source:Coinbase;Compiled: bitchain vision

Key points:

-

Bullish signals for October: dollar weakening, increased liquidity and higher federal funds futures prices, and the possibility of the Federal Reserve’s dovish tendency to increase

-

Liquidity enters gold as a signal: BTC has a relatively high correlation with global liquidity, while gold does not show a consistent correlation

The impact of the U.S. government shutdown

Coinbase’s outlook for October’s crypto market is tactically bullish:IThey believe that the weak dollar, increased global liquidity in the short term and the Fed’s policy tendency to cautiously cut interest rates will create favorable conditions for the cryptocurrency market.Unless unexpected hawkish rhetoric occurs, we think these factors will increase the likelihood of BTC leading the rise until November, when liquidity headwinds may play a role.

What does the U.S. government shutdown mean for cryptocurrencies?The U.S. is currently in a state of shutdown in some governments, which could delay the release of some of the key economic statistics on which the Fed relies on.Due to funding shortages, agencies such as the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) will suspend data collection and postpone the release of key data — including monthly employment reports and the Consumer Price Index (CPI) — until funds recover.

Without official data release, we believe that the market will rely on private metrics such as ADP private sector employment data to measure future rate cut expectations.ADP data shows that after years of slowdown (compared to more than one million new jobs per month in 2021), the current net jobs increase is basically zero (Figure 1).We believe that the Phillips curve logic means that current employment weakness will shorten the channel for wage-dominated service industry inflation with a lag time of about 10 months, which reduces the cost of preemptive easing policies relative to the tail risk of nonlinear labor recession.

Our viewpoint:Data uncertainty caused by the government shutdown, coupled with the stagnation of private sector recruitment, has made the market more optimistic that the Fed will adopt a less restrictive policy path.In addition, it should be noted that the recent joint action of multiple factors has led to a temporary liquidity gap in the cryptocurrency market, including: (1) the US Treasury supplement to its general account balance (currently the balance is close to the target level, exceeding US$800 billion); (2) the flow of funds at the end of the quarter and the end of the month; (3) the “conference effect” brought by the TOKEN 2049 conference in Singapore.As these influencing factors fade,It is expected to play a positive role in promoting market price trends in the short term.

Figure 1. Monthly changes in private sector employment in the United States are at their lowest level since 2023

We thinkThe interest rate market has digested this change——The 30-day federal funds futures are currently reflected,The probability of 25 basis points cuts by two interest rates before the end of the year is 87% – the cross-asset signal also confirms the mechanism of lower real interest rates and weaker US dollar, which is beneficial to cryptocurrencies(Figure 2).At present, the pricing of successive FOMC meetings is concentrated in the target range of 3.75-4.00% at the end of October, and will tend toward 3.50-3.75% by December.at the same time,The dollar weakens and gold hits record highs – a sign that real interest rate expectations are easing,And the broader demand for “value preservation” is emerging (Figure 3).We believe thatThis combination will relax the dollar financial environment and reduce the competition for cash returns on risky assets, which should benefit cryptocurrencies.

Figure 2. The probability of 25 basis points cuts by two rates before the end of the year is 87%.

Figure 3. The dollar weakens, gold hits record high

Can we stop talking about gold?

In short, the answer is no, but the market seems to be struggling to explain why gold broke through record highs in September, while Bitcoin’s price trend sluggished last month.Part of this is that although Bitcoin’s performance is not stable during a period of high inflation, many market participants and media commentators remain obsessed with seeing Bitcoin as a gold-like inflation hedge.In fact, Bitcoin often plays a role in preventing excessive currency issuance, which is not exactly the same as inflation.This also explains why Bitcoin often benefits from global liquidity injections.

In September, gold prices soared due to interest rate cuts by several central banks around the world and market concerns (1) the shutdown of the U.S. government and (2) the possible damage to Fed independence.(With that being said, despite the SPDR gold ETF attracting $4.2 billion in capital last month, the U.S. spot Bitcoin ETF still received a net inflow of $3.5 billion.) However, we believe thatThis performance difference is not due to differences in institutional investor sentiment, but more because Bitcoin led the price trend in July and August.Therefore, Bitcoin continues to face selling pressure when the technology rebounds, while liquidity is sucked out of the market for the above reasons.

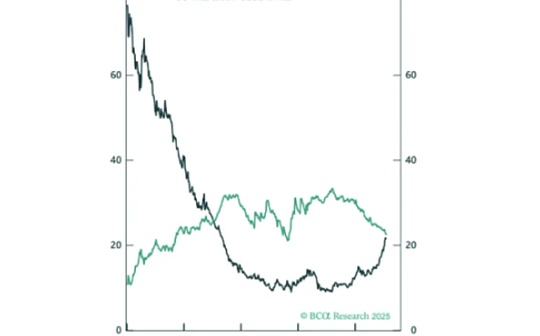

From a data perspective, we believe that gold indicators alone cannot become a powerful indicator of Bitcoin.Since 2013, the 90-day rolling correlation between BTC and gold has fluctuated dozens of times between the two extremes (-0.8 to +0.8), with short-term clustering fluctuations but lack of long-term persistence, indicating extremely weak average linkage (Figure 4).We believe thatA common driver of positive linkage is increased liquidity: when real interest rates fall and the dollar weakens, both assets tend to absorb excess liquidity in the market.Conversely, when gold rises due to risk aversion, while the dollar strengthens and liquidity tightens (as it has been seen in recent weeks), BTC, which is a high beta risk asset, usually decouples or even fluctuates in the reverse direction.

Our viewpoint:Actually, we thinkLiquidity is the most reliable macro signal for Bitcoin, this has been demonstrated by our customized M2 Global Liquidity Index to the approximately 0.9 correlation that Bitcoin has consistently over the past three years.

Figure 4. The last 90-day correlation between Bitcoin and gold