Written by: 0xjs@bitchainvision

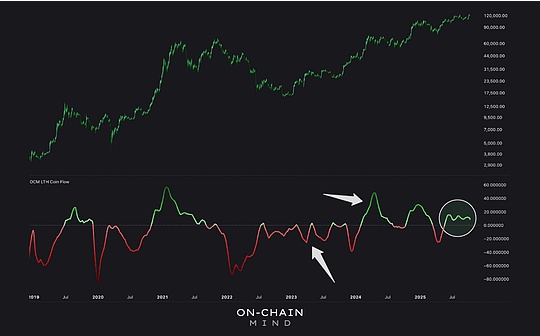

The crypto market flash crash on October 11 is still brewing.

What exactly triggered the crash?Who is short selling?These are all issues of concern to the crypto community.

Especially those short-selling giants who have made huge profits are even more dazzling in the wailing of the crypto market.

Trump insider?

For example, crypto analyst MLM’s “conspiracy theory” statement was particularly popular, with 3.4 million views.He wrote:

The BTC whale closed 90% of his BTC short positions on Hyperliquid and all his ETH short positions, making a profit of approximately US$190 million to US$200 million in just one day.What’s even crazier is that just minutes before the crash, he shorted 9 figures worth of BTC and ETH.And this is public shorting on Hyperliquid, imagine what he did on a centralized exchange (CEX) or elsewhere.I’m sure this man played a big role in what happened today.

The so-called “$190 million profit in 30 minutes” has been widely circulated, especially shorting in the minutes before the plunge (that is, before Trump’s tweet).Therefore, many people pointed this whale to people related to Trump’s insider group.

Many American users responded to this post using Trump’s youngest son, Barron.:

butHyperscan data shows that the so-called profit of US$190 million was not the result of short selling on October 11.

On October 11, this mysterious whale made profits of US$88 million and US$72 million respectively by shorting BTC and ETH.This giant whale made nearly $350 million in profit by going long ETH as early as August 25.

That’s where the $190 million comes in.

Detailed data at:

https://hyperbot.network/trader/0x2ea18c23f72a4b6172c55b411823cdc5335923f4

https://hyperbot.network/trader/0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae

Therefore, the evidence that this mysterious whale comes from the Trump Organization is not conclusive, but the possibility of the Trump Organization cannot be completely ruled out.

Is there anyone else in the mysterious whale?Who is Garrett Jin

Eyeonchains, a detective on the chain, later posted that he had tracked the giant whale and connected it with Garrett Jin.Let’s see his reasoning.

1. Investigate the identity of the mysterious Hyperliquid/Hyperunit whale, which holds more than 100,000 BTC.Recently, he dumped over $4.23 billion in BTC to buy ETH, and he was the man behind a $735 million BTC short order on the same platform.

2. During August and September, he sold more than 35,000 BTC in exchange for ETH using the SPOT and PERP platforms through Hyperliquid/Hyperunit and using a series of BTC wallets.169qYZJYkyW7HhmWTj58mVXRZDhMFHPZPd

17MWdxfjPYP2PYhdy885QtihfbW181r1rn

12XqeqZRVkBDgmPLVY4ZC6Y4ruUUEug8Fx

1E2JG2cZNkVdpdHQJ54MrpgoD28HHnZRpQ

19D5J8c59P2bAkWKvxSYw8scD3KUNWoZ1C

1NtXY85WnT4RLcsJU6a6dF5VRLos1XiWsi

https://intel.arkm.com/tracer/7ab8c884-b39b-47da-91a8-21e068722794

3. The following ETH address received more than 570,000 ETH, which were all subsequently deposited into the same Beacon deposit contract for locking.

0xE6D23a0504C51C495a24cA6874E838AFaf6C0ed0

0x308358d56A7319633dCDb4EACda485C3E0672311

0xF6FD12fbf8bBe0e08Ac739c3634CD1cB21acf5E9

0xe8337B3Fed1101924E9A9F89eD48A0D1C5B8Ec3F

0xF744f66621Df59861fe621444E473b595bb83Ad4

0x4116812b89749563d40B0ffC187Db7ce668711Cb

0x4515d87323f54b36949a478Ed64533779C228e23

https://intel.arkm.com/tracer/ad65f6e6-3775-4ee8-bb03-dd706c21a94a

4. The ETH pledge contract (0x2F44F404d835c3820059d216B957284a064E024b) is deployed by the address 0xBFBaEc1d047E19437a098Ab69EEA1388DBb0c14B in this transaction

https://etherscan.io/tx/0xc3356063c37c1e36ac8f6da3dee91272e0fd0cbb2e7eb964870fc1c5e4349f0f,

Funds come from wallet 0x1CB7B54AAB4283782b8aF70d07F88AD795c952E9.The wallet has received its first funds from ereignis.eth on BSC.After the staking contract was deployed, the first wallet it interacted with was ereignis.eth, which deposited 32 ETH.

5. AnalysisThe giant whale address that opened a short position of 735 million US dollars in BTC (0xb317D2BC2D3d2Df5Fa441B5bAE0AB9d8b07283ae), and found that it received a handling fee from wallet 0x52d361A5f9eB03868a4CBF0e6c6Db8EDAb6163E1.

Shortly before sending these fees, wallet 0x52d3 deposited $4.1 million in USDC to this Binance deposit account (0xD5D7072A18c4367e5Bc9c14B10FCA81b95571730).

Shortly before that, the same Binance deposit received $7.54 million from wallet 0x95368460c2ca94757BE67e76b50Df6cb55815215.

It’s worth noting that wallet 0x9536… sent $40,000 worth of USDT to ereignis.eth two weeks before the short selling began.

6. Investigation of the ereignis.eth address revealed that it has a second ENS name garrettjin.eth, which points to X user @GarrettBullish.

7. Garrett Jin graduated from Boston University with a major in economics in 2008. His career began as an internship at China Construction Bank and worked there until 2011.

In 2012, he founded his first company, Da Yo Trading (HK), which he operated until 2014.

He then jumped ship again into the cryptocurrency space, serving as director of operations at Huobi (HTX) until 2015.

He then moved to Frankfurt and co-founded the medical platform FuLang Medical Germany GmbH, which he left in 2017.

8. From 2017 to 2020, he served as CEO of BitForex, an exchange that was involved in a scandal for allegedly falsifying trading volumes.In 2023, the company was flagged by Japan’s Financial Services Agency (FSA) for operating without registration.In February 2024, the private keys of its hot wallet were leaked and approximately $57 million was withdrawn without any clear explanation.Shortly thereafter, the website became inaccessible, withdrawals were frozen, and all operations ceased.

In July 2024, BitForex announced that its team had been detained by the Jiangsu Province police in China and placed under investigation.They promised to reopen KYC-based withdrawal services but suspended trading and deposits to allow for “thorough rectification” before closing.

Hong Kong’s Securities and Futures Commission issues warning over suspected fraud.Subsequently, the company was constantly accused of withholding funds and misappropriating funds, and many users lost assets in this unregulated chaos because the problem was not fully resolved.

9. During the devastating collapse of BitForex, Garrett founded WaveLabs VC in 2020 (operating until 2023) and launched the following projects:

TanglePay (2021), IOTABee (2022), and GroupFi (2023).TanglePay is an IOTA-enabled mobile/Chrome wallet that supports tokens, staking, DeFi, and NFTs that has evolved into a Web3 “talking wallet”; its X account has been inactive since 2024.IotaBee was a cross-chain exchange DEX on IOTA/Shimmer that was eventually shut down in 2024.GroupFi, a free Web3 messaging protocol for gated/cross-dApp chat, is still running and has raised seed funding.

10. The ENS name ereignis.eth (meaning “event” in German) confirms his association with the wallet, thereby indicating that he is behind the large-scale Hyperliquid/Hyperunit operation.Oddly, following him on X is Hyperunit founder @sershokunin.

Hyperliquid/Hyperunit whale funds come from these two addresses:

1KYUyiWdVmj7zZnFrJq3Ug5KRUGQRrp3rd

1KAt6STtisWMMVo5XGdos9P7DBNNsFfjx7.

These BTC were withdrawn 7-8 years ago, mainly from HTX, OKX, ViaBTC, Bixin and Binance, a suspicious pattern related to his past with Huobi Global and the disappeared funds from the Bitforex scam.His Bitforex address is linked to the whale’s address 1BerWiJ9eNLg6XvFxzeTrWjjKYiFQXLrRq.

11. Garrett is also the founder of XHash (since 2024), a non-custodial ETH staking institutional platform.All staked ETH could have been used to funnel questionable funds into the company, continuing a trajectory of cryptocurrency controversies that cast doubt on its integrity.Clearly, he has not learned from his past fraud.Oddly, after @emmettgallic made a post, Garrett removed XHash from his X profile bio and changed his avatar.On Telegram, however, he still has XHash in his profile and uses the same profile picture (PFP) as before on X.

12. Currently, Garrett still holds 46,295 BTC (currently worth $5.19 billion) at the following address:

1C9dhpbtosmxW4L2ctTpPLdKwE2iaEHj7B

bc1qh3g2qyq2akw7ep03nsnmfyy8sgxs92q7jfc2jf

12XqeqZRVkBDgmPLVY4ZC6Y4ruUUEug8Fx

1DjmZD4ph1AQP1PhUGYtrd1G6HjwHFKpa6

1CKJYQPP9xhqjMMYAnzNux3h5wC2vb6Y5M

The identity of the mysterious giant whale remains a mystery

Of course Eyeonchains is just one company’s opinion.

Another well-known on-chain sleuth disagrees with Eyeonchains.

He stated that this was not new information as emmettgallic had disclosed the Hyperliquid whale transfer to Garrett Jin two days ago.The only direct connection is a transfer of 40,000 USDT. The rest of the Eyeonchains article is unconfirmed speculation.Seems more likely to be Jin’s friend.

And replied directly to Eyeonchains:

You explicitly stated in your post that the Bitcoin whale was Garrett Jin and now responded to me saying “These are definitely BTC from multiple entities”.

At present, it seems that the identity of the mysterious short-selling whale during the flash crash in the early morning of October 11 may need to continue to be investigated.

Although the market does not prohibit short selling, and short selling is neutral and guilt-free, it is still important to know his identity.

Because only by knowing his identity can we know whether this giant whale is an insider trader or a trading genius.

The former is important to the crypto market.