When Leek started writing the script: The National Day roller coaster ride of Binance Meme Coin exposed the ultimate truth about global finance. During this National Day holiday, when the A-share market was closed and investors were still crowding for photos in scenic spots, an even crazier drama was taking place in the crypto world.

Within the Binance ecosystem, the market value of several little-known Meme coins has increased dozens of times in a few days – Meme4, PALU, and “Binance Life”. These tokens sound like jokes, but they have allowed some early players to easily exceed one million US dollars in book profits.The crypto community in the Chinese-speaking area was in a frenzy, and the KOLs on Twitter cheered as if they had discovered a new world.

However, the carnival did not last long.Starting on October 9, these tokens began to fall in free fall, with individual currencies falling as much as 95% in a single day. More than 100,000 traders were liquidated, with a total amount of US$621 million.

The myth of getting rich overnight suddenly turned into a history of blood and tears for the leeks.

I have seen this scene both on Wall Street and in Lujiazui.

If you think this is crazy, think back to the GameStop incident in 2021.

At that time, retail investors on Reddit united to push up the stock price of a game retailer on the verge of bankruptcy by thousands of times, causing short-selling institutions to lose money.The chairman of the U.S. SEC called it a “milestone in behavioral finance.” Although the price is ridiculous, as long as the transaction is genuine and the information is fully disclosed, it is regarded as “part of the market.”

The logic of the United States is: let the bubble happen, because the bubble is the catalyst for market evolution.

If this Meme coin craze occurs on Nasdaq, it will spawn new financial products, such as “Meme Stock ETFs”, which quantify social heat into investment factors; the Wall Street Journal will discuss the “victory of retail capitalism” at length; the SEC will launch a study on “social media market manipulation,” but may ultimately conclude that this is not fraud, but a collective financial response of group emotions through algorithmic matching and social dissemination.

In China, the story will be another version.

If “Binance Life” appeared on the Shanghai Stock Exchange, regulators would quickly warn of risks, the media would call for rational investment, and the entire incident would be defined as a “speculative market movement” and become a vivid case for investor education.

China’s market logic is “seeking progress while maintaining stability” – liveliness is okay, but it must be orderly; innovation is welcome, but you have to bear the risks at your own risk.

But Meme coins live in another world

The cruel charm of the crypto market is that it is neither subject to the SEC nor regulated by the Securities Regulatory Commission.it is aBorderlands, a gray financial experimental field formed by code, liquidity and narrative self-organization.

Here, the American-style social speculation mechanism (information diffusion + collective momentum) and the Chinese-style folk wealth psychology (grassroots resonance + community participation) are wonderfully integrated.

The exchange is no longer a neutral platform, but has become a “narrative maker”; KOL is no longer a bystander, but a price amplifier; retail investors are reveling in and consuming themselves in the cycle of algorithms and consensus.

The most fundamental change is that price is no longer determined by cash flow, but by narrative speed and consensus density.We are witnessing the birth of “emotional capital” – a form of capital that has no financial statements, only cultural symbols; no company fundamentals, only consensus curves; and does not pursue rational returns, but only pursues emotional innovation.

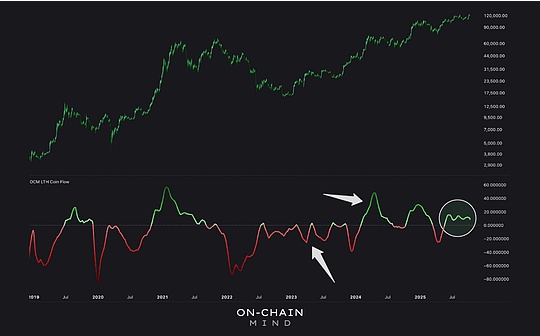

When Algorithms Fail, Emotions Are Currency

The data doesn’t lie: In the first nine months of 2025, 90% of the top Meme coins collapsed; in Q2, 65% of new tokens lost more than 90% of their value within six months.It’s like a gold rush in the digital age. Most of the gold diggers lost everything, and only those selling shovels made a steady profit.

But here’s the thing: when money starts telling stories, the logic of global finance is being completely rewritten.

In traditional markets, price reflects value; in crypto markets, price creates value.

This is both the extreme of decentralization and possibly the limit of deresponsibility.When narrative replaces cash flow and emotions become assets, each of us becomes the guinea pig in this experiment.

Where is the way out for the future?

The Web3 industry is at a crossroads.Should we continue to indulge in the short-term carnival of “emotional capitalism”, or move towards the long-term construction of a “value-driven ecology”?

The real way out lies in:Strengthen community governance, introduce a more transparent regulatory framework, and establish an investor education mechanism.Only in this way can decentralized technology truly empower global financial fairness, instead of becoming a tool for a few people to cut leeks.

The next time you see a KOL crazily recommending a “100x coin”, you might as well ask yourself a question:Am I participating in a financial innovation, or am I just paying for someone else’s financial freedom?When money starts telling stories, what you need most is not FOMO (fear of missing out), but the ability to think calmly.