Author: On-Chain Mind, Compiled by: Shaw Bitcoin Vision

Behind the market fluctuations, there is a group of investors who have been manipulating the situation behind the scenes since the birth of Bitcoin——long term holders.Their wallets barely move, their Bitcoins have lain dormant for years, and they control when Bitcoin supply tightens or floods the market.

Understanding what they are doing is not only interesting, but is arguably the most reliable way to predict Bitcoin’s next big move.

In this article, we’ll analyze the role of long-term holders, explore key on-chain indicators that reveal their influence, and highlight why tracking their movements may be the most reliable signals in today’s markets.

Key points overview

-

supply-led: Long-term holders control approximately 75% of Bitcoin, making them the market’s true liquidity anchor.

-

On-chain signals: Long Term Holder (LTH) indicators such as 30-day Net Position Change, HODL Momentum, and Liquidity reveal clear cycles of accumulation and distribution.

-

market stage: Current data points to orderly profit-taking rather than a speculative frenzy – meaning the market is consolidating rather than peaking.

-

Strategy adjustment: Aligning your strategy with long-term holding behavior can improve risk-adjusted entry points, especially for DCA-based strategies.

most dominant player

In the Bitcoin ecosystem, long-term holders (LTH) are the guardians of Bitcoin’s stability.in existingOf the nearly 20 million Bitcoins, about 15 millionStored in a wallet that has not been touched for more than 155 days.This threshold is not set arbitrarily – it is based on statistical analysis showing that Bitcoins that have been dormant during this time are much less likely to be used or traded in the near future.

The remaining 5 million coinsIn the hands of short-term holders.These players are quick to respond, sensitive to price fluctuations, and more likely to sell during market volatility.In contrast, long-term holders act as anchors for the market: their decisions influence the availability of supply, create price floors, and indirectly guide market sentiment.

Long-term holders (LTH) are often referred to as “smart money,” and there’s a reason for that.Historically, they:

-

Actively accumulate during bear markets to absorb excess supply.

-

Diversify your holdings during the peak of a bull market, effectively defining the top of the cycle.

-

Operate against the crowd, making their behavior a reliable contrarian indicator.

A look back at past cycles makes this clear.During its peak in 2017, LTH distribution pushed the market toShort-term holders and long-term holders account for 50% eachsituation.In 2021, a similar but slightly smaller pattern emerged:Supply drops to 61% for long-term holders as new participants absorb redistributed coins.

In the current cycle, two major distribution events have occurred: the first was inDuring the rally when the ETF’s price approached $70,000 after its listing, the second time was inPrice initially surged to around $100,000.Each event saw more than 1 million Bitcoins transferred from long-term holders to short-term participants –These large rotations temporarily increase market liquidity.

However, given that long-term holders still control 75% of the supply, we are still far from the supply and demand balance seen at the previous top.This indicates that this cycle may still have room to continue – prices need to rise further to prompt this group to release more chips.

Measuring long-term holder behavior

Understanding the activity of long-term holders requires a variety of indicators, each providing a different perspective on the dynamics of accumulation and distribution.

1. LTH 30-day net position changes

This metric summarizes the daily changes in long-term holder balances over a rolling 30-day period:

-

Positive values indicate net accumulation, indicating that long-term holders are absorbing supply.

-

Negative values indicate net distribution, i.e. Bitcoins are being put into circulation.

Historically, this indicator has been closely tied to market cycles.During a frenetic rally, long-term holders (LTH) sell off at an accelerated pace – previously achieved at major peaks25,000 Bitcoins per day.Currently, the selling rate is approximately6,000 Bitcoins per day.This measured sell-off reflects modest profit-taking rather than full-scale mania, which explains why price action appears “subdued” despite the influx of institutional money from ETF and Treasury buyers.

It’s important to note that not all allocations represent outright exits.Some long-term holders may move their Bitcoin holdings from self-custody into institutional vehicles like exchange-traded funds (ETFs) to increase security, convenience, or achieve tax efficiency.Even small lifestyle-related withdrawals—the “life chip” effect—could put Bitcoin back into circulation.

2. HODL Momentum

HODL momentum measures short-term holder activity relative to long-term stability, effectively tracking how quickly Bitcoin re-enters circulation.

-

Historically,Readings above 80Marks local and global peaks.

-

Currently, HODL momentumabout 68, which is at a high level but has not yet reached extreme levels.

The current structure of the swing suggests that the market is in transition: either cooling off after a round of allocations, or gathering momentum to move higher again.Crucially, this indicator can signal speculative fever well in advance of price extremes, providing a strategic advantage when timing accumulation or reducing risk exposure.

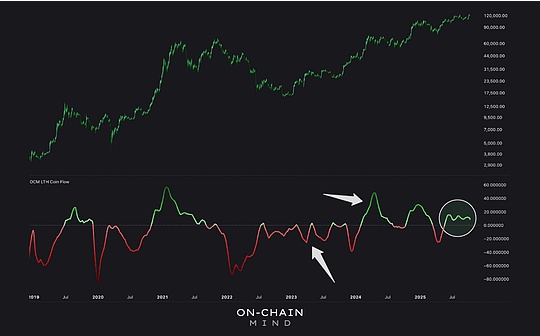

3. LTH traffic indicators

This is one of the most useful tools for continuous momentum analysis.The LTH flow indicator tracks changes in the proportion of Bitcoin that has been dormant for more than a year, effectively measuring absorption or selling by long-term players.

-

Positive (green) readings indicate net distribution—Bitcoin’s return to liquid markets.

-

Negative (red) readings indicate net accumulation—long-term holders absorbing supply.

Smoothed with a 50-day moving average and converted into an oscillator, this indicator is a momentum-based accumulation/distribution tool that fits well with traditional volume analysis.It is particularly useful for fixed-term investment (DCA) strategies:

-

The red area indicates that DCA allocation should be increased and bought in sync with the accumulation of long-term holders.

-

The green area indicates the need to be cautious or reduce allocations, as allocations at this time may indicate the arrival of a short-term top.

I like to use this method to adjust investments on the fly.Increase allocations during accumulation periods (dark red zone) and reduce or pause investments during distribution periods (green zone) to improve risk-adjusted entry strategies.

Currently, the indicator is pointing to slight net allocations – modest profit taking rather than a market top, which supports a patient, cautious approach rather than aggressive accumulation.

Look at the data

Taken together, these indicators reveal a nuanced picture of Bitcoin’s current cycle:

-

The 30-day net position changes show a stable but controllable distribution.

-

HODL momentum has increased, but not yet to feverish extreme levels.

-

LTH flows indicate lighter selling rather than aggressive selling.

This suggests that the market is neither partially undervalued nor overheated – it is in a transitional phase where long-term holders are quietly adjusting, allowing tensions to build but not yet to trigger panic.

In my view, the current 75% long-term holder supply level does not mean the market has reached a cycle top.There’s still room to fall in long-term holder dominance, suggesting further gains are still possible before the kind of massive sell-off that marked the top of the frenzy.

Moderate profit-taking is healthy – it absorbs inflows without overheating the market.The moderate long-term position distribution, coupled with the stable momentum indicator, indicates that the market is gaining momentum and preparing to start a new round of trading, rather than that it is about to peak.

For me, I’m slowing down my methodical accumulation and using this time to observe rather than react.