Author: 0xresearcher

In the past few years, the crypto market has shown a clear turn – from simple price speculation to gradually move towards the era of “asset efficiency” and “on-chain returns”.Ethereum is the first to benefit, and its staking economy and LST (liquid pledged token) ecosystem are becoming increasingly mature.Assets like stETH not only allow ETH holders to obtain stable on-chain returns, but also directly participate in DeFi lending, market making and derivative transactions, forming a multi-layer return cycle.

By contrast, Bitcoin’s on-chain capital efficiency is still in its “infancy stage”.Although it remains the core of the crypto world—about 60% market share, about $2.4 trillion in market capitalization, and the world’s most solid consensus network—on-chain, BTC is more regarded as “digital gold”: secure storage of value, but lacks composability, earnings capabilities and multi-chain liquidity.Most BTC holders either hold assets for a long time and remain unchanged, or rely on centralized platforms to obtain limited interest, missing the on-chain financial vitality zone.

Composability dilemma of BTC

The key to the success of ETH’s staking model lies in its deep integration with smart contracts and DeFi ecosystems, while the BTC main chain lacks an equal execution environment.Although there are cross-chain encapsulation (such as WBTC), sidechain and bridging solutions, there are still several core pain points:

-

Lack of native returns – Cross-chain BTC is mostly packaged assets and cannot generate returns naturally like ETH staking;

-

Liquidity decentralization – Cross-chain assets are distributed in different chains and protocols, and the scale is not enough to support large-scale capital operations;

-

The cost of trust is high – whether it is centralized hosting or multi-signature mechanism, users need to trust an organization or multi-party alliance.

These problems have left BTC in an embarrassing state of “high value and low utilization”.However, market expectations are changing.More and more institutions and DeFi teams, especially in Asia, are starting to drive BTC liquidity innovation—not only hope that BTC holders will receive safe returns, but also that it will become the core asset in the on-chain capital cycle such as lending, stablecoins and derivatives.

The acceleration of Asian markets

The demand for BTC DeFi in the Asian market has increased significantly.A large number of users who hold BTC for a long time are gathered here, and exchanges, infrastructure projects and communities are highly concentrated, so that once new products enter the right scenario, they can be quickly accepted by the market.An ideal BTC DeFi product needs to meet three conditions:

-

Low risk returns – avoid high volatility and high leverage strategies;

-

Strong composability – can directly integrate into mainstream DeFi protocols rather than being isolated;

-

Cross-chain convenience – supports multi-chain deployment and lowers the threshold for user entry.

WBTC – BTC Packaging and Liquidity

WBTC is the earliest BTC-encapsulated asset, introducing Bitcoin into the Ethereum ecosystem in the form of ERC-20, allowing BTC to participate in lending, liquidity provision and derivative transactions.Its advantages are wide acceptance and high liquidity, and almost all mainstream DeFi protocols support WBTC.However, WBTC essentially relies on centralized hosting, and users need to trust the custodian, which poses security and transparency risks.At the same time, it generates no additional benefits and only provides composability, which is a big limitation for users who want to fully realize their BTC value.

Babylon – Underlying pledge protocol and node operator

Babylon focuses on providing Bitcoin underlying staking infrastructure, aimed at technology-based node operators.Its advantages lie in its high security and decentralization, and ensures BTC staking security through strict node management and multiple verification.It supports institutional-level users and converts BTC into on-chain operational assets.However, for ordinary users, there are barriers to using the Babylon protocol directly, requiring technical capabilities or relying on derivative packaging products.Babylon’s core value lies in providing underlying pledge capabilities for the BTC ecosystem, but liquidity and ease of use still need to be further expanded.

EtherFi – ETH liquid staking and cross-chain composability

EtherFi provides ETH mobile pledge services, combining pledge income with DeFi composability.Users can easily participate in ETH staking and conduct capital operations on multiple chains to achieve superimposed returns.EtherFi is aimed at the ETH community, providing a low-threshold experience and supporting cross-chain operations.Compared with the BTC ecosystem, its model is mature, but it mainly serves ETH users and has not solved the BTC’s revenue and low volatility needs.

Ethena – Synthetic US dollar earnings and strategy features

Ethena provides stable USD returns (USDe) through perpetual contracts and arbitrage strategies, suitable for DeFi users with lower risk appetite.Users can obtain fixed income on the chain and participate in strategy combinations to improve the efficiency of capital use.But its composability is relatively limited, focusing mainly on stablecoin pools and synthetic assets, and lacks flexibility for investors who want to use BTC for a wider range of DeFi applications.Ethena demonstrates the potential for on-chain revenue diversification, but it still needs exclusive solutions for BTC to meet core market needs.

Lombard – LBTC: A representative case of BTC on-chain earnings

In this context, the LBTC launched by Lombard is a typical case.It is positioned as an institutional-level income Bitcoin, 100% supported by BTC, and obtains passive income by pledging the underlying BTC to the Babylon Bitcoin staking protocol.BTC holders both retain core exposure and receive stable on-chain returns.

Market performance:

-

It only took 92 days to go online, and TVL exceeded $1 billion;

-

More than 80% of LBTC is active in DeFi, used to lend, provide liquidity and restake strategies;

-

Attracting more than $2 billion in new liquidity, accounting for 40% of the market share of Babylon staking agreements;

-

In-depth cooperation with Finality Providers such as Galaxy, Figment, Kiln, P 2 P;

-

It has been included in institutional-level mortgage assets by Aave, Maple, Spark, Morpho, etc.

In terms of security, Lombard has built multi-layer protection: institutional alliances, multiple approvals, time locks, audits, and on-chain PoR (reserve certificates). No deaning incidents have occurred since its launch, which is close to the traditional financial “AAA-level” security standard.

In terms of cross-chain layout, LBTC has been launched on chains such as Base, Sui, Katana, BNB Chain, etc. The SDK is connected to Binance and Bybit, opening a direct BTC DeFi channel for Asian users.

The emergence of LBTC has solved the core issue of BTC’s on-chain revenue.ETH’s LST model has been verified to be feasible, but applying it directly to BTC requires consideration of security, liquidity and cross-chain deployment.LBTC first provides pledge income foundation through Babylon, and then combines multi-chain deployment and SDK integration to open up liquidity, so that it can form an economies of scale in the short term.If it is accepted as core collateral by more DeFi protocols in the future, or enters complex on-chain markets such as stablecoins and derivatives, BTC’s on-chain capital efficiency may usher in a qualitative leap.LBTC could be the accelerator of this wave of innovation.

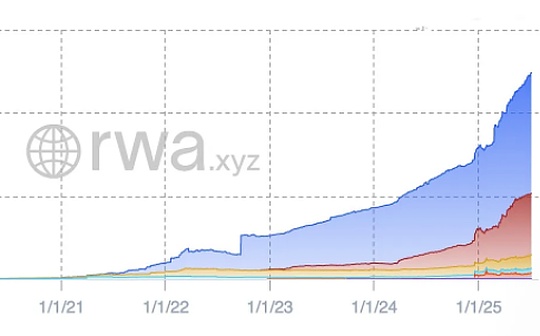

Overall market trends and future prospects

Overall, BTC on-chain capitalization is still in its early stages, but it has huge potential.As the market shifts from price speculation to asset efficiency and on-chain returns, more and more projects are trying to innovate in different directions:

-

Multi-chain expansion and interoperability: With more DeFi protocols cross-chain layout, BTC asset usage scenarios are more abundant;

-

Growth of low-risk returns products: Investors have strong demand for solid returns, and earnings BTC products are expected to become mainstream;

-

Institutional and compliance participation increased: Asian and global institutional investors actively explore on-chain BTC allocation to promote ecological maturity;

-

Innovation Strategy Testing Field: Derivatives, re-private, arbitrage and portfolio strategies are emerging continuously, improving BTC on-chain liquidity and capital efficiency.

Bitcoin is gradually transforming from “digital gold” to utilizing on-chain assets.Various innovative projects jointly promote the development of the BTC ecosystem, allowing long-term holders and DeFi users to release their asset potential more efficiently.LBTC is just one example, and its paths and ideas showcase the possible directions of future BTC financialization – diversified, low-risk, composable and cross-chain.With more technological innovations and products implemented, BTC will not only be a store of value, but also an important node in on-chain capital operation.