source:Haseeb; Managing Partner, Dragonfly;Compiled by: Bitchain Vision

During the market turmoil last weekend, I saw a lot of talk about USDe decoupling.USDe was said to have briefly decoupled to around 68 cents before recovering.Here’s the often cited Binance chart:

But after digging into the data and talking to some people over the past few days, it’s now clear that this statement isn’t true.USDe is not decoupled at all.

The first thing to understand: its most liquid platform isn’t actually an exchange, it’s Curve.There are hundreds of millions of dollars of standing liquidity on Curve, compared to tens of millions of dollars in standing liquidity on any exchange (including Binance).

So, if you just look at the chart of USDe on Binance, it looks like a decoupling.But if you stack up USDe’s other liquidity platforms, you get a different picture:

What we see here is that while USDe is down significantly on every centralized exchange (CEX), its performance is not uniform.Bybit hit $0.95 at one point before quickly recovering, while Binance decoupled like crazy and took a long time to re-peg to the US dollar.Curve, meanwhile, fell just 0.3%.How to explain this difference?

Keep in mind that every exchange was under huge load that day – it was the largest single liquidation event in cryptocurrency history.Binance was extremely unstable during this period, resulting in market makers (MMs) being unable to move inventory as the API was down, making withdrawals and deposits impossible.No one can step in and take arbitrage.

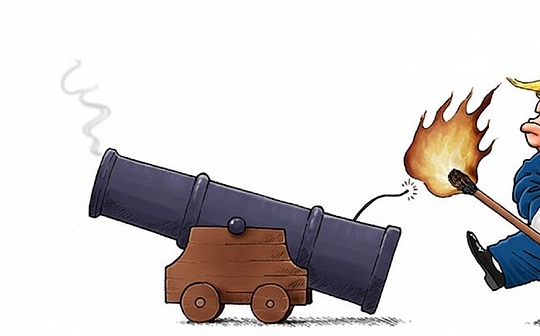

It’s like there’s a fire on Binance, but all roads are blocked and firefighters can’t get in.This caused wildfires to ignite on Binance, but almost everywhere else the fires were quickly put out by bridging liquidity.(As Ethena founder Guy shows in his post, USDC was also temporarily decoupled on Binance by a few cents due to the same general instability issues – liquidity couldn’t flow in, but this wasn’t a USDC decoupling event either.)

All right.Unsurprisingly, while there was API instability, prices on exchanges varied widely as no one was able to stock up.But why did Binance drop so much more than Bybit?

The answer is twofold – first, Binance does not have any primary dealer relationship with Ethena and cannot mint and exchange directly on the platform (Bybit and other exchanges have integrated this feature), which allows market makers to stay on the platform and still perform peg arbitrage.This is huge because otherwise market makers would have to *take* their money out of Binance, do an Ethereum peg arbitrage, and then bring their inventory back.In a time of crisis when APIs are down (plus many other currencies are plummeting), no one is going to do that.

Second, Binance’s oracle was poorly executed and began liquidating positions that should not have been liquidated—a good liquidation mechanism would not have triggered a flash crash.If you are not a major exchange for an asset (Binance is not a major exchange for USDe), then you should pay attention to prices on major exchanges.If you only focus on your order book, liquidation will be too aggressive.This caused Binance to start liquidating USDe as if it was worth around $0.80, setting off a chain reaction.This largely explains why Binance is refunding users whose USDe was liquidated (as far as I know, other exchanges are not doing this) – they screwed up and only focused on their own price, rather than the true external price.

So this was a Binance-specific flash crash that could have been avoided with better market structure.USDe remained pegged virtually throughout the day on its main trading platform, Curve.This is completely different from what people call decoupling.

If you remember USDC during the 2023 banking crisis, the actual decoupling looked like this:

During the banking crisis, USDC’s trading price fell across platforms.There is simply no place to buy USDC for $1.Redemptions are effectively suspended, so $0.87 is the true price.This is what “decoupling” means.

And this time it’s a Binance-specific decoupling.This is a big lesson for market infrastructure, but understanding the nuances is crucial if you want to extrapolate anything from last weekend’s USDe mechanics.

USDe has been fully collateralized at $1 on its main platform throughout the crisis, and actually saw its backing collateral increase over the weekend due to price volatility.That being said, this market instability is ultimately a good thing as it provides lessons for the entire industry.Guy’s post explains how any exchange, including Binance, can avoid such issues in the future.

In short: USDe itself is not decoupled, USDe on Binance is decoupled.