Author: Jesse Walden, co-founder of Variant Fund; Translation: 0xjs@Bitchain Vision

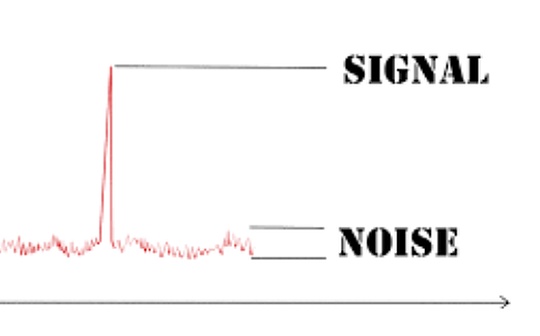

As the market rises, both signal and noise increase.

Signal:

-

The maturity of technology has expanded the possibility of adjacent

-

More and more talented teams are launching interesting projects

-

Price reflexivity arouses more general interest and use

-

Experiment speeds; new best practices continue to emerge

noise:

-

More mercenary teams start popular narratives; copy-paste projects

-

Everyone is posting a story, a token, and then the token will rise

-

A series of projects raise high-priced funds

Because everyone in the cryptocurrency space is an investor to some extent (whether by holding tokens or starting/operating a startup), it is important to look at short-term opportunities with a balanced perspective and a rigorous perspectiveLook at long-term opportunities to analyze increased trading volume.

I try to remind myself of the following principles:

-

Short-term token prices do not predict long-term success.

-

Popular projects are more likely to encounter adjustments from the black swan event.

-

In high noise environments, time management is crucial: measuring the time spent on short-term games and long-term games.It is dangerous to ignore both, and it is even worse to confuse them.

-

When working with partners, it is very important to know what games they mainly play.

I have been in the cryptocurrency industry for ten years and I still insist on long-term investment.That being said, it’s important to know the game on the field – sometimes the best way to know the game is to get involved.There are signals in the noise.But don’t lose your way.Use your time wisely.