Author: Dan Alexander, Source:Forbes, Compiled by: Shaw Bitcoin Vision

Looking at Donald Trump’s finances, it’s easy to overlook one of his most important assets: Bitcoin.The cryptocurrency does not appear in Trump’s financial disclosure documents submitted to the government.It is also missing from the list of assets listed on the Trump Organization’s website.Bitcoin is also nowhere to be found in other asset reports.But there is no doubt that Trump holds a large amount of Bitcoin, worth an estimated $870 million, enough to make him one of the largest Bitcoin investors in the world.

What makes Trump’s investments so secretive: He holds them indirectly through his stake in Trump Media Technology Group, the company that runs Truth Social (which does appear on his balance sheet).Although Trump Media Group generates less than $4 million in annual revenue, it was valued in the billions when it listed on Nasdaq and pivoted into cryptocurrencies earlier this year.In May, the company raised $2.3 billion through a massive debt load and the sale of its overvalued stock, before buying $2 billion in Bitcoin in July.The stock sale diluted Trump’s stake in the company from 52% to 41%.The price of Bitcoin is up about 6% since the Trump Media Group made its big bet.This means Trump owns 41% of an estimated $2.1 billion in Bitcoin reserves,Enough to bring his personal share to about $870 million.

Only a handful of billionaires appear to own more Bitcoins than Trump.If they hadn’t sold off any assets in recent years, the Winklevoss brothers might be worth more than $8 billion.Michael Saylor, who pioneered the Bitcoin reserve strategy, has about $5 billion in assets through holding a 7% stake in Strategy, in addition to about $2.2 billion in private equity.Tim Draper bought at an auction in 2014 Bitcoins that the U.S. government confiscated during its crackdown on the illicit market Silk Road, now worth $3.6 billion.Investor Matthew Roszak may hold more than $1 billion in assets.He is closely followed by Trump, who showed almost no interest in Bitcoin during his first term.

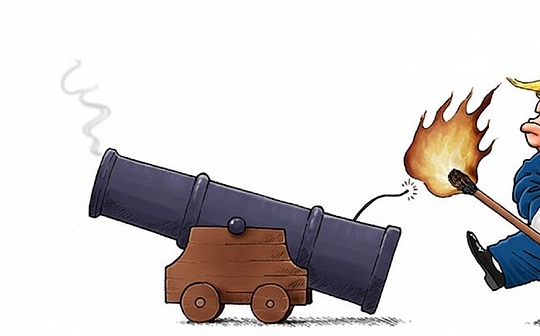

Trump tweeted in 2019: “I am not a fan of Bitcoin and other cryptocurrencies, they are not currencies, have extremely volatile values and have no basis. Unregulated crypto assets can facilitate illegal behavior, including drug trading and other illegal activities.”

Trump’s transformation from cryptocurrency skeptic to Bitcoin bull reflects his business strategy.An opportunist with a knack for marketing, he became involved in cryptocurrencies in the years after he left the White House.At first, Trump easily made millions selling NFT trading cards, including ones featuring himself as a superhero.With the 2024 election approaching, he launched a cryptocurrency project called World Liberty Financial with his three sons.There was little progress on the project until Trump won the election.At that time, the cryptocurrency community, which is highly sensitive to government regulation, rushed to buy World Liberty tokens, which ultimately increased Trump’s net worth by more than $1 billion, according to Forbes estimates.In Washington before the inauguration, the president-elect also launched a Meme coin, TRUMP, adding nearly $1 billion to his wealth.

Trump’s re-election as president boosted asset values across the industry.From Election Day last November to May this year, the price of Bitcoin surged 60%.Trump Media Group Announces Plans to Start Accumulating Bitcoin.The company relied on Bitcoin’s sky-high price to raise funds, selling $1 billion in convertible bonds and $1.4 billion in stock.Trump’s share of the bond, worth about $400 million, is now the largest loan in his portfolio, larger than any of his real estate mortgages.

The White House is unfazed by the moral concerns all this raises.”President Trump and his family have never been involved in, and will not be involved in, any conflict of interest,” press secretary Karoline Leavitt said, before contradicting herself by pointing out some apparent conflicts of interest.“Through executive orders, support of legislation like the GENIUS Act, and other common-sense policies, this administration is delivering on the president’s promise to make America the cryptocurrency capital.”

Investors who have bought the stocks and bonds that fund the Trump Media Group’s Bitcoin hoard are clearly hoping for a “meme stock”-like surge, and it doesn’t seem impossible.After all, Trump Media Group’s stock price soared solely on the back of a money-losing social media app, so maybe their stock price will soar again if it’s tied to one of the hottest assets in the world?Additionally, the bonds are structured to provide investors with some safety net, as if the stock price does not rise, investors will still receive a 4% return after a year and a half.

But the craze tends to fade eventually.Although the Trump Media Group has a stronger balance sheet, now with billions in Bitcoin and $1 billion in debt, its market capitalization is now $1.2 billion lower than it was before the company pivoted to Bitcoin.Putting aside the impact of Bitcoin, investors now believe that Trump Media Group’s original media business is worth only 60% of what they expected in May.

That’s not to say the Trump Media Group is doomed, especially with three years left in Trump’s second presidential term.If Bitcoin prices continue to climb, President Trump’s most loyal followers could begin bidding again, perhaps with the help of White House allies, potentially adding hundreds of millions or even billions of dollars to Trump’s fortune.