Author: Xiaoyue Xiaochu, beard watching coin member Source: x,@rueexiaochu

The upcoming big bull market is different from history that there are three major bull markets.Based on these differences, our trading strategy also needs to be adjusted.

1)Different capital volume, The total market value of the encryption is now 2 trillion, and the price of BTC is 5W.At the beginning of 20 years, BTC was only 1W.

2)Different consensus on the bull marketAt the beginning of the last round of the bull market, there will be reports that cryptocurrencies return to zero at the beginning of 18, 19, and 20, and I have seen many people leaving the industry in person.But this round of cycle, even in the 22 years of falling, most people will believe that the bull market will come next time.

3)The number of people in the market is different

The above three points are obvious. You can derive the differences in this round of bull market.

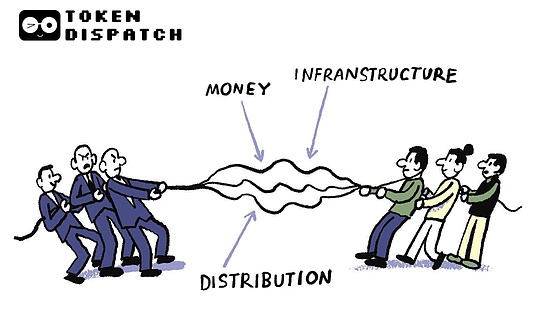

1 The increase in market professionalism and increase in professional secondary institutions

As the amount of funds in the secondary market increases, the professionalism of the market will definitely increase significantly.The simplest reason for the special secondary fund institution is the simplest reason. When your funds are 100K, you can study it yourself.When your funds reaches 10m, a professional research team will need to operate.In addition, there are funds that are optimistic about the secondary market and specially established.In general, these funds have professional teams, strong funds and rich resources.If it is a leek, it cannot be played with it. In the past two years, BTC’s predicting difficulty in its trend has increased, because there are more powerful institutions, and it has become a confrontation between large institutions.

So what should I do for me waiting for leeks?

1) The accuracy of some of the original skills will be reduced, which is an inevitable result of the improvement of market professionalism

2) Consider entering the core circle of professional institutions, through relationships and contacts.

3) If you can’t find the organization, hold a group with some who are also capable and friends, and study together

4) In terms of transaction, the disadvantage of the existence of professional institutions can be used,

For example, the speed of investment decisions is slower than individuals, which leads to new projects. The reaction speed of new hotspots is slower than individuals.

The institutional investment target is limited, because the institution will pursue the mainstream investment logic, and some investment segments do not conform to the transaction logic.The most obvious is the inscription.In the future, the tracks similar to inscriptions may have a greater chance of getting rich.

2 Deep cultivation of some projects or ecology

Suppose it is necessary to operate a project to a certain market value (such as the circulation of 1 billion US dollars).Then in this round of bull market, the amount of funds in the market has increased by dozens of times, which means that opportunities have also increased by dozens of times.Of course, the actual situation is worse than the ideal, because it is necessary to remove those projects with high initial market value.But compared with the previous round of bull markets, the opportunity is still much greater.In other words, this round of bull market, a good project or public chain, a few institutions that are optimistic about it, and some community users can become a project with a low market value.

At the same time, it means that a project does not require many people to be optimistic, or even if it is not optimistic, there is no problem.Because it only requires small proportional institutions in the market, large households, and retail identification, there will still be a low market value.

Take this round of market as an example. The inscription may be the huge increase, followed by the SOL ecology.However, except for the general market, many coins still have a very good increase, and even many coins have not even heard of it at all.Not to mention, some new online projects will benefit a group of people.Such as Pixel, DYM and so on.

But don’t be happy too early.Because although there are more opportunities, there are more institutions and more professional teams.Therefore, many people will stare at better projects.So in this round of bull market, you still just taste it, or follow the hotspot with the waves.Then you may only eat some of them to eat, and sometimes you can’t eat it.

Therefore, the method of maximizing returns is to focus on good projects.Due to the large market funding, better projects will have good income in the future.But it is guaranteed to be in the car in advance.

3 The valuation premium is obvious, and there are very few underestimated projects

In this round of bull market, everyone has realized that the market value of many launched projects is very high.This is an inevitable manifestation of abundant funds.But many people do not realize that there are very few projects in the market.

The reason is very simple, there are many people in the market.Some professional teams can find projects that are underestimated by market value.But it is very difficult for ordinary people to find.Therefore, it is better to study the bottom of the trend cycle instead of looking for an underestimated project.Each cyclical adjustment in the market will drive the decline of coins, and basically no one can be spared.And, when panic, the price was killed by mistake.Therefore, researching time at the bottom of the research cycle, then you can easily buy at a beautiful price.

The use of information difference is also a way, especially when the market funds are abundant, new projects on the chain will take a certain time from the appearance to discovery.