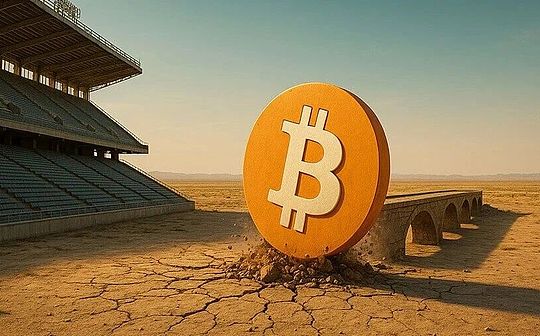

On October 10, 2025, the cryptocurrency market ushered in an epic deleveraging storm.

When fanatical long traders are forced to face the iron laws of the market,Over $20 billion in leveraged positions liquidated in one hour,Bitcoin plummeted 15% in a single day, altcoin liquidity almost dried up, and even experienced players were caught off guard by the bloody market.

This massacre was triggered by multiple negative factors at the macro level: escalating trade tensions triggered panic selling of risk assets.

Bitcoin plunged 13% in one hour, and altcoin slippage was even more severe.Tokens such as ATOM were once close to zero on exchanges that lacked liquidity.Although some losses were subsequently recovered, the market has been hit hard..

The total amount of liquidation on the market-wide centralized and decentralized platforms exceeded US$20 billion, setting a record for the largest single-day liquidation in the history of cryptocurrency.

This is not a mild downturn – weeks of bullish sentiment and high levels of open interest evaporated overnight.US$65 billion in open positions disappeared from the system, and the market pattern returned directly to the level of a few months ago..

On the surface, it looks like a “retail rout”, but the story of “The Wolf of Wall Street”Scott Melkerwith manyAn analyst pointed out the truth: “Those who liquidated their positions were not retail investors, but native crypto traders who used decentralized exchange leverage.,This is a leverage cleanse for the most committed holders.”

Data confirms: Newly entered funds are mainly allocated to spot ETFs or mainstream assets, avoiding the impact of the DeFi leverage mechanism.Those who are really hit hard are high-leverage perpetual contract players, who are mainly crypto veterans rather than newbies.

According to Bitwise FundmanagerJonathanResumption, the root cause lies in the marketThe market structure is defective, and the perpetual contract is a zero-sum game.Systemic risks arise when the solvency of the losing party collapses.

The surge in volatility caused liquidity providers to withdraw, weak altcoin order books caused price collapse, and the automatic lightening mechanism even accidentally damaged profitable positions.

Platforms such as Hyperliquid make reverse profits through on-chain liquidity pools, taking advantage of forced liquidations to acquire assets at a discount.By the end of the day, even market-neutral precision strategies were hit by operational delays and collateral liquidation issues.

Centralized exchanges, especially long-tail tokens, have become the hardest hit, while DeFi has shown resilience with its strict mortgage standards and hard-coded price mechanism.

Protocols such as Aave require high-quality collateral to avoid the death spiral caused by stablecoin price decoupling.But the pain point still exists: USDe fell to $0.65 on some exchanges, and related margin positions evaporated instantly..

The price difference of up to US$300 between exchanges creates opportunities for arbitrageurs, but what is even more alarming is that while US$20 billion has evaporated, spot buying has remained stable.

Prices rebounded from extreme values and excess leverage in the market was forced out.asJonathanWhat he said,The key to survival is not only direction judgment, but also operational capabilities and the art of liquidity management..

Hunter Horsley, CEO of Bitwise, commented: “The largest one-day drop in the history of Bitcoin was only 15%, which demonstrates its inherent strength. This train is unstoppable.”

The increasing correlation between cryptocurrencies and the macro environment means that such deleveraging is both an inevitable market adjustment mechanism and a necessary pain to reshape a healthy ecosystem.

When the cruelty of leverage becomes clear, every participant needs to remember:Risk control is always more important than profit chasing.