Author: Thejaswini, Source: Token Dispatch, Compiler: Shaw Bitcoin Vision

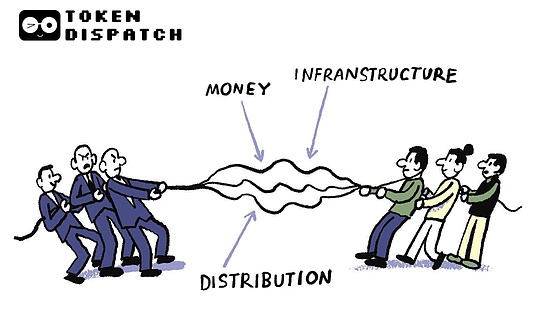

I’ve been thinking about how we divide the world into different levels.We like to think that currency is one thing, infrastructure is another, and distribution is something else entirely.This statement is clearer and simplifies the problem.Dollars are dollars, banks are banks, and payment networks are payment networks.But none of this is true.Money is always tied to the system that circulates it, and the system that circulates it is always tied to who controls its use.Every time money moves through the system, those who control it take some profit from it.We just pretend otherwise because the illusion is convenient.What’s happening now is not that cryptocurrencies have blurred these lines, it’s that these lines never existed in the first place and everyone is just now realizing it at the same time.

For me, the illusion is finally shattered, and it stems from a seemingly mundane factor: interest rates.Your bank savings account only offers a meager 0.4% interest rate, while stablecoins backed by the same treasury bonds offer 4% to 5% interest rates.This is clearly a manifestation of some kind of market failure.It’s clear that what we call “currency” and what we call “infrastructure” have never been separate.The bank gives you such a low interest rate not because the cost of banking business is high, but because it can do so. Because it controls both funds and channels, it decides to keep the interest rate difference to itself.

The issuer creates the currency.Blockchain moves money.The platform distributes the currency.For a brief period, we could clearly see each tier and price it independently.And when people were able to see through the layers, they realized that whoever controlled one of them was going to lose profits.The rational thing to do is to master all levels.

Now everyone is scrambling to rebuild the technical architecture, fearing that others will beat them to it.

For years, stablecoins have been simple.Tether and Circle dominate the market with USDT and USDC, forming a seemingly unbreakable duopoly.Together, the two control 90% of the stablecoin market.Their business model is simple and clear.Hold client funds in the form of Treasury bonds, earning an annual yield of 4% to 5%, pay no interest to the client, and pocket the difference.In 2024, Tether will earn US$13 billion in profit and Circle will have revenue of US$1.7 billion.That’s not bad for a company that essentially operates like a money market fund and doesn’t share earnings.

But the next question is: What happens if we distribute earnings to holders?

Since the end of 2024, the market share of income-based stablecoins has tripled, with a market capitalization exceeding $14 billion and now accounting for more than 6% of the total stablecoin market.JPMorgan analysts predict that if this growth momentum is maintained, income-generating stablecoins could account for as much as half of the market share.

If Tether holds Treasury bonds that yield 5%, and you hold USDT that yields 0%, then in theory, for every $100 you hold, someone is making $5.If you expand that number to hundreds of billions of dollars, it represents one of the most significant transfers of wealth in the digital age, quietly flowing from holders to issuers.

Banks realize they face competition

At the Blockchain Summit in Washington, D.C., Senator Kirsten Gillibrand made clear the concerns of the banking industry, which looks at yield-generating stablecoins as an existential threat.

“Do you expect stablecoin issuers to pay interest? Probably not, because if they pay interest, then you don’t have to keep your money in your local bank.”

The U.S. Treasury Department calculated a figure: allowing the issuance of interest-bearing stablecoins could drain $6.6 trillion from bank deposits.Standard Chartered goes a step further and estimates that emerging market banks alone could lose $1 trillion over the next three years.In a country with double-digit inflation, stablecoins are not speculative.They are a survival mechanism, a way to hold onto dollars when the local currency loses value.

So the banks did what any rational incumbent would do.They lobbied for the GENIUS Act, which was passed in July 2025 and specifically prohibited stablecoin issuers from paying earnings or interest to holders.Problem solved, right?

Not exactly.

The GENIUS Act prohibits issuers from paying interest but does not mention intermediaries.Circle quickly realized this.Rather than paying interest directly to USDC holders, Circle shares reserve revenue with Coinbase through a commercial partnership.Coinbase then uses this money to pay USDC rewards to its customers.From an economic perspective, holders can reap at least some of the benefits.From a legal perspective, it was Coinbase that made the payment, not Circle.

This arrangement is not even subtle.Circle and Coinbase publicly describe it as a revenue-sharing model, and together they generated $1.7 billion in revenue in 2024.Other platforms quickly followed suit.PayPal offers balance rewards for PYUSD through a similar partnership with issuer Paxos.This benefit didn’t come out of nowhere.It comes from the treasury bonds that have always supported these stablecoins, but there is just an additional middle link.

The Bank Policy Institute is understandably unhappy.They urge Congress to end the so-called “interest payment workaround” by prohibiting affiliates and agents from making indirect payments.Whether regulators will take action depends on how the final rule interprets “payment of interest” and whether intermediaries are grouped with issuers.Currently, this vulnerability still exists and the transaction volume is high.

For Tether and Circle, the solution has always been liquidity and universality.USDT and USDC are widely accepted, integrated by all major exchanges, and embedded in all DeFi protocols.Their network effects have been their moat.

But that moat has begun to collapse.

While banks and regulators bicker over semantics, some more fundamental changes are taking place.Tether and Circle’s combined market share peaked at 91.6% in March 2024.By the end of 2025, this had slipped to 86% and continues to decline.The reason is not just income-generating stablecoins, but also that the cost of issuing stablecoins is significantly reduced and easier.

A few years ago, launching a white-label stablecoin meant calling Paxos and incurring high fixed costs.Today, you can choose from Anchorage, Brale, M0, Agora or the Stripe-acquired Bridge.Companies in Galaxy Digital’s portfolio have already launched stablecoins at the seed stage using Bridge’s infrastructure.Barriers to entry have been significantly lowered.

Exchanges, wallets, and DeFi protocols realize that they no longer need to rely on USDC or USDT.They can issue their own stablecoins, internalize the proceeds, and return part of the proceeds to users.

Bridge co-founder Zach Abrams

Stated the situation clearly: “If you build a neobank using off-the-shelf stablecoins, you don’t fully capture the returns required to create an optimal savings account. Your reserve mix cannot be customized. And you have to pay a 10 basis point redemption fee to withdraw your own funds.”

So they no longer use off-the-shelf stablecoins.

Popular Solana wallet Phantom recently launched Phantom Cash, a stablecoin issued by Bridge with built-in earnings and debit card functionality.Hyperliquid has launched an open bid for its own stablecoin, aiming to reduce reliance on USDC and capture reserve yields for the protocol.Ethena has been particularly successful in marketing its revenue-sharing model to exchanges.

MetaMask, the leading self-hosted Ethereum wallet, has also entered the stablecoin space.MetaMask has partnered with Bridge and M0 to launch MetaMask USD (mUSD) and integrate it directly into its wallet for on-chain usage, redemption and, soon, debit card payments.Thanks to MetaMask’s in-wallet “stablecoin earnings” feature integrated with the Aave mining pool, users can now earn not only passive earnings from mUSD, but also from mainstream stablecoins such as USDC, USDT, and DAI.

Other exchanges are joining forces to form alliances.The Global Dollar Network, powered by Paxos, includes major players such as Robinhood, Kraken, Anchorage, Galaxy and Bullish.

For every $1 billion of USDT deposited by investors on the platform, Tether can generate approximately $50 million in annual revenue.You provide trading infrastructure, custody, liquidity, regulatory compliance and customer support.Tether provides the token.Guess who owns the $50 million?

Blockchain wants stablecoins, stablecoin issuers want blockchain

This integration happens in both directions.

Hyperliquid holds approximately $6 billion in USDC.If these activities were conducted on Hyperliquid’s native stablecoin USDH, both reserve proceeds and transaction fees would flow back into the ecosystem for buyback and growth.This is an ongoing source of revenue that Circle currently has at its disposal.

Following the success of USDH, other Layer 1 protocols followed suit.Projects like Ethena are offering a “stablecoin-as-a-service” model that enables ecosystems to deploy compliant and profitable stablecoins without heavy technical or regulatory burdens.

Stablecoin issuers are now launching their own chains.Why?Because running on an external chain will create dependencies: performance issues, throughput bottlenecks, handling fees, wallets, and third-party cross-chain bridging.Every touchpoint creates friction and, more importantly, value loss.By launching their own chain, stablecoin issuers can vertically integrate the currency layer and settlement layer, taking control of both value and user experience.

Circle’s Arc is the most obvious example.Circle built Arc to run USDC with zero fees and instant settlement, and then created CCTP as the official cross-chain bridge for burning and minting native USDC on different chains instead of encapsulating it.Circle now controls this chain and all cross-chain flows.

Subsequently, Tether launched Plasma, a new Layer 1 blockchain built specifically for stablecoin payments, supported by USDT, but not limited to USDT.Plasma’s design focuses on achieving ultra-fast, zero-fee transfers of stablecoins and removing unnecessary features on general-purpose chains.Its bridge USDT0 currently has a trading volume of $8 billion, exceeding CCTP and Wormhole combined.Plasma started as an infrastructure for moving tokens and has evolved into a way to control liquidity and remove middlemen to capture value between chains.

Agencies are building out entire technology architectures, and Stripe is a clear demonstration of where this trend is headed.

Stripe processes $1.05 trillion in transaction volume annually.Rather than building on Ethereum or Solana, it launched its own payment optimization chain, Tempo.Why?Because at this scale, Stripe cannot afford the congestion or governance risks that other chains bring.Tempo integrates Bridge (for issuing stablecoins) and Privy (for wallets) to provide a complete architecture: chain, coin and custody.

What struck me most was that this seemed less like a disruption and more like some sort of revelation.Technology does not change the rules, but reveals them for what they are.Control of funds means control of infrastructure and access.

It was never three different things.They are the same thing, just wearing three different masks.

The optimistic view is that once everyone understands this, competition can improve the system.Perhaps a dozen vertically integrated architectures competing against each other will lead to better results than just one architecture.Perhaps regulatory transparency around stablecoins could prevent the worst abuses.Perhaps the cost of building and maintaining a complete architecture will naturally limit the ability of any single actor to capture value.

The pessimistic view, however, is that we are simply witnessing the same integration game unfolding in a faster, more pronounced fashion.The winners will not be those with more advanced technology or a fairer economic model.They will be the ones who are quickest to reestablish their monopoly before others do.

Regardless, the illusion is gone.Over the next decade we will find out whether this matters.