Author: Tom Mitchelhill, CoinTelegraph; Compilation: Whitewater, Bitchain Vision

The U.S. exchange-traded fund investing in spot Ethereum experienced a net outflow of $113.3 million on the second day of trading, mainly due to the large losses of Grayscale Ethereum Trust Fund.

Seven of the eight “fresh” Ethereum ETFs achieved net inflows the second day of trading.Fidelity’s Ethereum Fund (FETH) and Bitwise Ethereum ETF (BITW) are the two largest net inflows, with inflows of $74.5 million and $29.6 million respectively.

BlackRock’s iShares Ethereum Trust (ETHA) ranked first among similar funds on July 23, but raised $17.4 million from investors on July 24.

Ethereum ETF experienced a net negative outflow on the second day of trading.Source: Far Side

The new spot fund was dragged down by another day of massive sell-offs by the recently converted Grayscale Ethereum Trust (ETHE), which flowed out $326.9 million.

ETHE was launched in 2017 by Grayscale and allows institutional investors to buy ETH.However, it imposed a six-month lock-up period on all investments.Investors are able to sell their ETH more easily after converting to a spot Ethereum fund on July 22.

Within two days of the conversion, ETHE’s outflow reached $811 million, meaning existing ETHE investors have now sold a little more than 9% of the fund’s stake.

The recent performance of Ethereum ETFs is not unprecedented.

Spot Bitcoin ETFs had cumulative net outflows in 6 of the 10 trading days on the first day of listing, and many blamed this on the losses of Grayscale Bitcoin ETFs.

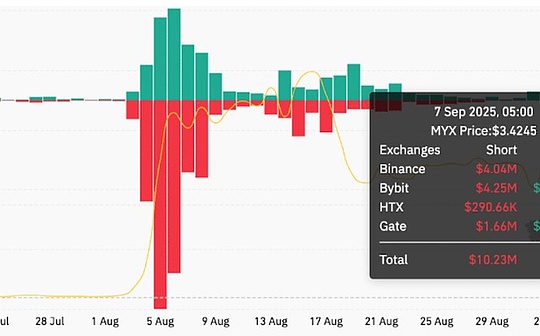

According to TradingView, ETH is currently trading at $3,172, down more than 6.8% in the past 24 hours and down 7.4% this week.

As Ethereum prices were underperforming, stocks were selling in general, with the S&P 500 closing down 2.3% on the day.

The outflow of ETF funds has caused a sharp decline in ETH prices.Source: TradingView

It is worth noting that ETH has fallen even more than Bitcoin, with Bitcoin falling only 2.6%.This is consistent with Kaiko analyst Will Cai’s prediction, i.e.The price of ETH may be extremely “sensitive” to capital inflows after the ETF is launched.

Grayscale’s ETHE, a spot Ethereum fund, shrank by $484.4 million on the first day of trading.However, strong inflows from the other eight products drove cumulative net inflows to $106.6 million.