Author: Zhang Feng

U.S. Senate DemocratsThe proposal, titled “Preventing Illegal Financing and Regulatory Arbitrage through Decentralized Financial Platforms,” unexpectedly triggered a crisis over the bipartisan Cryptocurrency Market Structure Act.

Coinbase CEO Brian Armstrong’s outspoken statement on social media

1. The proposal treats DeFi front-end as an intermediary

The controversial document was submitted by Democrats on the Senate Banking Committee to Republicans on the committee and targets regulation in the DeFi field.The core content of the proposal isCompanies or individuals handling client needs on the front end of DeFi operations are advised to contactU.S. Securities and Exchange Commission(SEC) or the Commodity Futures Trading Commission (CFTC) and are regulated as a broker.

More critically, the proposal adopts an extremely broad definition of who would be considered an intermediary for regulation.According to the proposal, any individual or entity that “designs, deploys, controls, or operates front-end services for DeFi protocols” or “obtains substantial benefits from promoting decentralized financial protocols” will be considered an intermediary.Variant Chief Legal Officer Jake Chervinsky pointedly pointed out that this definition language seems to include“Everyone in Crypto”.

The proposal also plans to give the Treasury Department and other financial regulators the power to define when an entity or individual “exercises control or sufficient influence.” The Treasury Department would also be responsible for determining whether a “protocol is sufficiently decentralized.”

2. The industry is worried that the proposal will stifle innovation and freedom

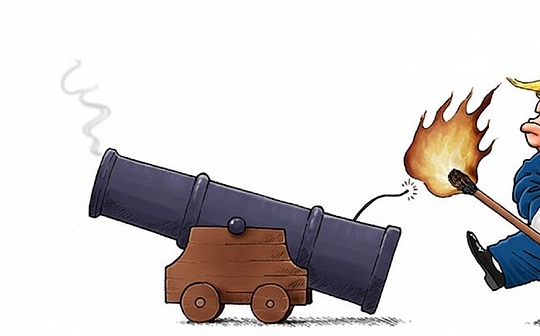

The fundamental reason for Armstrong’s objection was that he believed that this proposal “Will hinder innovation and prevent the United States from becoming the crypto capital of the world“. As the largest cryptocurrency exchange in the United States, Coinbase naturally wants to see the United States maintain its leadership in the crypto field. He warned that the crypto industry “absolutely will not accept” the Senate Democrats’ DeFi regulatory proposals. This tough stance reflects the industry’s deep concerns about the negative impact that the proposals may bring.

Chervinsky pointed out more fundamental problems in the proposal: “It would make everyone in the encryption field an intermediary, force front-end providers to apply know-your-customer (KYC) rules to users, and give institutions ‘unlimited power to selectively regulate.'” More importantly, the proposal grants the Treasury Department excessive discretion.Chervinsky explained: “It allows the Treasury Department to regulate anyone with ‘sufficient influence’ on a DeFi protocol, while also allowing the Treasury Department to define ‘sufficient influence’ as it pleases. It creates a ‘restricted list’ of protocols and front-ends that the Treasury Department deems too dangerous, and then makes it a crime for anyone to use them.”

Summer Mersinger, CEO of the Blockchain Association and former CFTC commissioner, criticized from a compliance perspective, pointing out that the proposal “would effectively ban decentralized finance, wallet development and other applications in the United States.”Merzinger further emphasized: “As written in the existing language, it is impossible to comply and will push responsible development overseas. We urge our policymakers to continue to participate in the discussion.”

Even Democrats appear divided over the proposal.Anonymous sources told prominent crypto journalist Eleanor Terret that the leaked proposal was “intended as a starting point for discussion, not a final position,” with Democrats apparently unhappy that the documents were made public.Jacques Petit, communications director for Senator Ruben Gallego, likened it: “They are asking for a marking date before the text is agreed upon, like setting a wedding date before a first date. It’s ridiculous.”

3. The game between the two parties and the future direction of proposals

The legislation relies on bipartisan support in the Senate to meet the usual 60-vote requirement.While the encryption effort has a long list of Democratic allies, they have made clear they are seeking a series of changes to previous Republican draft legislation before joining.

Republicans reacted strongly to the proposal.Jeff Naft, Republican communications director for the Senate Banking Committee, said: “What was sent to Republicans was not a legislative proposal; it was not written as a legislative text, contained multiple incoherent policy ideas, and was not a sincere effort to build market structure.” Of course, according to anonymous sources, the leaked proposal is“As a starting point for discussion, not a final position”, Democrats were unhappy that the documents were made public.

The U.S. Senate has been moving forward with its own legislation, while the House of Representatives passed its version of the Cryptocurrency Market Structure Act this summer.The Senate Banking Committee’s draft seeks to divide jurisdiction between the SEC and the CFTC and create a new term for “ancillary assets” to clarify which cryptocurrencies are not securities.

Looking at the broader regulatory landscape, the U.S. Securities and Exchange Commission (SEC) is also preparing to introduce something called“Innovation Exemption”’s new rulemaking, which could significantly reduce the regulatory burden on crypto projects and digital asset developers.This exemption will provide tailored regulatory relief to startups and companies working on cutting-edge digital technologies, including blockchain protocols, DeFi, tokenized assets and other forms of digital innovation.

SEC Chairman Paul Atkins announced a timeline for the initiative, with plans to start the process in late 2025 or early 2026.When building a reasonable DeFi regulatory framework, policymakers need to take into account the technical characteristics of decentralized finance and find a balance between preventing illegal activities and promoting innovation.Liability immunity to protect software developers, and at the same time regulating participants with actual control, may be a more feasible direction.

A more balanced and informed approach is needed to drive DeFi regulation forward.The legislative process itself is an art of compromise, requiring the participation and consensus building of various stakeholders.Armstrong affirmed that legislation is a process and pledged to continue fighting for the rights of investors and developers and “protecting economic freedom.”He added that Coinbase leadership is “committed to engaging and helping Congress do the right thing.”

4. Improvement paths for future DeFi supervision

It is generally believed that building an effective DeFi regulatory system requires taking into account both risk prevention and industry innovation, and should follow the following core paths:

First, establish a regulatory principle that focuses on activities rather than entities.Abandon the attempt to forcibly incorporate decentralized protocols into the framework of traditional intermediaries, and instead apply corresponding rules based on the functional essence of specific financial activities (such as lending and trading) to achieve precise supervision.

Second, implement risk classification and regulatory sandbox mechanisms.Risk stratification is carried out based on the degree of decentralization of the protocol, user scale and system importance, and loose supervision is adopted for low-risk protocols.At the same time, a regulatory sandbox will be set up to provide a safe testing space for innovative projects.

Third, establish a new regulatory paradigm empowered by technology.Promote the application of regulatory technology (RegTech), use blockchain analysis tools to monitor on-chain activities in real time, incorporate code audits and smart contract security standards into the regulatory framework, and achieve automated compliance verification.

The ultimate goal is to build a multi-party governance ecosystem, through clear developer liability exemptions, industry self-regulatory standards and international regulatory collaboration, while maintaining financial stability while retaining the necessary space for innovation.

The outcome of this debate will determine the future of innovation in the United States: whether it becomes the “crypto ban” that Chervinsky warned of, or whether it becomes the fuel that Armstrong called for making the United States the “crypto capital of the world.”In the coming weeks, all eyes will be on the Senate Banking Committee to see whether they can make sense of this chaos or whether it will set the United States further behind in the global race to regulate cryptocurrency.