Helix boldly reshapes the landscape

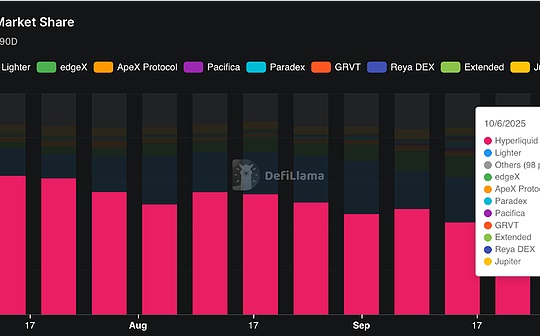

The Perp DEX track has been booming in the past few days. Platforms such as Aster and Hyperliquid have successfully exceeded 100,000 daily active users, and their contract trading volume has continued to set new records and hit new highs.With innovative incentive mechanisms and smooth trading experience, these emerging exchanges have successfully captured considerable market share from CEX.

However, a growth bottleneck has gradually emerged under the prosperity: the vast majority of Perp DEX’s trading targets are still limited to mainstream cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). The single asset class has limited its future imagination.When user growth and transaction volume naturally hit the ceiling, all platforms will involute on homogeneous assets.

Helix, the core exchange in the Injective ecosystem, is reshaping the landscape with a bold answer. So where is the next breakthrough for Perp DEX?

RWA——bringing the most valuable asset in the real world, Pre-IPO company equity, to the chain.

Just after October, Helix suddenly dropped a bomb: it launched perpetual contracts for unlisted companies such as OpenAI, which is different from the Pre-IPO investment channels provided by centralized platforms such as Robinhood.Helix gives ordinary investors around the world the opportunity to access and trade such high-potential assets on the chain for the first time.Previously, this type of assets was once monopolized by top institutions, such as investment banks and large capital.Complex KYC restrictions, investment amount restrictions and other threshold restrictions are even more daunting to ordinary investors.

Helix’s confidence in breaking traditional financial barriers comes from the Injective blockchain behind it and its deep accumulation.InjectiveLabs was founded in 2018 by Eric Chen and Albert Chon.Its extremely critical starting point was being selected into the first phase of the Binance Incubator (BinanceLabs is now called YZi Labs). This not only brought seed capital to the team, but also stood out among hundreds of projects. More importantly, it obtained industry endorsement and top resources of the Binance ecosystem.

As Injective officials said, the Pre-IPO perpetual contract on its chain has the characteristics of programmable, leveraged, composable, and high capital efficiency. It is supported by data provided by SedaProtocol and Caplight Data, ensuring that it is 100% safe and transparent when running on the chain.

In fact, it is not limited to crypto-native assets. Injective’s ambitions have already been revealed.It has targeted perpetual contracts on real world assets (RWA) through the Helix platform, ranging from commodities such as gold and crude oil to tokenized Apple and Google stocks.The launch of the Pre-IPO market, as the ultimate embodiment of its “financial democratization” vision, completely breaks the barriers of traditional finance.

Endorsement by top institutions: seven-year deeply bound capital matrix

In terms of financing endorsement, in addition to billionaire Mark Cuban, Injective’s list of investors is star-studded, covering Pantera Capital, Jump Crypto and many other institutions.It is the continuous support of these top institutions that provides solid backing for Injective’s focus on technological innovation and ecological expansion.

This top-level endorsement is not a temporary choice, but a deep binding that lasts for seven years.The recent speech of Ella Zhang, head of YZi Labs, confirms this. She said that YZi Labs’ vision to support DEX started when it incubated Injective seven years ago, and will build the ecosystem together with founders like Eric Chen who continue to build (#BUIDLing).This long-term trust from the founders of the industry is the most valuable intangible asset of the Injective ecosystem.

Conclusion

From a DEX solution focused on on-chain order books to bringing the $2 trillion Pre-IPO market on-chain.The evolution paths of Injective and Helix clearly present the next frontier of DeFi.It is no longer willing to carry out stock games in the walled gardens of the crypto world, but takes the initiative to decentralize the most valuable and most unequal parts of the traditional financial field.

In the second half of Perp DEX, the competition is about who can break through the “crypto island”. While other platforms are still fiercely competing for handling fees in the BTC/ETH contract, Helix has led users to plunge into the core area of traditional finance.This is not just product innovation, but a power shift.In the past, the power of financial discourse was in the hands of Wall Street. Now, an ordinary user can compete in the same market with institutional giants by simply connecting their wallet.

Helix confirmed with the Pre-IPO contract: “Financial democratization” is not just a slogan. When ordinary people get the keys that were once out of reach, blockchain technology actually opens a hole.Next, let’s see how many people dare to hold this key and open the door to a new world.