Author: Nick Tomaino, founder of 1confirmation; compilation: 0xjs@比 chain vision world

The prediction market is outbreak. June is the month with the highest transaction volume of Polymarket, and the transaction volume exceeds US $ 100 million.

Participate in it, otherwise you will shut up

It’s hard to know what the facts are today.

We know that the US government often controls corporate media for its own interests (see the Central Intelligence Action of the Central Intelligence Agency) and social media (see Twitter documents) to spread lies.

One of the great benefits of Musk’s takeover of X is that the review system and top -down narrative control have decreased.But on X, anyone can easily make up their false narrative, and the algorithm tends to reward popularity rather than the truth.Community Notes solves this problem to a certain extent, but X still has a long way to help people distinguish between truth and lies.

If you talk to young people today, they will deeply feel this problem.They know that the popular narrative created by corporate media and social media is often unreal, but they do not know how to distinguish what is true and what is false.So they usually just follow the popularity by default.

The market is the best source of the truth

The prediction market is an open market. Anyone who understands future results can contribute their knowledge in the form of betting. If they guessed right, they will make money. If they guessed wrong, they would lose money.

For example, “Joe Biden will withdraw from the 2024 US presidential election?”

Empty talk is cheap.Experts can easily say that Biden withdrew, if they said wrong, there would be no loss.But in the forecast market, if you are wrong, there will be actual financial cost loss.At present, you can purchase YES shares in the market at a price of $ 0.81 per share at PolyMarket.If you buy YES, this means that if Biden withdraws from, you will get 23% of profits. If Bayeng continues to run, you will lose 100%.All the independent views participating in it believe that the possibility of Biden withdrawing from 81%.

Bayeng’s withdrawal market on Polymarket has always been the best way to learn about Bayeon’s participation in the general election of the 2024 election.As early as October 2023, the market showed that Biden’s withdrawal was 26%.At the same time, the New York Times and other corporate media continue to spread lies on Biden’s mental state.

In the debate on June 27, 2024, Polymarket continued to become the leading indicator of the Democratic Party.The market immediately responded to Biden’s obvious lack of keen thinking, and the market price he withdrew from the election almost doubled.

The market is superior but not perfect

If Biden did not withdraw from 81% of the victory, does this mean that the market cannot provide the truth?It’s not at all.The large -scale market reflects the current reality and is represented by participants in all walks of life.They do not always predict the results accurately.Market participants may have prejudice and irrationality.Moreover, there are many new information that can be introduced to change the results.

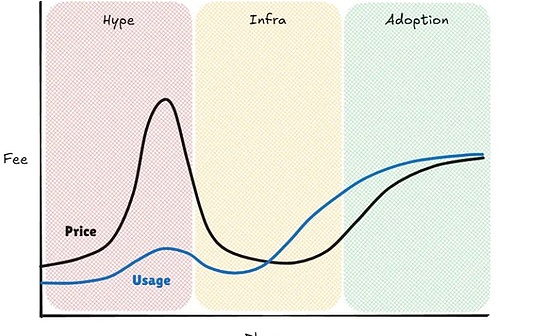

The point is that the market can provide the truth than a group of pre -selected elite (old media) and algorithms (new media) pursuing profits, and will play a key role in the world in the next few years.Especially in the global liquidity scale, the orbit on the chain can be realized.In the cryptocurrency industry, we have been waiting for mainstream cases, and people don’t even need to know that this is a cryptocurrency case.Now, we have a case that play an important role in the future.