In the early morning of October 11, 2025, panic selling broke out in the global cryptocurrency market..

The prices of mainstream currencies and altcoins have plummeted simultaneously.This incident is directly related to the urgent warning of the threat of quantum computing, becoming one of the most significant liquidity crises after the market crash in 2021. Its timing resonates with multiple risk signals, highlighting the profound impact of technological security anxiety on the valuation of crypto assets.

Before the selloff broke out, the market was trading at historically high levels.Bitcoin once reached a historical peak of $126,080 on October 7, and Ethereum simultaneously climbed above $4,500.

However, after the mood reversed in the early morning of October 10, the price of Bitcoin quickly retreated from the key support level of US$126,000. However, due to insufficient liquidity reserves, the decline of altcoins was significantly magnified, with some small and medium-sized market capitalization currencies falling by more than 20% in 24 hours.

The market sell-off on October 11, 2025 set a historic liquidation record, reflecting that the panic caused by the quantum threat has transformed into a substantial liquidity crisis.according toCoinglass real-time data shows that in the past 24 hours, the amount of cryptocurrency liquidation across the entire network reached US$19.141 billion, a 27-fold increase from the October 10 incident. A total of 1,621,284 leveraged traders around the world suffered forced liquidation..This data not only refreshed the historical record, but also highlighted the extreme sensitivity of the market structure to technological security anxiety.

Judging from the distribution of long and short positions, the liquidation amount of long orders reached US$16.686 billion, accounting for 87.2% of the total liquidation amount, and the liquidation amount of short orders was US$2.455 billion, indicating that the sell-off was mainly caused by the stampede of bulls.The largest single liquidation occurred in the ETH-USDT perpetual contract on the Hyperliquid platform, with an amount of US$203 million, setting a single-day liquidation record on the platform.It is worth noting that Ethereum, as a currency sensitive to quantum threats, has a significant linkage with Bitcoin in its liquidation scale, confirming that quantum security concerns are spreading from Bitcoin to the entire encryption ecosystem.

All traders roared in their hearts. The plunge was so tragic and they woke up back to BC!

Quantum computing has stolen our home!

Quantum computing is based on the superposition and entanglement principles of quantum mechanics, and realizes parallel computing through quantum bits (qubits), which can solve complex problems that are difficult for classical computers to handle.

Its core threat to cryptocurrencies stems from Shor’s algorithm, which can break cryptographic systems that rely on prime factorization or the discrete logarithm problem in polynomial time. The ECDSA digital signature mechanism widely used by cryptocurrencies such as Bitcoin is based on the computational complexity of the discrete logarithm problem.

In contrast, it takes traditional computers far longer than the age of the universe to crack a private key. Quantum computers can significantly shorten the cracking cycle through Shor’s algorithm, and can theoretically even complete it within a few minutes.

Judging from the current technical status, there is still a gap between the current quantum hardware level and cracking needs:Although Google Willow chip (105 qubits) and IBM Condor processor (1121 qubits) have made breakthroughs in quantum error correction and specific tasks, approximately 2,000 logical qubits are needed to crack Bitcoin ECDSA..

However, Google research shows that through algorithm optimization (such as reducing quantum resource requirements by 20 times), the threshold for realizing quantum threats may be lower than expected.

As the analysis pointed out, there is no real threat in the short term but the long-term risk is urgent – currently quantum computers do not yet have actual attack capabilities, but the “harvest now, decrypt later” attack strategy has been warned by experts. More than 60% of the Bitcoin supply (including Satoshi Nakamoto addresses) is stored in quantum vulnerable addresses. If quantum technology accelerates breakthroughs, the existing encryption system will face severe challenges.

Temporal correlation of quantum threat signals

Event triggering forms a tight time coupling with multiple quantum security risk signals.

Catalyzing academic breakthroughs: On October 8, the 2025 Nobel Prize in Physics was awarded to a scientist in the field of basic research on quantum computing, directly igniting market concerns about the approach of “Quantum Day (Q-Day)”;

Authoritative warning overlay: Charles Edwards, founder of Capriole Investments, spoke out continuously on October 8-9, pointing out that 4.5 million Bitcoins (worth approximately US$550 billion) were stored in early addresses that were vulnerable to quantum attacks, and emphasized that “quantum resistance upgrades must be completed before 2026,” otherwise they may face systemic risks;

Technical proposal disputes: The Quantum Resistant Bitcoin Upgrade Proposal (QRAMP) disclosed during the same period triggered concerns about hard forks and further exacerbated market uncertainty.

These signals form a clear time chain with the selling behavior in the early morning of October 11, reflecting that investors’ tolerance threshold for quantum security flaws in cryptocurrency has been significantly lowered.This incident not only exposed the vulnerability of digital assets under the pressure of technological iterations, but also provided a key case for subsequent evaluation of quantum resistance technology solutions and research on market sentiment repair mechanisms.

Bitcoin’s size and risk calculation exposing quantum threats

About 25% of all Bitcoins in circulation (or 4.5 million coins) are currently stored in early blockchain addresses that are vulnerable to quantum attacks. The encryption mechanisms used by these addresses do not take into account the threat of quantum computing, and their public keys have been exposed in past transactions, making them potential targets for quantum cracking.

Typical cases includeThe 1.1 million BTC held by Bitcoin founder Satoshi Nakamoto. These assets have been dormant for a long time in addresses in the early “Pay to Public Key” (P2PK) era. Their public keys have been completely exposed and will face the risk of direct theft after quantum computers break through the ECDSA algorithm..

Based on the current Bitcoin price of US$120,000, the potential loss scale of 4.5 million exposed assets can reach US$5.4 trillion, accounting for 222% of the current total market value of Bitcoin (US$2.43 trillion), highlighting the seriousness of risk exposure.

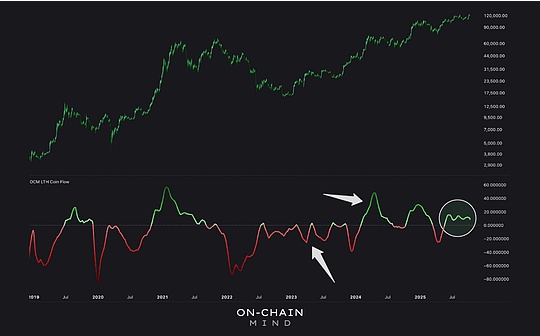

Risks show significant concentration characteristics: more than 10 million Bitcoin addresses have exposed public keys. Among them, old wallets that have not been moved in the early stage have weaker protection capabilities due to technical flaws and have become the main attack targets.Systemic threats have triggered chain reactions in the market. For example, after the release of Google’s Willow quantum chip in December 2024, the price of Bitcoin fell by 6.25% in a single day, and 572,000 people liquidated their positions in 24 hours, amounting to US$1.75 billion.

Institutional holdings further amplify risks. For example, BlackRock’s iBit fund holds 3% of Bitcoin (valued at $62 billion). Concentrated holdings may trigger a liquidity crisis under a quantum attack.

Market selling behavior analysis

The cryptocurrency sell-off triggered by the quantum threat is essentially the result of a combination of psychological panic and market structural fragility.This dual mechanism not only amplifies short-term price fluctuations, but also forms a systemic risk transmission path through the superposition of historical memory.

Psychological dimension: triggering and amplification of FUD emotions

Quantum computing technology breakthroughs trigger market sentiment of fear, uncertainty and doubt (FUD) through a three-fold path.

Superposition of historical memory: The suddenness of technological breakthroughs directly impacts investors’ core understanding of the security of cryptocurrency.After the Google Willow chip benchmark test results were released in December 2024, although Satoshi Nakamoto had already designed anti-quantum solutions such as single-use addresses, investors’ lack of understanding of Bitcoin’s anti-quantum capabilities led to a deterioration in sentiment. The price of Bitcoin fell from US$100,000 to US$94,000 in 24 hours, a drop of about 6%, while altcoins fell by 20% due to more fragile security confidence.

Risk warnings from authoritative institutions have intensified the spread of panic. Noah’s Arc downgraded the Bitcoin ETF rating to “sell”, emphasizing the market’s neglect of quantum risks. After BlackRock added a quantum computing warning to its ETF risk factors, Bitcoin’s volatility increased significantly during the consolidation phase above $100,000.

The expectation of “current risks in the future” has shortened the cycle of market panic. Investors are worried that under the “harvest now, decrypt later” attack mode, currently held crypto assets may be cracked after quantum technology matures. This long-term risk is compressed into short-term selling motivation.

The fragility of the market structure further amplified the decline in the panic, especially in the differences in asset attributes and the risk of the leverage mechanism.From the perspective of asset attributes, altcoins have become the hardest hit area in the sell-off wave due to their poor liquidity and high risk appetite of holders.

How to mitigate short-term risks

The short-term response focuses on reducing the quantum attack surface of the current encryption system, and the core measures revolve around address security optimization.

The general consensus in the industry is that reusing addresses will prolong the exposure time of the public key and increase the risk of quantum computers using the public key to infer the private key.

Therefore, it is strongly recommended that users adopt a one-time address mechanism to reduce the public key exposure window by generating a new address for each transaction.

In addition, some projects explore hybrid encryption solutions as a transition. For example, Blockstream tests combine traditional hashing algorithms with SPHINCS+ anti-quantum signatures to provide an additional layer of protection against quantum attacks while maintaining transaction verification efficiency.

For historical risk addresses, AvaLabs co-founder Emin Gün Sirer proposed a targeted solution, suggesting that the Bitcoins minted by Satoshi Nakamoto in the early P2PK format be implemented for a limited period or frozen to reduce the quantum fragility of old addresses.

write at the end

The leverage battlefield has shrunk by hundreds of billions overnight, and warriors with zero funds but undying faith, please note: numbers are just dust, and your value is far more than that.It’s not that we haven’t experienced liquidation, but we can still add positions with a smile even if we fall in a pool of blood.

A day in the cryptosphere is comparable to a year in reality – every scar is a medal, and every restart is an evolution.

The market never skimps on opportunities, but what it lacks is the courage to start over.Pack your bags and see you at the next summit!