory capitulation.

Policy gift package

But that’s just the beginning.Really game-changing policies were introduced one after another.

pension reformIt’s the heaviest blow.Trump signs an executive order allowing Americans to invest part of their retirement savings in cryptocurrencies.what does that mean?The total size of Americans’ retirement accounts exceeds $30 trillion. Even if only a small part flows into the crypto market, it will be an astronomical figure.

This policy is packaged as “giving Americans more investment options,” but in the eyes of the crypto industry, it opens an unprecedented pool of funds.

Stablecoin legislation: The Genius ActThis is a landmark moment for policy change.

In July 2025, Trump signed and passed the first federal-level cryptocurrency bill, officially called the “Genius Act” – the name itself is very Trump-like.

This bill sets regulatory standards for stablecoins and establishes federal registration and reserve requirements for issuers of stablecoins anchored to fiat currencies.Most importantly, it gives stablecoins such as USD1 legal status for the first time.

The timing is intriguing: the Trump family happens to be operating the USD1 stablecoin, and he signed the bill legalizing the stablecoin.

Some members of Congress questioned this as a conflict of interest, and the bill was delayed for this reason.In the end, it was clarified in the additional clause that stablecoin projects held by relatives of the president were subject to independent review, and then it was reluctantly passed.

But how binding is this “independent review” clause?Time will tell.

In any case, the implementation of the Genius Act has given the US stablecoin market an opportunity for standardized development, and USD1 issued by WLF has become one of the biggest beneficiaries of this policy dividend.

Banking restrictions liftedAllowing traditional banks to enter the crypto market in a big way without fear of regulatory crackdowns.Wall Street’s doors are open to cryptocurrencies.

Trump even pardoned Silk Road founder Ross Ulbricht and employees of the BitMEX exchange.These men had been sentenced for serious financial crimes, but now they were free.This is the clearest signal to the crypto industry: a new era is here.

Bitcoin madness

The market reaction is immediate.

In early 2024, under the strict supervision of the Biden administration, the price of Bitcoin was hovering around $40,000.After the election, prices began to climb.After Trump took office, Bitcoin soared and hit record highs many times.

Now, Bitcoin price is around $110,000.Increase: 175%.

This is not because of any technological breakthrough or expansion of application scenarios, but purely due to policy expectations.This is a rare extreme case of “policy market” in human history.

The Trump family is standing at the center of this feast, preparing to harvest.

Act Three: How US$1.3 billion was made – the birth of two major money printing machines

World Liberty Financial: A magnificent turn from underground to above ground

Among the Trump family’s crypto empire, one name appears repeatedly: World Liberty Financial.

This is a “decentralized financial platform” – at least that’s what the officials say.In fact, this is a profit machine created by Trump’s two sons, the youngest brother Barron, and the sons of Middle East envoy Steve Witkoff.This platform, which was only created in 2024, has now become the core of the explosive growth of family wealth.

The company’s shareholding structure is full of doubts.Initially, the Trump family’s company DT Marks DEFI LLC held a 75% stake.But a few months later, the shareholding ratio mysteriously dropped to 38%.

Who was the 37% stake sold to?How much does it cost?No one knows.This is a black box.

World Liberty Financial does two things:

First, sell WLFI tokens.These are so-called “governance tokens” that allow holders to vote on certain decisions on the platform.But to put it bluntly, this is a speculative tool.

These tokens are locked until September 1, 2025 and cannot be traded – they can only be used to vote.But in July, the early investor community voted and passed the proposal to unlock the transaction.

On September 1, WLFI tokens were officially listed for trading.This is a historic moment.

September 1st: Debut of WLFI Token

Binance, OKX, Bybit – the world’s major crypto exchanges launched WLFI trading pairs almost at the same time.This in itself is a signal: how much the market pays attention to the “Presidential Family Token”.

The craziness at the opening exceeded all expectations.

The price briefly surged above $0.30.On the trading floor (albeit a virtual one), buy orders poured in.But then, reality kicked in.

By 18:40 GMT that day, the price fell back to $0.246, down about 12% from its high point.This kind of roller coaster ride is common when new coins are launched, but the scale is staggering.

At a price of $0.246, WLFI’s total market capitalization reaches$7 billion.This has made it the 31st largest cryptocurrency in the world, on par with well-known projects such as Tether and Shiba Inu Coin.

A project less than a year old with a market value of US$7 billion.This is almost unimaginable in the traditional business world.

Alt5 Sigma’s $1.5 billion bet

But the WLFI token listing is only part of the story.The bigger deals happen behind the scenes.

In August 2025, Alt5 Sigma, a US listed company, announced an amazing plan: to investUS$1.5 billionPurchase WLFI tokens as company asset reserves.

This transaction is divided into two parts:

•Alt5 Sigma issues new shares, exchanges equity for $750 million worth of WLFI tokens

•Pay an additional $750 million in cash to purchase an equal amount of tokens

what does that mean?Alt5 Sigma became a major institutional holder of WLFI while the Trump family cashed out a huge amount of money.

According to WLF’s token economic model, the platform will use the proceeds from token sales to75%Distributed as income to the founding team and related entities.

The math is simple: $1.5 billion × 75% =US$1.125 billionto businesses controlled by the Trump family.

Bloomberg estimates that this transaction alone added approximately$670 million.

This is only part of WLF’s income.According to Reuters calculations, from its launch in 2024 to early September 2025, the Trump family has accumulated approximately RMB 100,000 in profits from the WLF project.US$500 million.

USD1 stablecoin: $2.7 billion in reserves

WLF’s second business line is the USD1 stablecoin—a digital currency pegged 1:1 to the U.S. dollar.

As of September 2025, sales of USD1 have reached$2.71 billion.

The business model of stablecoins is interesting.The company must hold an equal amount of assets as reserves, so the sales of 2.71 billion cannot be directly converted into profits.But this money can be invested in short-term U.S. Treasury bonds, with current interest rates of about 4-5%.

A conservative estimate is that the interest income alone is approximately$40 million.

What’s more, USD1 is becoming the base currency of the Trump crypto ecosystem.PancakeSwap, a subsidiary of Binance, provides high-yield incentives for using USD1, and the US$2 billion investment of Abu Dhabi sovereign fund MGX was also completed through USD1 – not US dollars, but USD1.

This creates a self-reinforcing cycle: the more people use USD1, the more liquid it is; the better the liquidity, the more people are willing to hold it; the more people hold it, the larger the WLF reserve is; the larger the reserve, the higher the interest income.

The “nuclear bomb” held by the Trump family

But that’s not all.

According to reports, the Trump family currently holds22.5 billion piecesWLFI tokens, these tokens are still locked.According to the current market price, this part of the token is valued at approximately$4 billion.

The potential wealth of US$4 billion cannot be realized for the time being, but it hangs above the market like the sword of Damocles.

What happens if the Trump family chooses to sell once the lockdown ends?Can the market withstand such a shock?

This is a question that all WLFI investors have to think about.

American Bitcoin: Rocket Journey from Mine to Nasdaq

If World Liberty Financial is the Trump family’s “financial brain” in the crypto world, then American Bitcoin is their “industrial body.”

In March 2025, a new name appeared in the crypto world: American Bitcoin Corp (ABTC).

This is a Bitcoin mining company, but not an ordinary mining company.It was co-founded by Canadian listed mining company Hut 8 Company, Eric Trump and Donald Trump Jr., and it set an ambitious goal from the beginning: to become“The largest and most efficient pure-play Bitcoin mining enterprise in the world”.

Eric serves as co-founder and chief strategy officer.It wasn’t a nominal position – he put a lot of time and effort into it.In his own words: “At least 50% of my energy now is on cryptocurrency.”

The Capital Magic of Reverse Mergers

In order to quickly enter the capital market, American Bitcoin did not choose a traditional IPO, but adopted a smarter strategy: a reverse merger with Gryphon Digital Mining, a listed company.

This SPAC model is popular in the United States because it can bypass the cumbersome IPO approval process and obtain listing status directly.

At the end of August 2025, the transaction was finalized.Gryphon changed its name to American Bitcoin, changed its stock code to “ABTC”, and is preparing to start trading on Nasdaq in early September.

The equity structure after the merger is completed is as follows:

•Hut 8 holds 80% of the shares (as the main investor)

•Eric Trump holds about 7.5%

•Donald Trump Jr. holds about 12.5%

In other words, the Trump family collectively controls approx.20% equity.

This ratio may not seem high, but considering the company’s valuation, it is already an astronomical sum.

September 3: Nasdaq Madness

On September 3, 2025, American Bitcoin was officially listed on Nasdaq with the stock code ABTC.

It surged at the opening.

The share price soared rapidly from the reference price and hit an intraday high of$14.52——More than doubled.Trading volume is overwhelming, and almost all major financial media are reporting in real time.

“The Trump family’s Bitcoin company doubled on its first day!” – Such headlines dominated the headlines of major websites.

Although it subsequently fell back (a technical correction after the surge), the closing price was still at$8.04, an increase of approximately 16.5% from the issue price.

Digital time:

Based on the closing price of $8.04, American Bitcoin’s market capitalization is approximately$7.3 billion.

Based on the intraday high of $14.52, the market value was once close to$13.2 billion.

For the Trump family:

•The two brothers’ combined 20% stake was worth approximatelyUS$1.5 billion

•Based on the intraday high, Zenda$2.6 billion

•Eric’s personal 7.5% stake was worth approx.$548 million

In just one day, the Trump family’s book wealth surged by US$1.5 billion.

What is this concept?This is equivalent to the profit that would take a large real estate project 5-10 years to generate, and American Bitcoin achieved it in one day.

“Sell a kidney to buy Bitcoin”

But American Bitcoin is not just a mining company, its business model is more radical:Both mining and hoarding coins.

CEO Asher Genoot explains the strategy this way: “When the price of Bitcoin is low, we hoard coins; when mining profit margins are high, we mine with all our strength. We dynamically switch between the two methods to pursue the highest returns.”

The model sounds like a hybrid between MicroStrategy (another publicly traded company that has been aggressively buying Bitcoin) and traditional mining companies.

Listing filing shows American Bitcoin plans to raise additional funds$2.1 billion, used for:

•Buy Bitcoin Spot

•Purchase the latest mining equipment

•Expanding mines in North America

Eric Trump became the strategy’s most fervent evangelist.He flies around the world — Hong Kong, Tokyo, Dubai — attending crypto conferences, preaching about Bitcoin in every speech.

At the end of August 2025, at the Bitcoin Asia Conference in Hong Kong, Eric quoted the joke of Bitcoin advocate Michael Thaler:

“Buy Bitcoin now, even if you have to sell a kidney!”

The audience burst into laughter, but some people took note of this sentence seriously.

Global expansion ambitions

American Bitcoin’s ambitions don’t stop at North America.

According to the Financial Times, the company is evaluating acquiring at least one listed company in Asia – possibly in Japan and possibly Hong Kong.The goal is to quickly build a large-scale Bitcoin reserve similar to MicroStrategy.

Eric also plans to enter the Middle East and seek support from sovereign funds.After all, the UAE has already invested $2 billion in WLF, why can’t it invest more in American Bitcoin?

This is a global encryption empire dream.

1 billion becomes 1.3 billion: Wealth explosion in a few weeks

Let’s stop and do some math.

Contributions from World Liberty Financial:

•Historical cumulative profit: approximately US$500 million

•Alt5 Sigma deal: ~$670 million net increase

•WLFI token listing market value: $7 billion (family holds $4 billion, but locked)

•USD1 stablecoin interest: about 40 million US dollars

American Bitcoin’s contributions:

•First-day stock price performance: US$1.5 billion in paper wealth (20% equity)

•Potential Future Value: This number will inflate if Bitcoin continues to rise

Other crypto projects:

•$TRUMP and $MELANIA tokens: approximately $427 million

•NFT digital trading cards: millions of dollars

•TMTG holdings: $1.9 billion book value

total:$7.7 billion net worth(Bloomberg Billionaires Index estimate)

In just a few weeks in September 2025, the two projects WLF and ABTC added approximatelyUS$1.3 billionof wealth.

Eric clearly knows what he’s talking about when he says “probably more.”

Tokenizing Real Estate: The Next Crazy Plan

But the Trump family is not content with the status quo.They are planning an even bolder plan:Real estate tokenization.

According to Warren Hui, one of Alt5 Sigma’s investors and co-founder of Soul Ventures in Hong Kong, the WLF team recently proposed an exciting idea to them: using blockchain tokens to map the ownership of tangible assets such as real estate.

Eric Trump was personally involved in pitching the idea.He draws on his extensive experience in the hospitality and real estate sectors to explain to potential investors the potential benefits of digitizing properties.

Imagine: In the future, the public may hold interests in real estate projects under the name of the Trump Organization by purchasing tokens – skyscrapers on Fifth Avenue, luxury hotels in Miami, golf resorts… all of these physical assets can be traded on the blockchain.

This is not just a technological innovation, this is a grand idea that combines the Trump family’s most traditional asset – real estate – with the most cutting-edge technology – blockchain.

If successful, this will create a new business model: digital, fragmented, and global transactions of physical assets.

The Trump family will be at the forefront of this revolution.It is both a rule maker (through the president’s policy influence) and the biggest beneficiary (through the tokenization of its properties).

$TRUMP and $MELANIA: The Presidential Couple’s Memecoin

If World Liberty Financial is still disguised as “decentralized finance”, then $TRUMP and $MELANIA tokens are naked money traps.

What is Memecoin?They are purely speculative tokens with no real purpose.Its value is entirely dependent on hype and celebrity.

The timing of the Trumps’ Memecoin launch was extremely precise: a few days before the inauguration.That was the moment when Trump’s political capital was at its highest and public attention was strongest.

The tokens were snapped up as soon as they were listed.Sales revenue plus transaction fees totaled approximately $427 million.

Trump-affiliated companies “collectively hold” 80% of the shares.In other words, most of the 427 million went into the pockets of the Trump family.

What’s even more exciting is how Trump “rescues” the market.

In May of this year, the price of the $TRUMP token dropped.Investors began to panic.At this time, Trump sent a message: He would hold a private dinner for the first 220 currency holders at his golf club.

The currency price rebounded immediately.

This is no joke.The President of the United States used his position and influence to directly manipulate the price of a speculative token.If this isn’t market manipulation, what is?

But no one pursued it.Because this is a “decentralized” cryptocurrency, regulatory regulations have not caught up yet – or rather, deliberately have not.

NFT: Superhero President

In addition to tokens, Trump also sells NFT digital trading cards.

The cards include images of Trump in a superhero tights, Trump riding a motorcycle and Trump muscled in front of an American flag.

The absurdity of these images makes one wonder if they are a spoof of a satirical show.But they were real and sold for millions of dollars.

Who is the buyer?Some are genuine supporters, some are speculators, and some may be interested parties trying to curry favor with the president.Regardless of the motivation, the money ended up in Trump’s pocket.

The Transformation Miracle of Truth Social

Trump Media & Technology Group (TMTG) is the parent company of the Truth Social social platform.The platform was supposed to be Trump’s weapon against Twitter (now X), but it has been a commercial failure.

In 2024, TMTG will lose US$401 million.Investors began to lose patience and stock prices plummeted.

Then, a miracle happened.

In early 2025, after Trump returned to the White House, TMTG announced a strategic transformation: entering cryptocurrency.The company will raise billions of dollars to buy Bitcoin and other tokens and launch multiple Bitcoin funds.

The market went crazy.TMTG’s stock price soared.This company, which suffered huge losses last year, suddenly generated more than $3 billion in cash flow.

Trump holds approximately 52.9% of TMTG shares.At current market capitalization, his holdings are worth about $1.9 billion.

This is not a business miracle, this is a political miracle.Because investors know that as long as Trump is in the White House, cryptocurrency policies will continue to be friendly, and TMTG’s encryption business will have policy guarantees.

The president is creating value for his company.This is unprecedented in American history.

$1 billion bill

Let’s calculate the realized profits (excluding paper wealth):

•World Liberty Financial: $550 million (WLFI token) + approximately 40 million (USD1 interest) = $590 million

•Memecoin ($TRUMP + $MELANIA): $427 million•NFT digital trading cards: millions of dollars

total:over $1 billion.

And this does not include the book value of TMTG stock ($1.9 billion), does not include other undisclosed income, and does not include future ongoing income.

When Eric says “probably more,” he is most likely stating a fact.

Act Four: The Shadow of Foreign Powers

UAE’s big deal

On the list of investors in Trump’s crypto empire, a few names stand out.

UAE sovereign fund MGX invested $2 billion in Trump-backed stablecoins.

Aqua 1 Foundation, a UAE-based fund, invested $100 million in World Liberty Financial’s tokens, becoming its largest public investor.

This is not small money, nor is it an ordinary business investment.This is a direct injection of capital by a foreign government into the business of the family of the President of the United States.

What does the UAE want?A friendlier U.S. foreign policy?Support on the Middle East?Or something else?

No one has answered these questions publicly.But the possibility of an exchange of benefits is clear.

China’s accession

China’s GD Culture Group announced a $300 million fundraise to purchase Bitcoin and $TRUMP tokens.

Why would a Chinese company invest in a U.S. President’s Memecoin?This makes almost no business sense.But politically, it could be some kind of signal, or some kind of bet.

Justin Sun’s “Spend money to buy peace”

But the most blatant case is Justin Sun.

Who is Justin Sun?Chinese-born cryptocurrency billionaire, founder of TRON.He is a celebrity in the encryption circle and a controversial figure.

In 2023, the SEC sued Justin Sun, accusing him of fraud and market manipulation.This is a serious case and if found guilty, Sun could face huge fines or even jail time.

The timeline is like this:

November 2024, shortly after Trump won the election, Justin Sun invested US$75 million in World Liberty Financial.

February 2025, only three months after Trump took office, the SEC suddenly announced that it was “suspending” the case against Justin Sun on the grounds of “exploring potential settlement options.”

Justin Sun posted a string of handshake emojis on social media.

May 2025, Justin Sun had dinner with Trump at a golf club in Virginia.The photo shows the two talking and laughing in a harmonious atmosphere.

Subsequently, Justin Sun became one of the most active promoters of the $TRUMP token and pledged to purchase an additional $100 million in tokens.

Total investment: 75 million + 100 million = US$175 million.

There are many interpretations of this story.Sun Yuchen said that he is optimistic about the encryption-friendly policies of the Trump administration.The White House said the SEC’s decision was independent and had nothing to do with the president.

But the timeline says it all: investment → case pause → dinner with the president → more investment.

That’s how New Era works in Washington: A big enough check can change your legal fortunes.

Binance’s “dramatic” turn

Justin Sun’s case is explicit enough, but Binance’s story is even more shocking.

Binance is the world’s largest cryptocurrency exchange, founded by Chinese entrepreneur Changpeng Zhao (CZ).In 2024, Binance faced serious accusations from US regulators: illegal operations and misappropriation of customer funds.This is a felony that could result in the company closing and the founder going to jail.

Zhao Changpeng pleaded guilty in court and received a short sentence.But what about his company?

In May 2024, just as the Trump campaign was in full swing, U.S. regulators suddenly dropped most of their lawsuits against Binance.

Timeline:

Early 2024: Binance faces serious accusations, and the industry generally believes that its business in the United States is over.

May 2024: Regulators dropped the lawsuit and Binance received “lenient treatment.”

Summer 2024: Binance has launched a series of cooperation with the Trump family’s WLF through its platform PancakeSwap.

What is the content of the cooperation?

PancakeSwap provides high income incentives for users who use the USD1 stablecoin.This is actually helping the Trump family promote USD1 and increase its demand and circulation.

Is this a coincidence?Or exchange?

We don’t know the exact answer.But the timeline explains everything: Withdrawal of the lawsuit → Cooperation → USD1 received huge promotional resources.

Binance, a company that was once considered an “illegal operation” by the US government, has now become one of the most important partners in the Trump family’s crypto empire.

Act Five: A Spider’s Web of Conflicts of Interest

Not just the Trump family

If this were just the Trump family’s business, things would be relatively simple.But the entire top level of government is involved, and it becomes a systemic problem.

Secretary of Commerce Howard LutnickThe situation is particularly striking.His Cantor Fitzgerald not only holds a large amount of Bitcoin, but more importantly, this company is the main custodian of Tether.

What is Tether?The world’s largest stablecoin, with a market value of more than 120 billion US dollars.It claims that each Tether token is backed by $1 in reserve assets, and these reserve assets—tens of billions of dollars in U.S. Treasury bonds—are hosted at Cantor Fitzgerald.

As Secretary of Commerce, Lutnick formulates policies that will directly affect the development of the cryptocurrency industry, and his own company receives huge custody fees from Tether, an industry giant.

Isn’t this a conflict of interest?

Vice President JD Vance’s financial disclosures reveal that he personally holds cryptocurrency.He has also attended Bitcoin conferences and delivered supportive speeches.

Federal Housing Secretary Bill PulteAlso holds cryptocurrencies.

The Witkoff Family: The Most Outrageous Conflict of Interest

But the most outrageous thing is Steve Witkoff and his family.

Steve Witkoff is an old friend of Trump and now serves as the U.S. special envoy to the Middle East.His two sons, Zach and Alex, are co-founders of World Liberty Financial.

The Witkoff family holds 3.75 billion WLFI tokens, currently worth approximately $530 million.Moreover, they and their affiliated companies will receive 25% of the platform’s revenue share.

Now imagine this scenario:

Steve Witkoff represents the United States in diplomatic negotiations in the Middle East.Sitting across from him were officials from the United Arab Emirates.And the UAE sovereign fund just invested $3 billion in his son’s company (2 billion to buy stablecoins + 100 million to buy WLFI tokens, etc.).

How could Witkoff objectively represent U.S. interests?When American interests conflict with those of the UAE, whose side will he side with?

The White House counsel responded: Witkoff is working with ethics officials to “ensure compliance” and will take “necessary legal steps to divest.”

But so far, no real action has been taken.The Witkoff family still holds those tokens and still profits from that platform.

Where is Eric’s “big wall”?

Last year, Eric Trump publicly promised a “very large wall” between the family business and the government.

What about reality?

Donald Trump Jr. and Eric Trump fly around the world — Abu Dhabi, Hong Kong, Singapore, Las Vegas — attending cryptocurrency conferences and drumming up investment for family businesses, emphasizing their father’s presidential status in every speech.

Where is that “big wall”?

In May 2025, at the Bitcoin Conference in Las Vegas, Donald Trump Jr. said something jaw-dropping:

“Now the people who make crypto laws are themselves invested in cryptocurrencies. That bodes very well for the community.”

This isn’t avoiding conflicts of interest, it’s openly acknowledging and celebrating them.

On the same occasion, Eric Trump said that Washington would be hoarding “a lot of Bitcoin.”He also predicted that a single Bitcoin will be worth $1 billion in the future (current price is $110,000).

As the president’s son and as a businessman who holds a large amount of crypto assets, making such price predictions in public – isn’t this market manipulation?

But no one pursued it.Because this is the rule of the new era: as long as you are shameless enough, nothing is off limits.

Nasdaq Bell Ringing Show

In August 2024, a dramatic scene took place on Nasdaq.

World Liberty Financial’s executive team rang the opening bell on Nasdaq to celebrate a financial partnership.Participants included Donald Trump Jr., Eric Trump, Zach Witkoff and others.

The symbolism of this ceremony was clear: how close we are to the seat of power in Washington.

To the market, this is a signal: Invest in us, and you’re investing not just in a company, but in the White House itself.

Act Six: The Judgment of History

Carter’s Peanut Farm

In 1977, Jimmy Carter became President of the United States.He owns a peanut farm, a business that has been in his family for generations.

To avoid a conflict of interest, Carter made a decision: Put the farm into a blind trust, managed by an independent third party, and not report operations to him.

The decision came at a financial cost to the Carter family.When he left office in 1981, the farm was deeply in debt.But Carter never regretted it because he believed that this was what a president should do – public interest over private interest.

Bush’s baseball team

In 2001, George W. Bush became president.He was a co-owner of the Texas Rangers baseball team, which brought him considerable income.

During the campaign, Bush took the initiative to sell his shares in the team.He didn’t want anyone to question whether his decisions were influenced by private interests.

even nixon

Nixon was discredited by the Watergate scandal and was eventually forced to resign.But even Nixon had no known conflicts of official or personal financial interest.

Richard Painter, the chief White House ethics lawyer under George W. Bush, said this:

“Every president since the Civil War has avoided significant financial conflicts of interest related to the duties of his official office. Even Nixon did so. Trump is the first to blatantly ignore that tradition.”

Trump’s “Trust”

Trump, of course, also set up trusts – but it’s a complete joke.

Who manages this trust?His son, Donald Trump Jr.

Who are the beneficiaries?Trump himself, and the only beneficiary.

Is this a blind trust?Not at all.Trump is well aware of his financial situation, and his sons have invested in family businesses around the world.

When will he get the money?It can be used immediately after leaving office.

This is not a trust, it is a legal cover-up designed to meet formal requirements without any separation in substance.

Attorney Painter put it more directly:

“Trump should divest himself of any financial interests that might conflict with his official duties. That’s the bottom line. But he doesn’t even bother to pretend.”

Act 7: Voters are kept in the dark

Amazing polling data

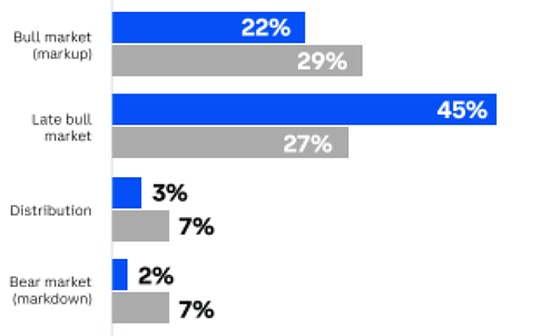

Public First US conducted a poll for the Financial Times among Trump supporters.The results are shocking:

Regarding profit scale:

•More than 50% believe Trump made less than $100 million while in office•Nearly 30% believe he has not benefited from the presidency at all

About crypto projects:

•Over 40% of people have never heard of the $TRUMP memecoin•More than 40% of people have not heard of the family’s crypto platform

The gap between reality and perception

What is reality?

•Realized profits from the crypto business alone exceed $1 billion

•Book wealth increased by billions

•A business empire involving billions of dollars of investment from foreign sovereign funds

What is cognition?

•Most voters have no idea these things exist

•Those who know also seriously underestimate the scale.

•Many people even think that Trump is making “selfless sacrifice”

How wide is this gap?30 times?50 times?Or infinite?

Why is this happening?

The power of the information cocoon.Trump’s supporters mainly get their information from friendly media such as Fox News and Newsmax.These media outlets either don’t report these things, downplay them, or defend Trump.

The complexity of cryptocurrencies.What is WLFI Token?What is a stablecoin?What is a DeFi platform?For ordinary people, these things are too complicated.When you don’t understand something, you tend to ignore news about it.

Cover for multi-tiered corporate structures.The money did not flow directly into “Trump’s” personal account, but into various LLCs, trusts, and platforms.It is difficult for ordinary people to trace the final destination of this money.

The blindness of partisan loyalty.For many Trump supporters, any information critical of Trump is automatically classified as “fake news” or a “witch hunt.”They automatically filter out information that does not fit their worldview.

Media fatigue.Trump has been so controversial that people have become numb to new scandals.$1 billion?That sounds like a lot, but in the Trump news cycle, it’s quickly overshadowed by the next breaking story.

Information War Victory

In a sense, this is a victory in the information war.The Trump team successfully ensured that most supporters were unaware of, did not understand, or did not care about these conflicts of interest.

As long as voters are kept in the dark, there is no political pressure.Without political pressure, there are no institutional constraints.Without institutional constraints, money can continue to flow.

This is a perfect closed loop.

Act Eight: A textbook case of regulatory capture

What is regulatory capture?

In political economy, there is a concept called “regulatory capture”: regulatory agencies are controlled by the industry they are supposed to regulate, thereby serving the interests of that industry rather than the public interest.

Typical regulatory capture works like this:

1.Industry offers benefits to regulators (job opportunities, consulting fees, revolving door, etc.)

2.Regulators create industry-friendly policies while they are in place

3.Regulators leave and enter industry to gain high-paying jobs

4.New regulators see predecessor’s “example” and continue to cooperate

This mechanism has operated in Washington for decades, spawning massive industry lobbying and policy capture.

But Trump’s model goes further.

Trump Model: Direct Community of Interest

In traditional regulatory capture, a certain distance remains between regulators and industry—the benefits are delayed and indirect.

Trump’s innovation: policymakers themselves are the industry’s biggest stakeholders.

It is no longer “I help you, you will help me in the future”, but “helping you means helping me, because I am you”.

The operating process of this model is:

Step One: Industry Despair.Tough regulation during the Biden era has put the crypto industry on the verge of survival.After the collapse of FTX, the entire industry was discredited and faced unprecedented regulatory pressure.

Step two: political bets.The crypto industry bets on Trump, ensuring Trump wins through $260 million in super PACs and massive political donations and owes them a favor.

Step 3: Establish a community of interests.Trump didn’t just accept donations, he directly created a crypto business and made himself part of the industry.His wealth is now tied directly to cryptocurrency prices and policies.

Step 4: Seize regulatory power.Immediately after taking office, he replaced all encryption skeptics and installed friendly people into key regulatory agencies such as the SEC and the Department of Justice.

Step 5: Policy shift.Withdraw all enforcement actions against the industry, launch a series of friendly policies, and introduce trillions of funds into the encryption market.

Step 6: Harvest profits.During the policy dividend period, the Trump family’s encryption business made a profit of $1 billion.

Step 7: Positive feedback loop.After profits are made, continue to organize political donations (such as the Digital Freedom Fund PAC) to ensure that the 2026 midterm elections and the 2028 general election continue to be crypto-friendly, forming a self-reinforcing cycle.

This is not regulatory capture, this is regulatory annexation.

Why is it more dangerous?

Traditional corruption is illegal, or at least punishable.But Trump’s model is mostly “legal” in law:

•Political donations are legal (after Citizens United case)

•It is legal for the president to appoint regulators

•It is legal for the president to sign executive orders

•Family businesses are managed by trusts (even if they are joke-like trusts) and are formally compliant

This veneer of “legitimacy” makes it difficult to hold the entire system accountable.You cannot prosecute someone who operates within the framework of the law, even if he is completely morally bankrupt.

More dangerously, it sets a precedent.If Trump can do this with impunity, will the next president follow suit?Will more industries be “captured”?

Pharmaceutical industry?Military-industrial complex?Energy industry?

When the combination of power and money becomes so naked and the system is unable to restrain it, democracy itself is in danger.

Act 9: What should investors learn?

The ultimate in policy market

Trump’s crypto empire teaches investors a lesson: In some markets, fundamentals are less important than policy.

Bitcoin rose from US$40,000 to US$110,000, an increase of 175%. In the process:

•No major technological breakthroughs

•No new killer app

•No explosive growth in user numbers

Some are just changes in policy expectations.

This is a textbook case of “policy city”.

How to identify policy dividends?

The Trump model provides a template:

Signal One: Political donations surge during election years.When an industry suddenly and significantly increases its contributions to a candidate, it may mean they are betting on a policy shift.

Signal Two: Clear Commitment from the Candidate.Trump’s speech in Nashville was not vague, but a specific promise-“Fire Gensler on Day One” and “Build a Bitcoin Reserve.”Such concrete promises tend to be fulfilled.

Signal Three: Act quickly after taking office.Gensler resigned on Trump’s Inauguration Day, and the Justice Department changed its policy three months later.This speed shows that the commitment is serious.

Signal 4: Industry turning point.When the regulatory environment changes 180 degrees, funds will flow in quickly.The price of Bitcoin rose from 40,000 to 110,000, which is a direct result of this turning point.

Where are the risks?

But here’s the thing about policy markets: Policies can change, and they can change suddenly.

2026 midterm elections.If Democrats take back Congress, they may launch investigations and push for tighter crypto regulations.

Presidential change in 2028.If the Democrats retake the White House, the entire friendly policy framework could be overturned.

Public opinion turned.If a large-scale crypto fraud case occurs, or ordinary investors suffer heavy losses, public opinion may force the government to tighten regulations.

Foreign power risks.What are the political purposes behind the large investments made by countries such as the United Arab Emirates and China?If geopolitical relations deteriorate, these investments could suddenly be withdrawn, triggering a market crash.

The biggest risk is: when a market’s valuation depends entirely on policy expectations, once expectations are reversed, the collapse may be instant and devastating.

moral dilemma

There’s another issue that investors rarely think about: ethical dilemmas.

What are you doing when you buy $TRUMP tokens or invest in World Liberty Financial?

From a pure investment perspective, you are participating in a potentially profitable speculative opportunity.

But looking at the bigger picture, you’re funding a corrupt system.Your money reinforces the collusion between power and money and weakens the checks and balances of a democratic system.

This is a personal choice.But it should at least be an informed choice.

Act 10: The collapse of the system

Failure of checks and balances

The basis of the American constitutional system is checks and balances of power: the president, Congress, and courts check each other.

But where are these checks and balances in the story of Trump’s crypto empire?

Congress?A Republican-controlled Congress will not investigate its own president.Democratic lawmakers raised their voices in criticism but were drowned out in the partisan noise.

Court?Most of Trump’s actions fall into a legal gray area, or have the veneer of “legality.”It is difficult for the courts to intervene.

media?Mainstream media reported it, but the impact was limited.Trump supporters don’t watch the mainstream media, or don’t believe their reporting.

voter?As mentioned before, most voters don’t know, or don’t care.

Ethics agency?The White House has ethics lawyers, but their “advice” is not mandatory.Witkoff’s “cooperation with ethics officials” has become a joke – months have passed and nothing has happened.

The checks and balances of the entire system appear weak when faced with a sufficiently shameless power.

The consequences of Citizens United

In 2010, the Supreme Court ruled in Citizens United v. FEC that corporations can make unlimited political donations because they are part of “free speech.”

The verdict is seen by many as a turning point for American democracy.It opened the floodgates of money and spawned the super PAC system.

But even those who supported the verdict at the time had a hard time foreseeing the Trump model.

Trump’s innovation: Not just accepting donations, but becoming directly part of the industry’s interests.Policy makers and profit makers become one.

This is the ultimate in Citizens United’s logic: If money is speech, then those with the most money have the greatest say.And when the president becomes the largest financial stakeholder, the entire system becomes naked money-power politics.

Demonstration effect for other countries

Even more worrying are the global impacts.

The United States has always regarded itself as the beacon of democracy.But when the president of the United States can blatantly use his power to seek $1 billion in benefits for himself and his family with impunity, will this beacon still shine?

Leaders of other countries are watching.What they see is:

•Conflicts of interest are okay, as long as they are packaged properly

•Foreign investment can influence policy, as long as the amount is large enough

•Regulation can be bought, as long as enough donations are made

•Voters can be deceived by controlling the flow of information

If America is like this, why can’t we?

This is a dangerous demonstration effect.The corruption of the US system may provide a rational excuse for the decline of democracy around the world.

Epilogue: $7.7 billion is just the beginning

Eric’s Carnival Manifesto

“The crypto space is exploding.” Eric Trump said excitedly in an interview.

The president’s second son now devotes at least 50% of his energy to the cryptocurrency business.Traditional real estate and golf resorts are no longer the main growth engines of family wealth—digital assets are.

He flies around the world, to Hong Kong, Tokyo, Las Vegas, and Dubai, emphasizing a theme in each speech: “The crypto community has embraced my father in a way that I have never seen. I hope this has paid off handsomely.”

Got it?

Net assets of US$7.7 billion have increased by US$1.3 billion in a few weeks. Is this return “generous” enough?

When asked if there was a conflict of interest, Eric’s answer remained firm: “My father has nothing to do with this business. He is busy running the country and is not involved in our business in any way.”

He is even proud of his role: “I think in the last 12 to 18 months, I have become one of the best voices in the crypto space.”

This is not humility, this is declaration.

The logic behind the numbers

Let’s understand how amazing the speed of this wealth creation is.

The Trump family has been operating real estate for decades, and the wealth they have accumulated has grown linearly and slowly.A large-scale real estate project may take 5-10 years from planning to completion, during which time it must deal with numerous regulatory approvals, financing challenges, and market fluctuations.

But in the cryptocurrency world:

1. WLFI Token: Listed on September 1, with a market value of US$7 billion on that day.

2. American Bitcoin: Listed on September 3, the market value on that day was US$7.3 billion, and it reached US$13.2 billion during the session.

Two projects less than a year old created more paper wealth in two days than all the Trump family’s real estate gains in the past decade.

This is exponential wealth growth, not linear.

This is the ability to directly realize power, rather than the result of commercial operations.

latest action

The story is far from over.September 2025 is just a new starting point.

World Liberty Financial announced its support for the establishment of the “Digital Freedom Fund PAC”, a new super PAC with the goal of “advancing Trump’s crypto vision.”

what does that mean?From passively accepting donations to actively organizing political funds.From beneficiary to organizer.The Trump family is no longer just an ally of the crypto industry, they are becoming an industry leader and even an ideological shaper.

The Winklevoss twins (early Bitcoin investors and billionaires) have donated $21 million in Bitcoin to this PAC.Kraken exchange donated $1 million.More money is pouring in.

What will the money be used for?Support pro-crypto candidates in the 2026 midterm elections to ensure Congress remains friendly.Perhaps it will also be used in the 2028 presidential election – whether it is Trump’s third election (if he can change the Constitution), or to support the next friendly candidate.

American Bitcoin’s expansion plans are also accelerating.The company is preparing to raise US$2.1 billion to acquire listed companies in Asia, seek support from sovereign funds in the Middle East, and expand mines in North America.

Plans to tokenize real estate are advancing and could redefine how physical assets are traded.

The community of interests is being deepened, institutionalized and globalized.

unsolved mysteries

There are many unanswered questions about this story:

To whom was the 37% stake in World Liberty Financial sold?Is it some foreign fund?Is it someone in need of political asylum?Or is it an interest group that wants to influence U.S. policy?

Are the $2.71 billion in reserves of the USD1 stablecoin really there?Where to invest?Who is the custodian?Is there an independent audit?

What’s the deal behind UAE’s $3 billion investment?What do they want?A shift in Middle East policy?Approval for arms exports?Or something else?

What are the true intentions of Chinese funds?Why invest in $TRUMP tokens?Is this a business investment, a political gesture, or a more complex strategy?

How many more deals are there that we don’t know about?Is $1 billion all there is?Eric said “probably more” – how many more?

These questions may take years to answer.Or there may never be an answer.

three questions

Let’s go back to the beginning and summarize this story with three questions:

First question:When a president can openly use his power to seek $1 billion in benefits for himself and his family, and most voters have no idea, what should we reflect on?

This isn’t just a Trump problem, it’s a system problem.Information asymmetry makes democratic supervision ineffective.Accountability is empty talk when voters are uninformed.

Second question:When regulators become the umbrella for regulated industries, who will protect ordinary investors?

The SEC’s job is to protect investors, but it now serves industry interests.When FTX crashes next (which is almost certain), it will be ordinary investors who lose money, while regulators and industry leaders have already cashed out.

Third question:Where is the national security when foreign sovereign funds pour billions into the president’s family businesses?

This is not a business investment, this is a political investment.Foreign governments are buying influence.What is left of “America First” when U.S. foreign policy can be influenced by foreign money?

Final Thoughts: Lessons from 1 Billion to 7.7 Billion

Trump’s crypto empire is not an isolated incident, it is a symptom – showing the deep-seated pathology of the American political and economic system and the new model of combining power and wealth in the 21st century.

A few months ago, when the Financial Times calculated that the Trump family had made more than $1 billion in profits from the crypto business, Eric said “probably more.”

Now we know he was right.And it’s much more than just “more”.

Net worth of $7.7 billion.

An additional $1.3 billion was added in a matter of weeks.

The two projects, less than a year old, have a combined market value of more than $14 billion.

This is not the logic of traditional business, this is a new paradigm of power realization.

The combination of money and powerThere’s no hiding it anymore—the president’s sons are on a global roadshow to promote the family’s crypto projects, and the president himself signed a bill legalizing the family’s stablecoin.

Institutional checks and balancesWeak and helpless in the face of a shameless power – Congress does not investigate, the courts cannot control, and the “suggestions” of ethics lawyers become a joke.

information asymmetryLet democratic supervision be in vain – 40% of Trump voters do not know that the family has encryption projects, and 50% believe that the president has earned less than 100 million U.S. dollars, while the real number is 7.7 billion.

cloak of legitimacyMake corruption unaccountable – political donations are legal, appointing regulators is legal, signing administrative orders is legal, and even family businesses are “managed” by trusts (although it is managed by the son, and the father is the only beneficiary).

The significance of this story goes beyond the numbers themselves—even astronomical numbers like 7.7 billion.It shows what happens when all the protective mechanisms of a system fail.It is a warning: Democracy is more fragile than we think, and power corrodes faster than we think.

For some, it’s an investment opportunity – a textbook on how to profit from the policy market, a template for how to recognize “political dividends.”

For others, it is a scandal – corruption that needs to be exposed and stopped, institutional loopholes that need to be reformed.

But this should be a wake-up call to anyone who cares about political economy: We are witnessing a turning point in an era.The game of power and money has entered a new stage – more naked, more unscrupulous, and more difficult to restrain.

The significance of creating 1.3 billion US dollars in a short period of time

Let’s get back to that core number:$1.3 billion added in weeks.

what does that mean?

This means the Trump family has found a way to convert political capital into economic capital at an unprecedented rate.

World Liberty Financial’s WLFI token will be listed on September 1st, and American Bitcoin will be listed on September 3rd.Within two days, the book wealth increased dramatically.

It’s not about building better products, it’s not about providing better services, it’s not about creating real value.

This is because of the name “Trump”.This relies on the president’s policy influence.This depends on the cooperation of regulatory agencies.This is based on bets from foreign sovereign funds.

This is pure power.

What does the future hold?

The story continues.Money is still flowing.The game of power and money has entered a new stage.

“The crypto space is exploding,” Eric Trump said.

What he didn’t say is: the center of this explosion is the Trump family themselves.

Will they continue to expand?Of course it will.

Real estate tokenization is coming soon.American Bitcoin is set to raise $2.1 billion.Global expansion plans are being implemented.Digital Freedom Fund PAC will play a role in the 2026 midterm elections.

US$7.7 billion is just the beginning, not the end.

And we, as witnesses of this era, the questions we need to think about are:

What does democracy mean when a presidential family can profit $1.3 billion from policy-friendly industries in a matter of weeks, without most people knowing?

What is left of national sovereignty when foreign sovereign funds can influence U.S. policy by investing in the president’s family businesses?

When regulators are the regulated and policymakers are the biggest beneficiaries, does the public interest still exist?

There are no easy answers to these questions.But they must be raised, discussed, and taken seriously.

Because this is not just a story about the Trump family, it’s a story about an era.

We are all witnesses to this story.The question is: will we be silent bystanders or vocal participants?

History will remember this moment.Our choices will determine how history writes this page.

Eric may have been prophetic when he said “probably more.”

The question now is: how much more will there be?

The more important question is: are we ready to face this “more”?

Data sources and statements

Main data sources:

•Financial Times in-depth investigative report (October 2025)•Reuters report on American Bitcoin and World Liberty Financial•Bloomberg Billionaires Index and related reports•Real-time tracking reports from CBS News, Channel NewsAsia, Cointelegraph and other media•Analysis of regulatory changes by The Guardian and El País

Key time nodes:

•November 2024: Trump wins the election

•January 20, 2025: Trump inaugurated, Gary Gensler resigns

•March 2025: American Bitcoin is established

•July 2025: Genius Act signed

•August 2025: Alt5 Sigma announces $1.5 billion deal

•September 1, 2025: WLFI token will be listed for trading

•September 3, 2025: American Bitcoin is listed on Nasdaq

Core numbers:

•Trump family net worth: $7.7 billion (Bloomberg estimate)

•New wealth added in weeks: About $1.3 billion

•WLFI token market cap: $7 billion

•American Bitcoin Market Cap: $7.3 billion (close) / $13.2 billion (intraday high)

•Locked WLFI tokens held by the Trump family: 22.5 billion, valued at $4 billion