Source: The Kobeissi Letter; Compiled by: Bitchain Vision

The cryptocurrency market experienced the largest liquidation event in history on October 11, with 1.6 million traders liquidated.Over $19 billion in leveraged cryptocurrency positions were liquidated in 24 hours, nine times the previous record.

Why does this happen?Let us explain.

To put this in perspective: the liquidations we saw in the past 24 hours were approximately $17 billion larger than the February 2025 crash and more than 19 times larger than the March 2020 FTX crash.History has never seen an event of this magnitude.

During the liquidation period,The amplitude of Bitcoin’s daily K-line chart reached $20,000.This means that Bitcoin’s market value fluctuated by $380 billion in one day.This exceeds the combined market capitalization of all but 25 listed companies in the world.This has never happened in history.

But why does this happen?

timeline

For better understanding, take a look at the timeline below:

Cryptocurrency selling began at 9:50 a.m. ET, ahead of Trump’s tariff announcement at 10:57 a.m. ET.

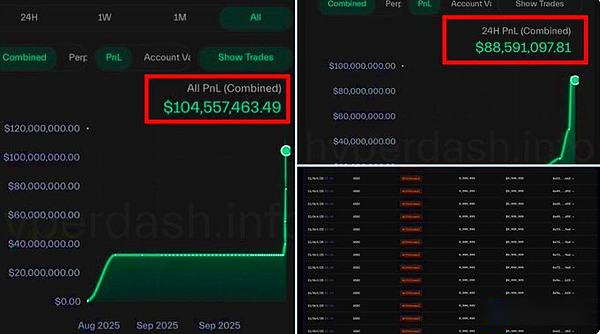

At 4:30 PM ET, a large “whale” began shorting the cryptocurrency.

At 4:50 p.m. ET, Trump announced 100% tariffs on Chinese goods.

The first question is,How did this “giant whale” seize the opportunity of the decline so accurately?

As of 5:20 p.m. Eastern Time, 30 minutes after Trump announced the additional tariffs, the amount cleared was as high as $19.5 billion.After the plunge, short positions were quickly closed, making a profit of $192 million.

However, there’s more to it than that.

The main reason for the great liquidation appears to be a combination of excessive leverage and high risk

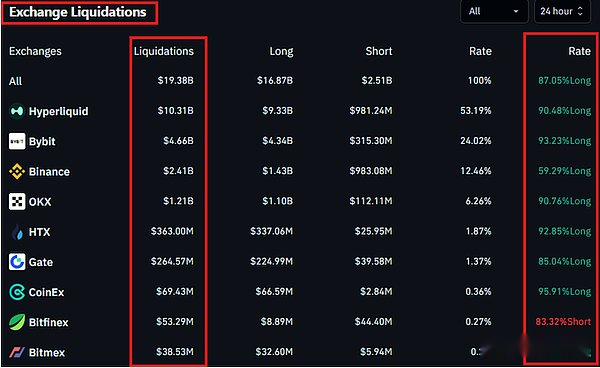

If you look at the breakdown of liquidations, the long positions are heavily skewed.Long positions were liquidated at $16.7 billion, while short positions were liquidated at about $2.5 billion.The ratio between the two is 6.7:1.

More evidence of excessive long leverage in the market: All major exchanges except Bitfinex have a fairly high percentage of long liquidations.Long positions exceed 90% on most exchanges, of which Hyperliquid alone is worth $10.3 billion.The same goes for Hyperliquid used by “Whale”.

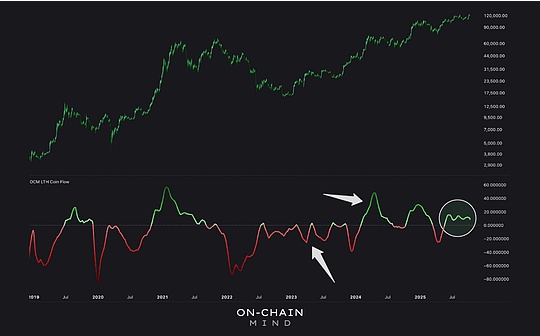

The next factor is the “shock effect”.The market has become overcrowded in favor of the longs after a historic run since the April 2025 lows.As shown in the chart below, the Greed Index exceeded 60 in the days leading up to the crash.

The sudden shock of the tariff announcement caused a dramatic shift in market sentiment.

Liquidity is the next issue:

Trump’s statement came 50 minutes after U.S. stocks closed on Friday.

As we often see,Cryptocurrency markets typically see large swings on Friday night and Sunday night.Why?Because of lack of liquidity.

There was a sudden surge in trading volume after Trump’s announcement, triggering a domino effect.

What happens next?

We think,The plunge was the result of a combination of sudden technical factors.It will have no impact on long-term fundamentals.

A technical correction is long overdue, we believe a trade deal will eventually be reached and the cryptocurrency market remains strong.We are optimistic.

This week’s rebound in volatility represents an opportunity for investors.The macroeconomics are changing, and stocks, commodities, bonds and cryptocurrencies all have investment value.

Yesterday’s plunge was a reminder of just how fragile, yet so profitable, the market has become today.

Between 9:30 a.m. and 5:20 p.m. ET, $800 billion was wiped off cryptocurrency market capitalization.Stay objective and take advantage of fluctuations.