author:A1 Research

introduction

Is the mass migration of institutional capital into DeFi inevitable?If you ask some of the world’s largest money managers, the answer is obvious:

Scott Bessent – U.S. Treasury Secretary:“Recent reports predict that the stablecoin market could reach $3.7 trillion by the end of the decade”

Larry Fink – CEO of BlackRock: “Every stock, every bond, every fund – every asset – can be tokenized. If this is achieved, it will revolutionize the way investing is done. Markets will not need to shut down. Transactions that currently take days will be completed in seconds. Billions of dollars currently frozen due to settlement delays can be immediately reinvested in the economy, creating more growth.”

Kai Fehr – Global Head of Trade at Standard Chartered Bank: “Based on current market trends, we expect overall demand for tokenized real-world assets to reach $30.1 trillion by 2034.”

Blockchains have attracted the attention of these financial giants because of their ability to revolutionize the way assets are owned, used and transferred in unprecedented ways.Two key advantages of blockchain are programmability and composability.

Both of these advantages are enabled by smart contracts, which provide the foundation of programmable logic for their respective blockchains.Although not all blockchainsAll support smart contract functionality (Bitcoin is the most notable example,Although it offers limited programmability via Bitcoin Script for conditional spending mechanisms such as multi-signature wallets and time-locked transactions), but the rise of DeFi benefits from the popularity of smart contracts.

Ethereum was the first blockchain to use smart contracts, but there are now hundreds of active blockchains supporting DeFi applications through smart contracts in a common programmable execution environment.

Smart contracts are programmable in nature, which enables developers to program specific features into an asset and more.The world has never seen anything like programmable assets at scale;This technology could lead to a new frontier of innovation, bringing customization and dynamic properties to assets for the first time.

Additionally, composability refers to the ability of smart contracts to communicate with each other permissionlessly by default.This enables unprecedented interoperability at the network, product and asset levels, resulting in exponential improvements in efficiency compared to traditional siled and centralized infrastructures.

Over the past few years, the global financial industry has been gradually entering the Web3 space.This has led some of the world’s largest asset managers (including BlackRock, Franklin Templeton, Apollo Global Management and Janus Henderson) to begin “tokenizing” some of their funds, i.e. creating on-chain versions across multiple asset classes.

While the adoption of blockchain technology has been encouraging so far, there is finally a turning pointpoint.The possibilities of tokenization and institutional on-chain finance not only sound enticing, but will actually be available for the first timebecome reality.One of the most important developments turning institutional possibilities into reality is CLOB (Central Limit Order Book) infrastructure.Essentially, the largest and most liquid markets in the world run on CLOBs because of their superior performance.Today, on-chain CLOB is constantly evolving and will not only soon reach the performance standards of the global market, but will also significantly improve existing financial infrastructure.

Tokenization megatrend

Tokenization has gained increasing traction in the institutional finance world over the past few years, leading some of the world’s largest asset managers to deploy billions of dollars’ worth of capital on-chain.Some notable examples include:

-

BlackRock’s $2.1 billion BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

-

Janus Henderson’s $783M Anemoy AAA CLO Fund (JTRSY)

-

Franklin Templeton’s $717M On-Chain U.S. Government Monetary Fund (BENJI)

Market Size and Forecast

Overall, awareness and action on tokenization have continued to grow; the total value of tokenized assets has grown 10x since September 2022 and now exceeds $30 billion (excluding stablecoins).

However, we’ve only just scratched the surface.Compared to the roughly $4 trillion cryptocurrency asset class, tokenized real-world assets (RWA) account for just 0.75%.But at the current rate of growth, and the shift in institutions from talking about tokenization to actually implementing it, the coming years have the potential to bring major changes to the way assets are created, managed, and traded.

Tokenizable assets exceed $1.28 quadrillion

As institutional players’ focus on tokenization increases, market growth forecasts are emerging, many of which are extremely optimistic about tokenization’s future role in global markets.Here are some examples of recent forecasts:

-

Business Research: $5.5 trillion by 2029 (including stablecoins)

-

Mordor Intelligence: $13.55 trillion by 2030 (including stablecoins)

-

Standard Chartered: $30.1 trillion by 2034 (including stablecoins)

-

Deloitte: Tokenized real estate to reach $4 trillion by 2035

When analyzing the potential future of tokenized assets, one key factor needs to be kept in mind: Tokenization applies to nearly every major asset class in the world.As such, the impact has the potential to extend far beyond a single region, market or asset type.

Tokenization by asset class

Currently, the five major asset classes leading the tokenization trend are debt, equities, real estate, commodities and private equity.The combined value of these markets exceeds $1.28 quadrillion.

Total Real World Asset (RWA) Value

debt

As of the first quarter of 2025, the global debt market has a total valuation of $324 trillion, making it the world’s second-largest asset class after real estate.

Typically, “debt” is a more general asset class that covers a variety of markets, such as:

-

Sovereign debt, issued by a government (such as U.S. Treasury bonds)

-

Corporate debt, issued by a company on the open market

-

Private credit, issued privately by companies to non-bank lenders

-

Personal debt, loans to individuals (such as car loans, credit card loans, mortgages)

To date, debt is the most commonly tokenized asset in the history of tokenization, according to verified public data; approximately $26 billion in tokenized private credit, U.S. Treasuries, non-U.S. government debt, and corporate bonds currently circulate on-chain.

In addition to the aforementioned BUIDL and BENJI funds, some notable examples of tokenized debt include:

-

Ondo Finance’s Short-Term U.S. Government Bond Fund (OUSG) and Dollar Income (USDY)

-

Circle’s Tokenized U.S. Treasury Bills (USYC)

-

Figure Cumulative private home equity loans (HELOCs) exceed $12 billion

stock

Given the high participation of retail investors in the $127 trillion global equity market, tokenized shares have been one of the most anticipated and widely discussed solutions in the real world asset (RWA) space.

However, this anticipation has yet to translate into actual tokenization of shares.However, ongoing developments aim to change this in the near future.Currently, the two most important projects actively promoting stock tokenization are Ondo Finance and Backed Finance.While some “tokenized” assets are essentially synthetic on-chain stock price trackers, both Ondo and Backed support the tokenization of markets represented by actual underlying shares.

Ondo Finance has tokenized approximately $290 million in equity value to date, including ETFs representing the S&P 500 (SPY, IVV), Nasdaq 100 (QQQ), and Russell 1000 (IWF).

Backed Finance has tokenized approximately $76 million in “xStocks,” their on-chain stock product.Backed not only brought several mainstream ETFs to the chain, but also launched digital versions of individual stocks, including Tesla (TSLA), MicroStrategy (MSTR), Nvidia (NVDA) and Circle (CRCL).

While Ondo has the upper hand in tokenizing value, Backed has established early dominance in attracting trading activity; traders have generated more than $4.5 billion in trading volume since xStocks launched in June 2025.

real estate

First, it’s important to note that due to the relative lack of liquidity and transparency in the real estate market, real estate tokenization is not included in any of the tokenization metrics mentioned above.

Nonetheless, real estate is the world’s largest asset class, with an estimated value of $654 trillion.Given its low liquidity, lack of transparency and market size, the real estate market is likely to be the asset class that benefits most from widespread tokenization.

One company leading the way in real estate tokenization is RedSwanDigital, which plans to tokenize $100 million worth of commercial real estate on the Stellar blockchain by the end of 2025.

While RedSwan is currently limited to private investments, one DeFi project bringing this innovation to the public is Propy, which allows users to tokenize their properties and list them for sale on-chain as fractional shares.To date, Propy has facilitated over $4 billion in transaction volume.

commodities

Like the aforementioned asset classes, the major commodities (oil, natural gas, and precious metals) have a combined market capitalization of over $170 trillion.

Among the major commodities, gold has the highest demand in Web3.Specifically, Paxos and Tether have collectively tokenized approximately $2 billion in gold.

Another project innovating in the field of tokenized commodities is Justoken, which currently offers markets for soybeans, soybean oil, cotton and corn.However, trading of these tokens is currently limited to private investors in off-chain channels.

private equity

While the private equity market is far less transparent than most other markets, its global market capitalization is estimated to be around $13 trillion in 2024.

Despite its relatively small size, private equity is currently one of the fastest growing asset classes globally, with growth expected to be approximately 54% over the next 5 years.The rise of private equity as a global asset class makes it an interesting candidate for tokenization, as its growing importance attracts the attention of investors from various areas of technological innovation.

Two prominent institutions currently offering on-chain private equity funds are Apollo Global Management (through the Apollo Diversified Credit Securitization Fund) and Hamilton Lane (through the Hamilton Lane Secondary VI Securitization Fund).The two global institutions have collectively tokenized approximately $133 million in private equity.

While more and more institutions are taking their assets directly onto the blockchain, there has been a recent wave of native DeFi projects aiming to speed up the process – particularly in the private equity space.

Two projects leading this effort are Jarsy and PreStocks.While their platforms are not identical, both offer pockets of private equity in popular companies that have not yet gone public (e.g., SpaceX, OpenAI, ByteDance, etc.).Behind the scenes, both projects hold equity stakes in their public companies that fully back all outstanding shares.

It is one of the most innovative real-world asset (RWA) solutions to date; it enables both retail and institutional investors to access private equity while leveraging the efficiencies of blockchain channels to ensure fast and cost-effective execution and settlement with round-the-clock convenience.

Collectively, these five asset classes encompass more than $1.28 quadrillion in value, making tokenization one of the most potentially impactful trends in financial history.While the possibilities for adoption are exciting, tokenization on a global scale will only be possible if the infrastructure to support it is in place.Central limit order books (CLOBs) are by far the most ideal solution.

Geographic Adoption Patterns

In recent years, the world has continued to advance in step with the adoption and implementation of digital asset technologies.So far, the tokenization movement among asset managers has largely taken off in the United States, led by aforementioned firms such as BlackRock, Franklin Templeton, Apollo Global Management, and Janus Henderson.

Additionally, there has been a significant shift in openness in the U.S., advancing the exploration of digital assets through Web3-friendly regulations such as the GENIUS Act, incentives for U.S.-based projects, and the potential for a sovereign wealth fund composed purely of digital assets.

However, if we look globally, this is only part of a global trend that has intensified significantly in recent years.

In Europe, notable institutional adoption efforts include:

-

Deutsche Bank manages €100m worth of tokenized corporate bonds on Polygon

-

Switzerland’s UBS launches $375 million worth of digital bonds and tokenized gold on Switzerland’s native SIX Digital exchange (SDX) and ZKSync

-

Nine EU countries work to create MiCA-regulated euro-backed stablecoin

Several countries in Asia have also joined the global tokenization race – some recent standouts include:

-

China Asset Management Corporation (ChinaAMC), with over $400 billion in assets under management, launches $500 million tokenized money market fund on Ethereum

-

DBS Bank (OCBC), Singapore’s second-largest bank, recently launched an initiative to tokenize US$1 billion worth of U.S. commercial paper

Additionally, tokenization has found use cases in Africa, South America, and Australia; here are some recent developments in these regions:

-

In Nigeria, the Lagos state government plans to implement tokenized real estate as part of a larger move towards a blockchain-based land registration system

-

Brazilian asset manager VERT Capital tokenized $130 million in agricultural receivable certificates as an initial deployment of its XRP-based private credit platform

-

Australia and New Zealand Banking Group (ANZ) became the first commercial bank to launch a tokenized Australian dollar and is currently working with China Asset Management Corporation and Fidelity International to improve cross-border financial efficiency through tokenization.

Global Tokenization Example

As the world comes to realize the potential benefits of tokenization for global capital markets, there has been a significant shift in attitudes from governments, central banks and private companies.This shift has provided a tailwind for the industry, prompting widespread focus on regulatory clarity to further fuel its growth.

Limitations of current infrastructure

Regulation and Compliance

While institutions have repeatedly expressed a positive view of tokenization as a technology, a major obstacle preventing them from tokenizing traditional assets at scale is a general lack of regulation.The industry has spent centuries creating and revising strict compliance standards, with a particular focus on risk mitigation.Therefore, in order for them to accept a new technology, no matter how attractive its prospects, there must be a clear regulatory framework that ensures the protection of the company, customers and assets.

Interestingly, this issue seems to be gradually resolving itself; increased institutional focus on digital assets has prompted many countries to be more inclined to develop adequate compliance frameworks:

Recently, the GENIUS Act has attracted global attention as the first official digital asset regulatory framework in the United States.The bill is expected to take effect in January 2027, and its main function is to regulate the issuance, reserves, operations and secondary trading of stablecoins.

One of the most important aspects of the GENIUS Act is its impact on sovereign debt demand.Stablecoin issuers are required to back each token at a 1:1 ratio with highly liquid, low-risk assets such as cash, insured deposits, U.S. Treasury securities, or qualified repurchase agreements.Until now, U.S. Treasuries have been a common collateral choice for major stablecoin issuers; in fact, Tether, the world’s largest stablecoin issuer, is now the 18th largest holder of U.S. Treasuries in the world.

U.S. Treasury bond holdings by country

This trend is expected to accelerate rapidly in the coming years.According to Citibank’s Stablecoin 2030 Report, they predict that by 2030, stablecoin issuers may hold more U.S. Treasury securities than any single jurisdiction currently.

However, this view only focuses on the additional demand for U.S. debt.While stablecoins to date have been almost entirely denominated in U.S. dollars, it is reasonable to imagine that the impact of additional debt issuance will incentivize countries around the world to issue stablecoins denominated in their respective currencies and backed by assets including sovereign debt.

In addition to the GENIUS Act, the EU’s Market Regulation in Crypto-Assets (MiCA) framework, which comes into effect in 2023, is another major development in global tokenization.MiCA’s goal is to bring clarity and security to the Web3 industry by ensuring asset protection for institutional clients, requiring qualifying information for new crypto projects, enforcing reserve requirements and limiting limits for stablecoin issuers, and more.Additionally, other similar comprehensive frameworks include Dubai’s VARA, Hong Kong’s VASP and VATP regimes, and Switzerland’s digital asset regulation under FINMA.

Major global asset managers, governments, central banks, etc. are not only discussing but also interacting with blockchain and tokenized assets.As the pace of adoption and experimentation continues to accelerate, the process of establishing adequate compliance standards should continue to grow at an accelerated rate.

infrastructure

In addition to a lack of compliance standards, DeFi infrastructure has not evolved to the point where institutional money managers feel comfortable participating in on-chain markets at scale.This is due to current inefficiencies (and perceived inefficiencies), including the lack of custody solutions, liquidity fragmentation and settlement finality.

Hosting solutions

When it comes to institutional money management, a trusted custodian needs to handle critical tasks such as asset protection, transaction processing, and trade settlement.

Since digital assets have historically been used primarily by retail investors, self-custody has been the primary form of asset protection and management.However, to meet the requirements of global institutions, a wave of hosting solutions has emerged.Notable custodians include Web3-native companies like Coinbase, Anchorage Digital, and Fireblocks, as well as traditional banks like Fidelity and BNY Mellon.

A recent development that separates collateral management and trading venues is the integration of tokenization platform OpenEden’s OpenDollar stablecoin (USDO) with Binance’s bank custody.As Web3 gradually realizes that institutions need this type of custody service, we may see a whole trend develop around “off-chain exchange collateral (OEC),” as OpenEden’s CEO previously explained.

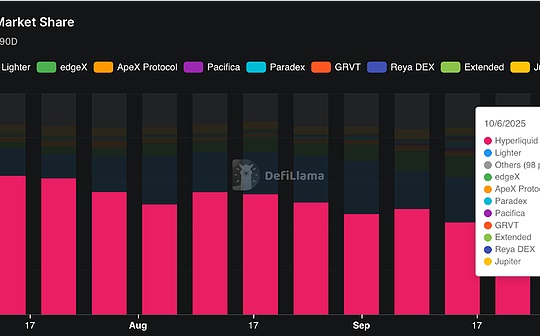

liquidity dispersion

Another flaw that has historically limited institutional participation in decentralized finance (DeFi) adoption is fragmented liquidity.Currently, there are hundreds of blockchains supporting DeFi activities, holding a total of more than $200 billion in assets, with 54 blockchains holding at least $100 million in assets.While it’s exciting to see so many blockchains contributing to the evolution of DeFi, the problem is that liquidity on each blockchain is often limited to itself.

It is important to note that the capital markets mentioned earlier contain over $1.2 quadrillion in assets.In order to facilitate the entry of even a fraction of these assets, DeFi liquidity needs to be as efficient as possible, which means that liquidity on any one blockchain should be able to seamlessly access applications on other blockchains.For example, just like a US stock account can trade stock products on any exchange (such as NYSE, Nasdaq, CBOE/BATS, OTC, etc.), the DeFi experience must enable users to use any application from a single source.

As the digital asset industry develops, solutions to the problem of fragmented liquidity are increasingly emerging.Prominent examples include:

-

Interoperability protocols such as Inter-Blockchain Communication (IBC), which enables communication between blockchains built on the Cosmos SDK (which has recently been expanded to other ecosystems such as Ethereum), and LayerZero, currently used by Tether, Ethena Labs, PayPal, Ondo, and Usual.A key selling point of LayerZero is that users can customize its decentralized verification network (DVN), providing flexibility for institutional compliance.In addition, LayerZero, through its chain-wide fungible token (OFT) standard, enables fungible tokens to exist across multiple chains, avoiding the packaging process.

-

Decentralized exchange (DEX) aggregators, such as Jupiter and 1inch, route transactions through multiple decentralized exchanges, often within a specific ecosystem.

-

Chain abstraction solutions, such as Particle Network or Arcana Network, focus on providing DeFi participants with an account to use across multiple networks in a frictionless manner, avoiding transferring the complexity of cross-chain operations to the user.

settlement finality

Understandably, the traditional financial industry places great emphasis on the settlement of all transactions (or the final recording of transfer of ownership) subject to a specific compliance framework to mitigate all possible risks.Settlement is typically performed by a clearing house; for example, many trades in the United States are settled by the DTCC, which processed $3.8 quadrillion in global securities transactions in 2024.

Current processes in major economies require settlement to be completed at least one day after the transaction actually takes place.For example, the “T+1” settlement in the United States and the “T+2” settlement in Europe respectively require the transfer of assets/cash to be officially completed one to two days after the transaction occurs.This is a key area where blockchain can improve, as some high-performance blockchains currently have settlement times of less than a second.

While blockchain automatically settles transactions based on the consensus mechanism of any given network, institutional adoption is currently limited by a lack of compliance standards.While this can be partially addressed through education (e.g. understanding when/how on-chain transactions are completed), institutions will likely need thorough compliance measures to ensure that on-chain settlements indeed represent absolute finality and that all potential risks (e.g. reversible transactions) are addressed and mitigated.

Why DeFi is finally getting “good enough”

While these are legitimate barriers to large-scale institutional participation, recent advances in blockchain performance and innovations in on-chain central limit order book (CLOB) infrastructure offer promising solutions.

Until recently, the idea of blockchain enabling thousands of transactions per second or even sub-second latency was considered speculative.However, these are now considered minimum baseline standards for high-performance blockchains.

Of course, in order for blockchains to effectively support global market activity, they need world-class transaction infrastructure.This is where CLOB comes in.

Through a high-speed matching engine (directly embedded in the execution logic of the application chain or combined with off-chain processing and on-chain settlement), CLOB optimizes liquidity efficiency, transaction throughput, complex order types, etc., CLOB is approaching the performance threshold of institutions for the first time.

CLOB infrastructure is the missing link

Why order books matter to institutions

In highly liquid and active markets, the central limit order book (CLOB) infrastructure is the most favored infrastructure by global exchanges (such as the New York Stock Exchange, Nasdaq, Tokyo Stock Exchange, Shanghai Stock Exchange, etc.).

One of the reasons why CLOB has become a mainstream infrastructure in the global liquidity market is the transparency and efficiency of its internal matching engine.The transparency of the matching engine enables real-time insight into order book activity, enabling efficient price discovery while ensuring the anonymity of participants.Additionally, the matching engine is specifically optimized to find the most efficient way to satisfy the ongoing inflow of buy and sell orders, making it an ideal mechanism to facilitate high-frequency trading.

Required functionality

Financial markets have undergone a series of major changes over the past few decades, resulting in a range of features designed to maximize efficiency.Among them, noteworthy features include sub-millisecond execution, deep liquidity pools, complex order types, portfolio margining, and regulatory reporting.

Sub-millisecond execution

As mentioned earlier, global markets place a premium on speed, especially due to high-frequency trading.The current optimized CLOB matching engine can be as fast as 10-100 microseconds, or 0.01-0.1 milliseconds.

Deep liquidity pool

According to a daily report from the Chicago Board Options Exchange, it is common for U.S. stock market trading volumes to exceed $1 trillion — most of which occur within a 6.5-hour trading session.The CLOB matching engine can efficiently integrate orders from many participants, essentially aggregate liquidity in a decentralized network, and execute orders in real time to handle such a massive amount of liquidity.

Complex order types

Another result of the evolution of global markets is CLOB’s ability to handle multiple order types.Because order books contain highly detailed data, they naturally support flexible conditional orders to meet the needs of any institutional money manager.

Portfolio Margin

By reading and broadcasting real-time information about market depth and liquidity, CLOB becomes an effective source of data for managing risk.Because they contain the exact price of all buy and sell orders at any given moment, models used by companies such as clearing houses or institutions such as Value at Risk (VaR) can continuously monitor overall risk and efficiently calculate the amount of margin that should be allowed.

regulatory reporting

By maintaining an ongoing order book, CLOB provides transparency into price data, allowing regulators to monitor liquidity and market behavior.Additionally, CLOB has the ability to record data in a standardized way, which is useful for analysis and cross-referencing between different assets and markets.

Advantages of on-chain finance

For all of the above reasons, CLOB can effectively serve as the “missing link” between DeFi and traditional finance, bringing institutions a familiar and performant infrastructure.However, the mechanisms built into DeFi enable its applications to significantly improve the performance of traditional markets.

Achieve 24/7 market

First, it is important to note that CLOB has always had the capability to operate around the clock.This is simply because they rely on algorithms to function rather than regular human-computer interaction.

Having said that, the “pre-24/7 market era” ends with the emergence of public blockchains.While some traditional markets have historically achieved 24-hour trading, there has never been a global market with 24/7 activity (forex exchanges come closest, but are often still “24/5” markets).The Nasdaq exchange is a pioneer in this space; earlier this year, its president announced plans to enable 24 hours a day, five days a week stock trading in the second half of 2026.Their CEO recently announced that Nasdaq will also support tokenized stocks.

Essentially, a public blockchain combines the algorithmic properties of CLOB with the advantages of decentralization; its operation is not restricted to any specific geographical location.This increased freedom finally allows CLOB to realize its potential: operate efficiently around the clock, globally, aggregating and processing liquidity from any source, anytime, anywhere.

Programmability and composability

As briefly mentioned in the introduction of this article, on-chain finance unlocks two major features for smart contract-based assets: programmability and composability.

Asset Programmability vs. Synthetic Assets

Essentially, asset programmability enables developers to customize the functionality of any specific asset, thereby changing how it operates and is used.A major trend toward programmability in Web3 is the creation of synthetic assets.In fact, many CLOBs currently use this feature to support the majority of the altcoin market.It works by letting traders deposit highly liquid tokens (such as USDC) into a centralized “vault” (or account owned by the protocol) and use that vault to provide liquidity to all markets.So, assuming the vault contains USDC, a series of oracles will broadcast altcoin prices to CLOB in real time, and USDC will be used to support all (or most) of the liquidity.Ultimately, this enables efficient market activity without the need for deep liquidity in long-tail assets (the vast majority of altcoins).

Asset Programmability vs. Synthetic Assets

This ability to reflect asset prices on-chain without the need for collateral not only creates more possibilities in asset customization, but also enables global exposure to virtually any asset class:

Synthetic perpetual futures

Injective’s L1 blockchain is designed to host innovative, high-performance applications to support institutional trading activities in synthetic programmable assets, known as iAssets in the Injective ecosystem.Helix is the largest decentralized exchange (DEX) on Injective and currently offers synthetic stocks with up to 25x leverage as well as custom indices such as the TradFi Technology Stock Index (TTI).It also provides leveraged exposure to commodity prices such as silver (50x leverage) and WTI crude oil (25x leverage).To provide liquidity for these assets, Injective uses an open liquidity program that allows both professional market makers and retail investors to participate.

At the core of Injective is the CLOB infrastructure, which includes an on-chain order book (relayed through off-chain initial orders) as well as on-chain matching and settlement.By combining CLOB infrastructure with innovative programmable assets, Injective demonstrates a powerful combination of performance and flexibility.

Ostium is another major player in the synthetic asset space, offering a variety of assets on Arbitrum, including:

-

100x leverage on global equity indices and individual stocks

-

100-200x leverage on Forex pairs

-

50-100x leverage on precious metals, base metals and energy commodities

Rather than relying on traditional market makers to manage liquidity, Ostium uses a centralized USDC “market making vault” similar to the one pictured above.To protect liquidity providers (LPs) from risk, Ostium also includes a liquidity buffer to absorb long-short imbalances and instant withdrawals from DEXs.Together, the market-making vaults and liquidity buffers form Ostium’s Shared Liquidity Layer (SLL).

In addition to offering the broadest selection of highly leveraged assets in DeFi, Ostium brings innovation to DEX architecture.Ostium abandons the common automated market maker (AMM)/CLOB architecture and instead employs specialized infrastructure to optimize simulated price exposure and provide asynchronous on-chain execution.

While Ostium’s pooled liquidity is similar to a VAMM architecture, liquidity providers benefit from not having to match counterparties immediately and avoid impermanent losses.However, they bear a more traditional risk of loss because their performance is positively correlated with the performance of the platform’s traders.

synthetic real estate

Parcl is a Solana-based application that leverages programmable assets to provide 24/7 real estate exposure, supporting hedging and speculation in 20 key markets (and growing).Liquidity is provided through a central pool to facilitate trading on each market, and real-time market data is provided by Parcl Labs’ powerful aggregated data ecosystem.

Parcl not only allows global retail investors to gain long or short exposure to some of the world’s most important real estate markets, it also enables unprecedented speculation without purchasing the underlying assets, significantly lowering the barrier to entry.Ultimately, Parcl fully demonstrates the power of programmable assets.

Although Ostium and Parcl are not based on CLOB infrastructure, we mention them here because they demonstrate the ability to merge traditional assets with programmable technology.Together with Injective, these platforms highlight an interesting trade-off unique to Web3: they eliminate the risk of price inefficiencies but rely on oracle providers to accurately transmit price data in real time.

Programmable token architecture

While programmability can obviously change how exposure to assets in any market is obtained, it can also specifically provide exposure to the “characteristics” inherent within a single token.A popular project demonstrating this use case is Pendle, which provides customized tokens for yielding assets.Specifically, any yielding asset is split into two tokens: Principal Tokens (PT), which essentially function like zero-coupon bonds, and Yield Tokens (YT), which give holders direct exposure to the fluctuations in the asset’s returns.This is essentially an on-chain version of bond stripping, but improves on the underlying mechanics by making it applicable to any yielding asset and open to any on-chain participant.

composability

Composability is related to programmability because it enables unprecedented customization of assets.However, it specifically refers to the ability of smart contracts to interact with each other and create unique products.One way composability is changing DeFi is by solving the aforementioned liquidity dispersion problem.By integrating smart contracts with different ecosystems, many developers are creating solutions to abstract chain-specific operations and build a more unified user experience (UX).

Another common example of composability is the creation of vaults, which are Web3-specific structured projects that can be customized in almost any way.An early example of custom vault creation is yearn, which initially used vaults to automatically rotate deposit funds into DeFi applications that offered the highest stablecoin yields.However, as DeFi innovation grows, so do the potential use cases for vaults.

In the CLOB space, two projects taking composability to the next stage of on-chain markets are Valhalla and World Capital Markets, described in our last report, Live Blockchains and the Rise of On-Chain CLOBs.

Currently, composability is also used to solve the problem of fragmented liquidity in the RWA field.Many institutions have a broad selection of funds, and as more and more funds are tokenized, they must integrate well with DeFi platforms to avoid the potential risk of illiquidity.Aave, a decentralized lending marketplace and top Web3 application (TVL, ~$75 billion) is leveraging its latest product, Horizon, to provide composability capabilities specifically for institutional users.The product enables eligible users, including institutional users, to use RWA as collateral for stablecoin loans.By integrating with one of the most popular applications in the DeFi space, this is a critical step for institutional assets to benefit from on-chain liquidity.

Ultimately, composability and programmability have the potential to greatly improve global markets.By enabling built-in functionality for RWA, the possibilities for tokenization go far beyond simply bringing assets to the blockchain; it can transform the utility and accessibility of assets and extend their reach beyond institutions to the general public by enabling entirely new capabilities within and across asset classes.By bringing assets to a public blockchain, tokenization has the potential to give exposure to anyone with a blockchain address, which naturally increases the available liquidity flowing into the market.This is particularly beneficial in markets where inefficiencies may exist due to low liquidity and accessibility (e.g. real estate, private equity, corporate debt, etc.).

The road ahead

As demand for stablecoins, tokenization, and on-chain finance heats up around the world, it’s clear that a major shift has begun.At this unique moment in history, we are witnessing the convergence of traditional organizations (e.g. financial institutions, governments, central banks) with Web3 projects that are at the forefront of the tokenization trend.

At the intersection of these two worlds lies CLOB: infrastructure commonly used in traditional markets around the world, repurposed for a future where digital assets become the new standard.While this has been a goal of blockchain developers for years, advances in on-chain infrastructure are reaching a tipping point that, for the first time, can deliver the levels of performance and compliance needed to support global market activity.

Ultimately, on-chain CLOBs provide institutions with a similar experience while laying the foundation for a new generation of programmable tokenized assets.This migration opens up new possibilities for asset trading, use and design, while providing more reliable liquidity to all markets through wider public exposure.

As this trend continues to develop, we will undoubtedly see existing favorable factors converging to accelerate its adoption.Finally, we’ll dive into some potential scenarios that this evolution could bring, as well as some of the milestones and new developments that could emerge from it.

Timeline prediction

The acceleration of the tokenization trend in the future can be attributed to two major factors: the evolving global regulatory landscape and the seemingly unlimited market space for tokenized assets (more than $1.2 quadrillion).However, a third major tailwind is also rapidly emerging: infrastructure capable of supporting institutional-grade assets and markets—specifically, CLOBs.Just as programmability and composability are the driving forces behind DeFi transforming capital markets, CLOBs are also the foundation for enabling this change.

In the next 1-2 years, these three positive factors are likely to form a flywheel effect, driving the acceleration of institutional adoption and laying the foundation for exponential growth in the total market value of real world assets (RWA).We can imagine this situation:

-

Global regulators continue to create compliance frameworks that not only fill regulatory gaps but also encourage institutional and government participation

-

Institutions identify significant opportunities and begin tokenizing relatively liquid, low-risk funds as a “test” (i.e. BUIDL) – we are currently in the early stages of this phase

-

At the same time, traditional/Web2 neobanks (e.g. Revolut, Chime, etc.) will increasingly integrate blockchain channels into their products to stay competitive

-

DeFi projects optimized for institutional DeFi are starting to integrate these RWAs into various applications (Aave’s Horizon has started this process)

-

Agency managers and their clients are experiencing first-hand the benefits of composability and programmability for the first time (and they’re very happy with it)

-

As institutional on-chain migration accelerates, developers realize opportunities from their own perspective (i.e., the ability to customize/program financial products)

-

This has resulted in a significant shift of developers from the “Web2” industry to Web3, attracting more talent and innovation into the industry

-

With the influx of new builders, more specialized and high-performance products are built, and institutions become more comfortable increasing the scale and choice of assets deployed on-chain

-

This has led to the expansion of early tokenization trends into emerging technologies – a leading example is the tokenization of GPU financing that has emerged due to the increased computing demands of AI innovation

Whether or not this happens in the coming years, the following remains clear: Globally, interest from governments, regulators, and institutions in the adoption and use of on-chain finance has grown significantly in recent years, and these tailwinds have never been stronger.

Milestones worth noting

The acceleration of the tokenization trend

As the mass migration of assets from traditional finance (TradFi) to decentralized finance (DeFi) approaches, some key milestones are worthy of attention and may further stimulate people’s awareness and interest in on-chain finance.To better understand these potential milestone events, we can look to what is happening now to determine what is likely to happen in the (short-term) future.

Important current developments include:

-

Large institutions that tokenize the assets they manage (BlackRock, etc.)

-

High-performance blockchain/CLOB is about to reach institutional-grade speeds

-

Continuing development of the regulatory framework (GENIUS Actwait)

-

Growing interest in tokenized assets from major exchanges (e.g. Nasdaq, London School of Economics)

-

Wave of “stablecoin network” announcements/launches (e.g. Plasma, Tempo, Stable, Arc, etc.)

Based on the assumption that these trends continue to accelerate, we may see some big events happening soon.

Tokenized IPO

One potential milestone that could happen in about the next 2 years is the first on-chain IPO.Specifically, this would involve a private company choosing to issue its equity to the public in tokenized form rather than on a traditional exchange.

It just so happens that we’re already on this path, with Bullish’s unprecedented effort to receive $1.15 billion of its IPO proceeds in the form of stablecoins.While we expect new issuances across all asset types (similar to UBS digital bonds), if this happens in the equity market, it will likely have the greatest impact, given the wide variety of retail and institutional participants in the equity market.

$1 trillion RWA

From an indicator perspective, tokenizationRWA(On the public chain, excluding stablecoins) the total amount exceeding US$100 billion or even US$1 trillion will also mark a watershed in the Web3 industry.Considering Web3’s current market capitalization is around $30 billion, this may sound like a huge leap.However, if we assume continued growth in adoption, we are already on track to reach this level within the next few years.

At the current growth rate, RWA is expected to have a total market capitalization of approximately $36.45 billion by the end of 2025, an increase of 1,889% from 2021 (CAGR of 108.4%).Considering the increasing attention paid to RWA by institutional investors and the resulting enthusiasm for deploying assets on-chain, it is not unreasonable to expect RWA to grow at a CAGR of 50% to 100% over the next 5 years.

Here are the total RWA market caps for each successive year, assuming CAGR of 50% and 100% (excluding stablecoins), extrapolated to 2030:

Potential acceleration in total RWA market capitalization

Asset Class Optimization

We should also expect various evolutions of the “stablecoin cyber wars.”Stablecoins have been widely promoted as the first true Web3 product to achieve global product-market fit.However, as blockchains are being optimized for stablecoins, a slight shift in perspective reveals that blockchains themselves are embarking on a journey to achieve this goal; if the latest wave of blockchains are currently being optimized for stablecoins, it is only a matter of time before we see optimizations for other major areas of need – especially with the resources available to customize on-chain assets.

a possible basis for this progressExamples arePlume, which specifically targets “RWAfi” projects and products, providing support by assisting every step of integrating TradFi with DeFi.Specifically, its infrastructure is designed to make the tokenization process more efficient, ensure compliance, provide custody solutions, and instantly integrate with the broad ecosystem of DeFi-native products.While Plume is not optimized for any specific asset class, the space could theoretically grow into such a platform by adding other L1 blockchains/appchains, L2 Rollups, or even applications within the Plume-like ecosystem.

Encrypted operating system

Another milestone this line of thinking could bring is a wave of user experience abstraction solutions.As we’ve said before, a serious problem currently limiting Web3 is liquidity fragmentation; a solution to this problem must be found if true mass adoption is to be achieved.Therefore, there is an overall solution similar to the operating system to improve the efficiency of Web3 through seamless cross-chain access.It may exist in the form of a Windows/Android/iOS-like interface for managing cross-chain and cross-platform activities, or it may be a completely new solution.