Original title:Nixon’s impact opened a new era in the United States -the full fiat currency system began.

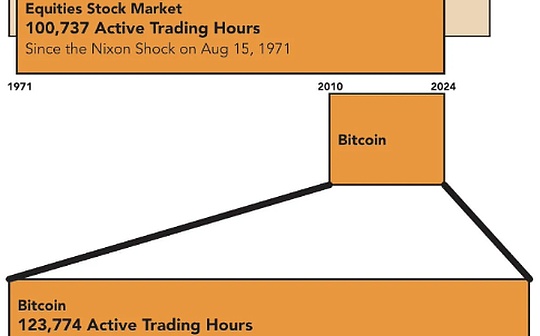

From that day,The US stock market opened a transaction time more than 100,700 hoursEssenceThis seems to be a useless data point, but Cory Bates pointed out that some interesting things happened this year, making the US stock market transaction time in the era of complete fiat currency deserves attention.

The Bitcoin launched in 2009 officially surpassed the US stock market in terms of transaction time.Bitcoin’s current transaction time exceeds 123,000 hoursIt is nearly 25%higher than the public stock transaction time in the era of full fiat currency.

There are two inspirations of these information: First of all, the US stock market has a long period of time from the market for a long time, which is too crazy.andBitcoin started public transactions less than 15 years ago, but it is easier to touch than the public stock market in the past 50 years. This is really eye -opening.

There are two inspirations of these information: First of all, the US stock market has a long period of time from the market for a long time, which is too crazy.andBitcoin started public transactions less than 15 years ago, but it is easier to touch than the public stock market in the past 50 years. This is really eye -opening.

Secondly,You can say that Bitcoin is more old than the stock market in the era of French currency.From the perspective of the total number of years, digital currency may not be old, but from the perspective of transaction time, it must be more mature.

Some people will disagree and may claim that the history of the US stock market can be traced back to 1971.Although he is talking about facts, butThe change in the currency system in Nixon’s impact is the most important factor in the stock market today.

Why is the Nixon impact the most important?The rise in the US stock market is largely driven by the depreciation of the fiat currency.The more depreciation in the US dollar, the faster the stock market rises.

How do you know?There are two excellent charts at the Chicago Commodity Exchange Group, focusing on the performance of (1) the performance of gold compared to stocks and (2) US stock markets priced at gold.

Let’s go back to my main point -although Nixon did not clearly predict, the US stock market changed significantly in 1971.If you look at the market since the beginning of the new era, its trading time is shorter than Bitcoin.

Let’s go back to my main point -although Nixon did not clearly predict, the US stock market changed significantly in 1971.If you look at the market since the beginning of the new era, its trading time is shorter than Bitcoin.

Bitcoin’s steady system has been tested more than the US stock market.This sentence will puzzled traditional financial people.But this is the fact.

The system is tested only when used.The Bitcoin market uses more than the stock market in the era of complete fiat currency.This is a story that should be widely spread.