Author: Bradley Peak, Source: Cointelegraph, Compiled by: Shaw Bitchain Vision

Michael Saylor’s Bitcoin Strategy

Michael Saylor’s goal is to redefine corporate financial funding management.

Since August 2020, his company (MicroStrategy, now renamed Strategy) has become one of the largest public holders of Bitcoin.

As of September 2025, Strategy has amassed 640,031 bitcoins, worth more than $73 billion.The average purchase price is as high as tens of thousands of dollars, and at current levels, the company has considerable unrealized revenue.

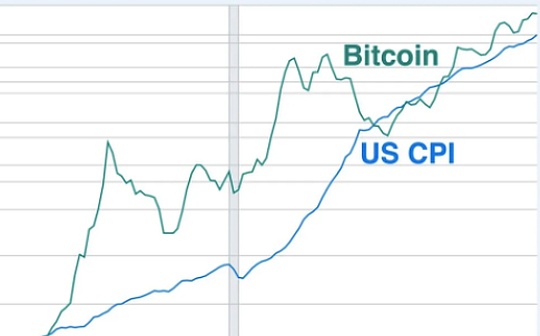

For Sailer, Bitcoin is both a tool to hedge inflation and a reserve asset that will not depreciate – a way he believes is ahead of future institutional capital flows.

His argument is fascinating: If Wall Street distributes 10% of its assets to Bitcoin, its price could climb to $1 million.

Bitcoin is the best reserve asset

Sailer’s strategy is simple but firm: accumulate Bitcoin, hold it indefinitely, and embed it into the company’s architecture.

Since 2020, Strategy has continuously purchased Bitcoin by leveraging excess cash, debt financing and equity financing.

Currently, the company holds 640,031 bitcoins (about 3% of the total Bitcoin supply), with an average purchase cost of about $73,983.To build Bitcoin reserves, Strategy uses a variety of financing tools: zero- or low-interest convertible bonds, preferred stocks, market-priced stock issuances, and other tools designed to raise funds while limiting shareholder dilution.

Volatility is not seen as a risk to avoid, but rather as an opportunity – buying on dips, holding during turbulent times and allowing Bitcoin’s scarcity to work over time.

The belief behind this hoarding stems from Sailer’s view on Bitcoin itself.He called cash “the melting ice cube” because inflation gradually erodes its value.Unlike cash, Bitcoin issuance capped at 21 million and enforced through code and halving events, which makes its issuance increasingly scarce.

Unlike gold – the cost of storage, transportation and certification of gold is high – Bitcoin is digital, borderless and protected by decentralized networks, making it more resistant to political intervention.

He also sees Bitcoin as a diversified investment vehicle.Bitcoin’s correlation with stocks and bonds has weakened, giving it a hedge-like character in an environment where inflation is high or central banks implement radical monetary easing.

For Sailer, these characteristics make Bitcoin an ideal reserve asset: scarce, portable, risk-resistant, and built specifically for 2025 and beyond.

The Road to $1 Million: Sailer’s Prediction Analysis of Bitcoin

Sailer’s boldest remarks are that the price of Bitcoin may eventually reach $1 million per coin.

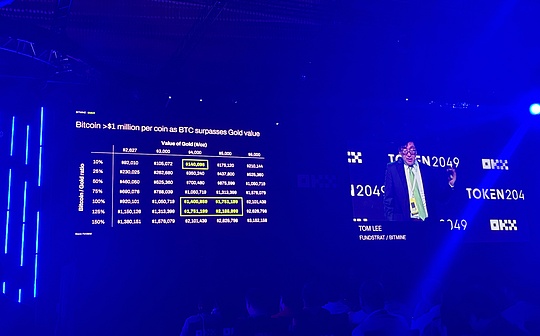

This starts with institutional capital: pension funds, insurance companies, mutual funds and asset management companies combine to control more than $100 trillion in funds.Even if 10% of the funds (about 10 trillion to 12 trillion US dollars) flow into Bitcoin, its price impact will be huge.

Judging from the fixed supply of 21 million coins, this demand alone means that each Bitcoin is valued at nearly $475,000.

But Sailer believes that the actual effective supply is much smaller.The number of Bitcoins that are believed to be permanently lost is between 2.3 million and 3.7 million (some estimates that this number is even higher).Meanwhile, the “old” Bitcoin supply (bitcoin that has not been used for seven years or more) plus corporate reserves account for about 24% of the total supply.

In addition, more than 72% of Bitcoin in circulation are currently considered illiquid assets, held by long-term holders and entities with little record of sale.These factors combined have resulted in a small fraction of Bitcoin that is truly circulating in the open market.

When recalculated based on the liquid supply of 16 million to 18 million bitcoins, the same allocation of $10 trillion to $12 trillion funds would increase the implied price range to $555,000 to $750,000.

As time goes by, institutional assets continue to grow, or the allocation ratio exceeds 10%, the threshold of a million US dollar appears.

However, Sailer points out that this process does not happen overnight.Regulatory approval, risk committees and liquidity restrictions mean that institutional allocation will be progressing slowly.

How Strategy provides funding for its Bitcoin reserves

Over the past few years, Strategy has relied heavily on convertible bonds, preferred stocks and innovative equity offerings to fund every new batch of Bitcoin.

Convertible Priority Notes

The core pillar is the issuance of convertible priority notes that can be converted into equity under certain conditions.Such transactions are usually extremely low interest rates, even zero (zero coupons), minimizing cash costs.

For example, in mid-2024, Strategy raised $800 million (net worth approximately $786 million) through the issuance of convertible bonds, with a conversion premium of 35%.The funds bought 11,931 bitcoins at an average price of $65,883.Not long after, another deal worth about $600 million was made.

These structures can lock in current capital while deferring potential equity dilution until conversion, providing flexibility for the company.

Preferred shares and “delayed” issuance

In addition to debt financing, Strategy attracts investors by issuing preferred shares.

These (preferred stock issuance) yields are usually higher than ordinary bonds and have fewer structural contracts.For example, Strategy recently issued a “Stretch” (STRC) preferred stock with a floating dividend of around 9% per year and made it clear that the proceeds are used to purchase Bitcoin.

In July 2025, Strategy expanded the originally planned $500 million Stretch preferred stock to $2 billion, highlighting investors’ demand.Some insiders also participated in the offering, with the preferred stock yielding 11.75%, indicating a strong interest in earnings-protected investments.

Recent acquisitions

The latest public acquisition occurred in September 2025, when Strategy purchased 196 bitcoins at an average of $113,048, totaling about $22 million.

Like recent acquisitions, the acquisition comes from common stock sales and preferred stock issuances, rather than operating cash flow or selling existing Bitcoins.

Risk, criticism and the next focus

Strategy becomes the largest corporate Bitcoin holder, but that comes with a trade-off.

The company currently operates akin to a leveraged Bitcoin fund, whose stock price closely tracks Bitcoin’s movements.Incumbent shareholders are at risk of equity dilution as they pay new Bitcoin purchase fees through stocks, convertible bonds and preferred stocks.

In addition to these risks, analysts also pointed out:

-

Regulatory risks: Changes in tax or accounting rules may weaken the reasons for holding Bitcoin.

-

Opportunity Cost: Billions of dollars are locked in an unstable asset.

-

Uncertainty in institutional needs: The $1 million argument depends on the actual allocation of 10% of Wall Street funds.

Nevertheless, its broader impact cannot be ignored.The strategy helped Bitcoin normalize its balance sheets and accelerated growth in custody services, exchange-traded funds (ETFs) and institutional OTC markets.

What to look at next:

-

Strategy’s future financing methods and funding structure

-

Regulatory Clarity of Bitcoin Accounting and Taxation

-

Signs of large asset managers transferring physical assets they manage to Bitcoin.

If these trends continue, Sailer’s bets could reshape corporate financial strategies and the role of Bitcoin in global finance.