Source: VanEck; Compilation: Bitchain Vision

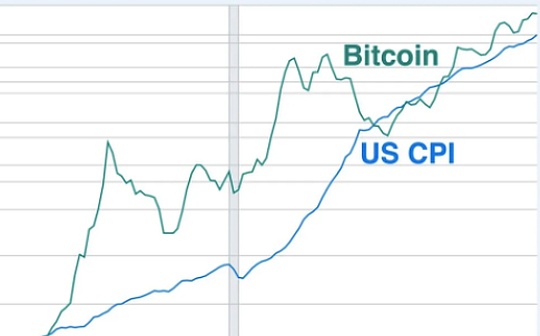

Cryptocurrencies are a combination of cryptography, distributed systems and economics, aiming to create a private currency that competes with government-backed fiat currencies.

Bitcoin proved that decentralized networks can coordinate and transfer value, and after that other companies began trying to build blockchains with less technical limitations.These players include businesses and foundations dedicated to building blockchains to solve the problems that plague large companies.

While blockchain presents a range of potential applications, most businesses’ efforts are in the exploration stage, motivated by adapting to trends rather than serious strategic intentions.

For example, in 2016, JPMorgan forked Ethereum and created Quorum, a licensed chain for financial institutions that integrates smart contracts to speed up asset settlements, execute repurchases and reduce compliance checks in cross-border payments.By 2018, entities such as Walmart and Carrefour began using blockchain to track the source of vegetables sold in their stores.Another interesting experiment is HSBC’s Voltron digital letter of credit, and MineHub, which placed BHP’s iron ore transactions on a private blockchain in 2020.In the shipping field, Tradelens, which IBM and Maersk collaborate, uses IBM’s Fabric distributed ledger to record global shipping data and documents.

Most of these early projects were nothing more than PR stunts and tax relief for R&D expenditures, and most of them were just proof of concepts, either lacking practical problems to be solved or hindered by regulatory restrictions.Many projects eventually collapsed completely because their value failed to exceed the necessary startup time and could not escape the attractiveness of stakeholders who were obsessed with traditional systems.

With the recent surge in crypto token prices and the introduction of legislation related to stablecoins and digital assets, companies have once again begun to explore the application of blockchain.However, this time it seems different, as Washington, D.C. provides both legal clarity and encourages the use of blockchain.

Now seems to be the “encryption moment”, just like Barack Obama was called the “Green Energy Moment” when he took office in 2009.

Some of the most eye-catching “enterprise” blockchain projects include:

1. Figure Technologies: Provenance is a Cosmos blockchain used as a record distributed ledger for HELOC and other future asset-backed securities.

2. SWIFT: SWIFT is working with 30 financial institutions to create a shared digital distributed ledger that interoperates with existing blockchains.

3. Societe Generale: Forge is a fully regulated and compliant tokenization and stablecoin platform that enables connections to public blockchains and traditional market infrastructure.

4. Stripe: Tempo is an Ethereum-based network that will become a neutral stablecoin payment network for proxy AI.

5. Digital Asset: Canton is the result of the cooperation between DRW, Tradeweb and GS. It is a privacy-first settlement network for securities trading and asset exchanges between financial institutions.

6. Circle: Arca, Circle’s USDC-centric payment blockchain.

7. OpenAI: Worldchain is a blockchain used to host ID systems that distinguish human users from artificial intelligence users on the Internet.

8. Coinbase: Base is Coinbase’s DeFi and crypto payment center, which may also include Cloudflare’s AI-proxy payment stablecoin NET.

9. Ripple: The Ripple network is creating settlement systems and payment financial entities, such as the main broker Hidden Road.

10. JPMorgan Chase: Kinexys digital payment network that creates programmable cross-chain payments around the clock.