Author: Haotian; Source: X,@tmel0211

Finally, a project has been launched!

Zerebro Lianchuang @omedia_jyu’s real name revealed some disputes with exchange listings and market makers: @binance wants 1 million US dollars in cash; @krakenfx wants 100,000-200,000 US dollars plus tokens; @Bybit_Official wants 250,000 US dollars plus tokens; @wintermute_t directly asked for 10% of the supply.

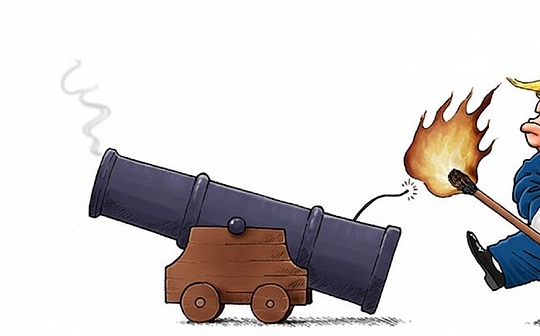

These numbers are unusual and look to me like a bombshell dropped into the crypto industry,The truth behind the so-called “listing of coins is the peak” in the currency circle is bloodyly revealed.

Of course, Zerebro itself is not a white lotus project. Jeffy had a farce of “suspended death”. To be honest, my $ZEREBRO was also cut off by 20,000 U.

However, this time he stood up and spoke out, I still think he should support him:

Because he tore open the window paper that the three parties of VC projects, exchanges, and market makers had long “tacitly understood”.

Why is it breaking out now?Everyone is familiar with this set of exchange listing rules and some market makers’ operating routines, and they have evolved in various “forms”.Why, exactly now?

Because the thunder of 1011 Black Swan can be called the “subprime mortgage crisis” in the crypto circle dominated by exchanges, and the currency price that once returned to zero also revealed a cruel fact, the liquidity of many altcoins has long been exhausted..

So, essentially this is the critical point where the VC coin era is dead, and the collapse of some altcoin projects.

In addition, this time the exchange got out of hand and suffered the emotional backlash after the climax of life, giving a group of VC coin project parties the opportunity to rise up and cry out.

In fact, it’s no wonder that when VC coins are often valued in billions, but there is no corresponding liquidity and user acceptance, every link in the interest chain of project parties, exchanges, and market makers is squeezing each other.

The exchange must maintain its proud image as the “Chosen One”, market makers must obtain excess profits, and VCs must exit and realize cash. In the end, all costs are passed on to retail investors..

As an intermediate link, the project party must not only bear the pressure of VC (high valuation, rapid listing), but also have to pay the sky-high fees of exchanges and market makers, and also face the doubts of retail investors and the plummeting currency price after the launch.

Squeezed by this multi-party conflict, some people finally couldn’t stand it anymore.

So, what is the underlying problem?

In fact, it is very simple. It is not a question of whether the listing fee is expensive. If the market is healthy, VC coins can also be afforded. It is not just the high FDV crash that hurts the hearts of retail investors. Retail investors have been seeking survival in the huge “token dumping” for several cycles.

The key is that the entire industry’s pricing mechanism and value discovery function have failed..

When listing is no longer based on project quality, user needs, and technological innovation, but on “how much money is given” and “how many coins are locked,” the entire market becomes a pure capital game.

What’s more, the exchange platform has long been unwilling to “strictly select projects”, but has set up its own platform and built projects in batches.Well, the exchange’s heart OS,Since VC coins use exchanges as their exit channel, why don’t we simply turn the tables and stop playing with VC coins?

I think this is the truth behind the conflict between exchanges and VC coins.

Pessimistically, I don’t think this revelation can change anything?Because in the eyes of many people, it is just a sad drama about dog eating dog, and there will be no immediate changes.

But but but!At least the silence has been broken, and I believe that more and more project parties on the righteous side will realize that theyMaybe we can stand up and give a shout to this “dirty game” and “twisted rights rules”!