Long Yue, Wall Street Insights

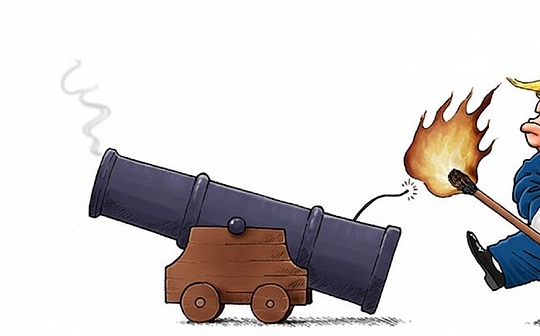

Last Friday, a post on social media by US President Trump about the threat of tariffs was like a bombshell, triggering a brutal “bloodbath” in the cryptocurrency market.

Bitcoin prices fell sharply from a historical high of more than $126,000 on Friday, once falling below the $110,000 mark, with a drop of 13.5% on the day.Ethereum once plummeted by more than 17%, and Ripple and Dogecoin plummeted by more than 30%.

Nearly $800 billion has been wiped out of the total cryptocurrency market value in a matter of hours.According to statistics, the total amount of leveraged position liquidation across the entire network exceeds US$20 billion.Described by the industry as “the largest liquidation event in cryptocurrency history.“

When the market needed liquidity the most, some centralized exchanges (CEX) fell out of business..During the peak liquidation period, exchanges such as Binance experienced system delays and trading interruptions, and a large number of users reported being unable to execute orders or manage positions, leading to increased losses.

Social media was awash with anger towards Binance, accusing it of “pulling the cord” at a critical moment.This incident not only exposed the technical bottlenecks of centralized exchanges under extreme market conditions, but also rekindled the debate on the risk resistance of centralized and decentralized finance (DeFi).

At the same time, some people point out that this plunge is not a simple market behavior, but a “fixed-point attack” that exploits loopholes in the Binance system and is caused by the de-anchoring of specific assets.

A liquidation like “a chain of iron ropes and a boat”

According to analysis from a widely circulated post on Binance Square, the crash did not come without warning, but was brewing slowly in a highly leveraged market environment.

The post points out that, first of all,The market is already a “ticking time bomb”, its characteristics include: traders generally use high leverage to go long, open interest is at dangerously high levels, and a large number of low-quality tokens are listed, causing liquidity to be diluted.

Trump’s tariff threat became the “external spark” that set off all this.Traditional markets reacted first, followed closely by Bitcoin and Ethereum, while already fragile altcoins collapsed instantly.

The second is the “trigger” of the chain reaction.Cryptocurrency markets operate on leverage, and when prices fall below key support levels, automatic liquidation mechanisms on exchanges kick in.This was not an emotional sell-off, but an automated process that the exchange executed to protect its own loans.

The post describes the specific details of the chain reaction of liquidation:

-

The first thing to bear the brunt is that accounts that used cross margin were forced to liquidate their entire positions due to the decline in the prices of some assets, and their collateral was forced to be sold by the system;

-

Then, the forced selling of collateral further depresses prices, creating a waterfall effect of “one liquidation triggering another liquidation.”

Data shows that in just a few minutes, more than $550 million in futures positions disappeared, ultimately leading to a liquidation tragedy totaling more than $20 billion.

Downtime crisis: Centralized exchanges encounter a crisis of trust

When the market needs liquidity and stability the most, the performance of some cryptocurrency centralized exchanges (CEX) is unsatisfactory.

According to Cryptopolitan, many centralized exchanges encountered severe system congestion during liquidation, resulting in application freezes, order book lags, and some users even being locked out of their accounts and unable to perform any operations during violent market fluctuations.

In addition to Binance, platforms such as Coinbase and Robinhood have also reported similar issues.

In sharp contrast, the decentralized finance (DeFi) platform passed this stress test smoothly.Decentralized exchanges (DEX) such as Uniswap and Aave reportedly did not experience any technical issues or service interruptions amid the market turmoil.

Among them, the Aave platform perfectly handled the liquidation of US$180 million without human intervention; while Uniswap handled nearly US$9 billion in transaction volume.This performance difference has once again put the industry’s trust in centralized platforms to the test.

“Fixed-point attack” or system defect?The world’s third-largest stablecoin is seriously unanchored

As more details emerge, a theory that the crash was a “targeted attack” against Binance is starting to gain traction.

Forgiven, an executive of Conflux Networks, posted on the social platform,This incident may be a coordinated attack on Binance’s Unified Margin system.This system allows traders to use a mix of assets as margin.

However, this flexibility becomes a risk transmission channel when the market fluctuates violently.As the assets USDe, BNSOL and WBETH used as margins become unanchored, the value of the collateral collapses, triggering large-scale forced liquidations.

Forgiven pointed out,Attackers may have taken advantage of this and concentrated on suppressing the prices of specific assets such as USDe, BNSOL and WBETH on Binance, causing them to become severely destabilized..Data shows that the price of USDe, the world’s third largest stablecoin, once fell to $0.65 on Binance, while the price on other platforms during the same period was still $0.90.

Forgiven believes that the extreme declines in multiple alternative tokens only on Binance are signs of a breakdown in the hedging portfolios of major market makers.

Binance becomes the target of public criticism

Regardless of the reasons behind it, as the world’s largest exchange, Binance has become the focus of user criticism in this crisis.

A large number of users claimed to have encountered problems such as account freezes and stop-loss orders invalidation during the market crash..What’s more serious is that tokens such as Enjin (ENJ) and Cosmos (ATOM) experienced “flash crashes” on Binance, with prices instantly returning to zero and then rebounding quickly.This sparked accusations of market manipulation from users, who argued that the platform was profiting from the chaos.

In response, Binance admitted that “violent market activity” caused system delays and display issues, and assured users that “funds are safe (SAFU).”Currently, Binance says its system is back online.

However, this did not quell the anger of the community.Critics have called for regulators to investigate, and this is not the first time Binance has faced charges over similar incidents.

Ultimately, the leverage-driven crash, while brutal, cleared the market of excess risk.As has happened many times throughout history, the deleveraging process is part of the market cycle and will continue in the future.

But this time, the risk control issues of centralized exchanges and decentralized exchanges will continue to become the focus.