Author: Thaddeus Pinakiewicz, Vice President of Galaxy Digital Research Center; Translation: Bitchain Vision xiaozou

1, Irrational carnival: some anchor assets decoupled in the storm

Trump’s unexpected tariff announcement at 20:50 UTC on Friday triggered a tremor in the market, kicking off the largest nominal deleveraging in crypto history: more than $19 billion in positions were liquidated in about 24 hours, and Bitcoin plummeted to a low of $106,000-107,000 before rebounding.U.S. stocks fell simultaneously (the Nasdaq fell 3.6% and the S&P 500 fell 2.7%, the worst single-day performance since April).The three anchored assets USDe, BNSOL, and WBETH on the Binance platform have experienced serious decoupling: USDe, which is supposed to be anchored 1:1 with the US dollar, fell to as low as 0.65 US dollars, but the minting and redemption function of the Ethena platform is normal and most exchanges still maintain parity; wBETH fell to 430 US dollars at the bottom, and BNSOL hit the lowest 34.90 US dollars, which is as high as 80%-90% discount compared to its underlying assets ETH and SOL.The sharp decline triggered large-scale clearing exchanges to activate risk control mechanisms, and multiple platforms triggered automatic reduction of ADL positions to limit the expansion of losses during the “free fall” period through forced liquidation.

2, event sequence and timeline

10moon9day04:40UTC: Hyperliquid “insiders” injected $80 million USDC into trading accounts.

10moon9day04:40to10moon10day20:49 UTC: The insider gradually built up a short position in BTC of approximately US$400 million, and stopped building the position one minute before President Trump announced the tariff policy.

10moon10day20:50-21:20 UTC: Trump posted a threat to impose 100% tariffs on China on Truth Social.Crypto futures plunged within minutes, option implied volatility soared, and liquidity dried up as market makers priced in regulatory uncertainty.Bitcoin fell by about 10% during the day, and Ethereum fell by about 13%.

10moon10day21:20-21:42 UTC: When BTC and ETH reached intraday lows, USDe began to fall below the $1 peg on the Binance exchange.

10moon10day21:42-21:51 UTC: USDe fell to a low of $0.65, and the Binance exchange experienced decoupling and serial liquidations intensified.The anchored assets suffered large-scale liquidation and selling. WBETH depreciated 80% relative to the anchor value within two minutes, and BNSOL followed suit and fell 80% within the next seven minutes.

10moon10day21:51-23:59 UTC: The market bottoms as the wave of liquidations subsides.USDe took the lead in restoring anchoring with the fundamental redemption mechanism. As market makers and traders assessed the severity of the plunge and reassessed counterparty and platform risks, WBETH and BNSOL gradually returned to anchoring exchange rates overnight.

10moon11From: The market has returned to normal operations.

The plunge was reminiscent of the 2010 “flash crash” event, when the S&P 500 fell nearly 10% in about 30 minutes before recovering most of its losses before the close.That crash was a market microstructural shock, where algorithmic trading spiraled downward due to the interaction of peculiar order types.Fundamentals take their time to respond to a market collapse, ultimately bringing the market back to normal before the close.

3,“Insider trading suspicions?HyperliquidGiant whale movements“

A Hyperliquid account established a huge BTC short position immediately before the tariff announcement and made a huge profit.The trader completed the position at 20:49 UTC exactly one minute before Trump’s announcement at 20:50 UTC.Such precise timing and huge scale immediately aroused market attention and people speculated whether it knew Trump’s policy trends in advance.

Our inability to prove this often leads to a tendency to downplay such narratives.People prefer to believe that this is a coordinated and orderly operation rather than admit that the market is simply out of control due to excessive leverage, but the timing is indeed too coincidental.On-chain detectives Eyeonchains traced the source of the funds at this address to fund manager Garrett Jin, who claimed the funds came from clients and denied any connection to the Trump team in deleted tweets.Another blockchain observer, ZackXBT, added that the wallet in question may involve multiple entities rather than a single operation.

Although it is a high-profile episode in this plunge, the $400 million in perpetual contract short positions is not enough to shake the entire market.The chain of facts is: the short position preceded the widespread decline and plunge, triggering the decoupling of Binance, and the decoupling intensified the wave of liquidation due to the collapse of collateral value.

4, Binance’s role and countermeasures

The decoupling phenomenon of USDe, BNSOL and wBETH occurred after the main decline stage of BTC/ETH.Binance attributed the decoupling to weak order book liquidity and infrastructure under pressure amid a violent wave of liquidations.It is worth noting that at the time, Binance was in the process of switching the margin calculation method for these assets from a price basis to a redemption/fundamental basis, but the switch was not completed in time to mitigate the price sensitivity shock.

Afterwards, Binance announced that it would compensate users who were liquidated due to the plunge in the price of the anchored asset relative to the underlying asset.Approximately US$300 million in compensation has been distributed (without recovery from profit-seekers), and a US$100 million low-cost loan program has been launched to support market makers.Binance made it clear that it would not be responsible for traders’ losses, emphasizing that these measures were aimed at restoring market confidence rather than admitting fault.

5, cause of event

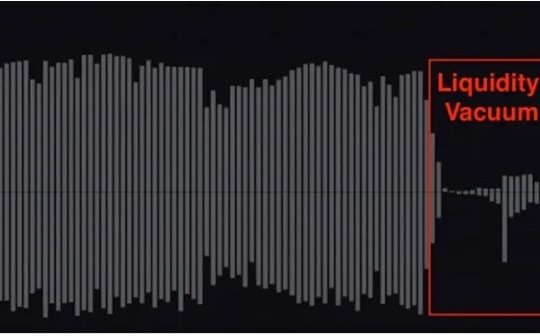

In short: high leverage, thin order book depth and macro black swan events combined to trigger a crash.Crypto markets entered this crisis with high open interest and strong risk appetite.Under the impact of sudden macro news, option spreads widened, hedging demand surged, market makers reduced risk exposure, and multiple perpetual contract platforms triggered automatic reduction of positions, forming a procyclical death spiral when order books are thin.

This is not a story caused by option expiration but a chain reaction of liquidity and leverage.Traders sold all available collateral, including “pegged assets” that were supposed to anchor fundamentals, until forced selling met with zero take-up.Although USDe’s underlying protocol, Ethena, has always maintained minting and redemption functions and the system remains over-collateralized, the token fell to as low as $0.65 on Binance.From a mechanism perspective, price shocks force over-leveraged USDe position holders on Binance to close their positions when liquidity dries up, while the ecological leverage built around USDe amplifies the chain effect after the order book evaporates deeply.As “decentralized perpetual contract exchanges” that support leverage have become the mainstream narrative in the market in recent months, a market cleanup is a foregone conclusion when all conditions are in place.

6,DeFiComprehensive transcript

During the market turmoil, USDe became unanchored on the Binance centralized order book, falling as low as $0.65, but its minting/redemption function was always normal – this vividly revealed a typical case of protocol value ≠ exchange market price in panic.The incident also rekindled discussions about oracles and pricing mechanisms, including Aave’s choice to hard-anchor USDe to USDT to avoid a flash-crash de-anchoring cycle caused by the exchange’s market price.Hard-coded assumptions, while working this time, may mask the true risk; essentially it’s a choice of what tail risk to accept.

Prices should not be forced to equate to “fundamental value” during liquidation.If no one bids, the liquidation price will naturally go lower, and closing positions based on this price is part of the game for traders.Although implanting “fundamental anchoring” into the oracle can solve the immediate problem, it only replaces price risk with fundamental risk.Don’t take this kind of “risk control solution” lightly: there is no zero-risk packaged asset, and fundamental oracles directly deprive users of the ability to perform risk adjustments on packaged assets and underlying assets.Is Binance custody or multi-chain deployment really risk-free?Obviously not.Fundamental oracles can prevent short-term turmoil like last week, but if there is a problem with the encapsulating entity, the risk will explode in the opposite direction.Fundamental oracles are not better than price oracles, they just optimize different result dimensions.

7, the best in history?

Although the liquidation scale of US$19 billion in a single day is a record, it only accounts for 0.45% of the current total crypto market capitalization of US$4.2 trillion – this is a violent deleveraging rather than a structural collapse.The next day’s rebound confirmed that this retracement was driven more by market microstructure than deterioration in fundamentals.In nominal terms this is indeed the largest liquidation event in crypto history, far exceeding the previous high of approximately $10 billion on April 17, 2021.

From a relative scale perspective, the intensity of liquidations on Friday eased significantly: accounting for 45 basis points of the total market value of US$4.2 trillion, only 5 basis points higher than the proportion of liquidations in April 2021 when the total market value was US$2.3 trillion.

Although Binance-specific market problems have exacerbated liquidation pressure, the main pressure is concentrated on perpetual contract exchanges such as Hyperliquid and Bybit (Coinglass currently does not count Aster data), these platforms are responsible for 75% of the total liquidation volume.

8, follow-up points of attention

In the final analysis, crypto assets follow the price mechanism rather than the spirit of the contract.Liquidation is based on market prices rather than courtesy notifications.If you participate in perpetual contracts or leveraged stablecoin cycle transactions, you are essentially taking on microstructural risks.When the crisis comes, the automatic lightening ADL mechanism will harvest profitable positions when order book liquidity dries up.

Traders need to keep a clear mind when participating in the market: What are you actually buying?How big is the true risk exposure?This event is neither unprecedented nor unpredictable.The excess returns generated by leveraged trading and yield farming are inevitably accompanied by liquidation risk.

Don’t expect market makers to unconditionally guarantee price stability and liquidity.When the market is in trouble, they will first choose to protect themselves.No one “owes” you a “fair” offer.

The response from exchanges has been equally frustrating.The crypto industry is building assumptions into markets and protocols.Although these measures can alleviate the immediate crisis, they will create more hidden dangers in the future.Hard-coding “fundamental” values into oracles or indices may avoid the recurrence of such de-anchoring, but it is actually using another type of tail risk (custodian/cross-chain/issuer failure) for social sharing.Recognize your risk exposure and don’t be shocked when leveraged machines show their true nature.

Such purges make healthy sense in terms of the broader market structure.It clears out excess leverage.As market makers re-entered the market, IBIT volatility was almost unaffected, and options volatility returned to the mean within a day, which confirms the overall resilience of the crypto market (with the exception of on-chain Meme coin casinos).