author:Anthony Pompliano, Founder and CEO of Professional Capital Management; Compiled by: Shaw Bitcoin Vision

Financial legends are making appearances this week.They gave interviews here and there, but the message was clear—U.S. financial markets are in a bull market.

First, we saw Paul Tudor Jones on CNBC saying that he felt like it was 1999.

“If it looks like a duck and quacks like a duck, it’s probably not a chicken.” This quote from Paul Tudor Jones is incredible.And he was right.

So, how does this famous investor think investors should position themselves to benefit from this inflationary wave?Gold, Bitcoin, Nasdaq and Retail Stocks.

Paul Tudor Jones isn’t the only one who’s bullish, though.Jamie Dimon of JPMorgan Chase also told Bloomberg that we are in a bull market.

It’s reassuring to hear the head of the world’s largest bank say he’s not worried about a recession.Dimon has more information than almost anyone in the world.However,He did express concern about inflation, which seems to be a bigger concern for global investors given the recent rise in gold and Bitcoin prices.

Another investing legend, Ray Dalio, said this week that he believesGold should make up around 15% of an investment portfolio.

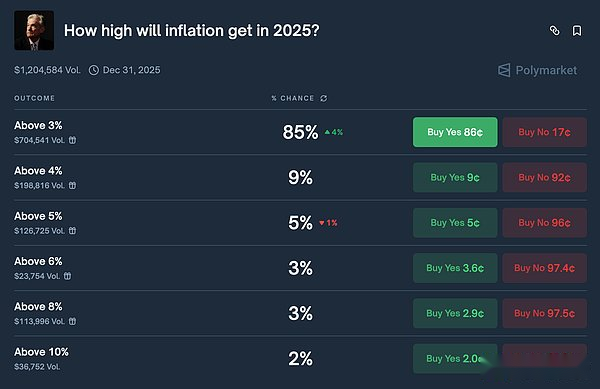

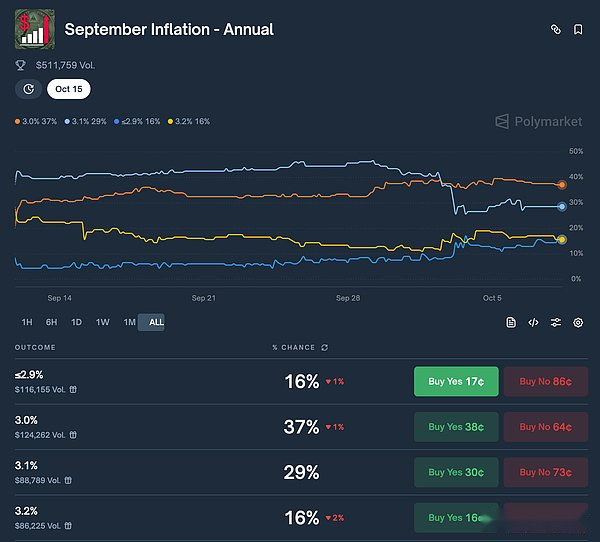

These sophisticated investors aren’t talking about gold because they think inflation will be low.In fact,Prediction market Polymarket shows that there is an 85% chance of inflation exceeding 3%.

But I still have to boldly say that the inflation problem is far less serious than these “legends” predict.In fact, I think inflation fears are grossly exaggerated.Using the same Polymarket data, you can see that the market is actually predicting that inflation in 2025 will end up being between 3% and 3.2%.

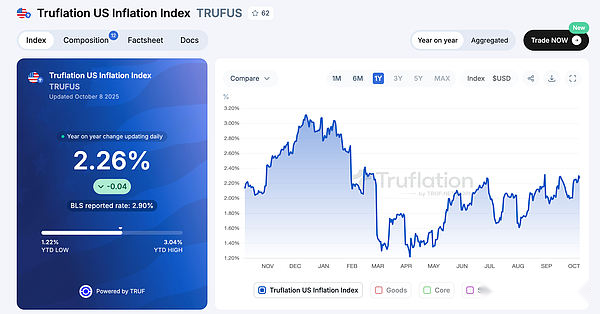

Since Truflation has real-time infrastructure, I prefer to use it to understand inflation.Truflation currently shows inflation at 2.2%.Compared with the more than 3% data given by Truflation at the beginning of the year, this is a relatively large decline.

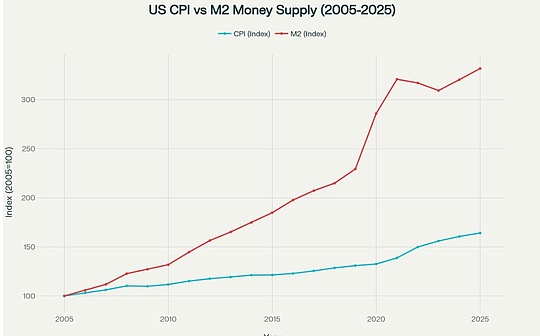

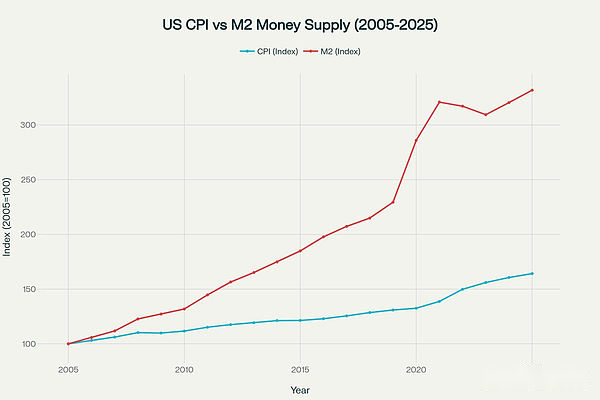

But in my opinion, inflation is not a chart to watch.It completely diverts attention from what is really going on.Strive’s Jeff Walton hits the nail on the head when it comes to the divergence between the Consumer Price Index (CPI) and the broad money supply (M2).

He said: “In the past 20 years, the growth rate of M2 money supply has been 2.5 times that of CPI.” So, which indicator are you more worried about?Is it the manipulated, slow-growing CPI data, or the parabolic surge in M2 money supply?

Obviously, the latter is the more worrying issue.The dollar’s depreciation is not caused by inflation, but by the government’s inability to stop printing money.There is no infinite supply of anything of value.So as long as governments don’t stop printing money, Bitcoin and gold will continue to soar.

Gold bulls are celebrating its recent stellar performance against Bitcoin.I thinkBitcoin will have a major breakthrough in the fourth quarter, I wouldn’t be surprised if Bitcoin’s annual returns exceed those of precious metals by the end of 2025.

But regardless of relative performance,Gold and Bitcoin, two assets that adhere to the principles of sound money, are working together to complete the task that central banks have failed to complete – protecting the purchasing power of the people..

We should all be grateful that we have these two options.