Shaw, Bitcoin Vision

The cryptocurrency market experienced an extreme decline in the early morning, and even experienced a big plunge in the short term.Bitcoin once fell below the $110,000 mark, and Ethereum also plummeted by more than 17%., various altcoins also experienced sharp declines to varying degrees..In the past 24 hours, nearly 20 billion US dollars were liquidated across the entire network, and more than 1.65 million people were liquidated..

At the same time, major global markets also experienced significant declines in the early morning, with the three major U.S. stocks all hitting one-month lows.The yield on the U.S. 10-year benchmark Treasury note fell below 4.04% after the market closed.The ICE U.S. Dollar Index (DXY) fell more than 0.7% on the day.Crude oil hit a five-month low and posted its biggest daily drop in more than three months.The gold market bucked the trend and rose, with New York gold futures rising nearly 1.7% and spot gold rising nearly 1.2%.

What are the reasons behind this decline in cryptocurrencies and other major global markets?Will the market still have the motivation to rebound?When will it rebound?Let’s briefly analyze one or two.

1. The encryption market plunged extremely early in the morning, and major global markets fell significantly.

In the early hours of this morning, the cryptocurrency market experienced an extreme decline again, with a short-term plunge. From 04:50 to 05:20 in the morning,Bitcoin’s maximum decline reached 12.7% within 30 minutes, and its short-term minimum fell to $102,000.00.Ethereum’s maximum decline reached 14.3% within 30 minutes, and its short-term minimum fell to $3,435.00..Bitcoin and Ethereum subsequently rebounded slightly.At present, Bitcoin has rebounded to above $112,000, and the decline has narrowed to about 7.8%; Ethereum has rebounded to above $3,800, and the decline has narrowed to about 12%.Affected by the market,The altcoin market also saw an extreme plunge, XRP and Dogecoin once plunged more than 30%.

BCH’s 24-hour drop reached 11.38%, LINK’s 24-hour drop more than 21%, AAVE’s 24-hour drop more than 22%, ADA’s 24-hour drop more than 24%, SUI’s 24-hour drop more than 26%, and DYDX’s 24-hour drop more than 45%.CoinGecko data shows that the total market value of cryptocurrency has fallen to US$3.84 trillion, a 24-hour drop of 9.35%.Currently, BTC’s market share is 58.45%, and ETH’s market share is 13.46%.

Coinglass data shows,In the past 24 hours, the entire network liquidation rose to 19.279 billion US dollars, refresh the history again,A total of 1,657,646 people around the world were liquidated.,inLong orders were liquidated to US$16.794 billion, short orders were liquidated to US$2.485 billion., the largest single liquidation order occurred in the ETH-USDT contract trading pair on the Hyperliquid platform, worth US$203 million.In terms of currency,Bitcoin’s liquidation liquidation amounted to US$5.353 billion, and Ethereum’s liquidation liquidation amounted to US$4.412 billion., SOL was liquidated to US$2.004 billion, HYPE was liquidated to US$890 million, and XRP was liquidated to US$707 million.

At the end of Friday, the main CME Bitcoin futures BTC contract fell 5.94% from the end of Thursday to below $116,000. It continued to fluctuate downwards at 22:57 Beijing time on Friday, with a cumulative decline of 7.37% this week.The main contract of CME Ethereum futures DCR plunged 11.29% to US$3,879 on Friday, and has dropped 14.80% this week. The US stock market once fell to US$3,500 after the market closed on Friday, and continued to decline from Tuesday to Friday.

Other major markets around the world also experienced significant declines to varying degrees in the early morning.The three major U.S. stocks all hit one-month lows. The S&P and Nasdaq posted their largest daily declines in half a year, erasing the previous four days’ gains and turning negative for the entire week. The Dow Jones Industrial Average fell for five consecutive months for the first time in two months.The yield on the U.S. 10-year benchmark Treasury note fell below 4.04% after the market closed, setting a new low since September 18 set on Friday.The ICE U.S. Dollar Index (DXY) remained down throughout the day on Friday, falling more than 0.7% on the day.Crude oil hit a five-month low and posted its biggest daily drop in more than three months.

At the same time, the gold market bucked the trend and rose. New York gold futures rose to $4,038.6, up nearly 1.7% on the day, and spot gold rose to $4,022.92, up nearly 1.2% on the day.

2. What are the driving forces behind the market flash crash?

1. The trade dispute between China and the United States has resumed, and market concerns have intensified.

The trade dispute between China and the United States has experienced another twists and turns. In the past few days, many Chinese departments have introduced a number of countermeasures against the United States, especially rare earth controls.The Ministry of Commerce issued an announcement on Thursday announcing that,Five new rare earth elements will be added to the control list (seven were added in April), and usage restrictions will be extended to refining technology and overseas military and semiconductor applications..Foreign companies using 0.1% of the value of Chinese rare earth materials need to obtain an export license.The measure is intended to improve national security but is seen as a bargaining chip in trade negotiations, with most restrictions set to take effect on December 1.

Trump reacted strongly and announced,An additional 100% tariff will be imposed on Chinese goods exported to the United States starting from November 1, and export controls on key software will be implemented in response to China’s tightening of restrictions on rare earth exports..

Global concerns over intensifying trade disputes between China and the United States, it is reasonable to trigger a market crash, and to a large extent it also stimulated the early morning flash crash in the cryptocurrency market.

2. The explosion in exchange traffic caused failures and accelerated the escape of investors.

Early this morning, Coinbase officially issued a statement saying that they noticed that some users may experience delays or performance degradation when trading, but the funds are safe.The team is investigating the cause and will provide an update as soon as possible.

Binance officially issued a statement stating that due to extremely active market activity, the system is currently under high load and some users may experience intermittent delays or display issues.The platform is actively monitoring and handling relevant situations, emphasizing the safety of user funds.Subsequently, Binance updated that all services have returned to normal and are gradually being restored.Officials will continue to monitor the situation closely to ensure that all operations proceed smoothly.

In addition, Kraken officials also issued a statement stating that they are investigating customer feedback regarding difficulties in connecting to websites, APIs, and access through mobile applications.The problem seems to be related to excessive traffic.

When the crypto market plunged in the early morning, a large number of transactions poured into the exchange, and traffic exploded, causing short-term access lags and failures on the exchange., also accelerated the flight of investors.

3. Stable coins such as USDe have become unanchored, triggering investor panic.

Early this morning,The stablecoin USDe suffered a serious de-anchoring situation, falling to a short-term minimum of $0.6567, with a maximum drop of over 34% in 24 hours..Ethena Labs officials stated that due to violent market fluctuations and large-scale liquidation, the secondary market price of USDe experienced temporary fluctuations.However, its minting and redemption functions have remained functional throughout the entire process, and USDe remains over-collateralized.Ethena will continue to update relevant information.Ethera Labs later issued a further clarification, confirming that no automatic position reduction (ADL) occurred in any position.USDe does not hold any short positions on DEX.

also,Binance WBTC, WBETH and WBSOL fell sharply in the early morning and became unanchored,WBTC once fell to $35,000, WBETH fell to $430.65, and WBSOL fell below $35., ATOM once fell to $0.001.Binance subsequently issued an announcement saying, “The decoupling of the prices of three tokens, USDe, BNSOL, and WBETH, triggered forced liquidation of users’ positions. The team is currently fully verifying the situation of affected users, the relevant details of this forced liquidation, and formulating an appropriate compensation plan. At the same time, Binance is also strengthening risk management control measures to reduce the risk of similar incidents in the future.”

The stablecoin USDe and several other currencies were unanchored on the exchange, causing users to liquidate their positions and triggering panic among investors., the sell-off of a large number of assets further stimulated the short-term plunge in the market.

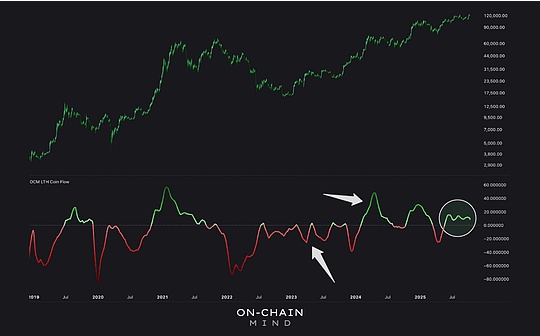

4. Whale accounts were active during the decline of cryptocurrency, exacerbating market volatility.

During the cryptocurrency decline early this morning, whale accounts were extremely active.According to monitoring by on-chain data analyst Ember, a certain contract whale address closed its short order at the bottom of the pin when the market fell sharply early this morning. The closing price of BTC was US$106,216 and the closing price of ETH was US$3,433, resulting in an overall profit of US$21.82 million.It is reported that this address shorted BTC and ETH worth $137 million on Hyperliquid after clearing ETH at a price of $4,221 on September 22 and making a profit of $11.6 million. The short prices were $120,892 and $4,502.

On-chain analyst Ai Ai (@ai_9684xtpa) monitors that the BTC ancient whale, which has high-profile swaps for ETH, opened a short position of US$1.1 billion 17 hours ago, including 10 times short BTC and 12 times short ETH, and has made a profit of US$78.56 million so far.

Lookonchain monitors that a Bitcoin OG has closed most of its short positions in Bitcoin and Ethereum, leaving only a short position of 821.6 Bitcoins (valued at US$92 million). The profit from this operation has exceeded US$160 million.

On-chain analyst Ai Ai (@ai_9684xtpa) also monitored that the ETH long orders of Big Whale Maji were liquidated this morning, resulting in a cumulative loss of US$12.16 million and a loss of US$29.92 million in one month. The bulk of the losses were caused by XPL and ETH.

The unusually active behavior of whale accounts and a large number of long and short contract transactions have exacerbated short-term market volatility during the cryptocurrency decline., may also be one of the causes of flash diving.

3. Does the market still have momentum to rebound?When will there be a rebound?

Will the crypto market still have the motivation to rebound after the sharp decline? When will it rebound and smooth out the decline? Will the previously predicted trend still occur in the last quarter of this year?What other analyzes and opinions do the market have?

1. Chief Investment Officer of BitwsieAccording to the article, various favorable factors have gathered together, and there will be record capital inflows into Bitcoin ETFs in Q4, which is strong enough to make BTC prices reach new historical highs.There are three reasons: 1. The crypto industry has won big wealth management platforms, and wealth management platforms such as Morgan Stanley and Wells Fargo that control huge assets allow advisors to make crypto allocations on behalf of clients; 2. “Devaluation trading” is a hot trade on Wall Street this year, and the government is indeed devaluing the currency; 3. There is optimism about Q4 Bitcoin returns, and higher prices will stimulate greater demand for Bitcoin ETFs.

2. Binance founder Changpeng Zhao (CZ)In a podcast interview, he said, “Being able to be exposed to Bitcoin at an early stage is a gift of the times. Blockchain and Bitcoin are technologies that will change the future. After understanding blockchain technology, I decided that the encryption industry is the future, and Bitcoin is the future. Bitcoin was the leader, and nothing could challenge it at the time. Even today, I don’t think any other token can come close to and challenge it.”

3. Michael Saylor, founder of StrategyPosted on the X platform, “Bitcoin has no tariffs.”

4. Justin d’Anethan, analyst at Arctic DigitalSaid that Bitcoin’s correction after reaching a new high is more like a short rest than a trend change.Short-term holders took profits and some leveraged long positions were liquidated, but long-term positions did not change.The current market is affected by macro uncertainties, and the United States is still in a state of ongoing partial government shutdown. This situation will provide positive support for “safe haven” assets such as gold and Bitcoin.

5. Deutsche Bank ReportIt shows that with the increasing interest of institutional investors and the weakening of the dominance of the US dollar, Bitcoin and gold are expected to become an important part of the reserves of many central banks around the world by 2030.The report pointed out that the central bank’s allocation of Bitcoin may reflect a new and modern “cornerstone of financial security”, whose status is comparable to the role played by gold in the 20th century.The report believes that uncertainty and geopolitical risks caused by U.S. tariff policies are prompting investors to seek tools to hedge inflation and prepare for a future in which the role of traditional fiat currencies may weaken.

6. State Street BankIt said it expects most institutions to double their Bitcoin and cryptocurrency holdings by 2028.

7. ABCDE Lianchuang Du JunThe article stated that the opening of the pledge function of the U.S. Ethereum spot ETF is super good for Ethereum.As supply decreases and demand increases, ETH staking increases the “income attribute” of ETFs, which is similar to stock dividends and can attract more institutional and retail funds.Competitors such as BlackRock will also follow suit, and it is expected that the new inflows of various Ethereum ETFs should exceed $10 billion in the next year.