On October 11, Beijing time, the encryption market suffered the most tragic “bloodbath” in history.Amid the violent price fluctuations, nearly 1.66 million investors across the entire network liquidated their positions, with the total liquidation amount reaching US$40 billion, setting a new historical record.Many people blame the crisis on macro risk spillover (Trump’s sudden attack) and the excessive level of leverage in the crypto market, but the real situation is far from that simple.

Although the market panic index (VIX) surged rapidly after Trump announced an additional 100% tariff on China,The impact of tariffs this time is obviously less severe than in April. The key difference lies in the degree of market panic and liquidity conditions.The current peak of the market panic index (VIX) is far lower than the high of 52 in April. At the same time, broad dollar liquidity remains stable, and the three-month SOFR and cross-currency basis have not experienced the violent fluctuations seen during the April panic, indicating that the supply of dollars in the international banking system is still abundant.Therefore, asset performance is divergent, rather than the indiscriminate selling in April where the Nasdaq plunged more than 5% in a single day.It can be seen from this thatMacro risks are only the most secondary reason.

So, the overall leverage in the crypto market is too high?Obviously, this conclusion is also inaccurate.The most direct evidence is two points: 1. The maximum declines of Bitcoin and Ethereum are far lower than the two extreme market prices of 5.19 and 3.12.There is no systematic deleveraging of core positions;2. The intensive liquidation of altcoins occurred after 5:15 in the morning. At this time, the decline of most altcoins has reached more than 70% (no leverage market in the world can resist this kind of decline). The leverage of a large number of altcoin investors who were “beheaded” by lightning was less than 2X.(In fact, investors in many altcoins have extremely low leverage due to their long-term decline and illiquidity).

What’s the problem?The massive mismatching of leveraged arbitrage mechanisms is undoubtedly the culprit of this crash, the most typical of which is the revolving loan strategy.Arbitrageers lend USDT by pledging BTC, ETH, SOL and other tokens, and then convert it into USDE to arbitrage the interest rate difference; then, they pledge USDE again to lend out more USDT, and the cycle repeats to enlarge the position.During this process, if ETH and SOL are first converted into liquid staking tokens such as WBETH or BNSOL and then pledged, they can obtain an additional layer of staking income while maintaining the same pledge rate as the original assets.Of course, there are also smart people who choose to get it right in one step.By combining a margin leverage account, borrow USDT with a bunch of half-dead altcoins as collateral, and then buy USDE.

This layer-by-layer nested leverage structure not only amplifies financial management returns, but also significantly amplifies the vulnerability of the entire system..When there are severe market fluctuations, the liquidation sequence of revolving loans is usually not a gentle, linear process, but more like a rapidly spreading “chain reaction” triggered by the collapse of key collateral.At this time, due to the rapid consumption of liquidity, the market activates the ADL (automatic position reduction) mechanism, and even the lowest leverage position will be forcibly liquidated due to the instantaneous evaporation of collateral value, eventually forming a death spiral of “price drop – liquidation selling – accelerated decline”.In other words, the root cause of the shocking collapseIt is not due to the high leverage used by retail investors, but to the implicit leverage hidden in arbitrage strategies and complex financial engineering.

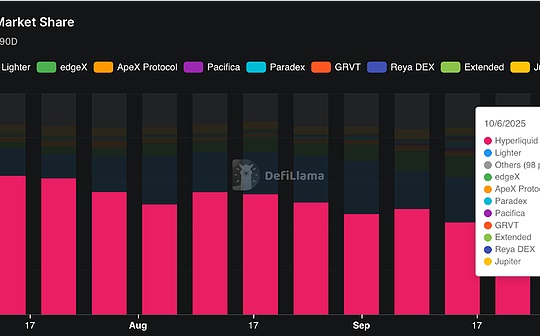

What’s even more fatal is that during the period of violent market fluctuations, a large U.S. firm went down due to excessive load, which prevented many investors from adding margin calls and closing positions in a timely manner.You can only watch your position being forced to be liquidated.At the same time, it is unknown whether the market maker triggered the risk control mechanism or the API malfunctioned (some feedback said that the API was abnormal). The market maker of a major cosmic exchange withdrew liquidity on a large scale after 5 o’clock, causing the market to show a free fall.

Judging from the videos recorded by some big players,Due to the huge liquidation scale and processing volume, it actually took Binance nearly an hour from taking over the account to completing the liquidation operation.In other words, the severe de-anchoring of USDe, WBETH, BNSOL and other assets we observed at 5:20 a.m. (for example, USDe once fell to $0.66) was not an independent secondary panic. It was essentially the continuation and manifestation of the liquidation of revolving loans: after the violent fluctuations, the huge amount of USDe, WBETH, and BNSOL mortgage positions taken over by Binance Risk Engine coincided with the large-scale withdrawal of liquidity by market makers, resulting in a deep market vacuum. The concentrated selling pressure generated when the system performed liquidation operations triggered a secondary price disaster.

If you put aside conspiracy theories, the core reasons for this crash can be attributed to the following two points:

First, most arbitrageurs seriously underestimate the destructive power of the implicit leverage in the revolving loan strategy and the fragility of the financial system to which it depends..many investorsMistaking USDE revolving loan as a simple stablecoin interest spread arbitrage,Think that as long as the first-level mortgage assets are not liquidated, you can rest easy.However, USDe is essentially a structured financial certificate based on a delta-neutral strategy, and its volatility and potential risk exposure are much greater than traditional legal currency-backed stablecoins such as USDT and USDC.

Second, there are systemic flaws in the exchange’s infrastructure, product risk control system, and market maker liquidity guarantee mechanism..Specifically, during periods of extreme market volatility, the trading system failed to ensure smooth transactions between users and market makers; while liquid pledged tokens such as WBETH and BNSOL enjoyed the same pledge rate as native assets, they did not receive corresponding liquidity guarantees; more importantly, when market makers collectively withdrew liquidity and caused the market mechanism to fail, the exchange lacked an effective crisis response mechanism, which ultimately exacerbated the market’s spiral decline (Bitmex suspended trading on 3.12 due to market mechanism failure).

Even though many altcoin investors who have used low leverage for a long time have made risk control preparations for historical extreme market conditions such as “3.12” and “5.19”, they were still not spared from this more tragic crash – it can be said that all the most unlucky situations have been caught up with them.However, from the perspective of market structure, the scale of chip changes brought about by this plunge has also reached an all-time high, which objectively provides the possibility for the reconstruction of the altcoin market (removing the burden of historical hold-ups).