Plasma invested by Framework Ventures has made everyone make a lot of money, and it has further verified @221ALABS’s idea of ”making big profits from stable coins”.This article will introduce USDai, another stablecoin project invested by Framework. This project was also born with a golden key. It is expected to be TGE next year. Get on board first, and then study, LFG!

Resource background inventory

The currently disclosed financing amount is 17M. The top investment institution is Framework Ventures, which led the 13M Series A round. Note that it is the A round. Generally speaking, after the A round in the currency circle, it is the best time to raise money, because the currency is about to be issued.The representative investment works of Framework Ventures include @Uniswap, @chainlink, and @aave. Did you see that this is a very stable and ruthless veteran in DeFi?Participating institutions include @dragonfly_xyz and @arbitrum.It’s not over yet. On August 26, we received another investment from @yzilabs, but the amount was not disclosed.On September 22, it received another 4M strategic investment from Bulish, an institutional-level exchange listed on the New York Stock Exchange.

After taking stock, I also found out why his YT can be purchased at Plasma and Arbitrum. One is the project of the son of the sponsor’s father, and the other is a strategic partner.

How can I put it, the background is very powerful.It is not an exaggeration to say that I was born with a golden key in my mouth.

Digging deeper into the reasons for popularity

So, we can’t help but ask why USDai is so favored and involves so many powerful stakeholders. Let’s analyze it from the perspectives of people and events:

1. Founding team inventory

The three founders of @USDai_Official, David Choi, Conor Moore, and Ivan Sergeev, co-founded @MetaStreet in 2021, a DeFi protocol focused on NFT lending.

@MetaStreet completed a $14 million seed round of financing led by @dragonfly_xyz on February 8, 2022, and received another $10 million in financing on October 13, 2022. Investors include DCG, OpenSea Ventures and many other well-known institutions.Therefore, @dragonfly_xyz and DCG have become continuing investors of USDai.It’s not an exaggeration to expand @yzilabs through these two awesome VCs.This means that this team is a team that has been successful before, a team that has achieved great results, and a team with deep industry resources.

2. Project business logic inventory

As a stablecoin project, there are two core points: enough reserves to deal with acceptance risks, and enough income to expand the market.

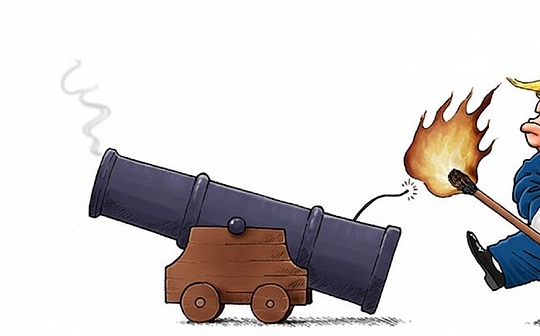

USDai’s strategies are different from those of other stablecoins on the market. 38% of its funds were used to buy U.S. Treasury bonds as a safe return.He lends the remaining 62% to companies with GPUs to earn interest.

Because the next step is the era of AI. The fuel of AI is computing power, and the backbone of computing power is GPU. Therefore, there is always a market demand for computing power that can be monetized.These companies with a lot of computing power equipment mortgage their equipment to USDai and lend money to expand reproduction.USDai has agreed with these AI companies to use GPU leasing and inference push to repay interest and principal, thus achieving an annualized return of 15-25%.

It’s really impressive. No wonder this project is called USDai.

Of course, mortgaged GPUs are over-collateralized and can be sold if something goes wrong.It then performs valuation and discount management of the GPU through the CALIBER system.I won’t go into details. In short, there is a systematic GPU price tracking and liquidation system that does not rely on on-chain oracles to achieve liquidation.

Of course, to be honest, the maneuverable space in the middle may not be so transparent. We don’t understand it and don’t dare to talk nonsense.

Perhaps USDai itself knows that compared to pure on-chain DeFi, its liquidation mechanism will face acceptance pressure, so it directly designed the QEV queue mechanism.To put it simply, you cannot withdraw money directly, there is a queuing mechanism.

Therefore, USDai will definitely be packaged with another layer, with higher market makers providing liquidity.

Taken together, it is actually a good project. After all, AI itself still has a long growth trend to go, and the team is not bad. How to make money by participating in this project will be explained in detail in our subsequent articles.