Author: Zoltan Vardai Source: Cointelegrap Translation: Shan Ouba, Bitchain Vision

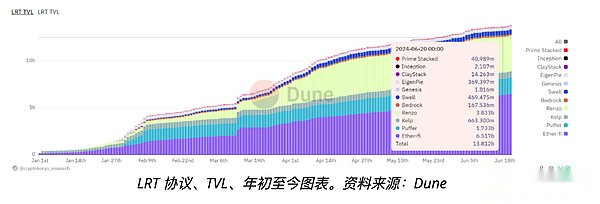

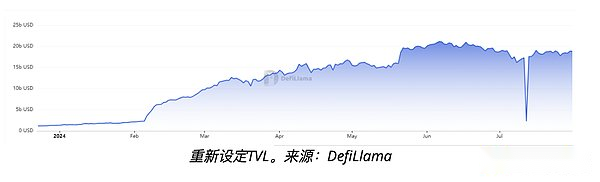

The flow of recovery of the tokens (LRT) is becoming an important part of the re -pledge industry, and may reshape the entire decentralized finance (DEFI) field.LRT provides pledges with pledged token equivalent that can be deployed in other agreements, thereby simplifying the complexity of traditional Ethereum pledge and improving the capital efficiency of DEFI.Show its increasing importance, LRT’s total lock value (TVL) has increased by more than 8,300% to US $ 13.8 billion, while in early 2024, it was only $ 164 million.

>

According to a report shared by Node Capital and COINTELEGRAPH, the simplicity brought by these protocols is part of its significant growth:

“The transformation of the rebuilding to the tokens from liquid is driven by the demand for more efficient and more user -friendly financial instruments … LRT may not only dominate the field of re -pledge, but also reshape the entire DEFI ecosystem.”

The liquid re -pledge agreement makes it easier for retail users to pledge. They need at least 32 Ethereum (worth more than 106,000 US dollars) to run the verification device node through traditional pledge.

Eigenlayer is the key part of the rise of liquidity re -pledge protocol

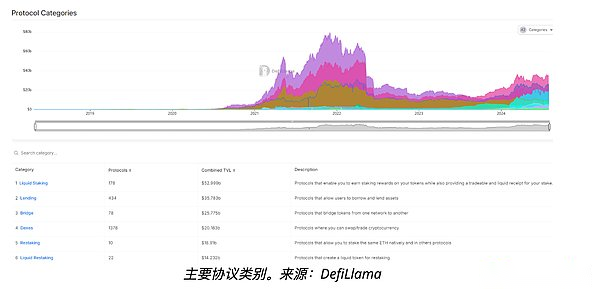

According to DEFILLAMA data, the liquidity pledge agreement has developed into the largest protocol category. The total TVL is 52.9 billion U.S. dollars, while the liquidity re -pledge agreement ranks sixth, with a cumulative TVL of more than 14.2 billion US dollars.

>

Harel, an analyst at Node Capital tokens, said that Eigenlayer is the largest re -pledge agreement for TVL and an important reason for the success of the liquidity re -pledge industry:

“In order to obtain an airdrop, the” points boom “caused the demand for the upper limit of the EIGENLAYER deposit than the supply. The leading liquidity re -pledged the pledge protocol used this technical arbitrage opportunity. One of the many complexity they abstracted was the management of EIGENPODS.Abstract it and related processes into tokens.

Harel explained that the sustainable development of LRP infrastructure helps the protocol category attracts billions of dollars in capital:

“In a short time, these LRP accumulated billions of dollars in equity capital, and established complex operator infrastructure, positioned themselves as key promoters of the supplier, and obtainedStrategic advantage “

EIGENLAYER’s TVL exceeded $ 16 billion, accounting for more than 85% of the entire re -pledge industry TVL, worth $ 18.9 billion.

>

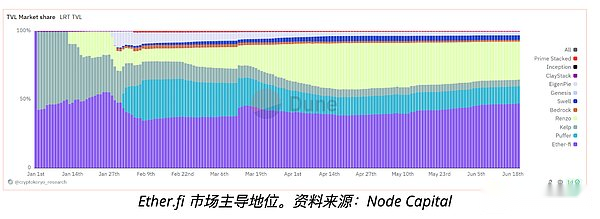

Ether.Fi controls more than 50% of the LRT market

According to Node Capital data, Ether.Fi controls more than 50% of the LRT market.

According to the report, the success of the agreement is largely due to its user -friendly re -pledge model. This model simplifies traditional pledge:

“The distribution of market share further highlights the dominant position of Ether.Fi, accounting for more than 50% of the entire market. This dominant position indicates that the platform has successfully simplified the complex reconstruction operation into a user -friendly token model, thereby promoting the promotion ofValue accumulate.

>

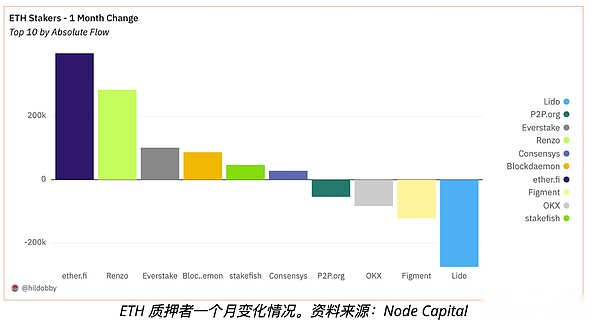

Ether.fi appeared a lot of capital outflows in April.According to Node Capital, on April 2, the absolute traffic of the agreement was nearly 400,000 ETH, while the outflow of Lido exceeded 250,000 ETH.

>