Author: Sean Rose, GlassNode; Compilation: Five Bah, Bit Chain Vision Realm

Foreword

In this article, we will turn attention to the Ethereum pattern.In the first quarter of 2024, it is vital to Ethereum, and its major development is changing its operating method.Dencun upgrades enhanced the scalability of Ethereum and reduced transaction costs.At the same time, the price of Ethereum has reached $ 4,000, which is the level that has never been seen in the past two years.During this period, Ethereum pledge also increased significantly.In this article, we will study these changes and discuss their widespread impact on the Ethereum network.

Ethereum pledged dynamics

Overview of pledge

In the Ethereum’s Rights Certificate (POS) mechanism, pledge involves locking ETH tokens to support the operation and security of the blockchain.The verifications use their ETH to confirm the transaction. In return, they receive rewards in the form of new ETH and trading fees.This process protects the network by providing pledge asset returns and encourages participation.

Pledge growth

The pledge pattern of Ethereum changed in the first quarter, and the pledged ETH increased by 9%.This growth is promoted by new development such as maximum extraction value (MEV), liquidity pledge, re -pledge, and liquidity re -pledge.These innovations have introduced new incentives to encourage more pledge activities. Among them, EigenLayer airdrops are a factor that specially promotes recalculation and liquidity re -pledge activities.

Stakeholder

Ethereum pledged ecosystem includes extensive participants, from individual investors to large institutions.Related to institutional interests use these opportunities to earn benefits from a large number of ETHs held.Lido and Rocket Pool liquidity pledge protocols are important because they provide the transaction token representing the pledged ETH, helping the pledges to maintain liquidity and make the Ethereum POS more attractive.

Ethereum derivative market and unbound contract

Underage contract rising

The total number of derivative contracts (such as futures and options) that does not settle in the unsuitable derivatives (such as futures and options.The Ethereum derivative market has increased significantly, and the options have increased by 50%, a new high.This growth indicates that traders and institutional investors are increasingly involved in Ethereum financial products.

Market maturity

The growth of the Ethereum derivative market can be seen from the advanced and diverse trading strategies adopted by traders.This progress has improved market depth and liquidity, allowing more complex investment and hedging choices.This maturity indicatesEthereum is being more widely accepted and incorporated into the traditional financial system.

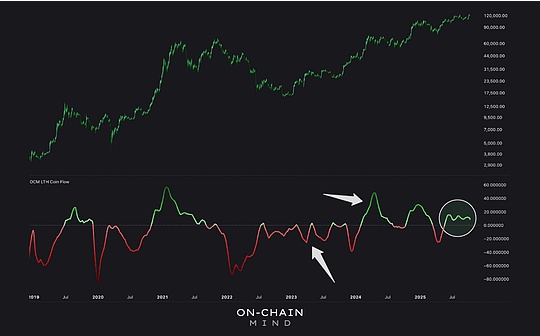

Driving factor for increasing the increase in the position

The increase in the unclear contract in the first quarter was caused by several related factors.Mainly, Ethereum often follows the market trend of Bitcoin.This connection is obvious, because Ethereum and Bitcoin derivative markets have responded to the excitement and speculation caused by the development of Bitcoin ETF.The expectations of these ETFs not only increased the activities of the Bitcoin market, but also affected Ethereum and affecting its derivatives.

in conclusion

Overall, the recent changes in Ethereum pledge and derivatives market and the Dencun upgrade indicate that its ecosystem has undergone major changes, affecting network functions and investment dynamics.As Ethereum increasingly reflects the trend of Bitcoin, investors need to adjust their strategies.Understanding the interaction between these upgrades and market changes is essential for optimizing investment methods, management risks, and using Ethereum to continue to expand in the financial market.