Source: Arthur Hayes, founder of BitMEX; compiled by: Bitchain Vision

Will those warriors who shout “freedom, equality, fraternity” be proud of the Fifth French Republic they fought for and dedicated themselves to?Will you be proud of being a leader who has married a teacher (French President Macron)?Will they be happy that a Lagarde, who is sneaking in Frankfurt, controls their monetary policy?Probably not.

Last year on the French National Day, I wore a Panama hat and sunglasses and danced two steps in Saint-Tropez. I couldn’t help laughing secretly with Rufus’ music. This is really ironic, because the French National Day actually happened after the independence of the United States.The bankrupt French royal family supported tax evasion slave traders (note: referring to the founding fathers of the United States), who were leading the revolution against King George of England, further exacerbating the precarious financial situation of the monarchy.A few years later, the idea that white male owners should follow their own laws rather than royal laws, coupled with the fragmented dissatisfaction of the country, eventually triggered a backlash across the Atlantic, leading to the fall of Louis XVI.

Ironically, changes in U.S. diplomatic and monetary policy would have become the fuse to force France (except nominally) to exit the euro zone.The euro contains multiple meanings: it is the universal currency of the evil Roman Empire; it is an abominable thing created by those who try to stifle native culture and public opinion; it is a complete stinking shit.I am delighted to write this article because I can’t wait to see the poor in the euro zone get rid of the claws of the euro and regain the right to self-determination.

Predicting the end of the euro is a bold thing.During the euro zone banking crisis from 2011 to 2012, many commentators had mistakenly predicted that the euro would collapse.However, if Germany and France, the two euro guaranteed countries, printed the necessary currencies through the European Central Bank (ECB) to prevent the euro from disintegrating, the small southern European countries will never be enough to disintegrate this evil monetary union.

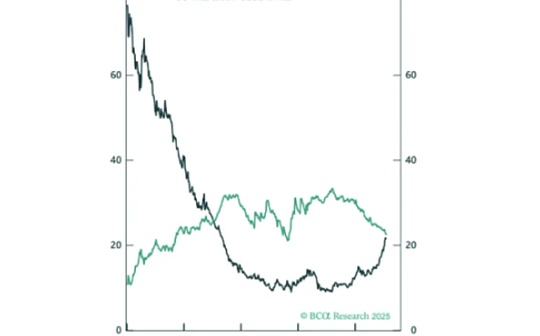

This time, Germany and France are moving in the opposite direction.French depositors know it well.They, rather than my rough understanding of the United States, Europe and economic history, told me that France would softly default, or even hardly default on its obligations to the eurozone.Take a look at this beautiful chart and hear what people say:

This is a chart of changes in the TARGET balances of central banks of the European Central Bank from January 2020 to the present.

If you are not familiar with the TARGET system, it’s a pity.Here is a brief explanation from Perplexity:

● TARGET balances are shown as net debt or net liabilities on the balance sheet of the central bank relative to the European Central Bank.

● A positive TARGET balance means that NCB has a net debt claim against ECB, indicating that more funds flowing into its banking system than outflows.

● A negative balance indicates a net liability, i.e. more funds out of the country than funds in the country, which is usually caused by payment outflows or capital flight.

● Daily, the bilateral balances of central banks are net settled, showing only their net positions with the European Central Bank, not with all other central banks.By design, the sum of all claims and liabilities of the euro system (all central banks plus the ECB) is always zero.

The simple way to understand TARGET is that Euro depositors believe that their funds are safe in countries with positive balances and are not safe in countries with negative balances.The relevant thinking experiment is to imagine that if a country exits the euro zone, will their new currency appreciate or depreciate against the euro?More importantly, what country’s banking system do you think is safer to put funds in?

Germany almost always maintains a positive TARGET balance because it is the largest and most powerful economy in the euro zone.In addition, the German Central Bank has the highest reputation in anti-inflation among all central banks of Europe.Therefore, those who have euro deposits at German banks do not have to worry about Germany’s exit from the euro zone, as the German Mark appreciates relative to the residual euro.

butSo what about a country that represents that thick white line?How should we describe it?The country maintained a TARGET surplus until early 2021.It is the second largest economy in the euro zone.Its politicians are spread across the major non-elected but extremely powerful centralized bureaucracies that dominate Europe.This country is France.French depositors are increasingly distrustful that their euro is safe within the French banking system.Therefore, they found a wider world in places such as Germany and Luxembourg.

Smart local capital tells us that things are serious and not good.Because of this,France’s TARGET deficit is the highest among the euro zone countries.If the euro zone’s second largest economy and the country with the heavyest debt burden encounter a bank run, it will not bode well for the future of the euro zone.The problem is that France is “too big to fail”, but “too big to save”.And this is exactly what Nakamoto’s loyal fans are interested in.Faced with the rapid deterioration of France’s fiscal situation, what policies will French politicians, the European Central Bank and foreign monetary authorities adopt?

This article will focus on why France is done.Why changes in U.S. monetary and foreign policy mean that German and Japanese capital can no longer support the generous French welfare state.France has a variety of means of stealing funds from domestic and foreign savers.Finally, what are the European Central Bank’s policy choices?In short, many people will wake up one morning to understand that the money in the bank is not theirs and then fully understand why Bitcoin is so important.The ECB will print money bravely to prevent the loss of its reasons for existence.It will be a brilliant day for its believers,Because the printed euro will be combined with the printed dollar, yen and other currencies, pushing up the price of Bitcoin.

Geographical irony

The goal of U.S. foreign policy sometimes explicitly stated but mostly unspecified is to prevent the integration of the Eurasian world islands.In any case, Russia, China and Iran cannot cooperate.These foreign policy goals have led to ironic consequences, especially given the current financial situation of the two major losers in World War II.

Expand a world map to see where Germany and Japan are located.Between them are the three strategic opponents or enemies of the United States’ rule, which depends on how much neoconservative cyanide is consumed by the United States.After World War II, the most unlikely thing that American political elites could allow was those left-wing communists who changed the social structure of Germany and Japan and formed an alliance with Moscow.In fact, German and Japanese cultures have created a very hardworking society.Unfortunately, this productivity, like other major nation-states, sparked war.They were eventually defeated, so history did not highly evaluate them.

The United States tolerated former Nazis and Japanese imperialists to maintain their social, political and economic status only to prevent public opinion from trying different forms of government.This means that the economy of Germany and Japan must grow to prove that communism is ideologically false and serve as the frontline to contain Soviet Russia.The easiest way to grow is to get them on the American Economic Rockets to ride.The United States provides capital and commodity loans to both countries so that they can rebuild industries and export cheaper finished goods back to the United States.However, the United States also allowed Germany and Japan to set up strict trade barriers to prevent more powerful American companies from entering.These trade policies can better illustrate the root causes of the current U.S. trade deficit and financial capital surplus than any other factor.

Another interesting fact is that even today, Japan and Germany still rank first and second among the US troops abroad, accounting for 50% of the total.This gives “Fuck Around and Find Out if you think of demonic Communist thoughts” a new meaning.

This policy worked, and for four generations, elite politicians in Germany and Japan have become American flatterers.Can you believe that the conservative Japan has even followed the United States to the abyss of nihilism, allowing the transformed man to enter the bathrooms in the workplace that were previously only allowed to enter by people born with uterus.Despite complaints about the U.S.’s aggressive and ugly foreign policy, politicians in Germany and Japan always follow their own opinions on important issues.The economic result is that Germany and Japan are the richest countries in the world as measured by net portfolio balances (NPB).To calculate NPB, subtract foreign ownership of the national portfolio assets from a country’s total foreign portfolio assets, but does not include its official foreign exchange reserves.

Germany NPB = $4.968 trillion

Japan NPD = $444.6 million

The United States has the highest national public budget deficit, accounting for 58% of GDP.Guess who is the second place?They eat baguettes, wear berets, and make high-quality Pinot Noir… they are really French.France’s national public budget deficit accounts for 38% of GDP, ranking second in the world.However, there are differences between the two.The United States has the global reserve currency, the world’s largest consumer market, and is ranked among the three major military superpowers along with Russia and China.France does not meet these conditions, but bears huge debts funded by the Germans and Japanese.Interestingly, after nearly two centuries of blood and sweat, white flags and tears, France was once again conquered by the Germans.

Eighty years later, the imbalance in this system will lead to drastic changes.The elites who “American rule” eventually broke their empire and in order to rebuild their strength, they had to turn domestically.This is exactly the true meaning of “America First”.The common people are restless because despite the economic prosperity of the United States over the past eighty years, their lives are not as good as their parents compared to their parents.The elites outsourced their work to China to curb inflation and boost corporate profits, and in the process, the United States was unable to win the proxy war between Ukraine and Russia, nor could it allow its “militant” Israel to bomb Iran unscrupulously due to its lack of defensive missiles.What a shame!If they can’t even win a crusade, then they are Christians…

If the United States eventually sets trade barriers and uses domestic funds to rebuild domestic industrial capacity, then Germany and Japan cannot continue to implement mercantilist policies.They themselves must repatriate these foreign capital and adjust their economic structure and focus on the domestic market in order to compete with China.This is a big problem for the United States. I have written an article to discuss how the US monetary authorities will replace foreign capital flows with printing money.But what about the EU?The problem with the EU is France, because its largest creditors, Germany and Japan, must repatriate their capital.

Germany and Japan have received memorandums that leaders of the two countries will remit their assets to the country to stimulate local industries.Here are some of the remarks made by the leaders of Germany and Japan.

Christian Sewing, CEO of Deutsche Bank, commented on “Made in Germany” like this:

61 leading companies and investors from all walks of life gathered together to launch the “Made in Germany” initiative aimed at creating a future-oriented German economy.Against the backdrop of geopolitical and economic challenges, “Made in Germany” has ushered in a new era of strengthening constructive exchanges between enterprises and governments, aiming to continuously improve Germany’s investment environment.

GZero describes the political program of former Minister of Economic Security, Takaichi Saemi, when he ran for the Liberal Democratic Party:

Her “Japan First” policy includes reviewing the US-Japan trade agreement, combating misconduct tourists, and restricting immigration.

If the capital of Germany and Japan no longer provides financing for other countries, why is this a serious problem for France?Both the French government and banks require foreign funds.59% of the one-year French OAT government bonds are held by foreigners.70% of French long-term bank debt is also held by foreigners.The two largest foreign holders who hold these debts eat sauerkraut and sushi.

Given that France’s financial situation is so bad, are domestic politicians willing to cut spending?Not willing.

One reason Macron’s presidency is that the ECB opposes the increased government spending expected by domestic politicians.Macron was unable to pass the budget; two prime ministers have failed to pass the budget this year.In Frankfurt, the Countess of the “crocodile criminal record” refused to support the French bond market with printed euros without large-scale budget cuts that were politically unfeasible.Ultimately, both the left and right factions in France firmly believe that the government should increase spending, rather than reduce spending.If this causes Macron to resign early, even if they succeed, then let it go.

France’s budget deficit will continue to grow, but the lack of foreign investors willing to take on its debts will not be enough to support its development.This leads to the next part of this article, where I will explore how capital controls can improve this situation.

I am the country (L’État C’est Moi)

When faced with the thorny question of who will pay off his debts, politicians always start with foreigners.Earlier this year, New National Front leader Jean-Luc Melanchon made the following remarks regarding foreign debt holders:

Don’t spread a panic atmosphere in France, which will trigger a crisis.This 3 trillion debt is not ours, and 60% belongs to foreign investors.Keep them alert to the French.If they try to let France go bankrupt and entertain themselves, it will eventually come at a price.

If you are a French government, bank or corporate bondholder, you will say to yourself, “He is a communist, France is a capitalist country, so I have nothing to worry about.” This is not a good answer.The country is facing bankruptcy and private property does not exist at all.Foreigners are always the first to lose capital.So I can say with confidence that if you are a foreign holder of French bonds and stocks, the best time to sell is yesterday, followed by today.There is no need to try to figure out whether the French would rather work longer, retire later, and pay higher taxes to keep your capital.If Macron raises his retirement age by two years sparks national protests in 2023 (remember the “yellow vest”?), then at this critical moment, no politician who advocates austerity will win the election.France is now in dire straits, with protesters expressing dissatisfaction with the possible reduction in government spending.

Let’s first look at what impact will the euro financial system if foreign holders holding French assets encounter difficulties.Remember, this “Fugazi” (slang from the U.S. military during the Vietnam War, meaning “too bad to repair”) is a fragmented system.The assets of one entity are often liabilities of another entity.All assets are supported by a thin layer of equity.Therefore, if French assets included in capital in EU financial institutions evaporate, bankruptcy will follow.

Here are some alarming statistics about French debt within the EU; we assume that foreigners hold 50% of their debt:

– 25% of the securities issued by the EU are French securities and 12.5% are held by non-French companies in the EU

– 27% of the debt issued by EU banks come from France and 13.5% come from non-French banks in the EU

– 39% of EU non-financial debt comes from France, and 19.5% comes from EU non-French countries

If we assume that banks hold these assets as collateral for loans, the average percentage is 15.17%.

Press Enter or click to view full-size images

If these assets are completely destroyed, the EU banking system will be on the verge of bankruptcy without leverage.In order to save the EU banking system, the ECB will issue 5.02 trillion euros.

What happens when systemic banking pressure is on the rise?The central bank in power will print the necessary banknotes to maintain the nominal solvency of the banking system.In the United States, the Federal Reserve did so in 2008; in Europe, the European Central Bank under Draghi did so in 2012.And Lagarde will do so in the late 2020s.

We know that the ECB will deal with the affair of French foreign bondholders by issuing 5.02 trillion euros to save the banking system.This is just a number to start; once it starts, it can’t stop.The ECB has moved away from false austerity policies such as quantitative easing and various forms of money printing and will continue to advance as the crisis spreads throughout the EU.Which other countries with high debt default on foreign bondholders?I don’t know, but investors will be scared and sell out all the assets they can sell in order to withdraw funds from the euro zone.

So what should non-EU foreign holders holding French bonds do?What will they do?In the EU, the largest holder of French bonds is Germany.Outside the EU, the largest holder is Japan.The key question is, will the Bank of Japan allow its regulated financial institutions and governments themselves to bear the huge losses of French bonds?Of course not.For Japanese financial institutions, the losses of French assets are not fatal, but embarrassing.It is estimated that Japanese companies hold $200 billion worth of French financial assets, which provides us with a starting point for issuing the yen to fill the deficit.

Finally, the Fed can use the spread risks brought about by the euro collapse as an excuse to speed up the printing of money.

Domestic Capital Control in France

The theft by politicians is never limited to foreign capital, because the financial crisis never stops after the first mine is knocked down.The euro is like a “ghoul” who is nearly thirty years old.This crisis will not end just because foreigners receive the punishment they deserve.The capital of French depositors was stolen by the state, and it was time for them to become patriots.

French depositors are completely right to worry that their euro assets in the banking system and French stocks denominated in euros will be repriced and eventually become depreciated francs.The only option for politicians to fulfill their social spending plans is to withdraw from the euro zone and re-adopt the franc.Although the French government has gone bankrupt, its inherent economic strength remains strong.France is a global tourist destination with fertile farmland and low-cost nuclear energy.Short-term self-sufficiency will not have a catastrophic impact on the French real economy.However, French people holding Euro-denominated French assets will face immediate deflation as these assets are revaluated into depreciated francs.

The sharp devaluation of the franc will boost tourism, stimulate exports, especially compared to higher prices in Germany, and will give France a new control over its money supply.Both the left and the right were angry at the Frankfurt and Brussels’ decrees.It is precisely because of this that the European Central Bank and the European Council firmly prevent any “extremist” left-wing or right-wing French politicians from taking office.But the people yearn for freedom and will soon be realized.

French capital realizes that this is likely to be a near-distance end.Because of this, the TARGET deficit is expanding rapidly.Those with discerning eyes and some common sense, get out of here.

Due to the turbulent political environment, locals holding French financial assets still have time to evacuate.At present, France has not implemented domestic capital controls.But once implemented, you will not be able to withdraw large amounts of euro cash, nor to remit the euro from the French banking system, nor to escape by buying bitcoin and gold.Therefore, Bitcoin will benefit as France’s economic growth target deficit accelerates.

How much capital will leave the French banking system?

As of July 2025, the total amount of domestic bank deposits in France was 2.6 trillion euros.

Most global banking regulators are not aware that digital banks will accelerate the transmission of bank runs.Therefore, large amounts of capital may flow out quickly before French banking regulators or the European Central Bank respond and limit capital outflows from France or the European banking system.I roughly estimate that 25% of this capital may flow out within the days before the implementation of capital control measures.This is equivalent to 650 billion euros.

What is the scale of financial assets held in France that may flow out of France?

Total French stock value: $3.45 trillion

Total value of French government bond market: US$3.25 trillion

It is not easy to sell these assets quickly because who will buy them?Germans and Japanese no longer raise market prices.Non-“frogman” investors will avoid the French capital market for fear of confiscation.Therefore, the same assumption estimates that 25% of holders may sell out and leave, equivalent to $1.68 trillion in capital flight.At the current EUR/USD exchange rate and adjusted based on the 53% foreign shareholding ratio, USD 1.15 trillion may flow out quickly.Of course, this is a bad estimate.I use this psychological test to point out that if domestic capital is frightened,Hundreds of billions or even trillions of dollars in funds could quickly flow out of France and find a home in Bitcoin and gold.

Once France’s capital controls become a reality, the virus will spread to other countries in the euro zone.

The euro crisis spreads

If Germany and France actually say “fuck you” to those idiots in Frankfurt and Brussels, why should other euro zone members listen to them?Although those in power have tried their best to suppress public opinion, domestic politicians across Europe have upheld populism.The common people hope to print money to improve their lives, not the lives of foreign capital holders.Nothing can prevent any eurozone member from having a deficit of more than 3% of GDP, which is prohibited by the Maastricht Treaty.

So the question is, does Germany want to retain the common currency of the euro zone?If Germany wants, then most of the eurozone member states will stay so they can take advantage of the German Federal Bank’s good reputation.If Germany exits the euro zone, other countries will also withdraw.Why does a domestic politician tie the future of his country to a group of middle-class countries with unstable fiscal conditions?The euro without Germany is weaker than the euro with Germany, which helps export, but foreign investors charge higher interest rates to finance the non-Germany euro.Given that most European countries are currently looking to maintain deficits to maintain generous welfare states and increase defense spending to fight evil Russia, I think they would rather choose to stay in Germany for cheaper foreign capital.

No matter what happens, there will be a period of high uncertainty.Investors holding euro-denominated stocks and bonds do not like this uncertainty.They will sell these assets without choice.The euro’s safe-haven incident will once again put the EU’s banking system on the verge of bankruptcy.To save this system, the ECB will print the euro again.These euros actually drive the rise in Bitcoin and gold, because in this case any investor who is human will buy both hard assets.I guess the next best option after Bitcoin and gold is US stocks, which is hard to say for me.Shortly after the ECB presses the “Brrrr” button, they will impose capital controls across the EU because they cannot allow capital outflows.

I can’t estimate how much capital will flee Europe and pour into hard assets and U.S. stock markets.If you think that the possibility of this happening is slim, you have to sell all your euro-denominated assets and pull funds out of the EU banking system.What else do you have to lose?Let’s take a look at the performance of EU stock and bond markets after the pandemic to understand the opportunity cost of protecting capital as soon as possible.Remember, the one who sells first sells the best.

From 2021 to the present, the EuroStoxx 50 Index (white) has performed worse than the MSCI Global Index (yellow).

During the same time period, the Bloomberg EuroAgg Bond Index (white) and EuroStoxx 50 Index (yellow) performed less than Bitcoin (magenta) and gold (green).

As you can see, EU stocks and bonds are performing worse than all major assets.In the future, with Europe’s consecutive misunderstandings, its financial situation will only worsen further.How can you invest in an economic zone that actively buys expensive U.S. shipped natural gas instead of cheaper Russian pipeline direct gas?Get out of here.

Why doesn’t the ECB print money?

None of these analyses are groundbreaking.Even the ECB idiots who only know how to do documents know that France’s fiscal situation is simply terrible in the absence of German and Japanese capital.If the euro is sacred, why doesn’t the ECB stop the eurozone from disintegrating “at all costs” (in the words of former ECB President Draghi)?The ECB should restart its quantitative easing policy and use its “letter soup”-style plan.

The European Central Bank’s goal is to maximize the euro, and as long as they are still under control, the euro will maximize it.The ECB hopes that all member states will follow their instructions.They were told that the government’s annual deficit should not exceed 3% of GDP.They were told that it would be unacceptable if domestic politicians and parties promoted the view of state sovereignty.As far as France is concerned, the ECB opposes any party that wants to develop a French priority policy like the very popular National Front led by Marina Le Pen.You might hate Le Pen, or more likely hate her father, because they both like Billie Holliday’s Algerian-style song “Fantasy Fruit”, but she believes in democracy more than Lagarde.This is a problem for Lagarde, because the French public wants the government to print money and spend money for the benefit of France, not those unelected bureaucrats in Frankfurt and Brussels.Therefore, as the ECB’s darling loses control over the French parliament, the ECB will implement control by detaining the newly printed euro.

The ECB and the EU Soviet believe that if France maintains a deficit of more than 3% in order to promote populist policies that benefit France’s domestically, then what else can prevent other willful European children from following?The austerity policy and its associated costs for the population must be implemented in order for the European™ to survive.The European Central Bank’s delay in doing anything, scaring French capital to escape the control of French domestic banking regulators and transfer deposits to other euro zone member states.

The ECB is so focused on controlling Europe™ that it is self-inflicted.The ECB should signal the market that it will save France and any other country where the “free” bond market refuses to fund the government at affordable interest rates.Why?Because the euro needs to depreciate significantly against the US dollar.If you have studied contemporary history, you may see that the United States is keen to maintain Europe’s status as its vassal, and elite politicians from all walks of life are pessimistic about their Judaism-Christian cousins who are eager to become Soviet Union and EU.Becente plans to continue this policy and destroy Europe’s competitiveness through a strong euro against the dollar.

In order to increase U.S. exports at the expense of Germany and other EU countries’ exports, Becent had to significantly weaken the dollar against the euro.Continue to maintain a huge deficit, announce an industrial policy and trigger a surge in bank credit, gold soars, and threaten the Federal Reserve to cut interest rates when all objective indicators indicate that the US economy is strong or even very strong, etc. These policies will weaken the exchange rate of the US dollar against most other fiat currencies, including the euro, when other conditions remain unchanged.Becente is busy devaluing the dollar to enhance the manufacturing recovery of “American rule”, while Lagarde is busy implementing austerity monetary policy to restrain elected politicians of member states who want to spend money to promote populist policies.That’s why the euro has appreciated 12% against the dollar since Trump took office.

Bitcoin doesn’t care

The ECB either presses the “Brrr” button now to secretly fund French welfare states, or wait until French capital controls threaten the euro.In either case, trillions of euros are printed.Bitcoin doesn’t care, it will continue to rise irresistiblely relative to the momentum of the euro, the garbage.

We are sure that EU banking regulators will try to close exports regardless of the path the ECB takes.If you are a euro poor and funds exist within the euro banking system, then the freedom you put money secretly into the only real Satoshi Nakamoto’s arms will be weakened rather than enhanced.The slow collapse of the French government is a signal that it is time to sell the euro and buy Bitcoin.If you read too much mainstream financial media and think Bitcoin is a scam,Sell the euro, buy bitcoin, and then use bitcoin to buy another hard asset outside the EU.Bitcoin is the best way to retain the option to use valuable funds, because it is a digital bearer asset.In a few minutes, you can convert your Eurobank deposits into Bitcoin via a spot exchange in mainland Europe.Look, you are no longer kidnapped by Lagarde.

If you are not a European resident™, don’t buy European financial assets anyway.Why not buy some bitcoin, sit down and watch your disgusting gains, becauseThe printed euro will fuel a bull market in which fiat money supply grows.If you want to know when the euro will break, then look at the trend of the French TARGET deficit.Maybe, just maybe, you can show off your wealth at next year’s Bastille Day Carnival.You can also buy a cup of Nebuchadnezzar-style sparkling water in the afternoon and then punch Rufus to ignite your capital.